It was a curious Friday around the globe. The Nikkei gave up its gains following an afternoon quake. The Hong Kong market was closed because of a Typhoon. In Europe and the US, most indexes finished flat, except for a modest gain in the NASDAQ, mostly thanks to Microsoft (NASDAQ:MSFT). Our benchmark S&P 500 sold off at the open to its -0.53% intraday low and rose steadily through the session to its 0.05% intraday high at the start of the final hour of trading. But that small gain evaporated in the closing trade to a flat finish, technically a loss of 0.01%.

The yield on the 10-year note closed at 1.74%, down 2 BPs from the previous close.

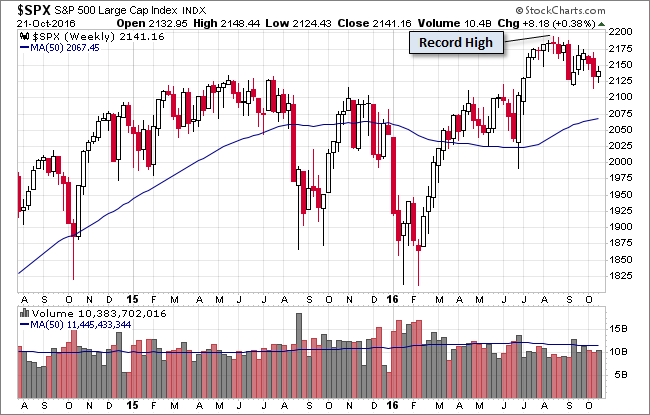

Here is a snapshot of past five sessions in the S&P 500.

Here's a weekly chart of the index. The 0.38% weekly advance snapped two weeks of decline.

