By Yasin Ebrahim

Investing.com – The Dow closed higher on Wednesday as gains in energy and industrial sectors helped overshadow a setback on Capitol Hill to increase direct payments included in the stimulus bill to $2,000.

The Dow Jones Industrial Average rose 0.24%, or 73 points to surpass its prior record close of 30,403.97. The S&P 500 closed up 0.19%, while the Nasdaq Composite rose 0.15%.

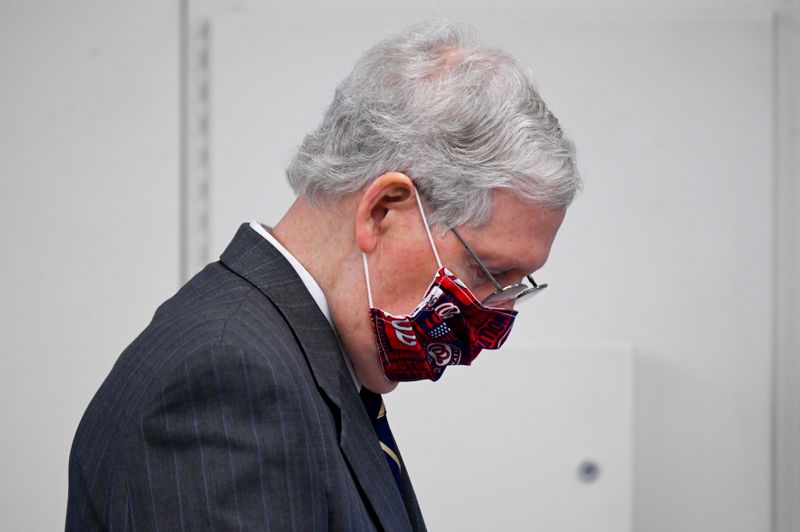

Senate Majority Leader Mitch McConnell refused to carve out the proposal to boost stimulus checks into a standalone bill, preferring to keep the measure as part of a packaged legislation that includes proposals to repeal a law offering protection to internet platforms, and create a commission to study voter fraud.

The move all but ends any hopes for a ramp-up in direct payments to Americans as the lawmakers are divided on the other two issues.

The latest political developments didn't turn the tide as the broader market closed in the green.

Energy stocks rose more than 1% on the back of rising oil prices following a larger-than-expected weekly draw in U.S. crude inventories.

The Energy Information Administration reported Wednesday crude inventories for the week ended Dec. 25 fell by 6.1 million barrels, compared with forecasts for a 2.6 million barrel decline.

Occidental Petroleum (NYSE:OXY), HollyFrontier (NYSE:HFC) and Devon Energy (NYSE:DVN), were among the biggest gainers in energy, with the latter up more than 5%.

Caterpillar (NYSE:CAT), meanwhile, led industrials higher after heavy-equipment was hailed a "top 2021 idea" by Baird on signs of improving construction equipment demand and a possible jump in infrastructure spending next year as both sides of the political aisle have acknowledged the need for upgrades across the country.

Investor sentiment on stocks was also boosted by positive vaccine news after AstraZeneca (NASDAQ:AZN) said its Covid-19 vaccine, developed in partnership with Oxford University, had received approval for emergency use and could be rolled out as soon as Tuesday.

The step-up in the fight against the pandemic comes as officials in Colorado believe they have found the second case of the more infectious coronavirus variant in the U.S., first identified in the UK, raising concerns about further restrictions.

In tech, meanwhile, Intel (NASDAQ:INTC) gave back some of its gains from a day earlier, falling 1%, following reports that hedge fund Third Point (NYSE:TPRE) took a $1 billion stake in the chipmaker. Third Point chief executive Dan Loeb reportedly urged the company to seek alternative strategies to boost its stock price.

In other news, Tesla (NASDAQ:TSLA) added 4% as Wall Street talked up the prospect of better-than-expected deliveries for 2020 ahead of the electric vehicle automaker's numbers next week.

Tesla is expected to surpass its target delivery of 500,000 electric vehicles in 2020 as it is forecast to beat Wall Street expectations of 163,000 deliveries in the fourth quarter, Credit Suisse (SIX:CSGN) said.

"While our expectation would require a record month for Tesla in December, we believe this is feasible given Tesla's typical quarter-end wave," it added.