We have a huge week for economic data. The Fed is now on hold until after the election. The election can still go either way. It is easy to find something to worry about. That said, the fourth quarter is usually good for stocks.

Should investors look past the gloom?

Last Week

There was plenty of economic news, and it was generally positive. The election had a lean to Clinton, which the market seems to like, but not a decisive verdict. There were two wild cards – the rumors about an OPEC deal and the concerns about Deutsche Bank (NYSE:DB). Both introduced day-to-day volatility, but not a lasting effect. The jury remains out on both.

Theme Recap

In my last WTWA, I predicted a focus on the first presidential debate, wondering if this would provide a clear path for investors. That was half right. The debate dominated discussions early in the week and post-mortems continued for a couple of days. There was no clear KO, so the election effects are still in doubt.

The Story in One Chart

I always start my personal review of the week by looking at this great chart of the S&P 500 from Doug Short. Stocks had a flat week and a rocky path.

Doug has a special knack for pulling together all of the relevant information. His charts save more than a thousand words! Read his entire post where he adds analysis grounded in data and several more charts providing long-term perspective. You can easily see the whipsaw on the OPEC and Deutsche Bank stories. In a break from recent trends the market traded inversely with oil early in the week before the “OPEC rally.” Some attributed this to the debate. The Deutsche Bank story sent markets lower on Thursday, with many seeing another “Lehman moment.” One day later, the pundits explained why the circumstances were not the same as in 2008. Who really gained from the scary stories on Thursday?

The News

Each week I break down events into good and bad. Often there is an “ugly” and on rare occasion something really good. My working definition of “good” has two components. The news must be market friendly and better than expectations. I avoid using my personal preferences in evaluating news – and you should, too!

The Good

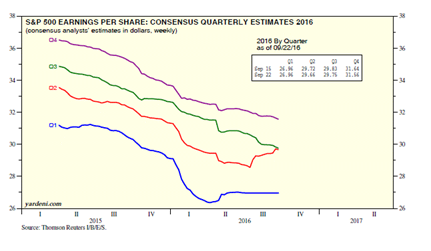

- Earnings are set to improve. Earnings guru Brian Gilmartin has been on this theme for weeks and adds to the evidence. Dr. Ed Yardeni joins in, suggesting that Q2 was the trough.

- Congress avoided a government shutdown. The Hill explains how. Are prospects for compromise better?

- Trucking increased sharply. Calculated Risk has the story.

- Global activity is stronger. Scott Grannis suggests that stable oil prices might be the reason. Readers may remember that I mentioned the possibility of a “sweet spot” in oil several weeks ago.

- New home sales were strong, beating expectations and up almost 21% year-over-year. Calculated Risk explains why this is important for the economy.

