After last week’s avalanche of economic data, the calendar is back to normal. More important is the onset of earnings season. Recent data have reassured many observers about the health of the U.S. economy. The period of seasonal weakness is ending. Expect people to be asking:

Can this earnings season lead to a big year-end rally?

Last Week Recap

My expectation for last week concerned the relationship between economic and stock market strength. That discussion might come another day, but last week’s attention was focused on Las Vegas.

The Story in One Chart

I always start my personal review of the week by looking at this great S&P 500 chart from Doug Short via Jill Mislinski. She notes the gain of 1.18% on the week, as well as other key comparisons. Once again, it was a week of very low volatility.

Doug has a special knack for pulling together all the relevant information. His charts save more than a thousand words! Read the entire post for several more charts providing long-term perspective, including the size and frequency of drawdowns.

Personal Note

Next week I am off for a weekend jaunt to celebrate Mrs. OldProf’s birthday. I’ll try to post an indicator update, and maybe a bit more.

The News

Each week I break down events into good and bad. For our purposes, “good” has two components. The news must be market friendly and better than expectations. I avoid using my personal preferences in evaluating news – and you should, too!

The economic news remained quite positive. New Deal Democrat’s weekly update of high frequency indicators shows what is going on in various lead times. “The last few months have been boringly consistent, but in a good way!”

The Good

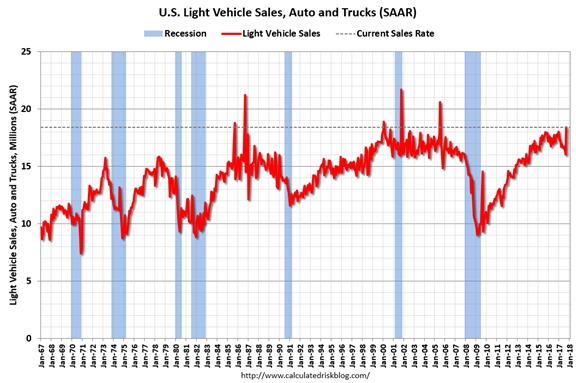

- Auto sales notched a gain of 14.8% over last month with an annual rate of 18.4 million in September. Hurricane replacements helped the increase. (Calculated Risk). See also “Davidson” via Todd Sullivan.

- Factory orders rebounded from last month’s decline of 3.3% to a gain of 1.2%, beating expectations.

- Construction spending also bounced from a decline of 1.2% to a gain of 0.5%, beating expectations.

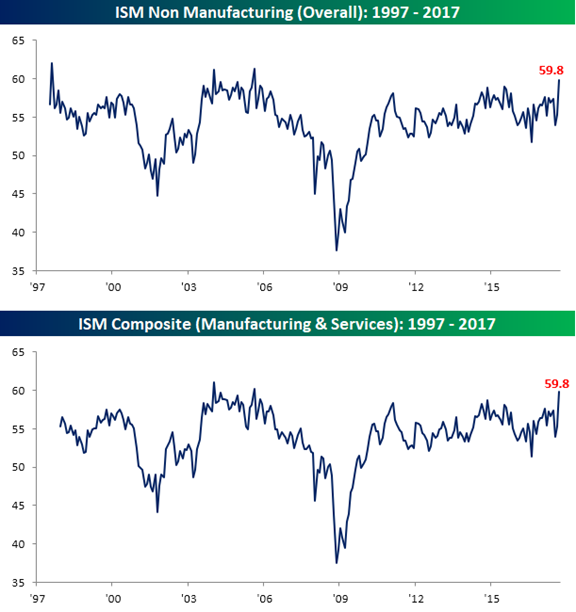

- ISM manufacturing index reached 60.8, over 60 for the first time in thirteen years. Bespoke cites key elements of the report to show both the overall strength and the hurricane effects.

- ISM services also registered a huge beat. (Bespoke).

