The S&P 500 spent most of the week climbing and opened Friday below Thursday's close. The index closed with a daily loss of -0.11% and a week-over-week gain of 1.19%. The index is up 13.87% YTD.

The U.S. Treasury puts the closing yield on the 10-year note at 2.37%.

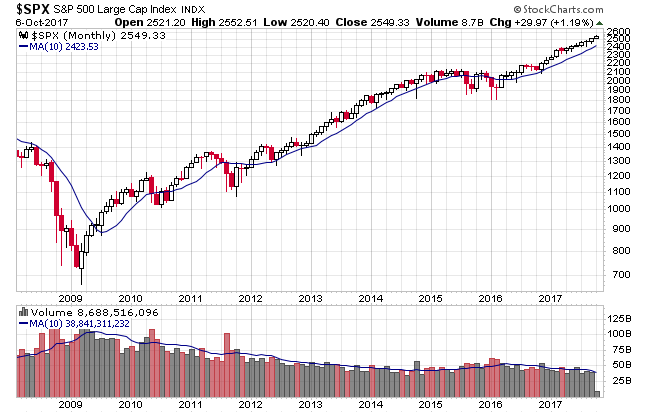

Here is a daily chart of the S&P 500. Friday's selling puts the volume 12% below its 50-day moving average.

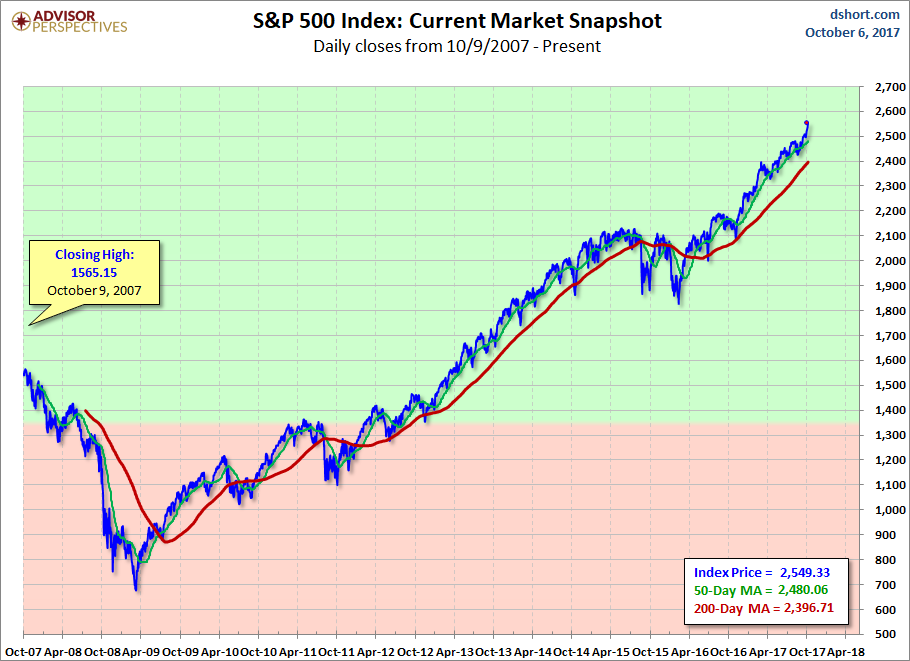

Here's a monthly snapshot of the index going back to December 2007.

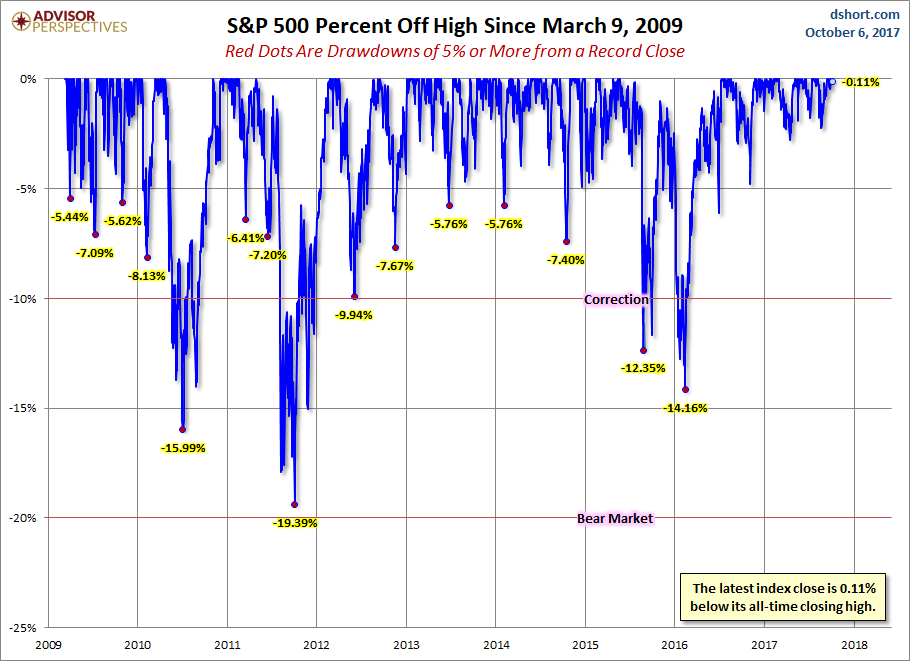

A Perspective on Drawdowns

Here's a snapshot of record highs and selloffs since the 2009 trough.

