Last week’s economic calendar was the biggest of the year and this week’s is the lightest. In the absence of important economic news and earnings, where will financial media turn to fill that space and time? The Presidential election campaign is providing a lot of zest as well as a little substance. I expect financial pundits to be asking:

What Does the Election Mean for Financial Markets?

Prior Theme Recap

In my last WTWA I predicted that attention would focus on whether the improving economy could support stock prices. Despite political events, that was a main theme of the week, with many observers noting that the data did not seem to support the widespread worries about a recession. Things were “less bad” than thought, and maybe even getting better. Friday’s employment data sealed the deal. There was not much additional gain in the overall market, but value stocks and economically sensitive names did very well. You can see the story in Doug Short’s weekly S&P 500 chart. (With the ever-increasing effects from foreign markets, you should also add Doug’s World Markets Weekend Update to your reading list).

Doug’s update also provides multi-year context. See his full post for more excellent charts and analysis.

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead. You can make your own predictions in the comments.

Personal Note

I will be traveling next weekend and might not be able to post.

This Week’s Theme

With a very light economic calendar and earnings season winding down, how will the punditry fill air time and blank pages? One solution is to look for raucous entertainment that has a little market content as well. These stories were already grabbing attention last week after the (ahem) spirited GOP debate and Super Tuesday results.

As always, I want to emphasize that I write about investments, not politics. Sometimes the two intersect. I try to show how investors should use knowledge about candidates and policies for profit, even if their personal opinions differ from the likely winners. (See today’s Final Thought, below).

WTWA starts with identifying the upcoming theme. I do not get to choose what the media should cover! This week, I expect a focus on the Presidential election, with people asking:

What does the election mean for financial markets?