The Bad

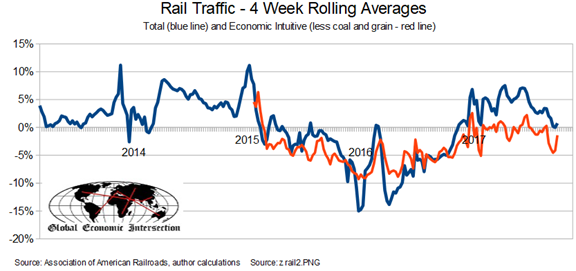

- Rail traffic is showing some improvement, but remains in contraction if one removes call and grain. By contrast, the intermodal measure showed strength. The data are difficult to interpret. Steven Hansen (GEI) is much more thorough than you will find in other sources.

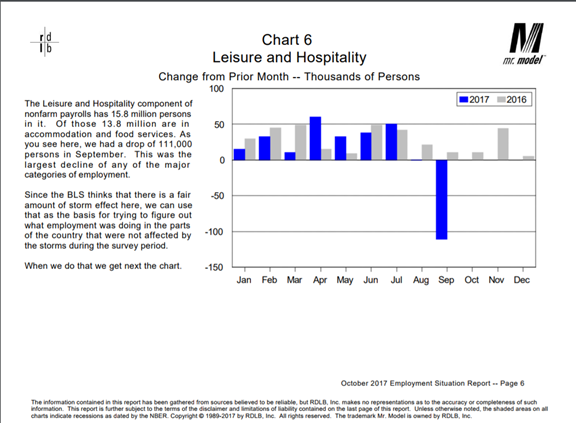

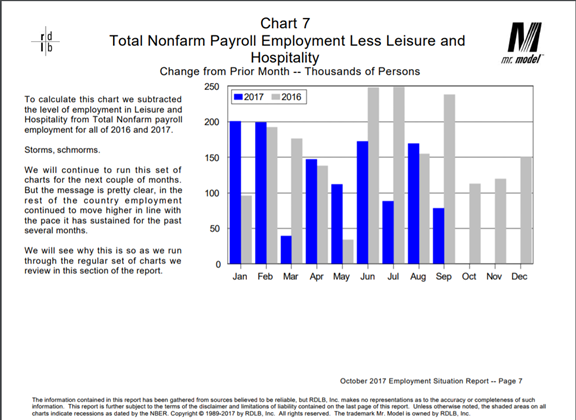

- Employment news was bad, at least in terms of the headline numbers. Hurricane effects are important to consider and defy accurate adjustments. I will include each of the key points in this section, positive, negative, and adjustments.

- ADP private employment grew only 135K, down from last month’s 228K and missing expectations for 160K.

- Initial jobless claims continue lower, now at 260K. While not at the levels from earlier in 2017, the hurricane effects clearly impacted this series.

- Headline payroll jobs declined by 33K and prior months were revised a bit lower. Unemployment declined to 4.2% and job gains from the household survey were 906K

- Hourly wages improved, but the change might well result from the compositional effects of the weather – a greater effect on lower-paid workers. (Dean Baker). His analysis wisely concludes that this report needs some context from the October data.

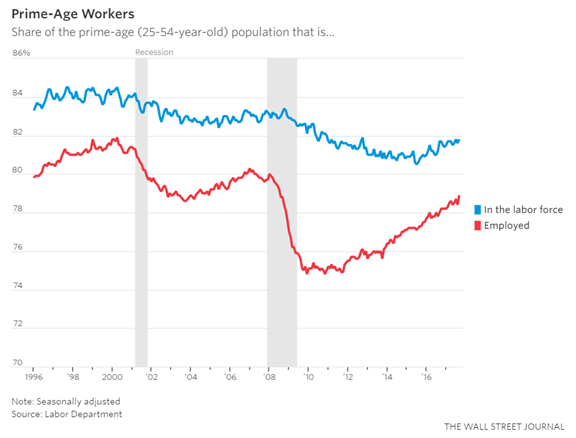

- Labor force participation is improving

(WSJ)

- ADP private employment grew only 135K, down from last month’s 228K and missing expectations for 160K.