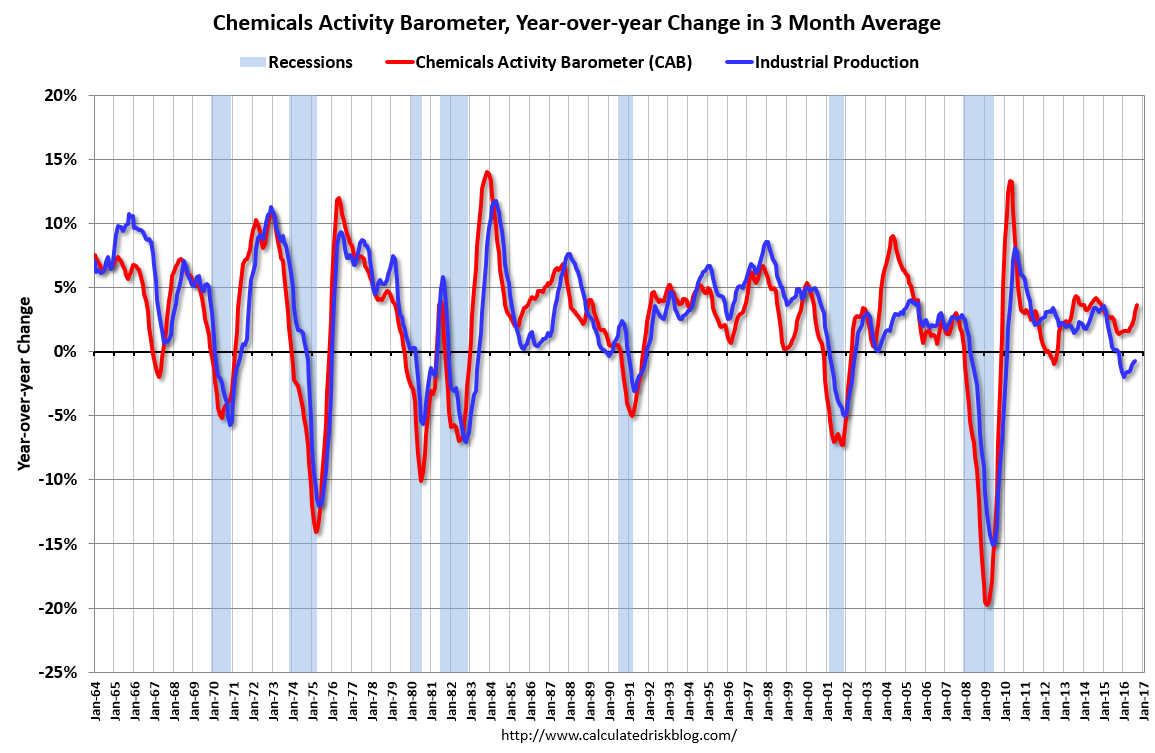

- Chemical activity is stronger. I noticed that several sources are now following this data series. Calculated Risk shows the leading quality of the indicator, represented in this chart:

The Bad

- Pending home sales declined 2.4%, missing expectations.

- Restaurant performance decreased 1% from July. Several sources are citing a “restaurant recession.”

- Deutsche Bank faces a large fine, possibly requiring more capital. Many worry about effects on other banks. Some hedge funds have reduced trading and maintaining collateral with DB.

- Durable goods production showed no increase.

The Ugly

Potential hacking of US elections. While it is unlikely to change the outcome, it is important that results are perceived as legitimate. (Yes, I have heard of Mayor Daley). Even Nixon accepted the 1960 results. The CFR opines that Congress should warn Russia.

The Silver Bullet

I occasionally give the Silver Bullet award to someone who takes up an unpopular or thankless cause, doing the real work to demonstrate the facts. This week I want to highlight Evidence Soup, by Tracy Allison Altman. She definitely has the right idea in her work. This week’s theme of whether immigrants disrupt US employment is both important and timely. She highlights evidence that supposedly disproves this notion, but there is a lot of work in evaluating it. I sympathize with this challenge. What do you think?

The Week Ahead

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead. You can make your own predictions in the comments.

The Calendar

We have a very big week for economic data. While I watch everything on the calendar, you do not need to! Check out WTWA to focus on what is really important – and ignore the noise.

The “A” List

- Employment report (F). Rightly or wrongly, even rather small changes create large reactions.

- ISM Index (M). Rebound expected in a private indicator with some leading qualities.

- ADP private employment (W). A strong measure of employment changes, deserving of more respect.

- Auto sales (M). Private data on an important growth sector.

- Initial claims (Th). The best concurrent indicator for employment trends.

The “B” List

- ISM Services (W). Not as interesting as the manufacturing index, but only because the series is shorter.

- Construction spending (M). Important sector, but August data.

- Trade balance (W). Important part of the GDP calculation for Q3.

- Factory orders (W). Volatile August data, but an important sector.

- Crude inventories (W). Often has a significant impact on oil markets, a focal point for traders of everything.

Did you get enough FedSpeak after the FOMC meeting, the press conference, the speeches last week, and the Yellen Congressional testimony? No? If not, you will have several more opportunities to get even more transparency and clarity this week!

Next Week’s Theme

Despite warnings to sell in May, the worst month of August, and the dangers of September, stocks have posted another positive quarter. The fourth quarter is positive over 80% of the time. But wait! To some the list of worries seems more important than usual. The biggest include the following:

- Election uncertainty

- Recession chances/economic weakness

- Length of the bull market

- Misleading corporate earnings

These factors have most market participants in a gloomy mood. The market resilience this year will have the pundits wondering: Is it time to look past the gloom?

The ever-witty Alan Steel wonders if sentiment is detached from reality.

Yes, and it’s always been that way; the consensus of opinion and the investor herd move in exactly the wrong direction at exactly the wrong time.

