Forex News and Events

AUD to suffer as iron ore rally loses steam (by Arnaud Masset)

The Australian dollar had have a nice bull run since the beginning of the year against the backdrop of fading rate-hike expectation in the US and rallying commodity prices, especially Iron ore, gold and crude oil. Iron ore prices surged as much as 60% since the beginning of the year with the most liquid future contracts on the Dalian commodity exchange (China) trading at CNY 500 a metric ton, which corresponds to roughly $74, the highest level since January 2015. The wave of optimism over the prospect for the Chinese’s is one of the major cause for this sharp increase in iron ore prices.

However, we believe that the rally in iron ore prices had its day as nothing justify further appreciation. Indeed iron ore ports inventory continued to rise steady over the first quarter while the production of crude steel kept decreasing. This situation suggests that the rise in iron ore prices has been mainly driven by massive speculation on the future market and that nothing justify the actual prices level. In addition, China’s construction sector, one of China’s largest consumer of steel, remains in the doldrums in spite of early signs of recovery. We therefore anticipate that iron prices will correct to the downside as speculators take profits home. In so doing, it would add pressure on the Australian economy, the world largest exporter of iron ore (50% of the world’s total production).

In such an environment the Australian should come under renewed pressure. However, one thing can delay a correction in the Aussie: the Federal Reserves. Indeed, fading rate hike expectation in the US should maintain the dollar lower, which would help commodity prices and therefore commodity currencies. On the other hand, the recent (very) disappointing inflation data from Australia - negative inflation in 1Q 2016 (-0.2%q/q and 1.3%y/y) - could encourage the RBA to ease further its monetary policy to boost inflation. All in all, we anticipate the Aussie will correct to the downside, with the $0.74 level as next target.

Japan: Holding off further stimulus (by Yann Quelenn)

Japanese stock markets were down this morning. Both the Nikkei and Topix index closed largely in negative territory, losing more than 3%. The reason behind this is simple: the perfusion from the Japanese central bank will not be increased. Its asset purchase target will be kept at 80 trillion yen per year and the deposit rate will remain unchanged at 0.1%. The BoJ has decided not to add additional stimulus despite recent weak fundamental data, including very low inflation. Japanese policymakers are now claiming that the 2% CPI target should be achieved by fiscal 2017.

The central bank stated that they need more time to assess the effect of negative interest rates. Only a deeper economic slowdown would push the BoJ to add more stimulus. Currency-wise, the yen is growing stronger against the greenback and less that 109 yen can be exchanged for a one dollar note. There is a decent likelihood that the BoJ’s wait-and-see approach would drive the yen towards 100. A major driver of the USD/JPY is also the monetary policy divergence between the Fed and the BoJ but the US path to higher rates only exists, for now at least, in the heads of Fed members. For the time being, we believe that there should not be any further easing until after this summer. For this reason we remain bearish USDJPY in the medium-term horizon. The BoJ will then be condemned to ease further.

USD/JPY - Collapsing.

The Risk Today

Yann Quelenn

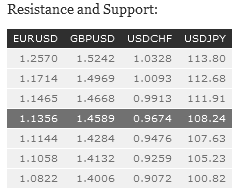

EUR/USD is moving sideways within downtrend channel. Hourly support is located at 1.1217 (25/041/2016 low). Stronger support can be found at 1.1144 (24/03/2016 low). Hourly resistance can be found at 1.1465 (12/04/2016 high). Expected to show further move within the downtrend channel. In the longer term, the technical structure favours a bearish bias as long as resistance at 1.1746 ( holds. Key resistance is located at 1.1640 (11/11/2005 low). The current technical appreciation implies a gradual increase.

GBP/USD has failed at the moment to reach resistance at 1.4668 (04/02/2016 high). Hourly support is given at 1.4475 (27/04/2016 high). Expected to show further another upside move toward resistance at 1.4668 (04/02/2016 high). The long-term technical pattern is negative and favours a further decline towards key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY has declined sharply on BoJ rate decision. The pair is now targeting hourly support at 107.68 (07/04/2016 low). Resistance can be found at 111.88 (intraday high). Expected to show further increase. We favour a long-term bearish bias. Support at 105.23 (15/10/2014 low) is on target. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems now less likely. Another key support can be found at 105.23 (15/10/2014 low).

USD/CHF is lying within a short-term uptrend channel but the pair fails to hold above former resistance at 0.9788 (25/03/2016 high). Hourly support can be found at 0.9499 (12/04/2016 low). Expected to show further increase. In the long-term, the pair is setting highs since mid-2015. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours a long term bullish bias.