- Adjustments Bob Dieli provides more insight into the numbers with a helpful approach you will not see elsewhere.

The Ugly

People want and deserve to know what is happening. They want details and understanding – in part to gauge the level of personal risk. If a desire for fame is the (apparently inexplicable) motive for random acts of mass violence, there is no real solution.

The Week Ahead

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react.

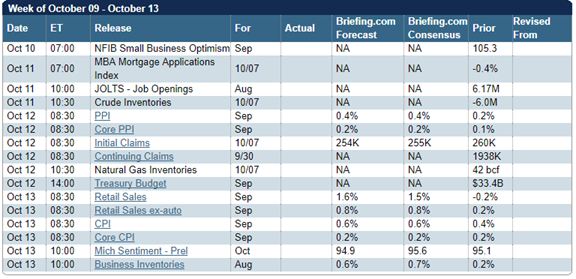

The Calendar

We have a normal week for economic data, featuring retail sales and the release of the FOMC minutes on Wednesday. Inflation data are still not very important, but that may change soon. There is plenty of FedSpeak on tap for those who can never get enough of such commentary!

Briefing.com has a good U.S. economic calendar for the week (and many other good features which I monitor each day). Here are the main U.S. releases.

Next Week’s Theme

After last week’s avalanche of economic data, it is time for earnings season. It is too soon to expect any serious news on tax cuts. The period of seasonal weakness is ending. The market has shown strength during recent earnings seasons. Economic news has been solid.

Expect the punditry to be asking:

Can this earnings season spark a big year-end rally?

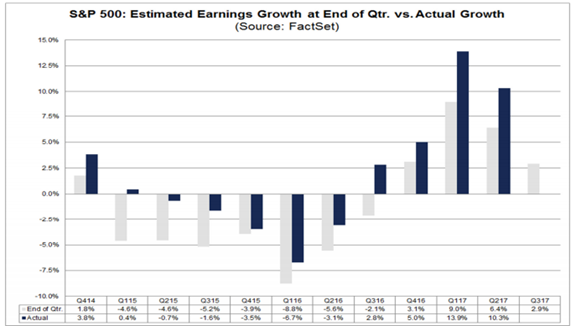

You might think that publication of actual audited reports about company performance would provide a solid, uncontroversial source of data. You would be wrong!

Earnings can be measured in different ways and interpreted in many others. Even when companies are beating pre-season expectations, the debate rages. Here are popular viewpoints. You will see them all in the next month.

- Operating earnings are deceptive. Those “one time” charges have a way of adding up.

- Analyst expectations are always wildly optimistic.

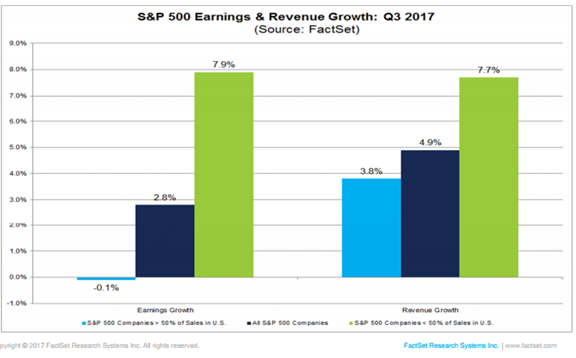

- Expectations set a low bar for earnings announcements. (Inconsistent with the “wildly optimistic” viewpoint, but often voiced by the same people. Factset notes that the typical “underbid” is 4.2%. That would imply an earnings season growth of 6%.

- Earnings quality is often low, even when the actual numbers seem fine.

- Growth may not be “organic.”

- Share buybacks give an illusion of growth, even when revenues are falling.

- “Financial engineering” abounds.

- Revenue is more important than earnings, and more difficult to manipulate.

- Outlook is more important than current earnings.