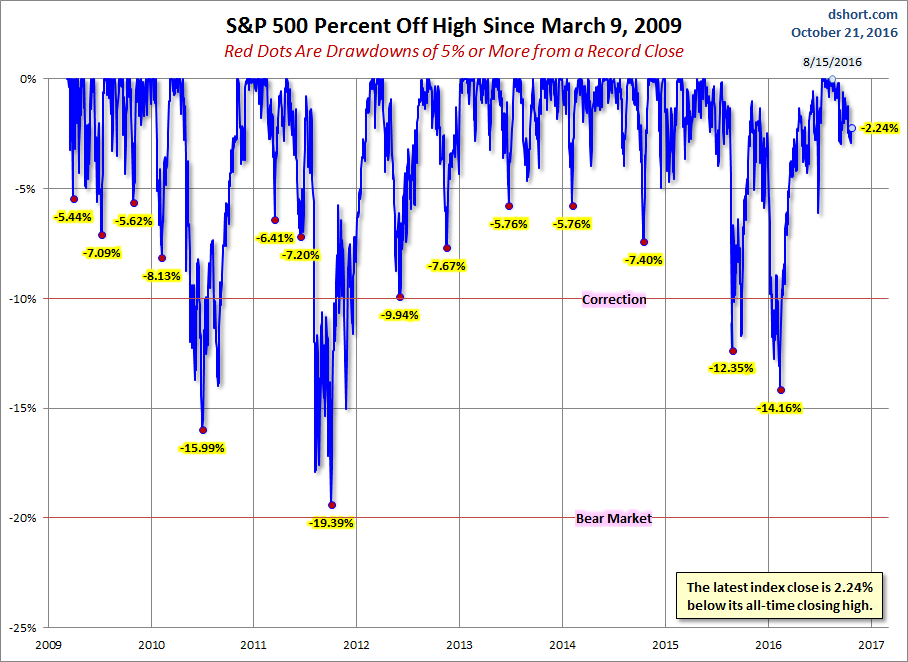

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

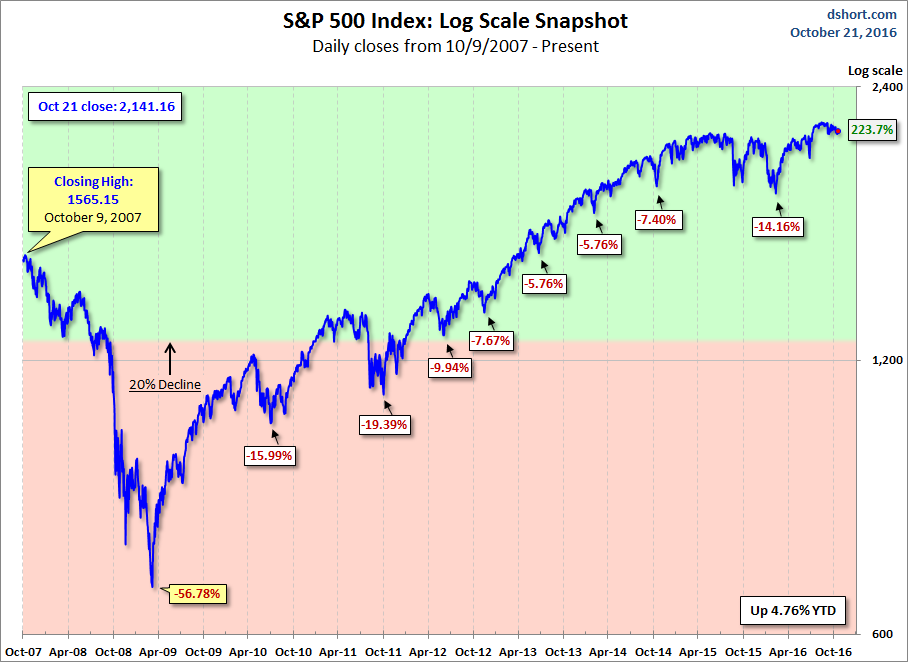

Here is a more conventional log-scale chart with drawdowns highlighted.

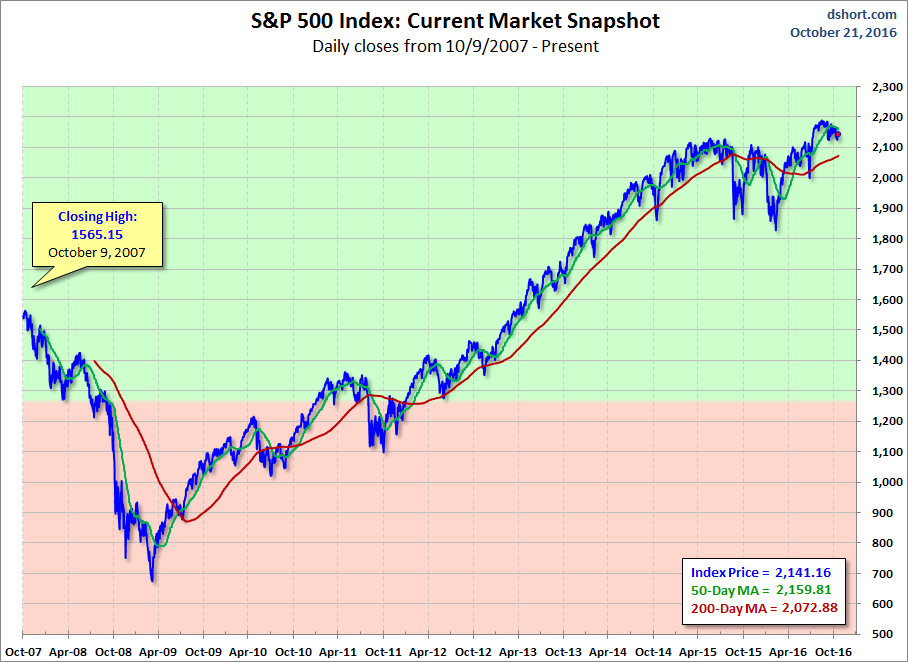

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

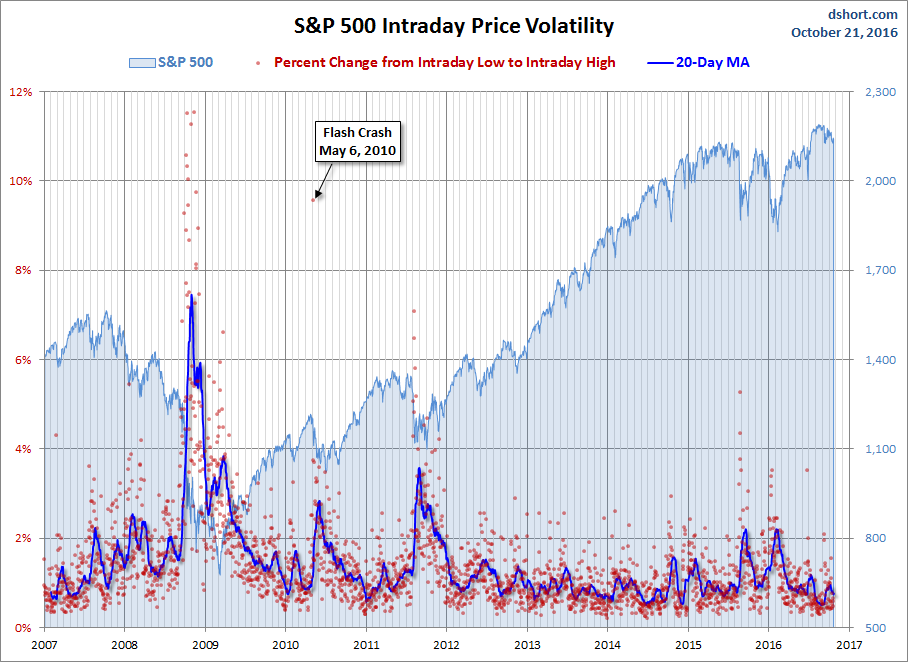

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.