Market Brief

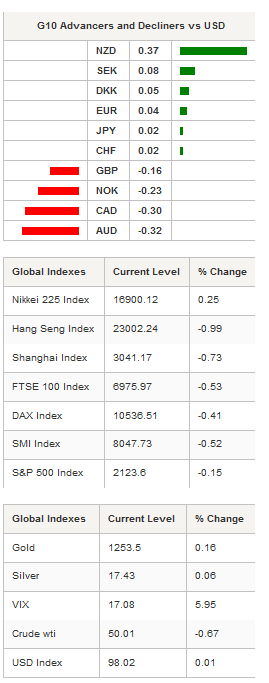

It was a soft open for Asian markets as investors lacked new directional drivers. The Nikkei rose 0.26%, while the Hang Seng and Shanghai composite fell -0.80% and 0.74%. USD was mixed but no single currency really gained a major advantage. In Asian FX, the KRW fell 0.41% against the USD as the Samsung (KS:005930) news flow continues to weigh on the export-driven economy. Interestingly, as we expected, there was little appetite to sell THB as the nation continues to mourn the passing to the world’s longest reigning monarch. USD/THB traded around the 35.35 handle. With economic events pushed into the end of the week, we anticipate volatility to remain subdued.

In Japan, industrial production was revised downwards to 1.3% m/m in August against 1.5% prior read. USD/JPY however, remains glued to yield spreads, and unreactive to the mildly positive result with the pair trading around the 104.00 handle.

NZD/USD was able to firm against the USD as traders await tomorrow’s release of New Zealand Q3 CPI. The RBA assistant governor, John McDermott’s comments that the weak inflation outlook indicates the need for further rate cuts, while a policy rate cut is almost completely priced in a soft read will have investors pricing in another 25bp cut. A disappointing inflation read will further put pressure on NZD with traders targeting 0.6960.

Crude prices are bouncing as a balance of production cut rhetoric and a rising US rig count is keeping WTI above the $50 handle for now. Yet, with a coalition of Iraqi forces planning a long-awaited offensive against ISIS in Mosul, uncertainty in the Middle-East is sure to rise.

In a speech, Fed Chair Yellen suggested that the monetary policy strategy should allow the economy to run “hot” for a period. By not tightening policy immediately this should result in the lingering supply side effect of a deep recession to recover. We have heard this thinking from Yellen and Bernanke in the past and it remains a primary rational for why we anticipate no hike in 2016. These comments should give the hike advocates room for pause however, USD was little moved today. With the probability of a December rate hike stuck around 65% we suspect there is significant room for adjustment lower.

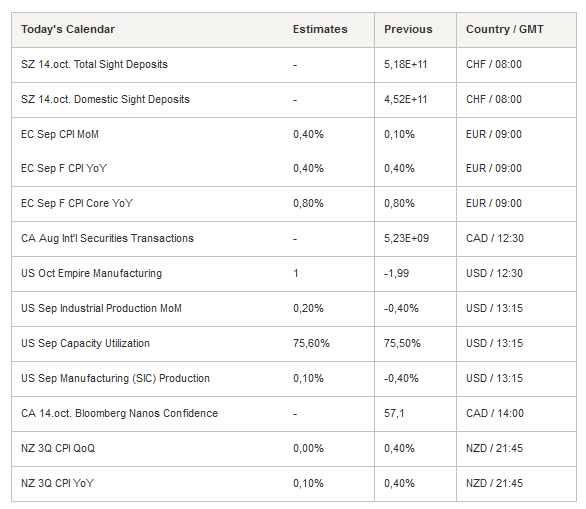

On the docket today, traders will be focused on US empire manufacturing, capacity utilization and industrial production.

Currency Tech

EUR/USD

R 2: 1.1616

R 1: 1.1428

CURRENT: 1.1113

S 1: 1.1046

S 2: 1.0913

GBP/USD

R 2: 1.3121

R 1: 1.2857

CURRENT: 1.2448

S 1: 1.2352

S 2: 1.1841

USD/JPY

R 2: 107.90

R 1: 104.32

CURRENT: 103.91

S 1: 99.02

S 2: 96.57

USD/CHF

R 2: 0.9956

R 1: 0.9885

CURRENT: 0.9825

S 1: 0.9522

S 2: 0.9444