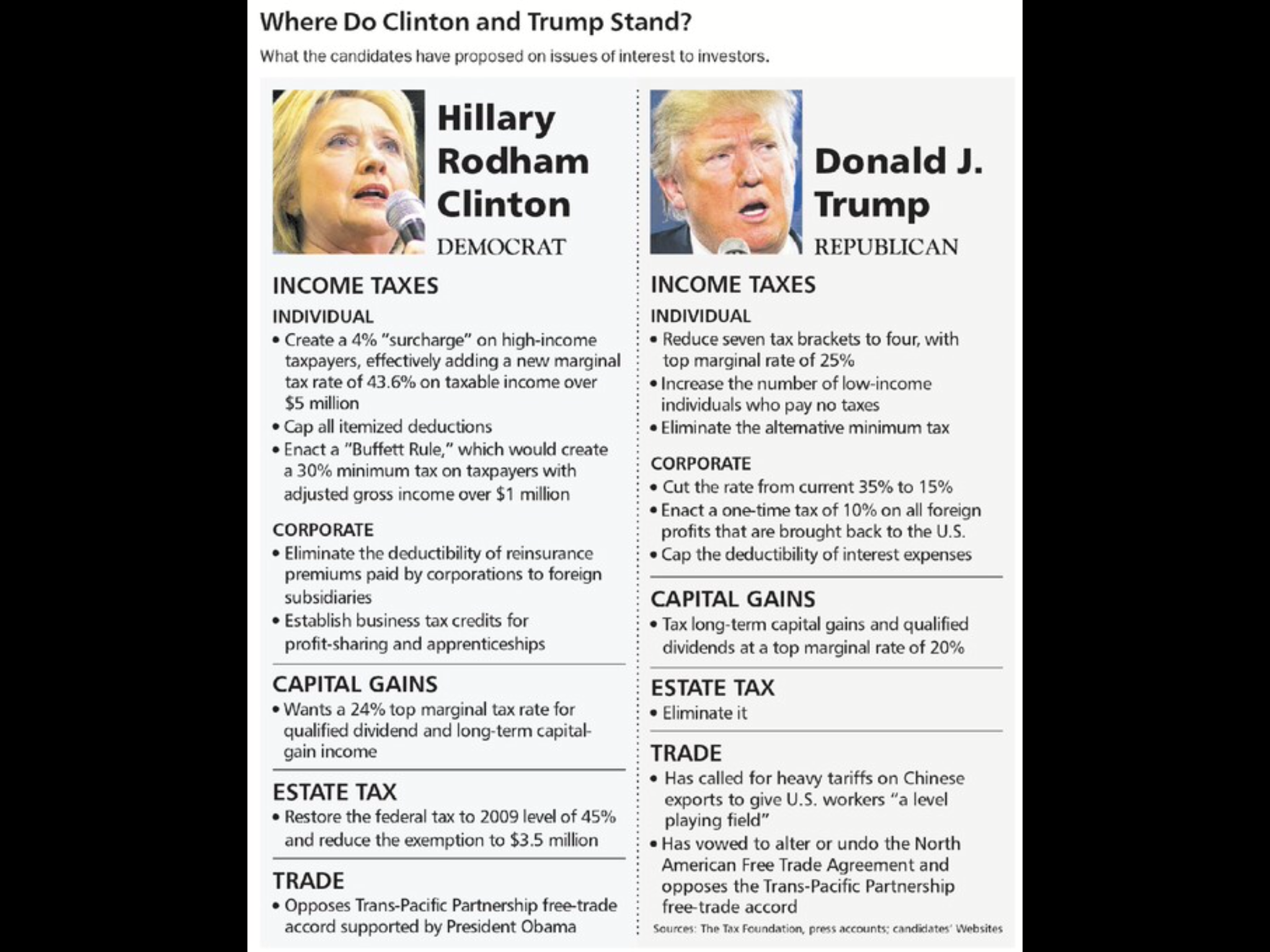

Barron’s reached a similar conclusion with a cover story asking whether Trump or Clinton was better for investors. Some might be surprised at their conclusion. This table summarizes their opinion about the key policy differences:

Viewpoints

Election coverage by financial sources includes the following:

- The “horse race” stories are all about who is leading and projections of results.

- The campaign stories feature interesting moments and quips.

- The advocacy stories tell you how you should vote — sometimes with contending viewpoints, but often not.

- The macro stories try to reach a conclusion about the overall economic and market effects that are the likely result from the election of each candidate.

- The policy stories bring in experts from sell-side firms to explain ideas of the market impact for the election of each candidate.

As always, I have my own opinion in the conclusion. But first, let us do our regular update of the last week’s news and data. Readers, especially those new to this series, will benefit from reading the background information.

Last Week’s Data

Each week I break down events into good and bad. Often there is “ugly” and on rare occasion something really good. My working definition of “good” has two components:

- The news is market-friendly. Our personal policy preferences are not relevant for this test. And especially – no politics.

- It is better than expectations.

The Good

On balance the important news was pretty good last week.

- Construction spending was up 1.5% versus expectations of 0.5%.

- Factory orders turned positive with a gain of 1.6% in January.

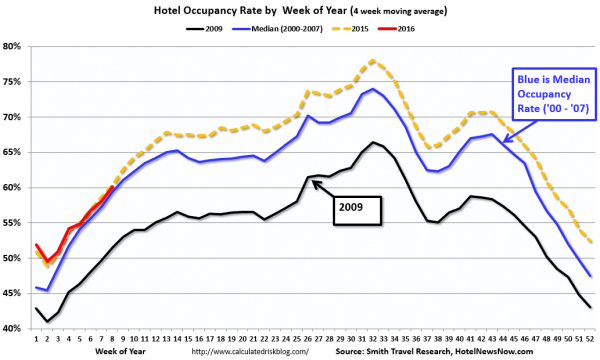

- Hotel occupancy remains on a record pace. (Calculated Risk)

- ISM services best expectations at 53.4 and remained in expansion. Steven Hansen at GEI analyzes with some emphasis on the mixed nature of the report.

