Last Thursday the S&P 500's SPDR® S&P 500 (NYSE:SPY) and the NASDAQ's Invesco QQQ Trust (NASDAQ:QQQ) tested new highs and then gapped lower on Friday showing that the market still had some overhead resistance.

Driving reasons could be related to fears of inflation raising as the U.S. pushes to take on more debt, to caution from pending earnings as Monday starts another round of incoming reports.

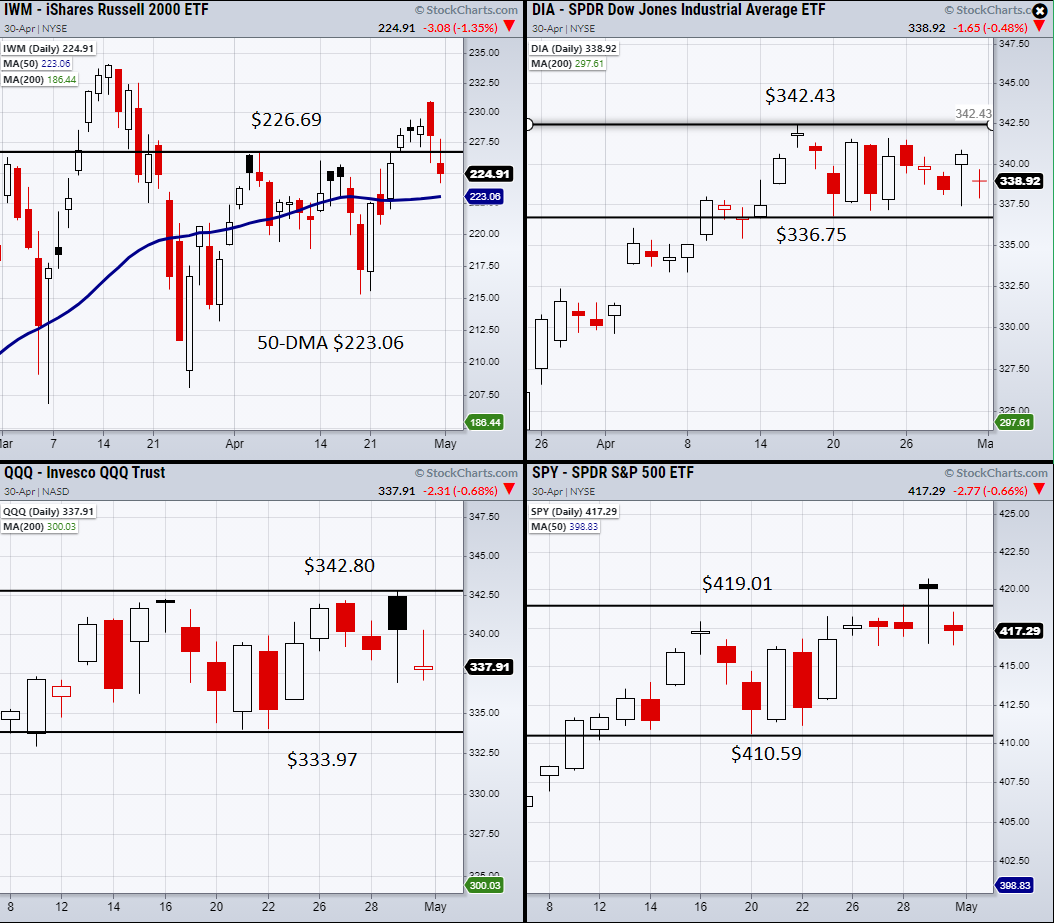

Additionally, the Russell 2000's iShares Russell 2000 ETF (NYSE:IWM) pulled off and could be looking for another revisit of its 50-Day moving average at $223.28.

With that said, we can also factor in the major indices' current price range.

In the above charts, each has a range created by their recent highs, lows, or in the case of IWM, support from 50-DMA.

This can give us clear support and resistance levels to reference and trade-off this week.

Also, when it comes to using these price levels to determine a potential breakout or breakdown in the market it can help to watch if the indices are pushing through the price levels at the same time.

This can help with fake breakouts or breakdowns like we saw last week in SPY and the QQQs.

ETF Summary

- S&P 500 (SPY) 10-DMA at 416.24 pivotal.

- Russell 2000 (IWM) Next support the 50-DMA at 223.26.

- Dow (DIA) 336.75 support.

- NASDAQ (QQQ) 333.97 support.

- KRE (Regional Banks) Support 67.22.

- SMH (Semiconductors) 242.29 support the 50-DMA.

- IYT (Transportation) Closest support the 10-DMA at 265.98.

- IBB (Biotechnology) 153.51 pivotal.

- XRT (Retail) Like this to hold over the 10-DMA at 92.41.

- Volatility Index (VXX) Closed over the 10-DMA at 40.00.

- Junk Bonds (JNK) Like to see this hold over 109.08.

- XLU (Utilities) Back over the 10-DMA at 66.54.

- SLV (Silver) 24.01 pivotal.

- VBK (Small Cap Growth ETF) Next support 280 area.

- VBK (US Gas Fund) Doji day.

- TLT (iShares 20+ Year Treasuries) Flirting with the 50-DMA at 138.45.

- USD (Dollar) Large range day back over the 10-DMA at 90.98.

- MJ (Alternative Harvest ETF) Like to see this stay over the 10-DMA at 21.12.

- LIT (Lithium) Holding the 10-DMA at 62.85.

- XOP (Oil and Gas Exploration) Could not hold over the 50-DMA at 81.88.

- DBA (Agriculture) Bounced off the 10-DMA at 18.16.