By Kate Duguid

NEW YORK (Reuters) - The price of the largest U.S. high-yield bond exchange-traded fund hit a two-year top on Monday as optimism about the "phase one" U.S.-China trade deal pushed investors into riskier corners of the market.

The iShares iBoxx $ High Yield Corporate Bond ETF (HYG) rose to $87.83, the highest since Jan. 26, 2018. The second-largest U.S. junk bond ETF by market capitalization, the SPDR Bloomberg Barclays (LON:BARC) High Yield Bond ETF (JNK), reached its highest since June 20, 2019 at a peak of $109.47 and could also climb to a two-year high if the rally continues this week.

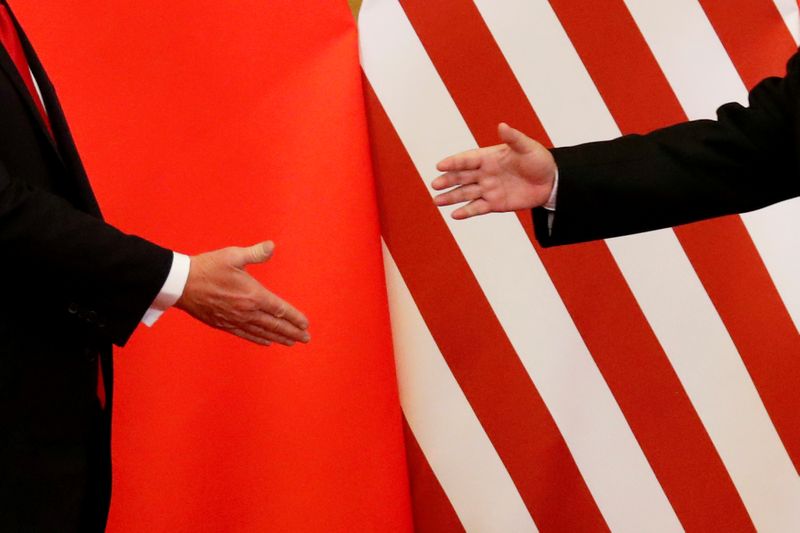

The "phase one" trade deal between Washington and Beijing has been "absolutely completed," National Economic Council Director Larry Kudlow told Fox News Channel, adding that U.S. exports to China will double under the agreement.

Under the trade agreement announced last week, Washington will reduce some tariffs on Chinese imports in exchange for Chinese purchases of agricultural, manufactured and energy products increasing by about $20 billion over the next two years. While Washington has touted the deal, Chinese officials have been more cautious, emphasizing that the trade dispute has not been completely settled.

The bullish trade news also benefited other higher-risk securities, including U.S. stocks, which recorded all-time highs, with the Dow (DJI) passing its November closing high and the S&P 500 (SPX) and Nasdaq (IXIC) marking record closes for the third straight session.

Safe-haven assets like U.S. Treasury yields were hit, driving the spread between U.S. corporate and government bonds tighter.

The spread of U.S. investment-grade credit yields over safer Treasuries was just 105 basis points at the close of trade on Friday, the tightest since March 2018, according to the ICE (NYSE:ICE) BofA corporate index < .MERC0A0>. The spread of the equivalent high-yield index over Treasuries was 371 basis points, the lowest since May 2019.