FedEx (NYSE:FDX) decided not to continue the contract on air express delivery for Amazon (NASDAQ:AMZN) packages. Will the FedEx stock price continue rebounding?

FedEx’s third quarter financial results were below expectations due to slowing global economies: the company reported earnings per share of $3.03, short of analyst estimates of $3.10. Net income fell to $797 million from $1.02 billion compared to the same quarter last year, with revenue rising from $16.5 billion to $17 billion. FedEx announced June 7 it will no longer provide air express delivery for Amazon packages in the US while continuing to serve as a carrier and last-mile delivery partner. Amazon accounted for only 1.3% of FedEx’s total revenue in 2018. FedEx stock dropped less than 1% on the news. FedEx’s next earnings report is scheduled for June 25. The company is expected to report earnings of $4.89 per share, a 17.26% year-over-year decline. HoweverZachs investment research company estimates FedEx will record a 3.75% increase in revenue from the year-ago period to $17.96 billion. FedEx’s stocks is currently trading at a forward price-to-earnings (P/E) ratio of 9.64. For comparison, its industry has an average forward P/E of 12.92, meaning FedEx’s stock is trading at a discount to the industry. While continuing global growth slowing is a downside risk for FedEx stock, the company is making investments to create new services and streamline in-house network of shipping and delivery services which should boost its competitiveness.

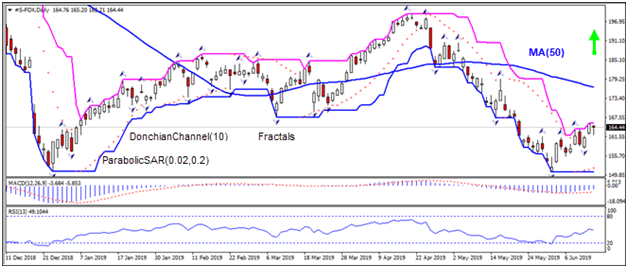

On the daily timeframe the S-FDX: D1 is retracing higher after falling to a six-month low at the end of May.

- The Parabolic indicator gives a buy signal.

- The Donchian channel indicates uptrend: it has widened up.

- The MACD indicator gives a bullish signal: it is below the signal line and the gap is narrowing.

- The RSI oscillator is declining but has not reached the oversold zone yet.

We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 165.79. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below the fractal low at 158.07. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (158.07) without reaching the order (165.79), we recommend canceling the order: the market has undergone internal changes which were not taken into account.

Technical Analysis Summary

- Position Buy

- Buy stop Above 165.79

- Stop loss Below 158.07

US stocks end the week slightly lower

US stock market ended marginally lower on Friday led by technology shares. The S&P 500 slid 0.2% to 2886.98, adding 0.5% for the week. Dow Jones industrial slipped 0.1% to 26089.61. The Nasdaq lost 0.5% to 7796.66. The dollar accelerated strengthening as data showed retail sales grew 0.5% in May, while sales were revised to 0.3% growth in April after an initial estimate of 0.2% decline. The live dollar index data show the ICE (NYSE:ICE) US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.5% to 97.55 but is lower currently. Futures on US stock indices point to higher openings today.

DAX 30 led European indexes losses

European stocks pulled back on Friday. Both the GBP/USD and EUR/USD accelerated their slide but are higher currently. The Stoxx Europe 600 Index lost 0.6% Friday. The DAX 30 slumped 0.6% to 12096.40. France’s CAC 40slipped 0.2% and UK’s FTSE 100 slid 0.3% to 7345.78.

Hang Seng the leader among Asian indexes

Asian stock indices are mixed today. Nikkei added 0.03% to 21124.00 with yen slide against the dollar intact. China’s markets are gaining after data showed last Friday industrial output and investment growth slowed in May: the Shanghai Composite Index is up 0.2% and Hong Kong’s Hang Seng Index is 0.5% higher. Australia’s All Ordinaries Index however pulled back 0.4% as the Australian dollar turned higher against the greenback.

Brent slips

Brent futures prices are edging lower today. Prices ended higher on Friday despite International Energy Agency downgrade of tis 2019 forecast for global oil demand: Brent for August settlement rose 1.1% to close at $62.01 a barrel Friday, falling 2% for the week.