By April Joyner

NEW YORK (Reuters) - The benchmark S&P 500 index and the Nasdaq edged upward to snap a two-day losing streak on Friday as positive corporate results offset lingering skepticism over the United States and China reaching a trade deal before the March 1 deadline.

Shares of Coty Inc, Mattel Inc (NASDAQ:MAT) and Motorola Solutions Inc (NYSE:MSI) jumped after the companies reported better-than-expected quarterly results.

In addition, shares of Electronic Arts Inc (NASDAQ:EA), which plunged on Wednesday after the company's quarterly results, surged after the videogame publisher said that its game Apex Legends had attracted 10 million players in three days.

Electronic Arts and Motorola Solutions were among the top boosts to the S&P 500.

Earlier, U.S. stocks dragged as trade concerns continued to weigh on investor sentiment. President Donald Trump said on Thursday he did not plan to meet Chinese President Xi Jinping before the deadline set for reaching an agreement.

U.S. Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin will travel to Beijing for principal-level meetings on Feb. 14-15, a statement from the White House said.

As the session wore on, Wall Street's major indexes regained lost ground.

"What's expected, based on the way the market has performed, is that there is a risk that we'll see another round of tariff-hiking, but that risk will be overridden by some type of agreement," said John Stoltzfus, chief investment strategist at Oppenheimer Asset Management in New York. "These are not indices that are showing extreme investor concern at this point."

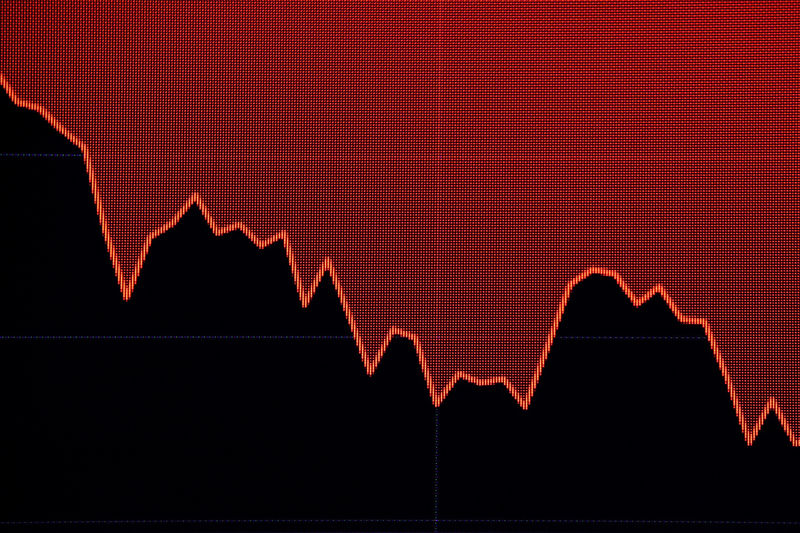

The Dow Jones Industrial Average fell 63.2 points, or 0.25 percent, to 25,106.33, the S&P 500 gained 1.83 points, or 0.07 percent, to 2,707.88 and the Nasdaq Composite added 9.85 points, or 0.14 percent, to 7,298.20.

For the week, the Dow added 0.17 percent, the S&P 500 rose 0.05 percent, and the Nasdaq gained 0.47 percent.

The S&P 500 has risen more than 15 percent from 20-month lows in December, spurred by a dovish Federal Reserve and largely positive fourth-quarter earnings, as well as hopes for an eventual U.S.-China trade deal.

Of the S&P 500 companies that have reported quarterly results, 71.5 percent have beaten profit estimates, according to IBES data from Refinitiv.

However, analysts now expect current-quarter profit to dip 0.1 percent from the year before, not grow the 5.3 percent estimated at the start of the year.

Declining issues outnumbered advancing ones on the NYSE by a 1.15-to-1 ratio; on Nasdaq, a 1.04-to-1 ratio favored decliners.

The S&P 500 posted 20 new 52-week highs and two new lows; the Nasdaq Composite recorded 35 new highs and 37 new lows.

Volume on U.S. exchanges was 6.83 billion shares, compared to the 7.46 billion average over the last 20 trading days.