The S&P 500 posted its fourth consecutive gain on Friday, with a modest advance at the close. The early trade appeared uncertain following the stronger-than-expected headline numbers in the February jobs report. The index bounced off its -0.33% intraday low about 25 minutes into the session. it then rallied to its 0.79% intraday high a bit over two hours before the final bell. That high was a selling opportunity, and the price dropped back to the opening price. Renewed buying then lifted the index to its 0.33% closing gain.

The yield on the US 10 Year T-Note closed at 1.88%, up five basis points from the previous close.

Here is a snapshot of past five sessions in the S&P 500.

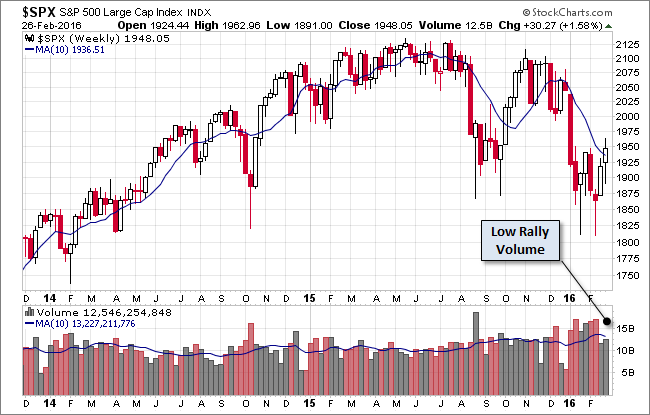

Here is a weekly chart of the S&P 500, which illustrates the 2.67% gain over the past five sessions. The index price is still moving in the same direction as oil, but the correlation over the past week was a bit muted. The West Texas Crude end-of-day spot price was up a whopping 9.38% over the same time frame.