- Employment showed solid gains both in the ADP private payrolls (up 214K) and the “official” BLS report (up 242K). Both beat expectations. (See The Capital Spectator for charts and coverage of the ADP story). The unemployment rate remained below 5% and labor participation increased. (Please note the absence of commentary on seasonal adjustments from the sources featuring that interpretation last month. This month the change was a subtraction of about 600K jobs. We need to observe when dogs quit barking!) FiveThirtyEight has a new economics column from Ben Casselman. He features the improvement in labor force participation.

One negative was the drop in hourly wages. Business Insider has the whole story in thirteen charts from Deutsche Bank). Many critics of employment gains point to the U-6 rate as a better read on conditions. It has been improving rapidly, suggesting less slack in the labor market.

The Bad

There was also negative news, but mostly consistent with continuing sluggish growth.

- Federal budget reform had a setback. This did not get much attention, which is very unfortunate. Former Congressional Budget Office Director, Georgetown Prof., and think-tank veteran Donald Marron explains both what happened, and why we should care:

On Monday, the Government Accountability Office (GAO) defended the current method for budgeting for federal lending programs, known as “credit reform.” By endorsing the status quo, GAO puts itself at odds with the Congressional Budget Office (CBO), which has championed a “fair value” alternative. The details are wonky but the stakes are big. Over a decade, federal lending support for mortgages, student loans, and the Export-Import Bank could appear $300 billion more costly under fair-value budgeting than under credit reform.

- Pending home sales declined by 2.5%. (Calculated Risk)

- The trade balance was -45.7 billion, a bit worse than expectations. Lower exports represent a drag on GDP.

- Auto sales had a SAAR of 17.43 million, slightly below the 17.6 expectations. The pace was about the same as last month and still up 7% from last year. (Calculated Risk)

- Nonfarm productivity continued the slide at -2.2%. I am scoring this as negative (even though it beat expectations) because a change here is especially important.

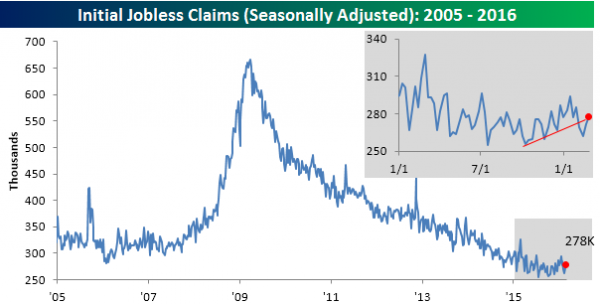

- Initial jobless claims increased to 278K. While this increase missed expectations, it is still in a comfortable range. Bespoke analyzes and includes this great chart:

- ISM manufacturing remained in contraction territory at 49.5. The Chicago PMI was only 47.6. Given the long-term decline in manufacturing, it is important to remember that these readings are consistent with a 2% increase in GDP. The official ISM report provides some color by showing examples of responses from different sectors:

WHAT RESPONDENTS ARE SAYING …

“Low oil prices and reduced activity continue affecting our business.” (Petroleum & Coal Products)

“U.S. business demand is solid; international demand is soft.” (Chemical Products)

“Mobility spend is up.” (Computer & Electronic Products)

“Business has to get better. And it appears it is. Healthy backlog for 2016.” (Fabricated Metal Products)

“Very strong demand for product. Material availability very good and commodity pricing continues to be depressed.” (Machinery)

“Airlines are still ordering planes and spare parts for plane galleys.” (Transportation Equipment)

“Market is beginning to trend up with spring season on its way.” (Wood Products)

“Not seeing impact from global economic volatility or oil prices. Business is strong and growth projections remain the same.” (Miscellaneous Manufacturing)

“Orders are coming in stronger than expected.” (Furniture & Related Products)

“Still a bit sluggish.” (Food, Beverage & Tobacco Products)

The Ugly

The small town hospital crisis. Many rural hospitals have closed and hundreds more are near bankruptcy. This affects the access to care as well as where people will choose to live. (Small towns watch aging hospitals shutter)

