Yesterday, after a bright start from markets with decent gaps higher, bears came in heavy in the morning and end-of-day trading to beat markets back below Friday's close.

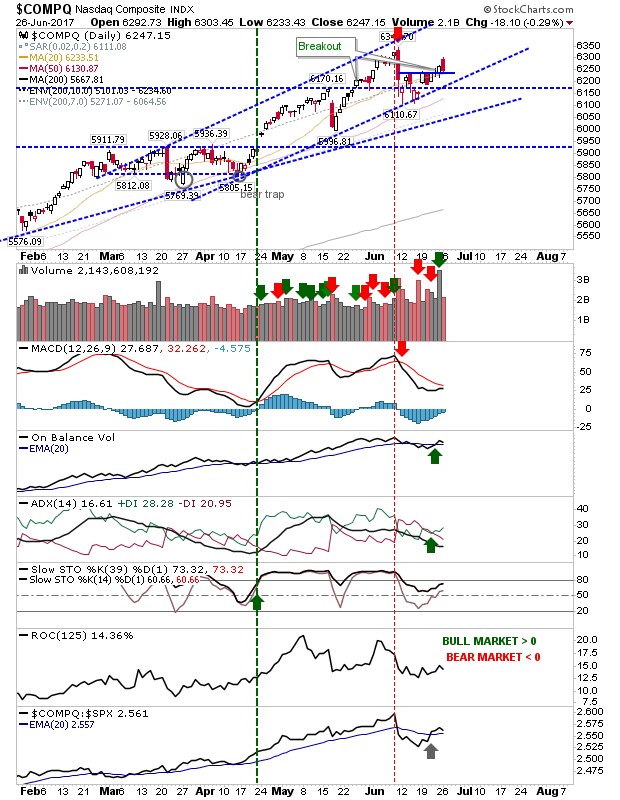

The NASDAQ closed with bearish cloud cover, a pattern which frequently leads to lower prices the next day. Despite this, the breakout hasn't been violated. The MACD is working to a new 'buy' trigger and rising channel support should offer support if there is some follow through lower - helped by the convergence with horizontal support at 6,170. Don't be surprised if there is a quick push lower to test 6,170 before rallying back to 6,170 by the close of business.

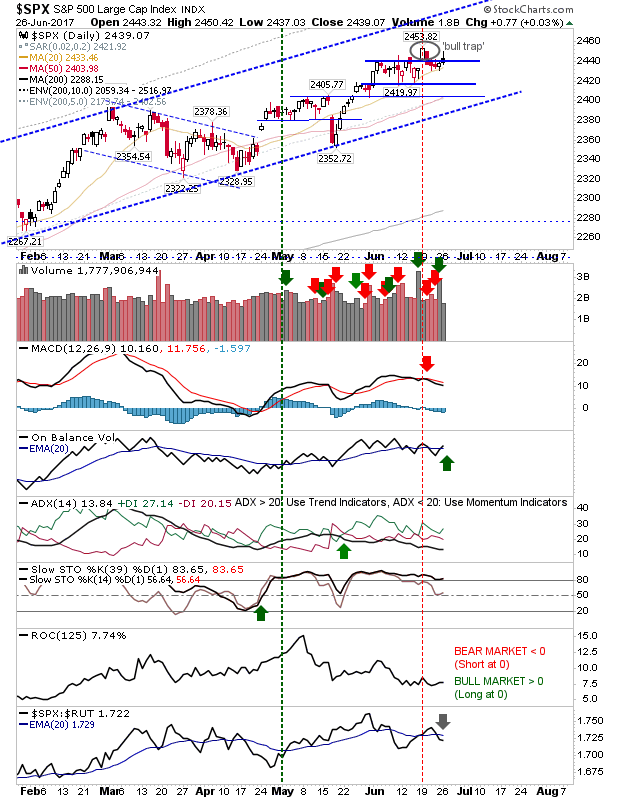

The S&P attempted to challenge its 'bull trap' but found itself finishing with a spike-high-bear-black-candlestick. This index looks more vulnerable to a series loss with support not likely to kick in until the 50-day MA at 2,403 is tested. There was some consolation with a new On-Balance-Volume 'buy' trigger but this is unlikely to last if there is another day of selling.

