We have a normal week for economic data, including the first estimate for Q3 GDP. There are also important earnings reports. Election stories have become even more intense. Meanwhile, the market has been pretty quiet. I expect financial media to be asking:

When will the trading range be broken?

Personal Notes

I will be traveling next week and probably will not write WTWA.

I have completed my new paper, The Top Twelve Investor Pitfalls – and How to Avoid Them. Readers of WTWA can get a copy by sending an email to info at newarc dot com. We will not share your email address with anyone.

Last Week

Last week’s news was pretty good, despite the modest reaction in stocks.

Theme Recap

In my last WTWA, I predicted more attention to the “stealth market rotation.” This idea got a little attention on Monday from the Pundit-in-Chief, but that was all. The rotation was less pronounced and the competing stories were good ones.

The Story in One Chart

I always start my personal review of the week by looking at this great chart of the S&P 500 from Doug Short. Stocks had a slightly positive week, but the real story is the continuation of a very narrow trading range.

Doug has a special knack for pulling together all of the relevant information. His charts save more than a thousand words! Read his entire post where he adds analysis grounded in data and several more charts providing long-term perspective.

The News

Each week I break down events into good and bad. Often there is an “ugly” and on rare occasion something really good. My working definition of “good” has two components. The news must be market friendly and better than expectations. I avoid using my personal preferences in evaluating news – and you should, too!

The Good

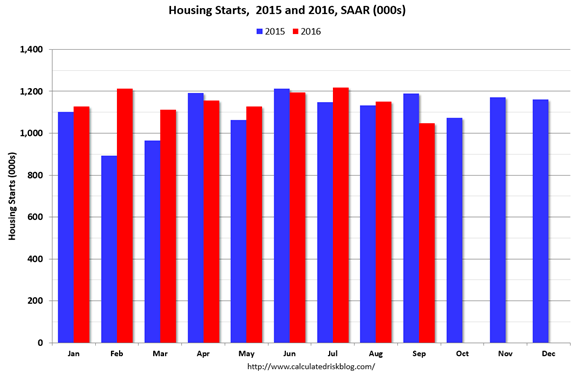

- Building permits rose and beat expectations. But housing starts declined (see below). New Deal Democrat analyzes this contrast and the effect on his leading indicators.

- Philly Fed also beat expectations.

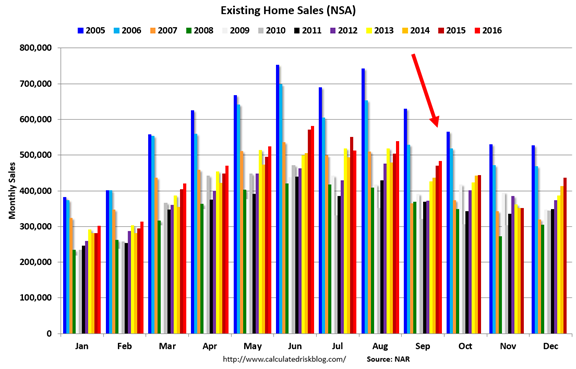

- Existing home sales rose 3.2%. Calculated Risk is the go-to source on housing, and Bill continues his analysis of the effects of the small inventory. This concept is essential to understanding housing trends.

- {{ecl-161||Industrial production}} registered a (small) increase of 0.1%. Steven Hansen notes that the year-over-year figure is still in contraction.

- Hotel occupancy still on pace to be the second best year in history. (Calculated Risk)

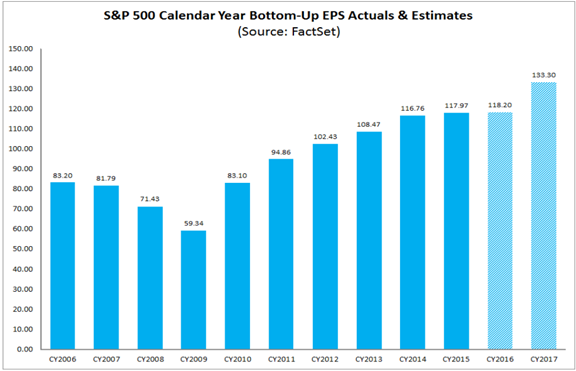

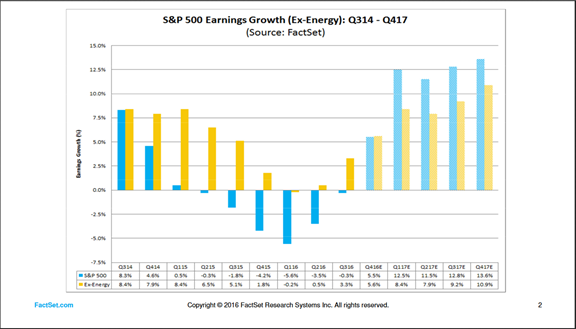

- Earnings season shows continuing strength. FactSet reports that 78% of S&P 500 companies are beating earnings estimates and 65% beating on sales. Take a look at the entire analysis. Here are two interesting takeaways.