- Earnings have been strong and growing; this has supported the rally in stocks. (Avondale)

- Forward earnings expectations are strong and growing.

What to watch for:

- The dollar. FactSet’s excellent Earnings Insight shows the effect on Q3 earnings.

- FactSet also notes the drag from insurance, probably a one-time effect.

- And what to expect about the dollar? Bespoke notes the recent rebound. See also “Davidson” via Todd Sullivan.

As usual, I’ll have more in the Final Thought, where I always emphasize my own conclusions.

Quant Corner

We follow some regular featured sources and the best other quant news from the week.

Risk Analysis

I have a rule for my investment clients. Think first about your risk. Only then should you consider possible rewards. I monitor many quantitative reports and highlight the best methods in this weekly update.

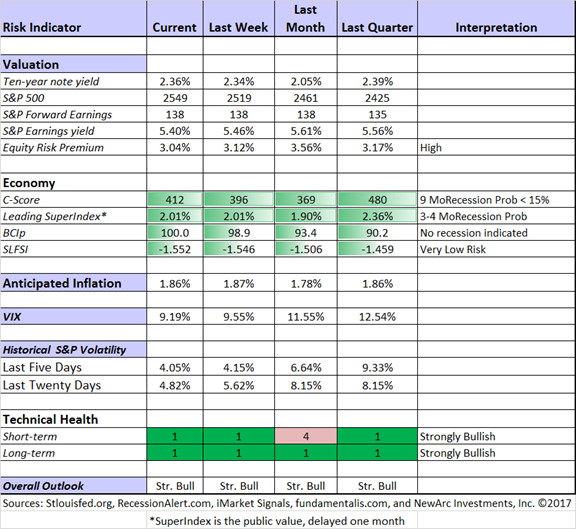

The Indicator Snapshot

The Featured Sources:

Bob Dieli: Business cycle analysis via the “C Score.

RecessionAlert: Strong quantitative indicators for both economic and market analysis.

Brian Gilmartin: All things earnings, for the overall market as well as many individual companies.

Georg Vrba: Business cycle indicator and market timing tools. It is a good time to show the chart with the business cycle indicator.

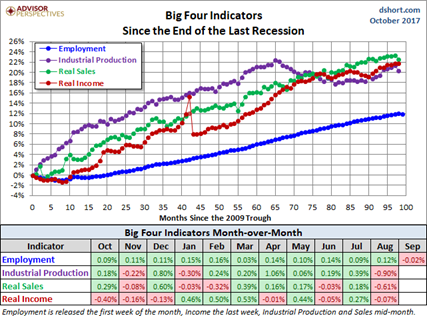

Doug Short: Regular updating of an array of indicators. Great charts and analysis. With Friday’s employment report in the books, it is time for an update of the Big Four economic indicators.

The start of a recession (better called a business-cycle peak as Bob Dieli wisely reminds us) requires two elements. The key series must roll over from a peak and then exhibit a significant decline. Put another way, if current levels later prove to represent the peak of the current economic cycle, the NBER will later date this as the recession beginning. This is merely a reminder of how to use the Big Four, not something that we should currently expect.

Insight for Traders

We have not quit our discussion of trading ideas. The weekly Stock Exchange column is bigger and better than ever. We combine links to trading articles, topical themes, and ideas from our trading models. This week’s post analyzed methods of stock-picking. Blue Harbinger has taken the lead role on this post, using information from me and from the models. He is doing a great job.

Insight for Investors

Investors should have a long-term horizon. They can often exploit trading volatility!

Best of the Week

If I had to pick a single most important source for investors to read this week it would be Charlie Bilello’s analysis of market risk, Is the S&P the New Money Market?

I love his lead quote from Mark Twain:

October: This is one of the peculiarly dangerous months to speculate on stocks. The others are July, January, September, April, November, May, March, June, December, August, and February.

