- Fed rate hike, U.S. jobs report, more earnings in focus

- Devon Energy stock is a buy with strong Q3 earnings ahead

- Robinhood set to struggle amid shrinking revenue, fewer MAUs

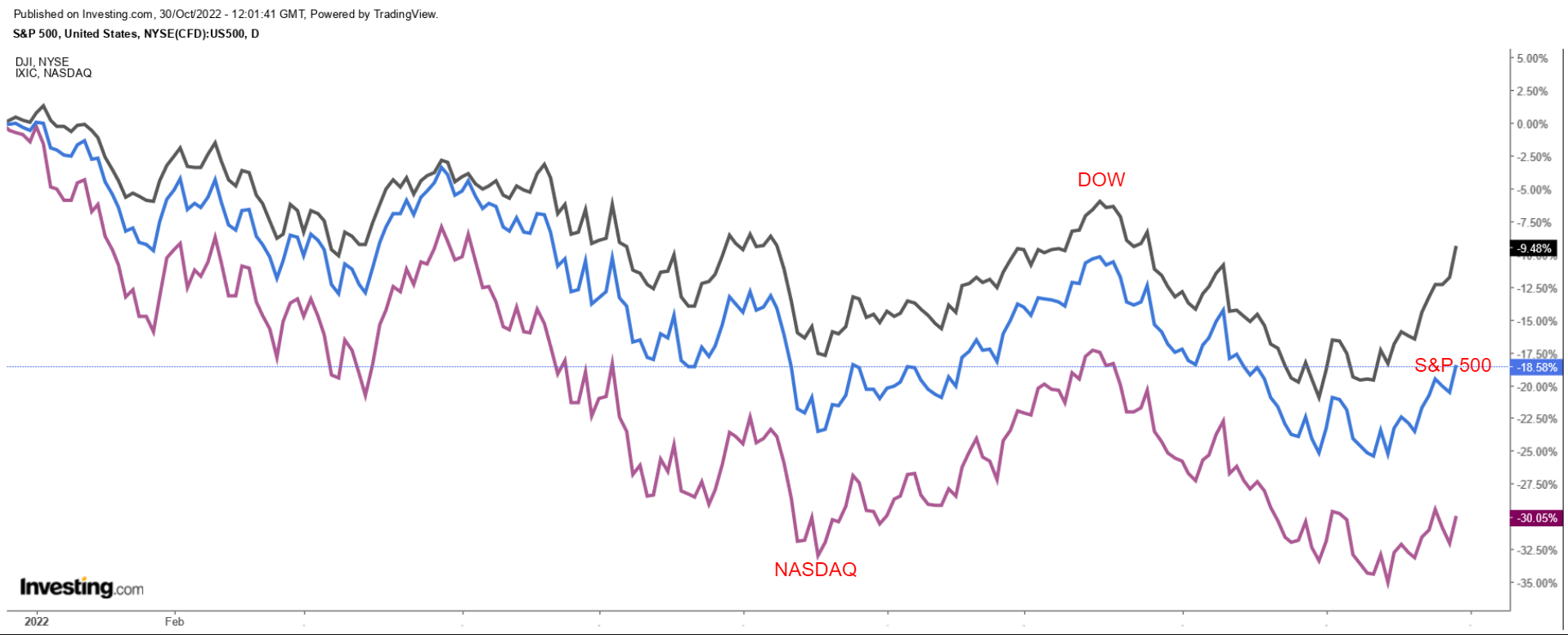

Stocks on Wall Street rallied on Friday, amid mounting speculation the Federal Reserve will slow its aggressive pace of interest rate hikes.

All three major indexes made notable gains on a weekly basis, with the blue-chip Dow Jones Industrial Average jumping 5.7% to notch its biggest weekly advance since May. Meanwhile, the benchmark S&P 500 rose 3.9%, while the tech-heavy Nasdaq Composite closed out the week 2.2% higher.

The coming week is expected to be another volatile one, with the Federal Reserve set to deliver its fourth straight 75-basis-point rate hike at the conclusion of its policy meeting on Wednesday. Fed Chair Jerome Powell’s comments on the pace of future rate increases will be in focus.

While some economists believe that the Fed will be ready to reduce the size of its rate hike to 50 basis points at its mid-December meeting, I expect Powell to push back on that notion.

