By Peter Nurse

Investing.com - European stock markets traded higher Wednesday, with positive corporate earnings more than offsetting tighter German restrictions to fight the coronavirus.

At 3:55 AM ET (0855 GMT), the DAX in Germany traded 0.6% higher, the CAC 40 in France rose 0.6% and the U.K.'s FTSE index climbed 0.2%.

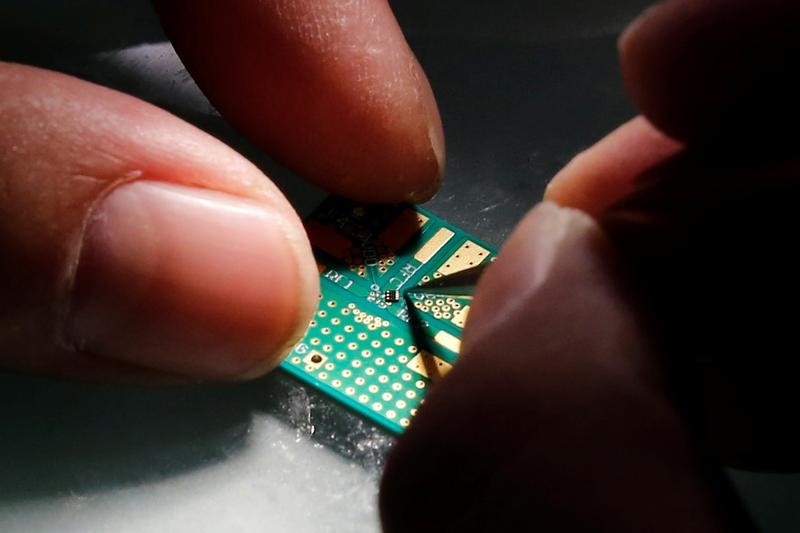

ASML (AS:ASML), the Dutch maker of chipmaking equipment, set the bar high by raising its dividend and launching a 6 billion euro buyback, in addition to posting a solid rise in profit and revenue in the fourth quarter.

ASML stock rose 2.3%, and helped propel the whole sector higher, with the EURO STOXX Technology index climbing to an all-time high. IQE (LON:IQE) stock rose 3.4% and Germany's Dialog Semiconductor (DE:DLGS) rose 1.3%.

In the luxury retail sector, Richemont (SIX:CFR) stock climbed 4% to its highest in 18 months, as growth in Asia helped drive 5% sales growth in its fiscal third quarter.

Burberry (LON:BRBY) stock rose 4.7% after an earnings update, while Hugo Boss (DE:BOSSn) stock added 4.6% after Mike Ashley-led Frasers (LON:FRAS) said it boosted its stake in the company.

These updates have helped alleviate the mood after Chancellor Angela Merkel and regional leaders agreed late Tuesday to tighten Germany’s coronavirus restrictions to check the spread of the disease. These moves included closing non-essential stores in hard-hit areas until Feb. 14, although stopped short of imposing a national curfew as in France.

There have been some signs that the incidence of coronavirus cases has been lessening in Europe, but the Dutch government warned Tuesday of the likelihood of additional measures on top of the current lockdown in place until at least Feb. 9, while the U.K. and Portugal reported record numbers of deaths.

In political news, Italian Prime Minister Giuseppe Conte won a confidence vote in the upper house Senate on Tuesday, ensuring he stays in power after a junior partner quit his coalition last week, albeit without a solid majority in parliament.

In the U.S. overnight, Treasury Secretary nominee Janet Yellen defended the need for the $1.9 trillion fiscal relief package, proposed by incoming President Joe Biden, urging lawmakers to “act big” in efforts to boost economic recovery from Covid-19.

Biden will take office later Wednesday under unprecedented security measures after the Jan. 6 assault on the Capitol.

Oil prices pushed higher Wednesday, helped by expectations that Biden's stimulus plans will boost fuel demand.

U.S. crude inventory data due from the American Petroleum Institute will be in focus later Wednesday, a day later than usual due to Monday’s holiday.

U.S. crude futures futures traded 0.6% higher at $53.30 a barrel, while the international benchmark Brent contract rose 0.8% to $56.34.

Elsewhere, gold futures rose 0.8% to $1,854.50/oz, while EUR/USD traded 0.1% higher at 1.2132.