Investing.com-- Chinese stocks rose sharply on Tuesday after the country’s top political body signaled a major shift in Beijing’s stance towards unlocking more stimulus and shoring up a sluggish economy.

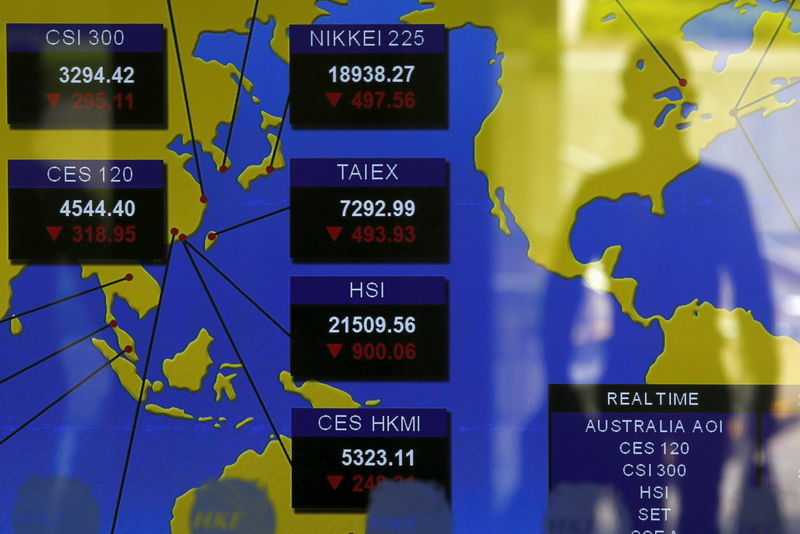

The benchmark Shanghai Shenzhen CSI 300 index rose 2.5%, while the Shanghai Composite added 1.9%. Gains in Hong Kong-listed mainland stocks saw the Hang Seng rally over 2%.

Gains in Chinese markets came after China’s Politburo- a committee of the 24 most senior officials in the Communist Party- said the country will adopt a “moderately loose” monetary policy, signaling a sharp pivot from its prior “prudent” stance established in 2010.

The Politburo also said it will support stock and property markets while “vigorously” boosting local consumption and demand- its most clear signal yet of more targeted stimulus measures.

The Politburo pledges now likely set the tone for China’s Central Economic Work Conference, which is set to begin on Wednesday. Analysts at Westpac expect the conference to “more firmly set out policy priorities and objectives including the annual growth goal.”

China’s benchmark stock indexes are trading up between 15% and 20% up so far in 2024, having rallied in October on promises of more stimulus. But a lack of details on the planned stimulus measures had swiftly cut short the October rally.

Beijing is now expected to ramp up its economic support, especially in the face of potential trade headwinds from the U.S. under a Donald Trump presidency.

The Politburo comments also helped investors mostly look past recent data that showed a persistent deflationary trend in China, further emphasizing on the need for more targeted stimulus measures.

A property market downturn and a sharp fall in private consumption have been the two biggest weights on the Chinese economy in recent years.