The Bad

- Rail traffic continues to decline, even when coal and grain are excluded from the data. Steven Hansen does a thorough analysis of the trends.

- Jobless claims edged 13K higher, moving away from recent lows.

- Housing starts declined and missed estimates. The annual rate was 1.047 million. Calculated Risk discusses and notes that his prediction at the start of the year, growth of 4-8% still looks about right.

The Ugly

Increased hacking. Friday’s widespread outage attacked a domain name service, according to MarketWatch. Engadget says, Blame the Internet of Things and provides the map below. The hacking began with home devices which often have weak security protocols. With that entry, the distributed denial of service attack took down a list of major sites, including “Twitter, Spotify, Reddit, The New York Times, Pinterest, and PayPal.”

The Silver Bullet

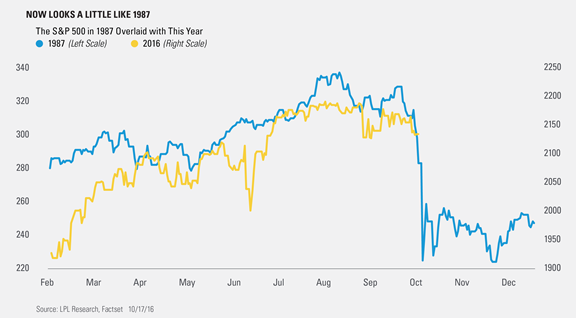

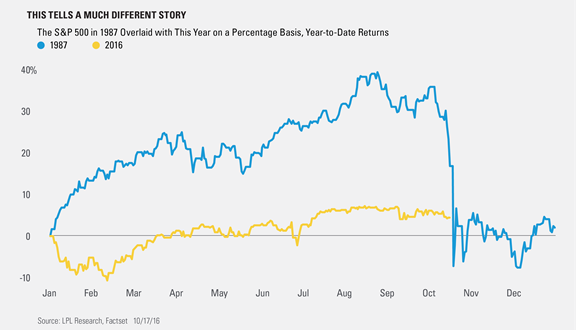

I occasionally give the Silver Bullet award to someone who takes up an unpopular or thankless cause, doing the real work to demonstrate the facts. This week’s award goes to Ryan Detrick of LPL Research. I am showing the power of his work via the two key charts, but reading the entire post will help you to spot these things on your own.

The Week Ahead

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead. You can make your own predictions in the comments.

The Calendar

We have a normal week for economic data, along with many important earnings reports. I watch everything on the calendar, so you do not need to! Check out WTWA to focus on what is really important – and ignore the noise.

The “A” List

- New home sales (T). Continuing strength needed.

- Consumer confidence (T). The Conference Board version spiked last month. Few expect the gains to hold?

- GDP for Q3 (F). Even though this is backward looking, it will get plenty of media attention in front of the election.

- Michigan Sentiment (F). Has been weaker than the Conference Board version. An important indicator.

- Initial claims (Th). The best concurrent indicator for employment trends.

The “B” List

- Pending home sales (Th). Not as important as new homes for immediate economic effect, but a good market indicator.

- Durable goods (Th). Volatile September data, but important for the overall assessment of the economy.

- Existing home sales (Th). Without the impact of new homes, but still a good read on the overall housing market.

- Crude inventories (W). Recently showing even more impact on oil prices. Rightly or wrongly, that spills over to stocks.

More important than the economic data will be continuing earnings news. We also have almost daily Fedspeak and plenty of international events and speeches. And of course…the candidates.

Next Week’s Theme

Despite the many events that normally increase volatility, the stock market has traded in a narrow range. There is an increasing sense that “something’s got to give.” The exact cause and timing remain unclear, but the obvious choice is Election Day.

I expect an active discussion about a looming market question:

When will the trading range be broken?

Here is a chart of the market over the last year:

If you look at mid-July through today, you can see that the trading range has been quite narrow.

Now let’s turn to the sequence of topics I have written about in the last two months. These remind us of what we were thinking and worrying about each week.