He describes a question about whether it was safe to “park some money” in an index fund. His excellent response includes a nice chart pack analyzing risk. Here is his conclusion:

Does all of this imply that the S&P is indeed the new money market? Is it “safe” to “park your money” there for a few months with the expectation that it will only grow?

Hardly. The absence of risk does not mean the elimination of risk, just as the absence of rain does not mean there will never be another storm.

Explaining that to investors can be trying at times, and perhaps no more difficult than today. Selling prudence in a risk-free world is akin to selling ice to an Eskimo. No one seems to want it or need it.

Only after risk rears its ugly head will prudence be back in demand.

We will have occasion to revisit this commentary – especially when there is a reaction from those with “all-weather” portfolios.

Stock Ideas

Different approaches generate widely varying ideas. This week has some great examples

Chuck Carnevale uses his disciplined approach on the six most expensive stocks in the DJIA. While right now he is holding ’em he also advises on when to fold ’em.

RoseNose is fussy about her REITs. Her recent addition of CorEnergy (NYSE:CORR) reflects attention to debt, payout ratio, and entry place as well as funds from operations. This process, drawing upon Chuck Carnevale’s tools, is very similar to ours.

24/7 Wall Street provides regular updates of recommendations from major sell-side firms. Here are Merrill Lynch’s top ten ideas for Q4. Merrill also sees 35% upside for GM.

Peter F. Way looks at market-maker behavior to determine upside and downside targets. Here is his interesting look at semiconductor stocks.

Jim Van Meerten looks for price appreciation and momentum. This week he suggests “five great large caps“.

John Thomas starts with current economic and political themes and then finds suitable stocks. Insulation from dollar strength and help from Trump policies lead him to U.S. Steel (NYSE:X).

Morningstar’s equity analysts identify 30 stocks viewed as undervalued.

Personal Finance

Seeking Alpha Senior Editor Gil Weinreich has an interesting topic every day. His own commentary adds insight and ties together key current articles. As usual this week he had several good posts, but my favorite must be his citation of three top Seeking Alpha contributors are especially valuable to financial advisors and engaged investors. Being included in this select group is especially nice because Gil’s comments reflect what I try so hard to do each week. Please read the post to see some great examples from Kevin Wilson and Jim Sloan.

Abnormal Returns writes about the need for critical thinking – not just intelligence – in avoiding “negative investing events.”

Sometimes doing nothing is the best advice. Eddy Elfenbein explains.

Watch out for….

Disney (NYSE:DIS) – is it a sports platform or the “house of mouse?” Ian Bezek explains his conclusion that the stock is too expensive.

Final Thoughts

My most important idea is one I have mentioned before, but not seen anywhere else. The main reason for strength in seasonality comes from the customary practice and discussion by most of the Street. At some point everyone discusses stocks in terms of next year’s earnings instead of the current year. Watch for it! Any talking head on TV or pundit in print will talk about a company’s multiple of 2018 earnings. It happens every October. This makes stocks seem cheaper.

Since I constantly update multiples and price targets for all stocks, my analysis does not experience this jarring change. My favorites are under-loved early in the year, and embraced in the last quarter.

By contrast, the Shiller followers continue to look backwards.

How can a method work for the overall market when hardly anyone uses it on individual stocks?

Shiller fans are due for a surprise in the next two years. The ten-year window for past results will soon drop 2007. Then will come 2008. The Shiller-land world will look better even if nothing else – the economy, earnings, stock prices – change at all.

What worries me…

- Aggressive and unilateral moves on trade restrictions. The average person does not understand how much this has benefited the world economy, and that of the U.S.

- The lack of unity and cooperation, starting in the U.S. but extending to all on a planet that seems ever-smaller.

…and what doesn’t

- The Fed. We are still more than a year away from when changes in Fed policy will be important for stocks, despite the popular focus on this topic. It also does not matter (in the short run) whom President Trump selects to be the new Fed Chair, or his other appointments.

- Tax cut delay. A failure of the first proposal is actually good news, implying eventual compromise. Bill Kort’s commentary is right on target.