I’ve heard just about every argument to be had on why the Dow Jones Industrial Average is a relic of a bygone era. Some point out that the index is too narrow, with just 30 mega-cap stocks. Others point to the antiquated price weighted construction methodology that confounds nouveau index enthusiasts. Still others can’t comprehend the plodding performance story when there are juiced up momentum ETFs begging for your attention.

No matter what your criticism is for the Dow, the inclusion of Apple Inc (NASDAQ:AAPL) along with the removal of AT&T, Inc (NYSE:T) and reshuffling of Visa Inc (NYSE:V) makes this index worthy of a second look. These changes have significantly altered the underlying structure of this market bellwether, which most investors can invest directly in though the SPDR Dow Jones Industrial Average ETF (DIA).

Furthermore, the alterations have shifted the balance of power in DIA to an overweight focus on best of breed technology companies. The Visa stock split has also reduced its weighting as one of the largest names and allowed Goldman Sachs Group Inc (NYSE:GS) to rise to the top spot.

In my opinion, these carefully thought out changes bring DIA back into the conversation for large or mega-cap equity exposure. This is especially true when you consider that Apple is the largest U.S.-listed company by market capitalization and a mainstay across virtually every large-cap, dividend, or technology-focused index.

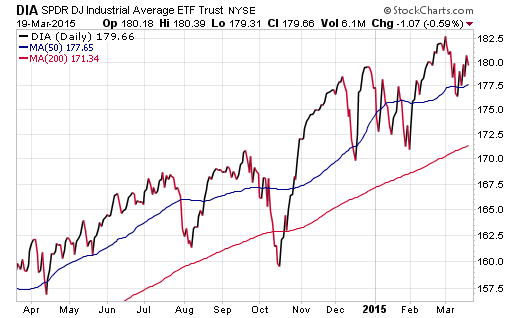

It’s worth noting that over the last 10 years, DIA has produced an average annualized return of 7.94% (though 2/28/15). That number bests the 7.89% gain in the SPDR S&P 500 ETF (ARCA:SPY) over the same time frame.

Even with just 30 stocks, DIA has been able to keep pace with the broader market and continues to show its relevance (if somewhat eccentric style) in today’s markets. These recent changes should solidify the ability for DIA to continue tracking well against other peer benchmarks moving forward.

One interesting feature of DIA is the monthly dividend this ETF pays as part of its unique portfolio structure. The current 30-day SEC yield on DIA is 2.05% and may fluctuate based on the shakeup in the asset allocation of the underlying holdings. It will be worth noting over the next quarter how the income will adjust in relationship to the dividends that are paid by some of these new stocks.

ProShares also has several leveraged long and short ETFs that track the Dow Jones Industrial Average. These funds will be expected to update their underlying holdings as well. Some of the more popular ETFs include: ProShares Short Dow 30 ETF (NYSE:DOG), ProShares Ultra Dow 30 ETF (ARCA:DDM), and ProShares Ultra Short Dow 30 ETF (ARCA:DXD).

The Bottom Line

While not the sexist pick, DIA can certainly be a well-rounded solution for both growth and income investors seeking a blue chip index with plenty of historical context. These regular updates continue to improve upon the overall asset mix as well as solidify the reasons for billions of dollars tracking this ETF.

Disclosure : FMD Capital Management, its executives, and/or its clients may hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.