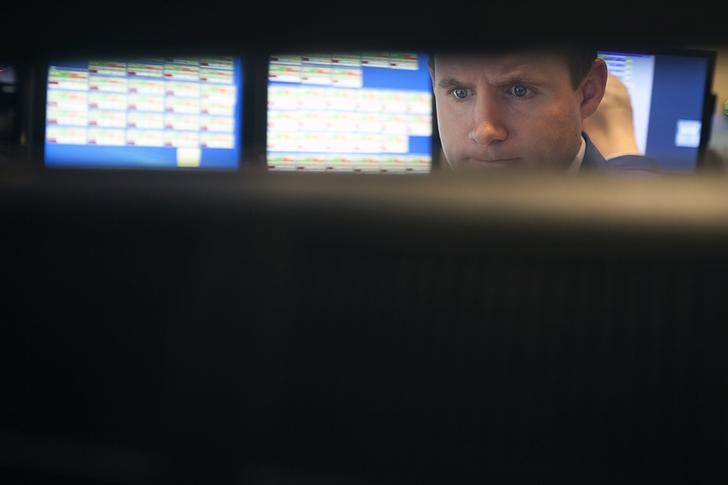

Investing.com – Stocks were rallying strongly Wednesday afternoon, paced overall by gains in energy, consumer discretionary and industrial stocks.

In addition, the Dow Jones industrials were surging because of strength in Boeing (NYSE:BA), Goldman Sachs (NYSE:GS), Home Depot (NYSE:HD), UnitedHealth Group (NYSE:UNH) and chemical maker Dow Inc. (NYSE:DOW)

At 3:15 PM ET (19:15 GMT), the Dow was up 0.97% and the S&P 500 had added 0.65%. The Nasdaq Composite was up a more modest 0.43% because of weakness in such key tech stocks as Microsoft (NASDAQ:MSFT), Facebook (NASDAQ:FB) and Adobe Systems (NASDAQ:ADBE).

Energy shares were surging on the Energy Information Administration's report of a big drawdown of U.S. crude oil inventories. West Texas Intermediate was up 85 cents to $55.78. Brent, the global benchmark, climbed 90 cents to $59.93.

Even with today's stock-market gains, the major averages are still below their late July peaks and their peaks in the early fall of 2018 before a major slump that ended at Christmas.

Gold was off slightly.

Interest rates were lower, with the 10-year Treasury yield at 1.464%. But there was still a yield inversion in place with the spread between the 10-year yield and 2-year yield at a negative 3.95 basis points. The inversion is a signal of a possible recession ahead.