On the economic calendar, most important will be Friday’s U.S. employment report for October, which is forecast to show solid job gains but a slowing from September’s solid growth. It will be one of the last major economic reports before the U.S. midterm election on Nov. 8.

In addition, the week ahead is also the busiest of third-quarter corporate earnings season, with nearly 150 S&P 500 companies releasing results. Some notable companies I’m watching include Advanced Micro Devices (NASDAQ:AMD), Roku (NASDAQ:ROKU) (see my article on Roku), Etsy (NASDAQ:ETSY), Coinbase (NASDAQ:COIN), PayPal (NASDAQ:PYPL), Block (NYSE:SQ), Uber (NYSE:UBER), Airbnb (NASDAQ:ABNB), Peloton (NASDAQ:PTON), Qualcomm (NASDAQ:QCOM), Starbucks (NASDAQ:SBUX), Pfizer (NYSE:PFE), Moderna (NASDAQ:MRNA), Eli Lilly (NYSE:LLY), CVS Health (NYSE:CVS), and ConocoPhillips (NYSE:COP).

Regardless of which direction the market goes, below we highlight one stock likely to be in demand and another which could see further downside.

Remember though, our timeframe is just for the upcoming week.

Stock To Buy: Devon Energy

I expect Devon Energy’s (NYSE:DVN) stock to outperform in the week ahead, with a potential breakout to a new 11-year peak on the horizon, as the low-cost oil and gas producer is forecast to deliver explosive earnings and revenue growth when it releases third-quarter numbers after the closing bell on Tuesday, Nov. 1.

As per moves in the options market, traders are pricing in a potential swing of approximately 6% in either direction for DVN stock following the earnings update.

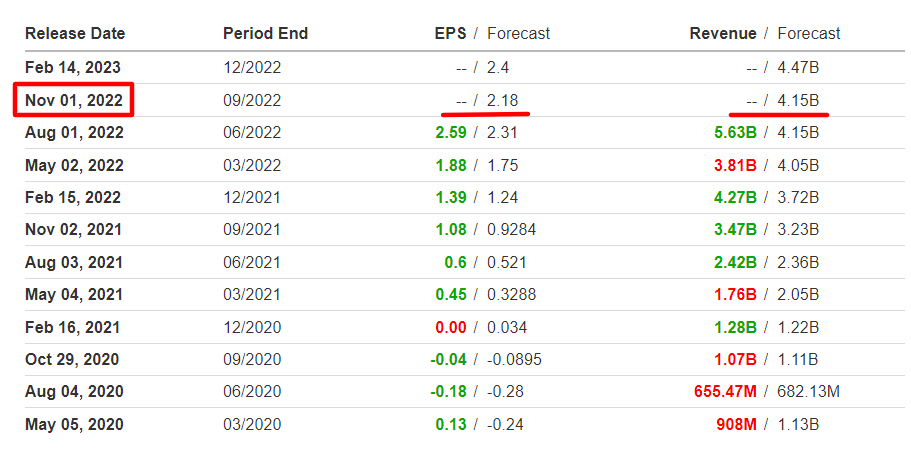

Following positive earnings and robust outlooks from industry heavyweights Exxon Mobil (NYSE:XOM) and Chevron (NYSE:CVX) last week, Devon - which has delivered triple-digit profit growth in four out of the last five quarters - is projected to report Q3 EPS of $2.18, soaring 101.8% from the year-ago period, as per Investing.com.

Revenue is anticipated to increase 19.6% year-over-year to $4.15 billion, as it benefits from its stellar operations in the oil-rich Permian Basin, while taking advantage of strong crude and natural gas prices.

Looking ahead, I expect Devon’s management will boost its profit and sales guidance for the current quarter and beyond to reflect the positive impact of skyrocketing crude oil and natural gas prices on its business. I will be curious to see if the thriving energy company plans to return more capital to shareholders in the form of higher dividend payouts and stock buybacks.

Devon is one of the largest U.S. independent shale oil and gas producers. It owns and operates key drilling assets in the Delaware Basin, Eagle Ford, Powder River Basin, Anadarko Basin, as well as the STACK shale formation in Oklahoma.

