Market Brief

Despite persistently weak economic data from the US, nothing could stop Wall Street closing in green yesterday. The S&P 500 was up 1.28%, the Nasdaq gained 1.14% while the Dow Jones rose 1.40%. After a disappointing Michigan consumer sentiment index on Friday (85.7 versus 91.1 consensus and 91.9 in August), retail sales rose 0.2%m/m in August compared to a revised increase of 0.7% in July. However, it fell short of expectations as economists were looking for stronger consumer spending (0.3%m/m median forecast). Manufacturing in the New York area contracted for the second month in a row with the Empire manufacturing index printing at -14.67 in September versus -0.50 consensus and -14.92 in August. Finally, industrial production contracted unexpectedly by -0.4%m/m in August, lower than the market expected figure of -0.2% and following a revised increase of 0.9% in July. All in all, recent data from the US is not supportive of a rate September. Nevertheless, US treasury yields are rising along the curve with the 2 Year note yields jumping 6bps to 0.7845% and the benchmark 10-Year yields rising 8bps 2.2653%, suggesting that traders start pricing in an increase of the federal fund rate.

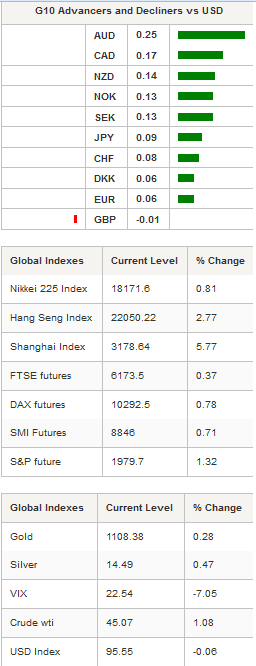

In Asia, regional markets are buoyed by Wall Street’s optimism. The Shanghai Composite erased completely yesterday’s losses, adding 5.77%, while its tech-heavy counterpart, the Shenzhen Composite, rises 6.90%. In Hong Kong, the Hang Seng climbed 2.77%. Australian shares are blinking green on the screen as well despite a disappointing reading of the Westpac leading index that printed at -0.3%m/m, below a revised increase of 0.1% in July. AUD/USD is gaining positive momentum ahead of the FOMC meeting; the Aussie is up 3.80% since September 6th and is now heading towards the 0.72 key resistance (previous high and psychological level). On the downside, a support can be found at 0.6896 (low from September 6th).

The US dollar lost ground in the Asian session. The greenback is down -0.25% against the Aussie, -0.17% against the loonie, 0.14% against the kiwi, 0.13% against the Norwegian and Swedish krone and 0.09% against the Japanese yen. However, major currency pairs are still trading range-bound, only emerging currencies are showing any substantial moves. EUR/USD is stuck within the 1.1262 - 1.1368 range but is still in its uptrend channel.

In Europe, equity futures are no exception and are trading higher across the board. In London, futures on the Footsie are up 0.37%, in Germany the DAX is up 0.78&, in France the CAC 40 adds 0.88% while in Switzerland the SMI is up 0.71%. EUR/CHF is still struggling to move break the 1.10 threshold and is therefore treading water 30-50pips below.

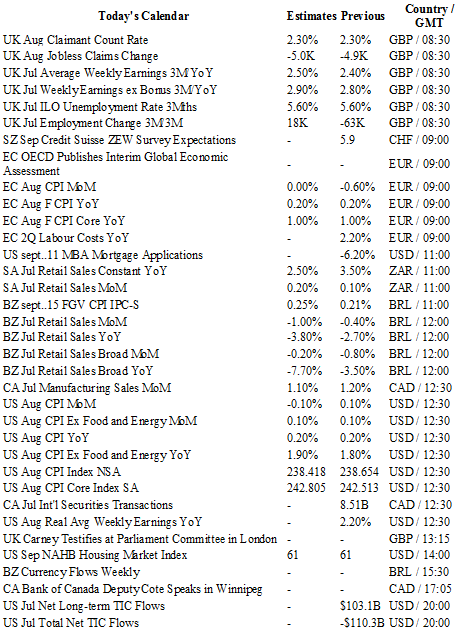

Today traders will be watching jobless claims change and ILO unemployment rate from United Kingdom; ZEW survey from Switzerland; August’s final CPI figures for the euro zone; retail sales from Brazil and South Africa; manufacturing sales from Canada; CPI report and NAHB housing market index from the US. Finally, the FOMC begins its two-day meeting today.

Currency Tech

EUR/USD

R 2: 1.1714

R 1: 1.1438

CURRENT: 1.1253

S 1: 1.1017

S 2: 1.0809

GBP/USD

R 2: 1.5819

R 1: 1.5628

CURRENT: 1.5332

S 1: 1.5346

S 2: 1.5165

USD/JPY

R 2: 125.86

R 1: 121.75

CURRENT: 120.40

S 1: 118.61

S 2: 116.18

USD/CHF

R 2: 1.0240

R 1: 0.9903

CURRENT: 0.9737

S 1: 0.9513

S 2: 0.9259