- Possible rate increase after Jackson Hole 8/28

- Chance of an Autumn Correction 9/3

- Should we fear the Fed? 9/11

- Is the bond correction at hand? 9/18

- Election effects on the market 9/25

- Time to get past the gloom? 10/2

- Earnings recession over? 10/9

- Market rotation at hand? 10/16

Despite this list of challenges, stocks have held up pretty well.

Many are expecting the trading range to be broken soon. But in which direction?

Election predictions range from a surprise, Brexit-style victory for Mr. Trump to a Democratic sweep. The markets seem to favor a Clinton victory, but a continuation of divided government, mostly because of reduced uncertainty.

At the beginning of the year I wrote that the investment effects of this election were smaller than most would expect. The President has much less power to change policy than most people think – especially in the face of a Senate filibuster. Either candidate would need to forge alliances with the other party to make major changes. OppenheimerFunds has some interesting comments about surprises from past elections, and advice for investors this time.

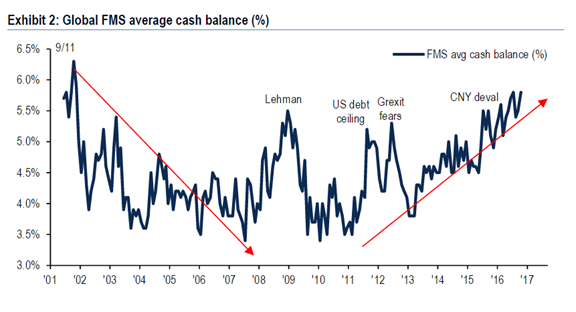

Data indicate that many are not following this advice. A BlackRock survey (via Financial Advisor IQ) found that 53% of investors have raised their allocation to cash because of the “persistent volatility.” The Presidential election gets credit as a major cause.

The perceived volatility is completely wrong – certainly for the last few months, and also for several years. If you missed my post on testing your Confirmation Bias Quotient, you might want to take a look. Something is causing many investors to perceive volatility that is not really there.

Bloomberg reports that investor cash levels have not been seen since 9/11.

Join in the comments with your ideas on when the trading range will be broken, and in which direction. As always, I’ll have a few ideas of my own in the conclusion.

Quant Corner

We follow some regular great sources and also the best insights from each week.

Risk Analysis

Whether you are a trader or an investor, you need to understand risk. Think first about your risk. Only then should you consider possible rewards. I monitor many quantitative reports and highlight the best methods in this weekly update.

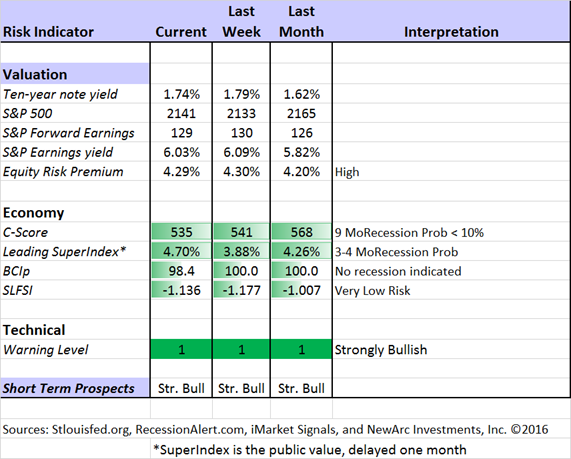

The Indicator Snapshot

The Featured Sources:

Bob Dieli: The “C Score” which is a weekly estimate of his Enhanced Aggregate Spread (the most accurate real-time recession forecasting method over the last few decades). His subscribers get Monthly reports including both an economic overview of the economy and employment.

Holmes: Our cautious and clever watchdog, who sniffs out opportunity like a great detective, but emphasizes guarding assets.

Brian Gilmartin: Analysis of expected earnings for the overall market as well as coverage of many individual companies.

Doug Short: The Big Four Update, the World Markets Weekend Update (and much more).

RecessionAlert: Many strong quantitative indicators for both economic and market analysis. While we feature his recession analysis, Dwaine also has a number of interesting approaches to asset allocation.

Georg Vrba: The Business Cycle Indicator, and much more. Check out his site for an array of interesting methods. Georg regularly analyzes Bob Dieli’s enhanced aggregate spread, considering when it might first give a recession signal. Georg thinks it is still a year away. It is interesting to watch this approach along with our weekly monitoring of the C-Score.

