By Sinéad Carew and Marc Jones

NEW YORK/LONDON (Reuters) - Wall Street equities made little progress in Thursday's choppy session as investors digested economic data after a big rally in the previous session from U.S. Federal Reserve signals that it would slow its interest rate hiking pace.

The U.S. dollar index fell to its lowest level since August and Treasury yields sank after Fed Chair Jerome Powell said on Wednesday that it was time to slow rate hikes. He also pointed to a protracted economic adjustment to higher borrowing costs and a slow decline inflation as well as a chronic shortage of workers in the United States.

While oil futures settled well below their session highs, crude had risen sharply earlier in the session on the chance of further supply cuts by OPEC+ and as easing COVID curbs in China spurred hopes for higher demand from world's top crude importer.

While equity investors cheered signs of moderating inflationon Thursday and an increase in U.S. consumer spending in October, risk appetites dimmed after data showed U.S. manufacturing activity contracted for the first time in 2-1/2 years in November as higher borrowing costs weighed on demand.

Still investors saw easing inflation supporting the Fed chair's indication that rate hikes could slow. In the 12 months through October, the personal consumption expenditures (PCE) price index increased 6.0% after advancing 6.3% in September compared with the Fed's 2% target.

"We're in a little bit of a limbo after yesterday's huge rally. Investors are still digesting that and waiting on the payrolls data tomorrow," said Garrett Melson, portfolio strategist at Natixis Investment Managers Solutions. Friday's jobs report meeting or missing expectation could help stocks as it would give the Fed support for easing rate hikes.

"All asset classes are one big rates trade," he said. "We're seeing the setup as favorable for a rally through year end. The bias is still bearish. There's still a lot of investors who are under-risked. Yesterday was ripping the Band-Aid off worrying about Powell continuing to be hawkish and the ensuing scramble to get exposure."

The Dow Jones Industrial Average fell 194.76 points, or 0.56%, to 34,395.01, the S&P 500 lost 3.54 points, or 0.09%, to 4,076.57 and the Nasdaq Composite added 14.45 points, or 0.13%, to 11,482.45.

The S&P had rallied 3% on Wednesday after Powell's comments while Nasdaq had gained more than 4% and the Dow had risen 2%.

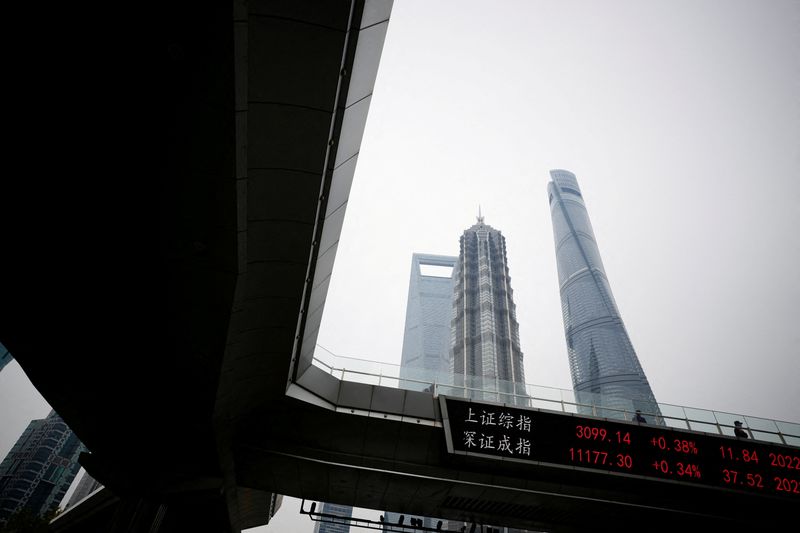

MSCI's gauge of stocks across the globe gained 0.79% while emerging market stocks rose 0.63%.

The dollar index was last down 1.002% after hitting its lowest point since Aug. 11, while the euro is up 1.12% to $1.0522, hitting its highest level against the greenback since late June.

The Japanese yen strengthened 2.03% versus the greenback at 135.29 per dollar, while Sterling was last trading at $1.2244, up 1.56% on the day.

In bonds trading, moderating inflation in October initially pushed U.S. Treasury yields further down following Wednesday's move in response to the prospects of slower rate hikes.

Benchmark 10-year notes were down 19.4 basis points to 3.507%, from 3.701% late on Wednesday. The 30-year bond was last down 21.9 basis points to yield 3.6039%, from 3.823%. The 2-year note was last was down 13.2 basis points to yield 4.2399%, from 4.372%.

In commodities, earlier in the day oil prices had risen sharply ahead of the Dec. 4 meeting of the Organization of the Petroleum Exporting Countries (OPEC) and allies including Russia, a group known as OPEC+.

Though sources had said on Wednesday that policy change is unlikely, some said that a further cut cannot be ruled out.

U.S. crude settled up 0.8% at $81.22 per barrel and Brent settled at $86.88, down 0.1% on the day.

Gold prices climbed sharply as the dollar weakened.

Spot gold added 2.0% to $1,802.94 an ounce. U.S. gold futures gained 3.17% to $1,801.40 an ounce.