By Peter Nurse

Investing.com - European stock markets posted strong gains Monday, after Joe Biden claimed victory in the U.S. presidential election over the weekend, ending months of uncertainty that has roiled financial markets.

At 3:40 AM ET (0740 GMT), the DAX in Germany traded 1.9% higher, the CAC 40 in France rose 1.6%, while the U.K.'s FTSE index climbed 1.4%.

Democrat candidate Joe Biden took the 270 electoral college votes required for victory in the U.S. presidential race on Saturday by winning the battleground state of Pennsylvania, seemingly putting to an end a tight and highly-charged election.

President Donald Trump, the first incumbent to lose a re-election bid in 28 years, has not conceded so far, but will find it difficult to overturn the results with allegations of voting fraud that have so far not gained traction in any court.

Republicans appear to have retained control of the Senate, though the final makeup may not be clear until runoff votes in Georgia in January.

Biden is “promising major spending increases, notably in healthcare, education and infrastructure projects. We also could be looking at major tax and regulatory changes. However, if Congress remains in Republican hands, we could see many of these policies watered down,” said ING’s James Knightley, in a research note.

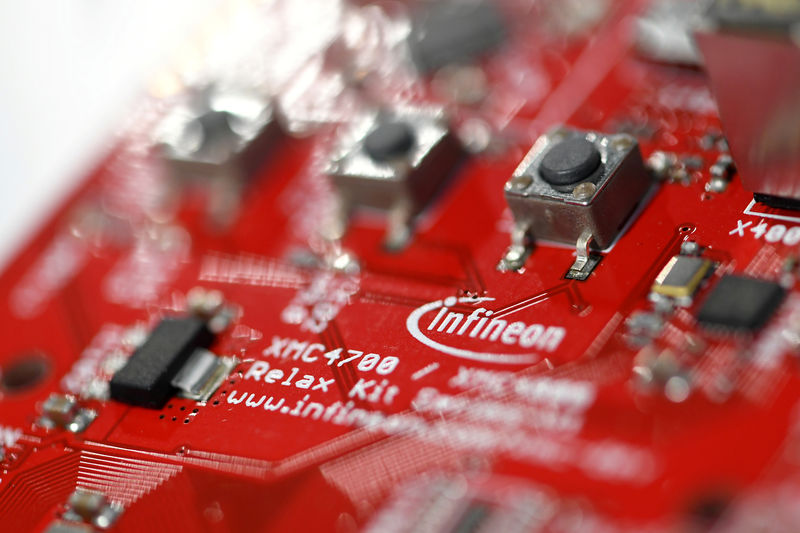

In corporate news, Infineon (OTC:IFNNY) stock rose 3.4% after the German chipmaker offered up strong guidance, forecasting that revenue would grow by nearly 23% in the year ahead. This has overshadowed a cut in its dividend.

Societe Generale (OTC:SCGLY) stock rose 2.6% after the French bank announced plans to cut costs, including cutting 640 jobs in France, mainly at its investment-banking operations.

On the flip side, Norwegian Air (OL:NORR) stock slumped over 20% after the Norwegian government said it will not provide additional financial support for the cash-strapped airline, leaving it again on the verge of bankruptcy.

The coronavirus, and the associated travel restrictions, is the main reason the airline is in difficulty, and its sudden growth remains a major market headwind, both in Europe and America.

Europe also has Brexit to deal with, as the Nov. 15 deadline for a trade deal between Britain and the European Union draws ever closer. Major differences over the so-called level playing field rules for business and access to British fishing waters still exist.

Oil prices surged Monday, with Biden’s victory in the U.S. presidential race buoying risk appetites as traders look for a larger coronavirus relief package, offsetting worries about the impact on demand from a worsening pandemic.

U.S. crude futures traded 2.3% higher at $37.99 a barrel, while the international benchmark Brent contract rose 1.9% to $40.20, recovering after losing 4% on Friday.

Elsewhere, gold futures rose 0.3% to $1,958.10/oz, but remained on course for its biggest weekly gain since July, while EUR/USD traded 0.1% lower at 1.1867.