Noteworthy

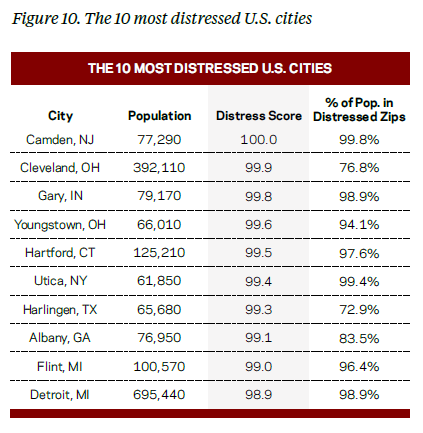

CityLab takes up a recent popular topic — inequality. They provide an interesting interactive national chart showing the most distressed areas. I cannot do justice to it in this post, but here are the most distressed cities:

The Silver Bullet

I occasionally give the Silver Bullet award to someone who takes up an unpopular or thankless cause, doing the real work to demonstrate the facts. Think of The Lone Ranger.

This week’s award goes to Robert Novy-Marx (HT Alpha Architect) for his article, Predicting anomaly performance with politics, the weather, global warming, sunspots, and the stars. The analysis shows explanations for a number of interesting subjects. Taking the stock market as an example of interest to us, he finds a correlation with the weather in Manhattan. We could infer some causation from the mood of traders, he suggests. But the same effect is present when looking at the weather in Hilo, Hawaii and Bozeman, Montana. He then further slices the data looking at seasonals. January is biggest. Sound familiar? It certainly should. You see similar post-hoc “explanations” every day. (If you missed it, please see my “Craving for Explanations” post, which is important for understanding the energy/stock relationship).

