By Kit Rees

LONDON (Reuters) - European shares dropped to two-week lows on Thursday as political upheaval in Washington D.C. continued to weigh, though deal-making activity and earnings updates kept the region's outperformance against global peers intact.

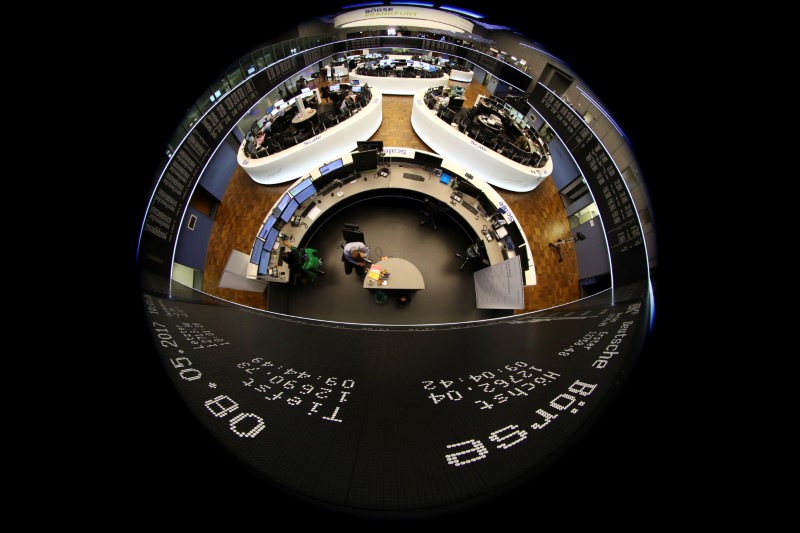

The pan-European STOXX 600 <.STOXX. index was down 0.9 percent, while Germany's DAX (GDAXI) retreated 0.8 percent and Britain's FTSE 100 (FTSE) dropped 1.3 percent, extending Wednesday's losses after reports that U.S. President Donald Trump had interfered with an FBI probe, following a week of tumult at the White House.

Financials and commodity-related sectors, the biggest beneficiaries of the reflation trade that accelerated in the aftermath of Trump's election win were the biggest drags.

The more defensive personal & household goods index (SXQP) was the only sector to make small gains.

"If you were long the market for the last five or six months ... or even a year, any sign of political uncertainty is going to trigger an opportunity to cash in your chips," David Madden, market analyst at CMC Markets UK, said.

"Everyone was buying the idea that the United States economy was going to take off, and now that this has majorly been put into jeopardy ... everyone's going to use that as an excuse to get out."

Some of the largest individual stock moves were spurred by fresh M&A action, with shares in Berendsen (L:BRSN) soaring more than 24 percent after French laundry firm Elis (PA:ELIS) made a $2.6 billion offer for the British rival.

Likewise shares in Swedish debt collector firm Intrum Justitia (ST:IJ) dropped 11 percent after it proposed a string of divestments in order to assuage European Commission concerns over its planned merger with Norwegian rival Lindorff.

Shares in Italy's Fiat Chrysler (MI:FCHA) were also weaker after the U.S. Justice Department said that it was preparing to sue the carmaker over excess diesel emissions as early as this week.

On the positive side, earnings buoyed shares in luxury goods firm Burberry (L:BRBY), which rose after its full-year update, while restaurant operator SSP Group (L:SSPG) also gained nearly 2 percent after some strong first half results.

So far Europe has enjoyed a strong earnings season, with 66 percent of firms which have reported results beating analysts' earnings expectations, which points to earnings growth of more than 19 percent, according to Thomson Reuters I/B/E/S data.

This chimes with an overall robust reporting season for major developed markets globally.

"Top line was particularly strong, helped by higher commodity prices, the pick-up in inflation and the rebound in global activity," JP Morgan's equity strategy team said in a note, highlighting that sales grew the most in Europe.