After yesterday's drop, the global market rout from previous months' highs is as follows (see charts below):

- S&P 500: -22.3%

- NASDAQ Composite: -33.4%

- Euro Stoxx 50: -20.7%

- Shanghai Composite: -13.3%

- FTSE MIB: -22.4%

We are now technically in a bear market.

The first thing that comes to investors' minds in such a situation is that we're looking at another 2008—where, as I recall, the S&P 500 index shed 58% (more than twice the current drop).

However, from a macroeconomic perspective, it was a completely different situation, as the whole financial system was at serious risk of collapse. Now, despite the many headwinds, risks lean more towards a global recession.

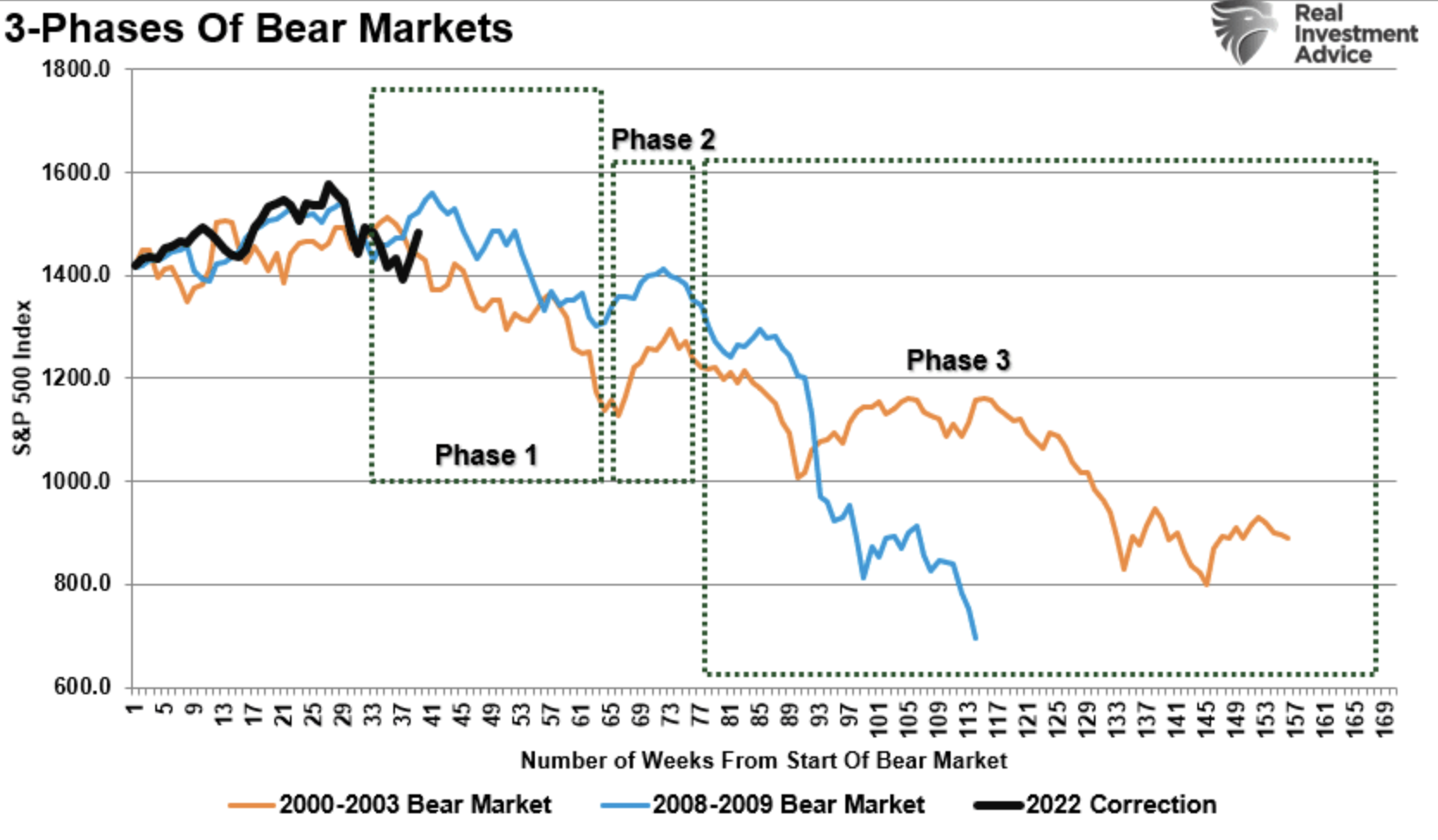

Let's look at the chart below to analyze the current situation in depth. It displays the last two extended bear markets—2001 (orange line) and 2008 (blue line), and the 3 phases that characterized them, namely:

- Phase 1: first decline (important but not excessive)

- Phase 2: technical rebound

- Phase 3: capitulation and final decline

(Please note that the 2022 line in the above chart was last updated in April, and we are now hovering right around the middle of phase one)

Source: Lance Roberts

As we can see in the two highlighted periods, although the dynamics are more or less the same, there are many differences both in terms of the magnitude of the decline and the duration of the bear market itself.

In the 3 charts above, we see how the 3 periods (including our current bear market) have several similarities but never identical paths.