That’s because investors rarely focus on anything beyond what they’re hearing and seeing today.

And in the words of our good friend Mike Williams of Genesis Asset Management in Chicago, “It’s not what’s now that matters, it’s what’s next.”

Bill Kort uses actual reader counts to demonstrate the effect of negative headlines – SELL ALL STOCKS!!!. He notes, “The articles I publish with overtly negative titles draw far more readers than those with neutral to modestly negative elements”.

As always, I’ll have a few ideas of my own in the conclusion.

Quant Corner

We follow some regular great sources and also the best insights from each week.

Risk Analysis

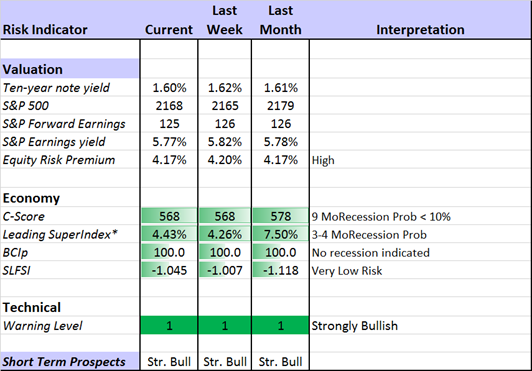

Whether you are a trader or an investor, you need to understand risk. Think first about your risk. Only then should you consider possible rewards. I monitor many quantitative reports and highlight the best methods in this weekly update.

The Indicator Snapshot

The Featured Sources:

Bob Dieli: The “C Score” which is a weekly estimate of his Enhanced Aggregate Spread (the most accurate real-time recession forecasting method over the last few decades). His subscribers get Monthly reports including both an economic overview of the economy and employment.

The recession odds (in nine months) have nudged closer to 10%.

Holmes: Our cautious and clever watchdog, who sniffs out opportunity like a great detective, but emphasizes guarding assets.

Georg Vrba: The Business Cycle Indicator, and much more. Check out his site for an array of interesting methods. Georg regularly analyzes Bob Dieli’s enhanced aggregate spread, considering when it might first give a recession signal. Georg thinks it is still a year away. It is interesting to watch this approach along with our weekly monitoring of the C-Score.

Brian Gilmartin: Analysis of expected earnings for the overall market as well as coverage of many individual companies.

Doug Short: The Big Four Update, the World Markets Weekend Update (and much more).

The ECRI has been dropped from our weekly update. It was not so much because of the bad call in 2011, but the stubborn adherence to this position despite plenty of evidence to the contrary. Those interested can still follow them via Doug Short and Jill Mislinski. The ECRI commentary remains relentlessly bearish despite the upturn in their own index.

RecessionAlert: Many strong quantitative indicators for both economic and market analysis. While we feature his recession analysis, Dwaine also has a number of interesting approaches to asset allocation.

James Picerno takes up a frequent question about the slope of the yield curve: Is it still relevant given the heavy-handed central bank involvement in the markets. My own thoughts are in the comments.

How to Use WTWA

In this series I share my preparation for the coming week. I write each post as if I were speaking directly to one of my clients. Most readers can just “listen in.” If you are unhappy with your current investment approach, we will be happy to talk with you. I start with a specific assessment of your personal situation. There is no rush. Each client is different, so I have six different programs ranging from very conservative bond ladders to very aggressive trading programs. A key question:

Are you preserving wealth, or like most of us, do you need to create more wealth?

My objective is to help all readers, so I provide a number of free resources. Just write to info at newarc dot com. We will send whatever you request. We never share your email address with others, and send only what you seek. (Like you, we hate spam!) Free reports include the following:

- Understanding Risk – what we all should know.

- Income investing – better yield than the standard dividend portfolio, and also less risk.

- Holmes and friends – the top artificial intelligence techniques in action.

- Why it is a great time to own for Value Stocks – finding cheap stocks based on long-term earnings.

You can also check out my website for Tips for Individual Investors, and a discussion of the biggest market fears. (I welcome questions on this subject. What scares you?)

Best Advice for the Week Ahead

The right move often depends on your time horizon. Are you a trader or an investor?

Insight for Traders

We consider both our models and also the best advice from sources we follow.