Quant Corner

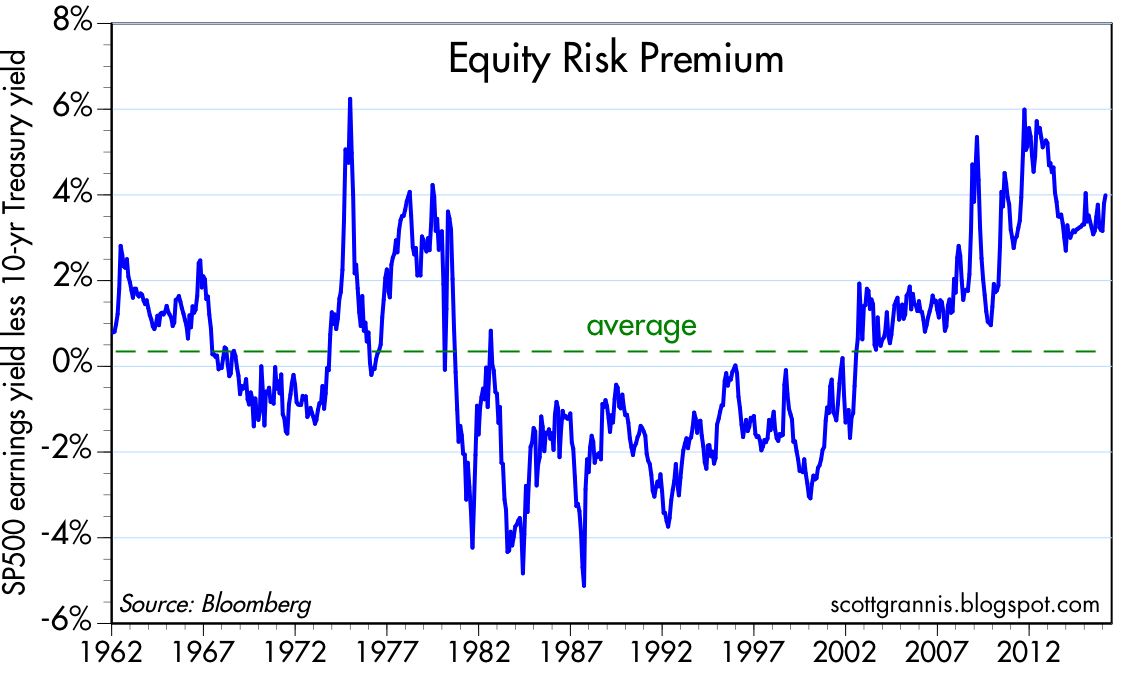

Whether a trader or an investor, you need to understand risk. I monitor many quantitative reports and highlight the best methods in this weekly update. Beginning last week I made some changes in our regular table, separating three different ways of considering risk. For valuation I report the equity risk premium. This is the difference between what we expect stocks to earn in the next twelve months and the return from the ten-year Treasury note. I have found this approach to be an effective method for measuring market perception of stock risk. This is now easier to monitor because of the excellent work of Brian Gilmartin, whose analysis of the Thomson-Reuters data is our principal source for forward earnings.

Our economic risk indicators have not changed.

In our monitoring of market technical risk, I am now using our new model, “Holmes”. Holmes is a friendly watchdog in the same tradition as Oscar and Felix, but with a stronger emphasis on asset protection. We have found that the overall market indication is very helpful for those investing or trading individual stocks. The score ranges from 1 to 5, with 5 representing a high warning level. The 2-4 range is acceptable for stock trading, with various levels of caution.

The new approach improves trading results by taking some profits during good times and getting out of the market when technical risk is high. This is not market timing as we normally think of it. It is not an effort to pick tops and bottoms and it does not go short.

Interested readers can get the program description as part of our new package of free reports, including information on risk control and value investing. (Send requests to info at newarc dot com).

In my continuing effort to provide an effective investor summary of the most important economic data I have added Georg Vrba’s Business Cycle Index, which we have frequently cited in this space. In contrast to the ECRI “black box” approach, Georg provides a full description of the model and the components.

For more information on each source, check here.

Recent Expert Commentary on Recession Odds and Market Trends

Bob Dieli does a monthly update (subscription required) after the employment report and also a monthly overview analysis. He follows many concurrent indicators to supplement our featured “C Score.”

Georg Vrba: provides an array of interesting systems. Check out his site for the full story. We especially like his unemployment rate recession indicator, confirming that there is no recession signal. He gets a similar result with the twenty-week forward look from the Business Cycle Indicator, updated weekly and now part of our featured indicators.

Doug Short: Provides an array of important economic updates including the best charts around. One of these is monitoring the ECRI’s business cycle analysis, as his associate Jill Mislinski does in this week’s update (still negative, with a focus on productivity). His Big Four update is the single best visual update of the indicators used in official recession dating. You can see each element and the aggregate, along with a table of the data. The full article is loaded with charts and analysis.

RecessionAlert: A variety of strong quantitative indicators for both economic and market analysis. While we feature the recession analysis, Dwaine also has a number of interesting systems. These include approaches helpful in both economic and market timing. He has been very accurate in helping people to stay on the right side of the market. The key is the change in the unemployment rate. (This is a factor in several methods).

Dwaine has introduced a new indicator, using only the timeliest data and a distinct improvement over the ECRI approach. Read the entire post for details and a number of interesting charts. He has also updated his long-leading index, which is starting to show some weakness.

Philosophical Economics joins those in search of the “perfect recession indicator” and concluding that there is no current threat.

Scott Grannis on the equity risk premium, which we recently began to feature:

So far, earnings are down only a little more than 2% in the past 12 months, and most of that is coming from the oil patch. Put another way, the current PE ratio of the S&P 500 is 17.4, whereas the PE ratio of the 10-yr Treasury is 58! To pay so much for the presumed safety of Treasuries is to have truly dismal expectations for economic growth and corporate profits.

The Week Ahead

We have a very light week for economic data. While I highlight the most important items, you can get an excellent comprehensive listing at Investing.com. You can filter for country, type of report, and other factors.

