Investing.com’s stocks of the week

Yesterday was a second day for bulls to shine despite modest end-of-day gains. Some indices did better than others.

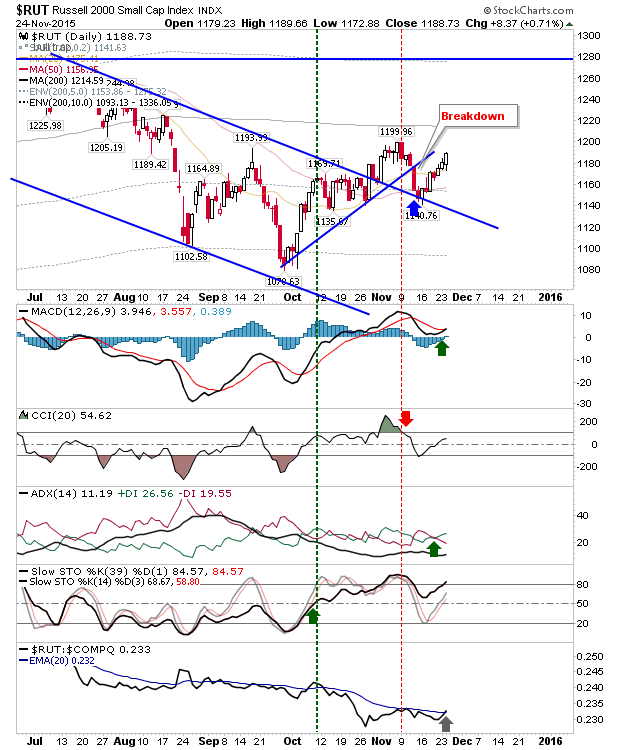

The Russell 2000 was the key performer. It finished with a MACD trigger 'buy' and looks ready to outperform the NASDAQ 100. This is an important development for bulls looking for more from other indices. A move to challenge - then break - its 200-day MA, would convert August-November action into a healthy basing action.

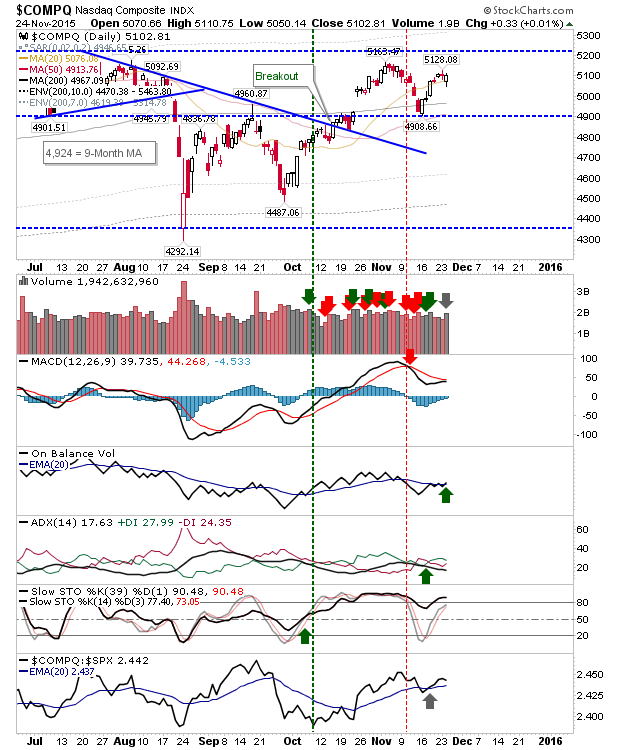

The NASDAQ registered higher volume accumulation as a brief sojourn below the 20-day MA was reversed. It's nicely set up for a push to new swing highs.

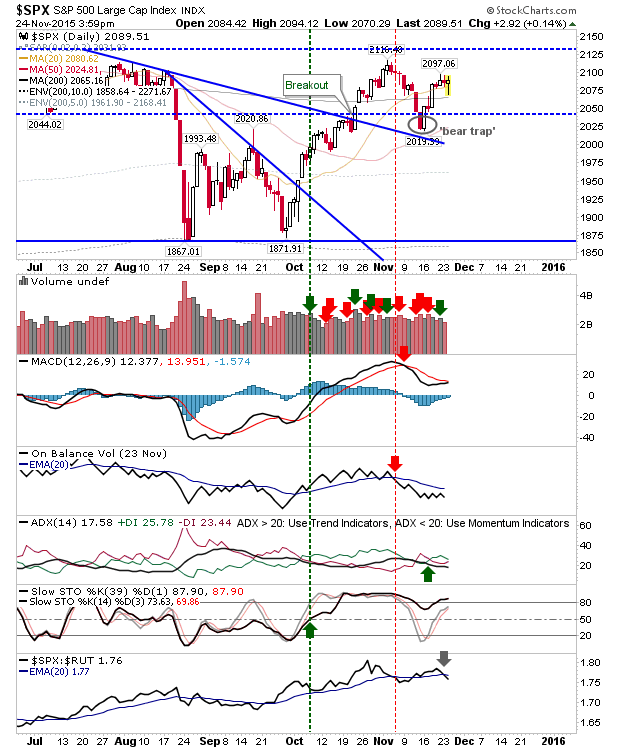

The S&P lost the most ground intraday, but managed to close positive by the close of business. It did clock a relative loss against the Russell 2000. The MACD hasn't yet triggered a 'buy,' but is close to doing so.

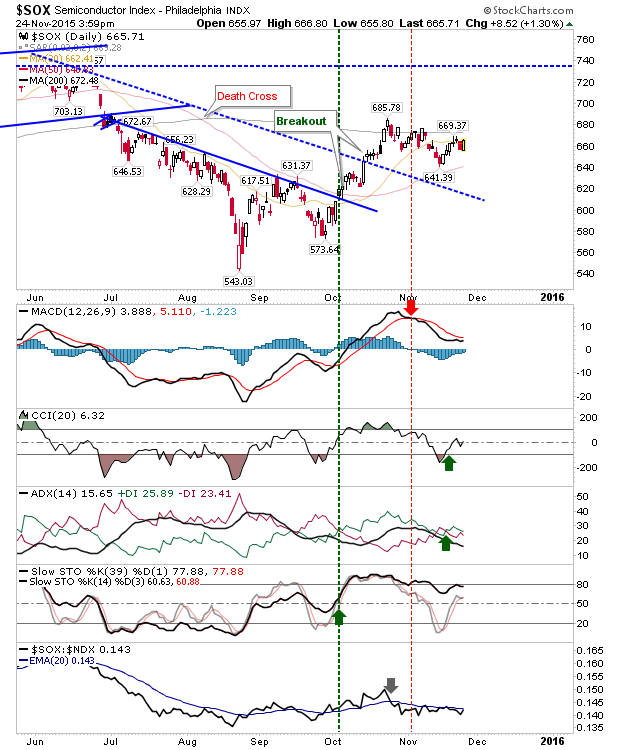

The Semiconductor Index finished with a bullish engulfing pattern and is continuing to build a solid base. Long-term prospects look good, especially as weak copper prices will eventually bring its reward.