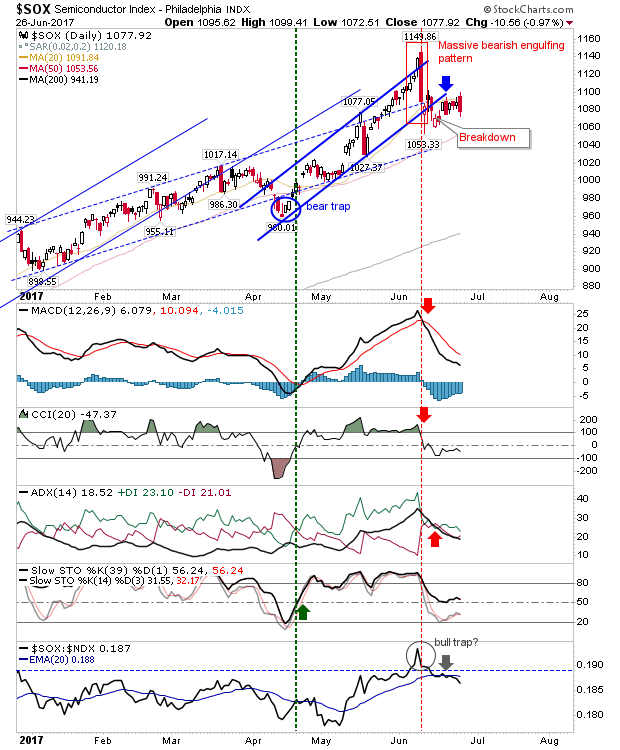

The index which was set up for shorts on Friday played to form yesterday. The Semiconductor Index offered a decent gap high short entry point in the morning before reversing hard into a significant bearish engulfing pattern. Even tentative shorts may find enough to hold on to for a test of the 50-day MA.

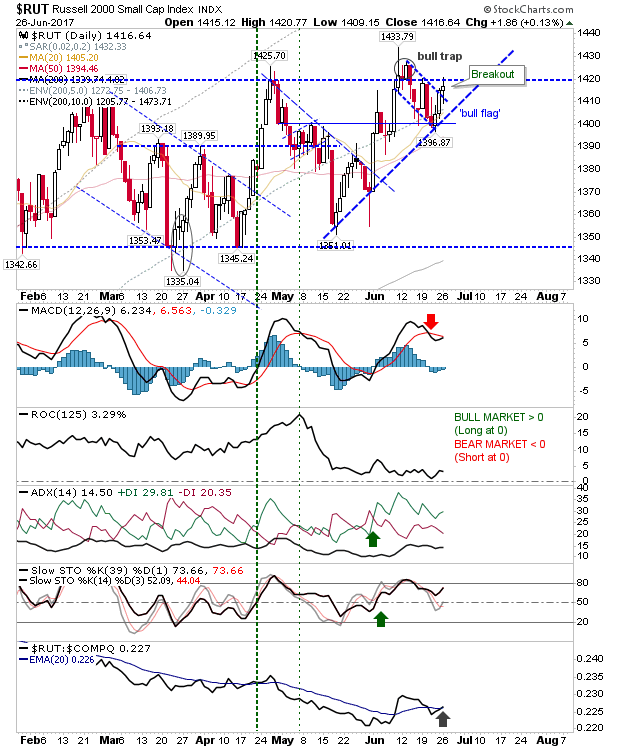

The one exception was the Russell 2000. While it wasn't able to hold the early gains it did do enough to register a breakout from the 'bull flag'. Bulls may have had a rough day but the Russell 2000 continues to deliver under the cover of its horizontal trading range.

For today, bears have the Semiconductor Index to look to, while bulls can stick with the ever improving Russell 2000. The NASDAQ also gives shorts an opportunity but the risk:reward is not as attractive as the Semiconductor Index.