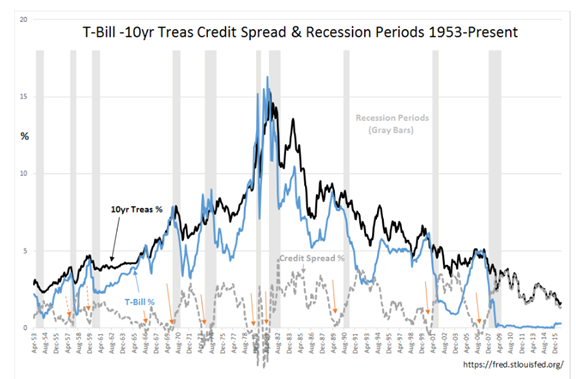

“Davidson” (via Todd Sullivan): An excellent, understandable description of the interest rate cycle and its close association with recessions. The description of the factors we can expect to see before a recession will come — someday. Here is a key quote and chart:

Recessions, for the most part, in my opinion, are predictable. The rate spread between T-Bills and the 10yr Treasury is 1.20% today or 120bps (basis points). Based on history, lending continues, a relatively high level of pessimism continues and so does economic expansion. The rate spread is only one of several economic measures we have available that indicates economic expansion is likely to continue for several years.

How to Use WTWA (important for new readers)

In this series I share my preparation for the coming week. I write each post as if I were speaking directly to one of my clients. Most readers can just “listen in.” If you are unhappy with your current investment approach, we will be happy to talk with you. I start with a specific assessment of your personal situation. There is no rush. Each client is different, so I have six different programs ranging from very conservative bond ladders to very aggressive trading programs. A key question:

Are you preserving wealth, or like most of us, do you need to create more wealth?

My objective is to help all readers, so I provide a number of free resources. Just write to info at newarc dot com. We will send whatever you request. We never share your email address with others, and send only what you seek. (Like you, we hate spam!) Free reports include the following:

- Understanding Risk – what we all should know.

- Income investing – better yield than the standard dividend portfolio, and also less risk.

- Holmes and friends – the top artificial intelligence techniques in action.

- Why it is a great time to own for Value Stocks – finding cheap stocks based on long-term earnings.

You can also check out my website for Tips for Individual Investors, and a discussion of the biggest market fears. (I welcome questions on this subject. What scares you?)

Best Advice for the Week Ahead

The right move often depends on your time horizon. Are you a trader or an investor?

Insight for Traders

We consider both our models and also the best advice from sources we follow.

Felix and Holmes

We continue with a strongly bullish market forecast. Felix is fully invested. Oscar holds several aggressive sectors. The more cautious Holmes also remains fully invested. They now have a regular Thursday night discussion, which they call the “Stock Exchange.” This is the place to get some ideas from the best technical analysis – and you can ask questions!

Top Trading Advice

Brett Steenbarger provides a checklist to help you determine if you are “operating in peak performance.” As he often does, Dr. Brett has raised a point that few people think about. This is one that could make a big difference – and not just for traders.

The Trading Goddess considers pot stocks for an election trade.

Insight for Investors

Investors have a longer time horizon. The best moves frequently involve taking advantage of trading volatility!

Best of the Week

If I had to pick a single most important source for investors to read this week it would be “Davidson” (via Todd Sullivan) and the analysis of current market fears. It is a post packed with good ideas, one of which is in the quant corner as well.

The past 12mos has seen many a ‘high profile’ investor forecast that a recession is imminent. This is the consensus view. Some claim it is driven by economic weakness from one area or another. There are still claims that employment is weak when it is at record highs. Others claim that retail sales and personal income (wage growth) are nearly unchanged for more than a decade. Not so! They are much better. Then, there are those who claim that recoveries only last a certain number of years before they expire. Not so! Finally, there are some who claim no recovery has occurred and that the SP500 is only higher because interest rates are so low, i.e. high stock prices are only supported by the Federal Reserve keeping interest rates at historical lows. Definitely, not so! The range of commentary covers a broad spectrum, but remains pessimistic just the same.

Please take a few minutes to read this valuable post.

Income Ideas

Many investors are looking for income stocks. Rightly worried about the valuation and downside risk of utilities, they seek alternatives. Some have joined us in buying sound, conservative stocks and writing near-term calls against the position. This can generate an excellent yield and is safer than owning the stocks alone. It is a lot safer than a basket of utilities.

REITs present another alternative. The trick is to find those that have some ability to hold up in the face of interest rate hikes. Brad Thomas has been writing on this topic, presenting several good ideas. This week it is Apple Hospitality REIT Inc (NYSE:APLE)). I have been adding some REITs to the yield portion of our client portfolios. Like Brad, we include analysis from Chuck Carnevale’s F.A.S.T. graphs as part of our research.

David Fish has an interesting article on dividend increases anticipated before the end of the year. There is also a link to his updated list of dividend champions.