Felix and Holmes

We continue with a strongly bullish market forecast. Felix is fully invested. Oscar holds several aggressive sectors. The more cautious Holmes also remains fully invested. They now have a regular Thursday night discussion, which they call the “Stock Exchange.” This is the place to get some ideas from the best technical analysis – and you can ask questions!

Top Trading Advice

Brett Steenbarger continues to provide a great piece of trading advice every day. It is always difficult to pick a favorite. One of the big trading questions is how much risk to take. How do you decide? Brett writes:

There are risk-averse traders who never make significant money. There are risk-seeking traders who blow up. Then there are smart traders who take calculated risks. They make selective bets. Like the skilled poker player, they know when they have a good hand and they know how and when to bet that hand.

Related, from Adam H. Grimes – why forecasting volatility is important.

Also – how not to “outthink” yourself when you hit a bad stretch.

Repeat after Bella: ALWAYS have a good entry price!

Insight for Investors

Investors have a longer time horizon. The best moves frequently involve taking advantage of trading volatility!

Best of the Week

If I had to pick a single most important source for investors to read this week it would be Morgan Housel’s explanation of the difference between a bubble and a cycle.

According to various media sources we now have at least 14 bubbles:

A new real estate bubble.

A bond bubble.

A tech bubble.

A VC bubble.

A startup bubble.

A stock bubble.

A shale oil bubble.

A healthcare bubble.

A dollar bubble.

A college tuition bubble.

A Canadian housing bubble.

A central bank bubble.

A social media bubble.

A China bubble.

One economist recently gave up and just said “Everything’s a bubble.”

At a conference I attended a few years ago, Yale economist Robert Shiller said something amazing: The word “bubble” wasn’t even in the economic lexicon 25 years ago. Not in textbooks, not in papers, not in schools. But now we have bubbles everywhere.

Read the full article for Morgan’s excellent analysis of how to distinguish real bubbles from hype.

Stock Ideas

When you read Chuck Carnevale’s articles – and you should – prepare for a stock idea combined with a great lesson. This week Chuck analyzes Consolidated Edison (NYSE:ED), a popular choice among retirement investors. He explains why valuation is a key to understanding whether it is a sound investment. A few minutes spent with this post and a cup of coffee can save you megabucks!

Abba likes Delta (NYSE:DAL). We do, too, but we have calls written against the position.

Peter F. Way’s interesting approach highlights current opportunities in chip stocks. As always, he has plenty of ideas, but you need to read the entire post for a full analysis and a list of interesting ideas.

Political commentary on drug prices have put a lid on biotech stocks. Michael Brush (MarketWatch) notes the decrease in such commentary and cites a number of “catalysts around the corner” for the sector. Buyouts ahead?

Our newest trading model, Holmes, has been contributing an idea each week, something we recently bought for clients. I will mention it here, but you can see it sooner (along with other interesting ideas) if you read my new weekly column, the Stock Exchange. I have a “conversation” with disciples of our four trading models. This week we took up the two most popular trader questions:

- Technical or fundamental analysis; and

- Ginger or Mary Ann

Since each model has a different personality and style, there are often disagreements – especially with me! While we cannot verify the suitability of specific stocks for everyone who is a reader, the ideas have worked well so far. My hope is that it will be a good starting point for your own research. Holmes may exit a position at any time. If you want more information about the exits, just sign up via holmes at newarc dot com. You will get an email update whenever we sell an announced position. This week Holmes added several stocks, including DuPont (NYSE:DD). See the Stock Exchange for a more complete analysis and ideas from the other experts.

Personal Finance

Professional investors and traders have been making Abnormal Returns a daily stop for over ten years. The average investor should make time (even if not able to read AR every day as I do) for a weekly trip on Wednesday. Tadas always has first-rate links for investors in his weekly special edition. There are always several great choices worth reading. My personal favorite this week is Tony Isola’s list of “deplorable” investments. I see the ads for many of these and become ill. If there was only some way to help individual investors before they lose a lot of money on an overpriced, illiquid asset. Here is a list of products that provide big fees to those offering them, and significant restrictions on the buyers:

- Equity-Indexed Annuities – How about an investment with limited upside but large potential for a substantial loss? Throw in a 10% sales charge and no dividend participation (50% of historic market returns) and we have the ingredients for a deplorable retirement scenario.