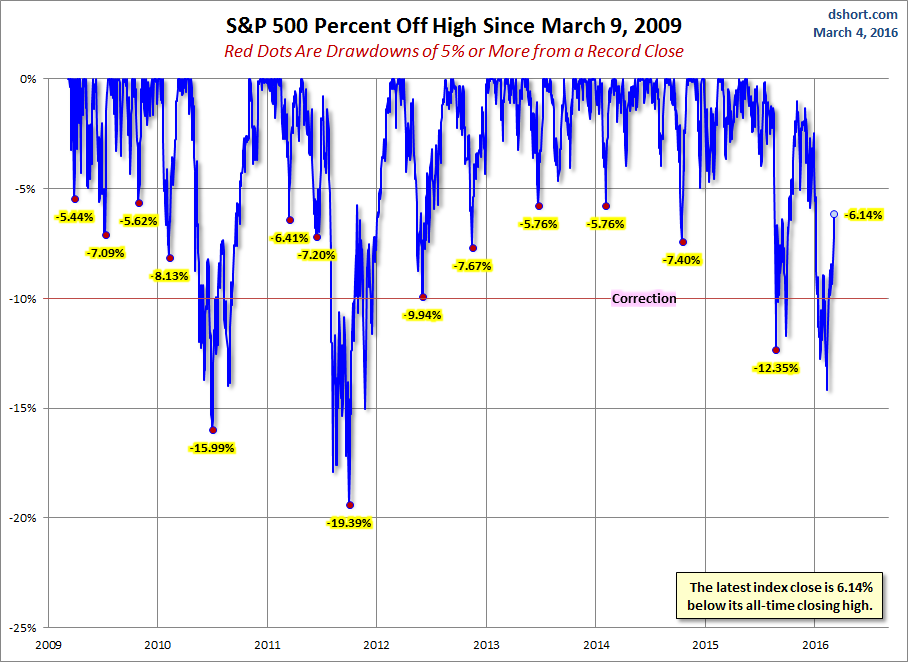

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

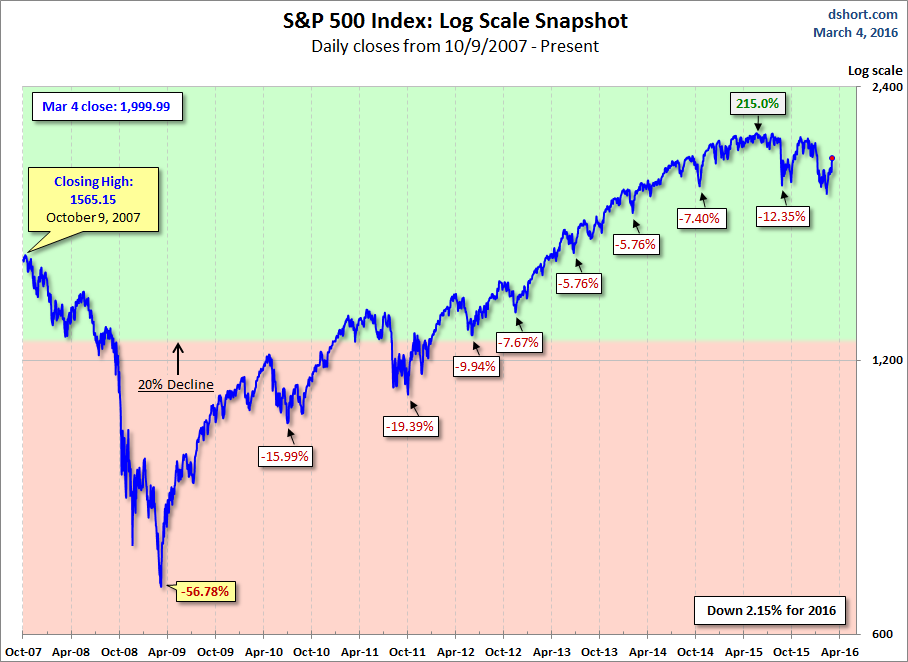

Here is a more conventional log-scale chart with drawdowns highlighted.

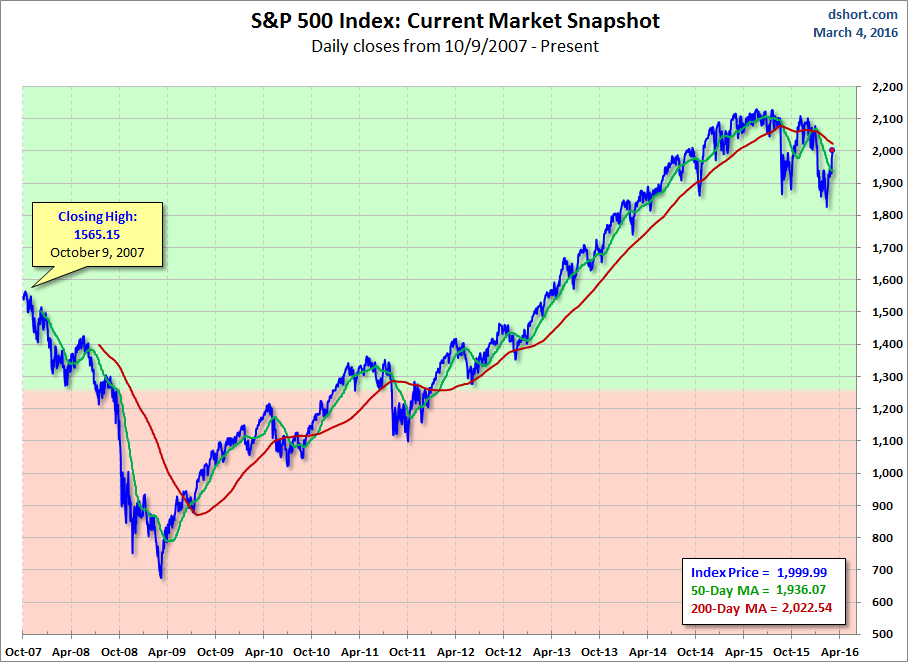

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

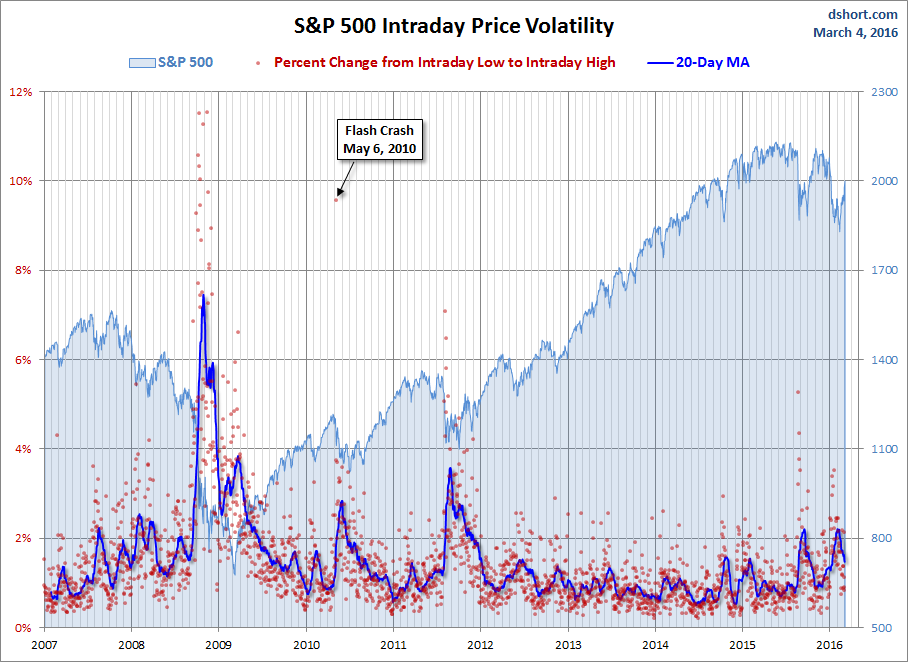

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.