DVN stock, which has been a standout performer in the booming energy sector this year, ended at $76.01 on Friday, near a recent 52-week peak of $79.40 reached on June 9, its highest level since 2011.

Year-to-date, shares of the Oklahoma City-based energy company have jumped 76%, blowing past the gains made by competitors EOG Resources (NYSE:EOG) (+55.8%), Pioneer Natural Resources (NYSE:PXD) (+51.4%), Continental Resources (NYSE:CLR) (+65.2%), and Diamondback Energy (NASDAQ:FANG) (+47.8%) over the same timeframe.

Stock To Dump: Robinhood Markets

In my view, Robinhood Markets’ (NASDAQ:HOOD) stock will suffer a challenging week as the struggling stock market-trading platform operator gets set to deliver its latest financial results, which are likely to reveal another quarterly loss as well as shrinking revenue.

Based on moves in the options market, traders are pricing in a big move for HOOD shares following the results, with a possible implied move of about 11% in either direction.

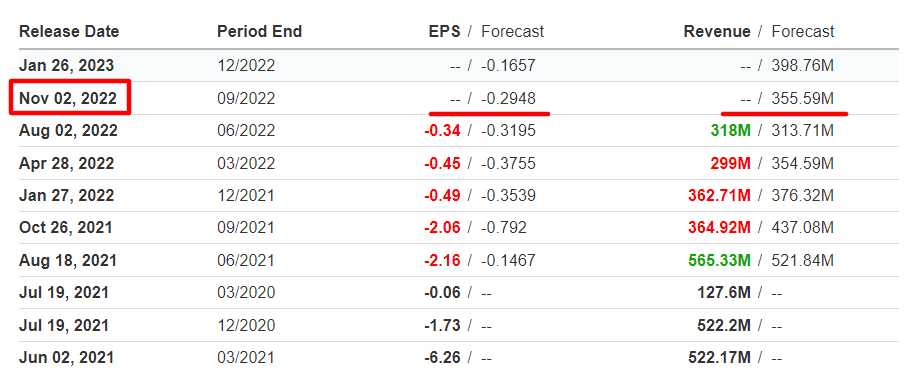

According to Investing.com, the retail brokerage firm is forecast to post a loss of $0.29 per share when it reports third quarter numbers after the closing bell on Wednesday, Nov. 2. If confirmed, it would mark the sixth consecutive quarterly loss.

Revenue is projected to slump 2.5% year-over-year to $355.6 million, reflecting the negative impact of several headwinds impacting the fintech company, mainly declining user growth amid a worsening macro backdrop and lower retail trading activity in stocks, options, and cryptocurrencies.

Robinhood earns nearly 70% of its revenue from customer transactions, so its financial results tend to suffer when trading activity on its platform slows.

As such, Robinhood’s update regarding its monthly active user (MAU) accounts will be in focus. The key metric badly missed expectations in the last quarter, tumbling 34% on an annual basis to 14.0 million. Assets under custody (AUC) - another key metric - will also be eyed after declining 31% in Q2 to $64.2 billion.

That does not bode well for Robinhood’s monetization efforts, which will prolong its path to profitability and heighten its execution risk.

Robinhood, which had already slashed 9% of its workforce in April, said it was laying off an additional 23% of its employees in August as the out-of-favor trading app attempts to navigate through the volatile market environment of mounting inflationary pressures and higher interest rates.

Year-to-date, Robinhood stock is down 35.2% amid the rout in shares of unprofitable technology companies with sky-high valuations. Nonetheless, shares of the Menlo Park, California-based firm have staged an impressive recovery since falling to an all-time low of $6.81 in mid-June, closing at $11.50 on Friday.

Despite the current turnaround, HOOD remains 86% below its record high of $84.12 touched shortly after its IPO in August 2021. The financial services company has a market cap of $10.1 billion, compared to a valuation of roughly $70 billion at its peak.

Disclosure: At the time of writing, Jesse is long the Dow Jones Industrial Average and the S&P 500 via the SPDR Dow ETF (DIA) and the SPDR S&P 500 ETF (SPY). He is also long the Energy Select Sector SPDR ETF (NYSE:XLE) and the Health Care Select Sector SPDR ETF (NYSE:XLV).

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.