By Jeff Stone -

Jittery investors faced another week of volatility as Asian markets opened Monday in the wake of the U.S. Federal Reserve’s decision not to hike interest rates. Analysts suggested the Fed's decision was motivated by difficulty in competing with China and other growing economies, a bad sign for already nervous investors.

Asian markets opened Monday largely lower, likely in reaction to the Fed's decision to keep interest rates near zero.

Economic reports on the U.S. gross domestic product, durable goods orders and the FHFA house price index are among the forecasts investors are anticipating later this week. Wall Street will likely keep an eye on flash business readings from China and the eurozone as well.

“The monetary-policy-watcher world has now turned decidedly bearish after last Firday's Fed meeting,” Evan Lucas, market strategist at trading services provider IG in Melbourne wrote in a note, as quoted by Reuters. “If emerging market risk, coupled with low-growth European environment is affecting Fed decision making, sentiment uncertainty will amplify.”

Major stocks including Apple (NASDAQ:AAPL), General Electric (NYSE:GE), Time Warner and Bank of America (NYSE:BAC) closed lower Friday. Analysts said it was proof the Fed's reluctance to raise borrowing costs has encouraged banks and asset managers, who were positioned to benefit from higher interest rates, to sell off sharply, pushing the Dow Jones Industrial Average down 290.16 points at the close, according to the Wall Street Journal.

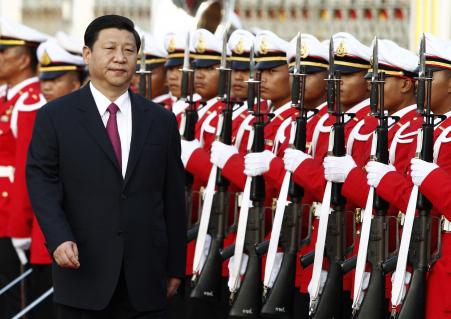

The uncertainty comes ahead of Chinese President Xi Jingping's scheduled trip to the U.S. Tuesday that includes a planned summit with President Obama, which is expected to focus on technology and China's commitment to open markets.

Other factors that could influence the market in the next week include the Taiwan central bank's decision on whether to cut interest rates for the first time since 2009, the level of Japan's consumer inflation and the pending release of industrial production data from Singapore Friday.

“The market is trying to discover where it's going next, and we have two possible paths, either we're overwhelmed by the lack of growth and China slams into a hard landing, or China is not slowing as much as people thought,” Wayne Lin, a portfolio manager at QS Investors, told the Journal. “What struck me about [the Fed's statement] was the reference to what was going on globally.”

Wall Street expects the earliest possible time for a U.S. rate rise will be December or early 2016. The Fed's surprise statement coincided with other market difficulties though, including China's move to devalue its currency and the S&P 500 entering a downswing in August.

“Once that trend is determined, a tenet of the century-old Dow Theory of market analysis says it is assumed to remain in effect, until it gives definite signals that it has reversed, according to the Market Technicians Associations knowledge base,” wrote Tomi Kilgore in a column for MarketWatch.com. “In other words, the trend is your friend, until it isn't.”