By Amal S and Sruthi Shankar

(Reuters) - European stocks inched up on Wednesday as merger talks powered gains in French grocer Carrefour (PA:CARR) and Spain's Telefonica (NYSE:TEF), offsetting weakness in banking stocks on worries about extended lockdowns across the continent.

Carrefour shares hit their highest level since August 2019 after Canadian convenience-store operator Alimentation Couche-Tard Inc said it had approached Europe's biggest retailer to discuss a combination.

The stock was last up 8.6%, leading gains in Paris' CAC 40, while shares in French rival Casino rose 3.1%.

Spanish telecom company Telefonica rose 7.9% after it agreed to sell its mobile phone masts in Europe and Latin America to U.S.-based telecom infrastructure operator American Towers for 7.7 billion euros ($9.41 billion) in cash.

Telecom stocks were the top sectoral gainers, up 1.4%.

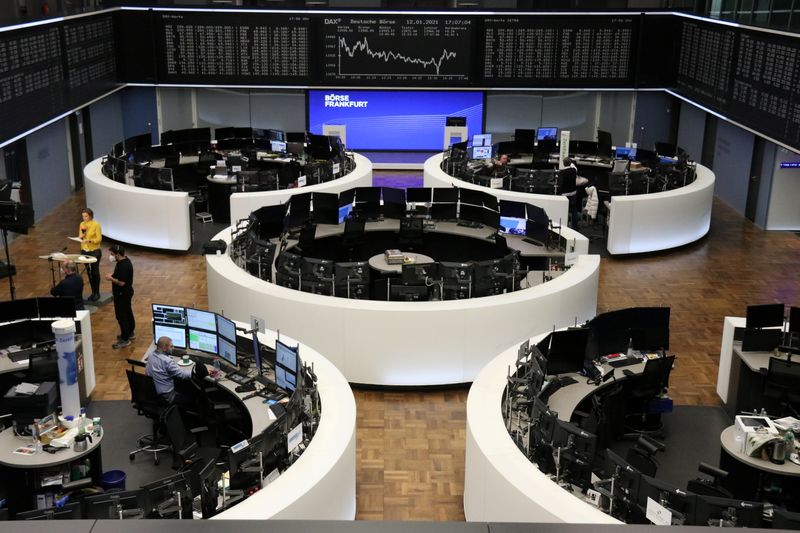

The broader pan-European STOXX 600 index rose just 0.2% as investors took a pause after last week's strong rally.

Banks fell the most as on fears that prolonged restrictions in Europe to control soaring coronavirus cases will further slow an economic recovery.

"We're not going to see restrictions being lifted anytime soon, so that's adding to fears of a decline in economic activity," said David Madden, analyst at CMC Markets.

"The longer the economies are under lockdown the more likely we're going to have loan defaults. So that's impacting the banks."

The German DAX was flat as Health Minister Jens Spahn said the country will not be able to lift all restrictions at the beginning of February.

The Dutch government also said it would extend lockdown measures, including the closure of schools and shops, by at least three weeks.

Investors also kept an eye on political developments in Rome where former Prime Minister Matteo Renzi warned that he was ready to sink the government if current premier Giuseppe Conte did not apply for a loan from the euro zone's bailout fund to relaunch Italy's battered economy.

Italy's FTSE MIB rose 0.2%, while banking stocks fell 0.6%.

Meanwhile, data showed Italian industrial output fell more than expected in November, suggesting the recovery petered out in the fourth quarter due to new curbs on business.

Utilities were a drag after Danish offshore wind farm developer Orsted (OTC:DOGEF) slumped 6.7% on warning a return to more normal wind speeds this year would hit operating earnings.

Copenhagen stocks fell 0.8%.

Food ordering group Just Eat Takeaway fell 3.9% as a disappointing 2020 margin guidance overshadowed a 57% jump in fourth-quarter orders.