The “A List” includes the following:

- Initial Claims (Th). A lot of attention to the recent volatility in the best concurrent news on employment trends.

The “B List” includes the following:

- Crude oil inventories (W). Attracting a lot more attention these days.

- Wholesale inventories (W).

There is also plenty of FedSpeak on the schedule.

How to Use the Weekly Data Updates

In the WTWA series I try to share what I am thinking as I prepare for the coming week. I write each post as if I were speaking directly to one of my clients. Each client is different, so I have six different programs ranging from very conservative bond ladders to very aggressive trading programs. It is not a “one size fits all” approach.

To get the maximum benefit from my updates you need to have a self-assessment of your objectives. Are you most interested in preserving wealth? Or like most of us, do you still need to create wealth? How much risk is right for your temperament and circumstances?

WTWA often suggests a different course of action depending upon your objectives and time frames.

Insight for Traders

We continue both the neutral market forecast, and the bearish lean. Felix is still 100% invested in fairly aggressive sectors. The more cautious Holmes is completely out of the market, after taking profits on the remaining positions. For more information about Felix, I have posted a further description — Meet Felix and Oscar. You can sign up for Felix and Oscar’s weekly ratings updates via email to etf at newarc dot com. They appear almost every day at Scutify (follow here). I am trying to figure out a method to share some additional updates from Holmes, our new portfolio watchdog. (You learn more about Holmes by writing to info at newarc dot com.

- Dr. Brett has another post with an insight you would not find anywhere else. He notes that there are cycles in life as well as in markets. His advice? “The trading psychology literature speaks a great deal of discipline and confidence and emotional control. Rarely do we focus on acceptance as a cardinal virtue”.

- Mark Hulbert sees more upside for stocks because of negative sentiment. Check out his comparisons and the chart of the Wall of Worry.

Insight for Investors

I review the themes here each week and refresh when needed. For investors, as we would expect, the key ideas may stay on the list longer than the updates for traders. Major market declines occur after business cycle peaks, sparked by severely declining earnings. Our methods are focused on limiting this risk. Start with our Tips for Individual Investors and follow the links.

We also have a page (recently updated) summarizing many of the current investor fears. If you read something scary, this is a good place to do some fact checking. Pick a topic and give it a try.

Many individual investors will also appreciate our two new free reports on Managing Risk and Value Investing. (Write to info at newarc dot com).

Other Advice

Here is our collection of great investor advice for this week.

If I had to pick a single most important source for investors to read, it would be Morgan Housel’s article on the “Anti-Reading List”. He warns that despite the need to read constantly, but warns about the need for filters. He cites three types of reading to avoid, including political opinions disguised as investment analysis. (He also quotes Sherlock Holmes, earning a “bark out” from our new company dog!)

Stock Ideas

Berkshire Hathaway (NYSE:BRKa). Warren Buffett notes that he might buy back stock if it were to trade at 1.2 times book value. It currently represents 1.3 times (a growing) book value. Many see this as providing a floor under a stock that is already attractive. (Brett Arends, MarketWatch)

Think tires, not autos. Lower gas prices mean more miles driven. Chris Bryant at Bloomberg explains.

Dividends are important, but must come from somewhere. Chuck Carnevale shows the need for considering total return in dividend stocks. As always, he has some great stock ideas.

Watch out for….

FANG stocks — now lagging the market. Beware of chasing last year’s favorites. (Horan Capital Advisors) (If you agree with me that 2016 might well be the “year of the value stock” then you should request a free report from info at newarc dot com).

Auto lenders. The WSJ highlights the risks.