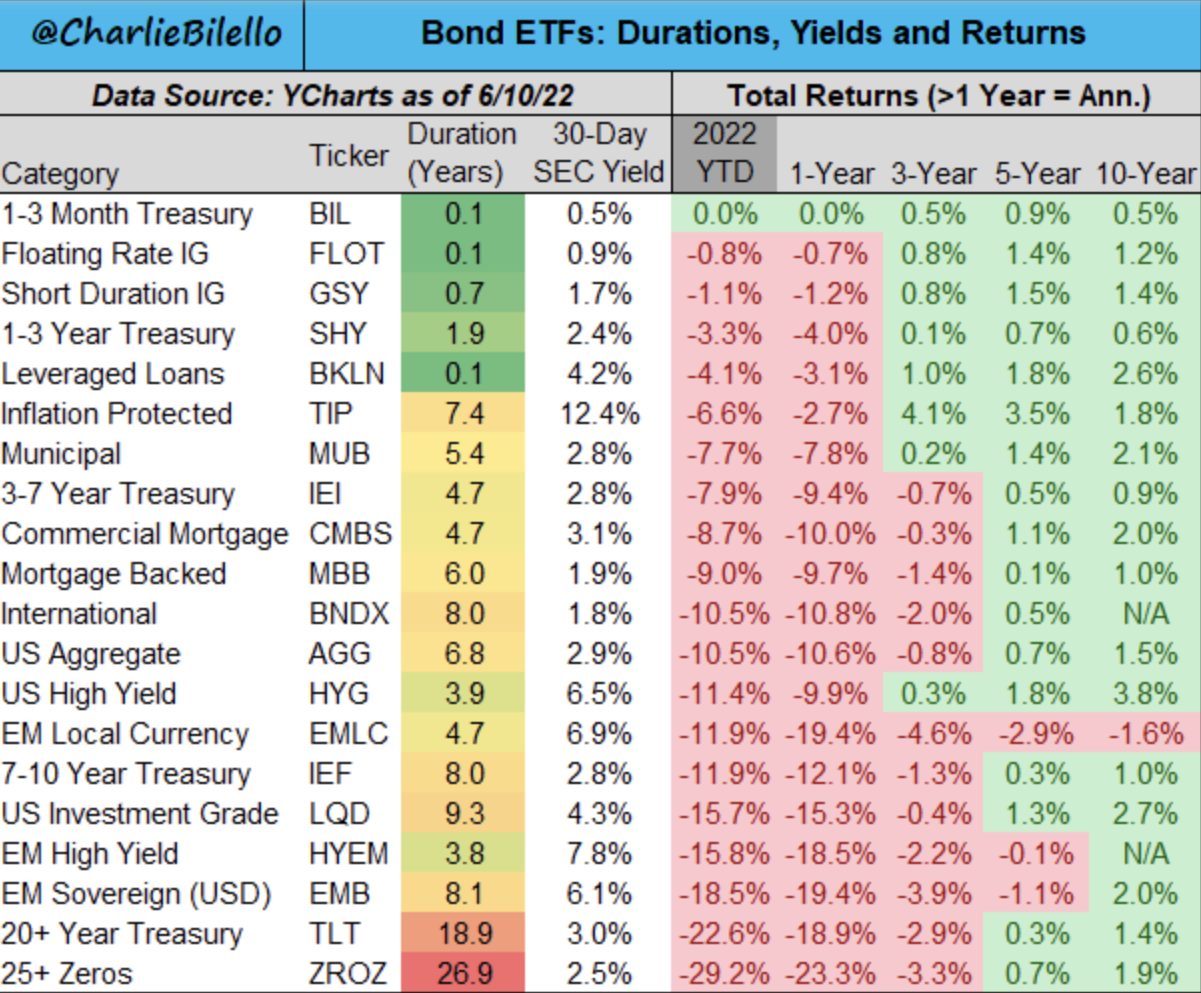

For example, one thing we must notice about the current period is that even bonds--historically more defensive in these situations or at any rate with more limited declines--are facing a worse-than-usual drawdown. So the protection that usually helps to limit drawdowns is missing in portfolios.

Still, in every one of these bear markets, we noticed the importance of owning bonds below 6-7 years, as the longer the bond duration, the sharper the drop.

Source: Charlie Bilello

How To Behave In Bear Market Cycles

I am not saying anything new here. However, a couple of pointers can help long-term investors fare better in such situations (remember, I am not talking about short-term traders):

- Accumulation plans

- Diversification

- Fractional entries into strategic positions

- Smart cash management

- Time horizon

- Rebalancing

These are always and will always be the only elements that can build a resilient portfolio in the different situations we will face.

In my case, having kept 20% cash from last year's bull run, the idea is to make gradual entries at every 6-7 percent decline in equity markets. This is because, as of today, I have a 50% equity, which I am looking to increase in the long run, taking advantage of declines.

In the event of the S&P 500 dropping about 40% (which would imply at least a 50% drop in the NASDAQ Composite, I would end up with all my cash invested.

But what if it keeps going down from there?

In such a case, I would rebalance my portfolio and move ahead with my accumulation plans, changing my horizon for another 8 years—rebalancing periodically.

There is no perfect formula. However, there must be a strategy that you believe in and will stick to, especially when declines can undermine an investor's confidence.

I close this analysis with a question: what have you been doing these days?

- Selling everything?

- Buying?

- Doing nothing?

Let us know in the comments.

"This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of assets, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with you."

***

Looking to get up to speed on your next idea? With InvestingPro+ you can find

- Any company’s financials for the last 10 years

- Financial health scores for profitability, growth, and more

- A fair value calculated from dozens of financial models

- Quick comparison to the company’s peers

- Fundamental and performance charts

And a lot more. Get all the key data fast so you can make an informed decision, with InvestingPro+. Learn More »