The Nasdaq Composite hit 9,000 for the first time ever in its history on Dec 26, 2019. The tech-heavy index is up more than 35% so far this year, driven by the scintillating performance of stocks like Microsoft (NASDAQ:MSFT) and Apple (NASDAQ:AAPL) along with non-tech stocks like lululemon, Roku and Charter Communications (NASDAQ:CHTR).

Meanwhile, the S&P 500 increased 0.51% to close at 3,239.91 and the Dow Jones Industrial Average climbed 0.37% to 28,621.39, both marking record highs.

The Santa Claus rally seems to have set in, with share price movement in all three indices indicating that Wall Street is on the verge of witnessing an impressive December.

The rally is now expected to continue in 2020 based on a strong labor market, record holiday season shopping and a partial resolution of the U.S.-China trade war.

According to the recently released data by the Labor Department, cited by CNBC, the U.S. weekly jobless claims decreased 13,000 to a seasonally adjusted 222,000 for the week ended Dec 21. Notably, in November, the unemployment rate stayed at 3.5% — a 50-year low level.

Moreover, robust holiday season sales have been a key catalyst for stocks like Amazon (NASDAQ:AMZN) , which jumped 4.5% on Dec 26. Per Mastercard (NYSE:MA) data, holiday retail sales (excluding auto) increased 3.4% between Nov 1 and Dec 24. Online sales grew 18.8% on a year-over-year basis.

Further, on Dec 13, both the United States and China declared that they have reached a phase-one trade deal likely to be signed by the two presidents in the first half of January 2020.

Per the deal, the United States will reduce the tariff burden on certain agricultural, manufactured and energy products. According to a report by Bloomberg, tariff relaxation will be applicable for $120 billion worth products carrying import duties of 15%. However, it will continue to maintain a 25% levy on $250 billion of Chinese goods.

Moreover, the United States has affirmed that it will bring into force new policies pertaining to intellectual property, currency and forced technology transfers. Also, the state will suspend import taxes for nearly $160 billion worth of products, including smartphones and toys. In exchange, China’s purchase of goods and services from the United States is likely to increase nearly $200 billion in the coming two years.

Meanwhile, President Donald Trump said on Dec 24 that the deal is “getting done,” adding there will be a signing ceremony with Chinese leader Xi Jinping.

Making the Right Choice

Nasdaq’s momentum is expected to continue in 2020 due to the aforementioned factors. Moreover, the index’s rally is expected to benefit from the robust performance of a number of stocks with solid growth potential.

However, stock picking is a difficult task and it is here that the Zacks Stock Screener comes in handy.

Here we pick six Nasdaq-based stocks that have a favorable combination of a Growth Score of A and a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Per Zacks’ proprietary methodology, stocks with this favorable combination offer strong investment opportunities.

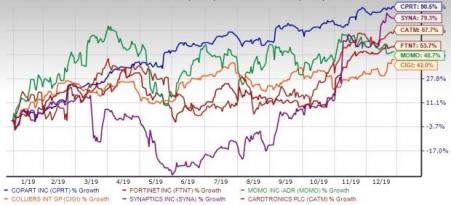

Moreover, these stocks have a market cap of more than $1 billion and outperformed the Nasdaq’s more than 35% year-to-date return.

Year-to-Date Performance

6 Key Picks

Dallas, TX-based Copart (NASDAQ:CPRT) provides online auctions and vehicle remarketing services. It offers a range of services for processing and selling vehicles over the web through its Virtual Bidding Third Generation Internet auction-style sales technology to vehicle sellers, insurance companies, banks and finance companies, charities, and fleet operators and dealers, along with individual owners.

Copart has a market cap of $21.13 billion. Shares have returned an astounding 90.5% year to date.

The Zacks Consensus Estimate for fiscal 2020 earnings has increased 5.7% to $2.77 per share in the past 60 days.

Sunnyvale CA-based Fortinet (NASDAQ:FTNT) is a provider of network security appliances and Unified Threat Management (UTM) network security solutions to enterprises, service providers and government entities worldwide.

Fortinet has a market cap of $18.43 billion and shares have returned 53.7% year to date.

The Zacks Consensus Estimate for 2020 earnings has moved north by 13.9% to $2.71 per share over the past 60 days.

Beijing-based Momo’s (NASDAQ:MOMO) shares have rallied 48.7% year to date. This mobile-based social networking platform provider has a market cap of $7.33 billion.

The Zacks Consensus Estimate for 2020 earnings has increased 3.1% to $3.37 per share in the past 60 days.

Toronto-based Colliers International Group (TSX:CIGI) provides commercial real estate services, including outsourcing and advisory services, lease brokerage and sales brokerage. The company operates across the Americas; Europe, the Middle East and Africa (EMEA); and the Asia Pacific.

This $3.11 billion-worth company has returned 42% year to date.

Notably, over the past 60 days, the consensus mark for 2020 earnings has moved upward 1.2% to $4.98 per share.

San Jose, CA-based Synaptics (NASDAQ:SYNA) designs and markets human interface solutions, such as touchpads for notebook computers, capacitive touch screen controllers for handsets and biometric fingerprint sensors for mobile devices. Shares have returned 79.3% year to date.

The Zacks Consensus Estimate for fiscal 2020 earnings has risen 29% to $4 per share in the past 60 days for this $2.23 billion worth company.

Houston, TX-based Cardtronics (NASDAQ:CATM) is a provider of automated consumer financial services. The company has a market cap of $1.91 billion and shares have returned 67.7% year to date.

The Zacks Consensus Estimate for fiscal 2020 earnings has increased 4.3% to $2.64 per share in the past 60 days.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 top tickers for the entirety of 2020?

These 10 are painstakingly hand-picked from over 4,000 companies covered by the Zacks Rank. They are our primary picks to buy and hold. Start Your Access to the New Zacks Top 10 Stocks >>

Fortinet, Inc. (FTNT): Free Stock Analysis Report

Cardtronics PLC (CATM): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Momo Inc. (MOMO): Free Stock Analysis Report

Synaptics Incorporated (SYNA): Free Stock Analysis Report

Colliers International Group Inc. (CIGI): Free Stock Analysis Report

Copart, Inc. (CPRT): Free Stock Analysis Report

Original post

Zacks Investment Research