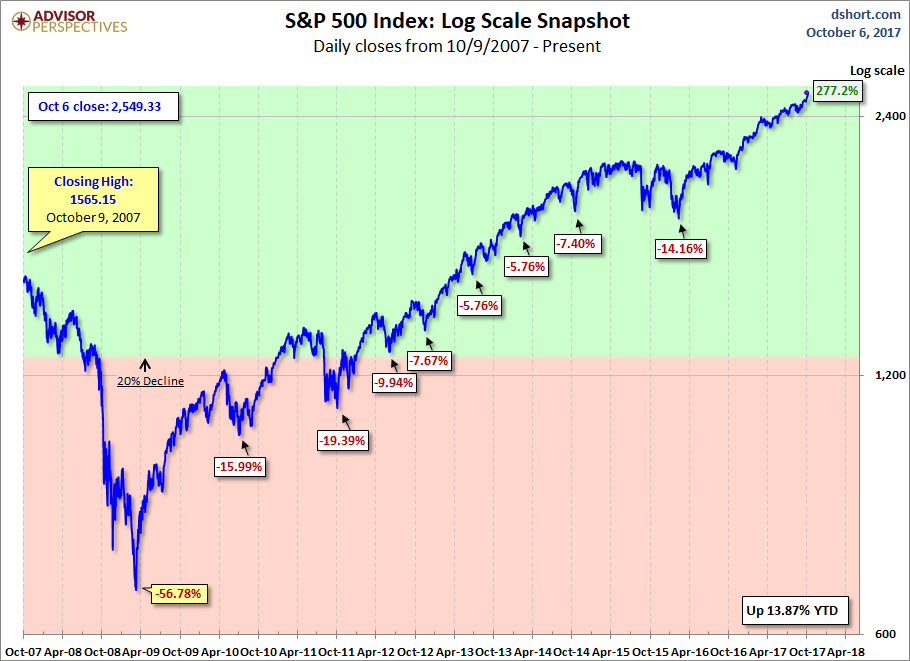

Here is a more conventional log-scale chart with drawdowns highlighted.

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

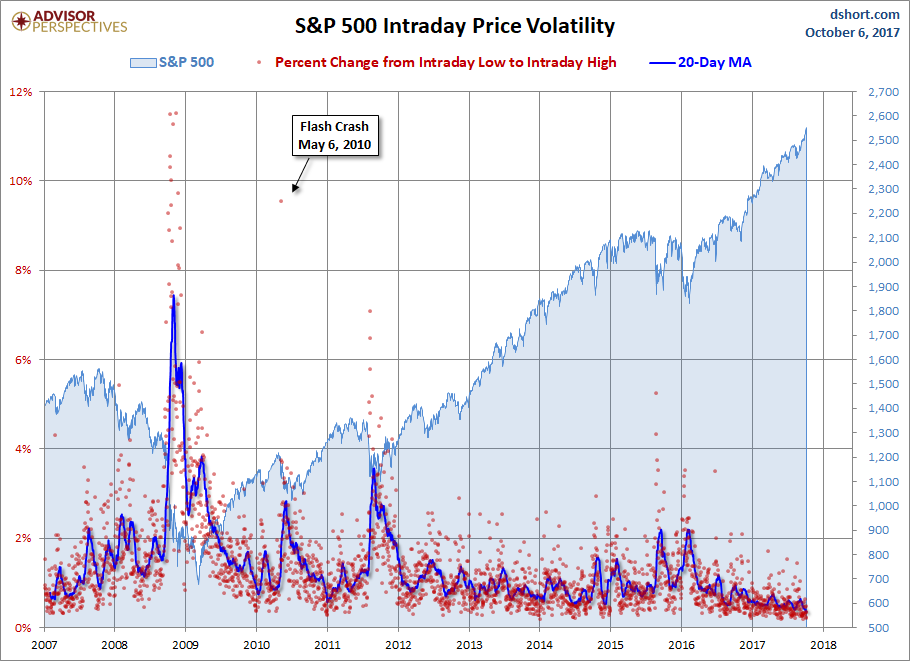

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.