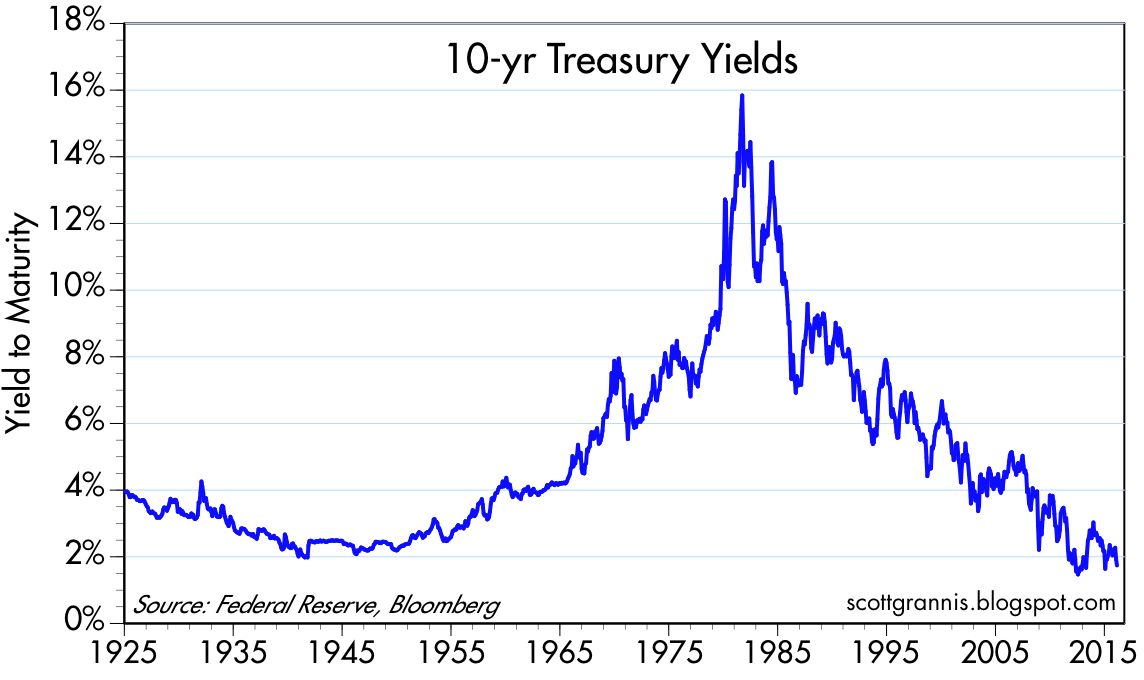

Bonds (and especially bond funds). Scott Grannis has one of his typical chart packs covering current economic conditions. The entire post is good reading, but this comment is especially interesting for investors:

With 10-Yr Treasury yields currently a mere 1.73%—only 25 bps above their all-time lows of mid-2012—the bond market is priced to slow-growth, low-inflation perfection; it’s vulnerable to any sign that inflation is either not falling or rising, and/or any sign that economic growth is, say, 2% or better.

Personal Finance

Professional investors and traders have been making Abnormal Returns a daily stop for over ten years. The average investor should make time (even if you are not able to read AR every day as I do) for a weekly trip on Wednesday. Tadas always has first-rate links for investors in this special edition. There are several great posts this week, but I especially liked Tony Isola’s advice on how to choose an honest investment advisor in ten minutes. It will only take two minutes to read the five statements that should be flashing a red light!

Final Thoughts

As always, my strong recommendation is that you should be politically agnostic when making investment decisions. Vote your heart and your conscience, but invest logically and without emotion.

Avoid the confirmation bias trap — believing that a candidate you do not like will wreck the country. We have had some pretty bad Presidents, and managed to muddle through. It is fairly routine for opponents to predict disaster and then miss out on big rallies in stocks. Barry Ritholtz writes:

Recall that some investors believed Obama to be a Muslim Kenyan Socialist who was going to destroy the Dow — just before the market tripled during his presidency. And before him, George W. Bush was going to blow out the deficits, kill employment, and cause other problems — instead, the market nearly doubled.

Watch developments strictly to determine which themes or economic sectors are most likely to gain or lose. The election is just one factor among many.

Most importantly, it is too soon to know who will be elected — and maybe not even who will be nominated. If you are a political junkie, go ahead and watch for entertainment