Stock Ideas

Lee Jackson writes about three “red-hot chip stocks.” These interesting ideas are based upon a research report from highly-regarded chip analyst Will Stein (SunTrust Robinson Humphrey).

Our trading model, Holmes, has joined our other models in a weekly market discussion (see link, above). Each one has a different “personality” and I get to be the human doing fundamental analysis. We have an enjoyable discussion every week, with four or five specific ideas that we are also buying. This week Holmes likes Nike (NYSE:NKE). Check out the post for my own reaction, and more information about the Holmes method.

While we cannot verify the suitability of specific stocks for everyone who is a reader, the ideas have worked well so far. My hope is that it will be a good starting point for your own research. Holmes may exit a position at any time. If you want more information about the exits, just sign up via holmes at newarc dot com. You will get an email update whenever we sell an announced position.

Dillard’s, Inc. (DDS): Has The Pendulum Swung Too Far? Asks Mitchell Mauer. I especially like to recommend articles that are backed by good analysis. Here you can see both pros and cons. It follows a method that is quite useful in selecting stocks.

Is the selling in Gilead Sciences (NASDAQ:GILD) overdone? Stone Fox Capital notes the falling analyst recommendations despite strong earnings. Should the stock really be trading at a multiple of 6. The net payout (stock buybacks plus dividends) is now almost 18%.

Personal Finance

Professional investors and traders have been making Abnormal Returns a daily stop for over ten years. If you are a serious investor managing your own account, you should join us in adding this to your daily reading. Every investor should make time for a weekly trip on Wednesday. Tadas always has first-rate links for investors in his weekly special edition. There are always several great choices worth reading. My personal favorite this week is the “lucky versus good” analysis from Jonathan Clements. He writes:

The problem: We typically judge our financial choices by a single, crude yardstick—whether they make or lose us money. But that measure of success or failure can result in faulty feedback that validates bad behavior. Consider three examples……

Check out the whole post for the examples and an excellent lesson.

Millennial Investors

Barron’s introduces a new site aimed at “a new generation of investors.” There is a combination of advice and some stock ideas. I enjoyed the article about why Apple (NASDAQ:AAPL) Pay is more secure than a credit card. They also introduce “The Next 50 Index” with stocks geared toward Millennials.

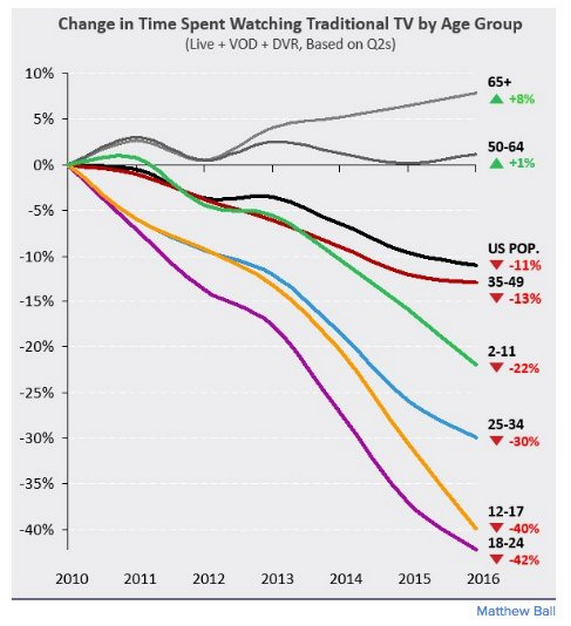

And from another source – this provides some inspiration about our changing habits.

Final Thoughts

There are several points to keep in mind:

- The market has been resilient in the face of challenges. Look again at the chart. The worrying seasonal predictions have all been wrong – as January goes, sell in May, September as the worst month. We now approach the period of greatest seasonal strength.

- The earnings recession seems to be at an end. Forward earnings are trending higher.

- There is no sign of an economic recession – just more of the same slow growth.

- Consumer confidence is still strong.

- Energy prices are back in a range where the threat to producers has been reduced and the consumer prices remain modest.

What is needed to spark a change? The biggest item is increased investment by business. Surveys continue to show caution among these leaders, even when their own business is doing well. When there are specific events to worry about, it is easy (and seems wise) to defer decisions.

Acclaimed system developer, author, and hedge fund manager Ralph Vince summarized the situation with a bold call in a post at Daily Speculations:

Regardless of who wins this election, this market is going to rip to the upside — and I can be quite certain of that without even looking at the numbers, just the very tentative nature of nearly everyone around it. I’ve smelled this dish cooking before, and so have a lot of folks on this site.

How is that for a contrarian position?