- Funds with 12b-1 Fees – Fund size and investment returns are negatively correlated. Investors are paying a fee to brokers designed to increase assets and reduce returns. Kind of like paying a restaurant to give you food poisoning!

- Proprietary Mutual Funds – This is cross selling at its most heinous. Never buy a mutual fund created by a broker’s employer- this is the ultimate perverse incentive.

- Non-Traded REITs – A false promise of safety combined with 10% upfront commissions, this is a true sucker’s bet. Just because something is not traded doesn’t mean it cannot go down in value. By the way, their publicly traded cousins have vastly outperformed this group over time, because of greater transparency and lower fees.

- Commodity Funds – High risk combined with low returns rarely ends well. These products specialize in something called “Contango.” Investor translation: Nearer dated futures’ prices are lower than the longer dated ones, or more commonly known as buy high and sell low, rinse and repeat.

- Variable Annuities – These are often sold on the pretense of guaranteed income and tax-deferred growth. In reality, very few investors need this product fraught with complexity and egregious fees. These are often placed inappropriately in tax-sheltered accounts; investors do not need both a belt and suspenders.

- Front-Loaded Mutual Funds – Investors pay a premium of 5.75%, and an additional 1% a year in fund fees to purchase an investment that is almost guaranteed to underperform an unmanaged index fund costing .05%, annually. There is NEVER a reason to pay this fee.

- Over-Niched ETFs – Healthcare Shares Dermatology and Wound Care ETF and Pure Drone Economy Strategy funds are all that needs to be said. The prosecution rests its case.

- Hedge Funds – 2% annual fees combined with 20% of yearly profit makes it pretty hard for investors to bring home any type of meaningful positive returns. While there is a small minority of hedge funds that are worth the steep price, they are either closed or have account minimums that rule out everyone except for the Bill Gates’ crowd.

- Market Linked C.D.s – The ultimate vanilla investment has been hijacked by Wall Street. Unless you enjoy paying a 3% commission and having the possibility of losing principal due to early withdrawal, run away from anyone who approaches you with this nonsense. Purchasing a complicated structure that will underperform your Credit Union’s basic offering is a deplorable choice.

Great work.

Less dramatic but also important is a Morningstar article on how to consider Social Security as part of your retirement planning. For many investors, even those with significant planning and savings, this can play an important role. You need to get it right.

And last but certainly not least in a great week for personal finance readers, check out Gil Weinreich’s three-part series on the issues facing those who “can’t afford retirement”.

Market Outlook

Eddy Elfenbein looks at the tough streak for value investing, and also the recent improvement.

Watch out for…

Overconfident forecasts. Tony Isola explains the dangers in coin-flip market timing strategies and predictions based upon politics.

Pension Partners underscores this advice, highlighting the danger of blindly following a “guru.”

Final Thoughts

Concerning the debates, there are three different methods of scoring.

- Points on specific issues – the method for formal debates. You look at each issue and determine who got the better.

- Technique. This is how we coach. You look for opportunities to insert carefully prepared “blocks.” These have pre-tested language and evidence.

- Change of opinion. This is, of course, what ultimately matters.

As someone who has judged hundreds of debates and followed them closely in all presidential elections, I thought that Secretary Clinton did better on point one and decisively better on point two. Being a coach for Mr. Trump would be very frustrating! He really likes to wing it.

That said, there was no knockout blow or major blunder. Voters are not watching this like debate judges. Mr. Trump’s message obviously resonates with many. The polls show a slight move toward Clinton, but the issue is still open with two debates to go.

Recession odds are low. Every week we see wannabee analysts who have no track record. This includes those at big-name firms. Understanding the economic cycle is one of the biggest advantages for the astute investor.

Bull markets (and economic cycles) do not die of old age. This is another great misconception. The odds of four heads in a row is 1/16. What do you think it is after you have already flipped three?

Energy earnings have colored overall results. We need to look forward.

The current market worries are no worse than ever. For perspective, look back at how negative everyone was when people criticized me for suggesting Dow 20K.

A list of negative headlines does not represent fundamental analysis. TV know-it-alls “explaining” yesterday’s news provide no edge. The best investments come from recognizing and ignoring bogus advice.