This week, market participants may pay attention to earnings results for Q1 by major tech companies, like Microsoft (NASDAQ:MSFT), Google (NASDAQ:GOOGL), Facebook (NASDAQ:FB), and Amazon (NASDAQ:AMZN), but also to monetary policy decisions by the BoJ and the Fed.

Neither Bank is expected to alter its policy, so attention may fall on hints and clues as to how they intend to move forward. With regards to the data, we get the 1st estimate of the US GDP for Q1, as well as inflation numbers from Australia and the Eurozone.

Today's economic agenda looks relatively light. The only releases worth mentioning are the German Ifo survey for April and the US durable goods orders for March.

Market participants may focus more on Q1 earnings by Tesla (NASDAQ:TSLA). The rest of the week is also packed with earnings releases by big-name tech companies.

On Tuesday, Microsoft and Google are expected to release their numbers, while Apple (NASDAQ:AAPL) and Facebook follow on Wednesday. Amazon will release its Q1 results on Thursday. All firms are expected to have enjoyed another quarter of stellar earnings and sales growth, which may allow US indices to go for new records this week.

On Tuesday, during the Asian session, the Bank of Japan decides on monetary policy. When they last met, policymakers of this Bank decided to allow long-term yields to move up and down by 0.25% around zero, instead of by 0.2%.

They also decided to remove their explicit guidance over ETF purchases, saying that instead of buying at a set pace, they would buy only when necessary, while maintaining the JPY 12trln annual ceiling.

On top of that, they added that they will confine purchases to only TOPIX-linked ETFs, instead of ETFs linked to the TOPIX and Nikkei stock average. They said that the changes were intended to make easing more sustainable.

Given that they proceeded with the aforementioned changes and tweaks just at the prior meeting, we don’t expect any changes this time around. Therefore, we will pay attention to the updated economic projections.

We believe that the Japanese economy has been performing relatively well as it has never gone into full lockdown, and with exports surging 16.1% last month, we see the case for officials to revise up their growth projections.

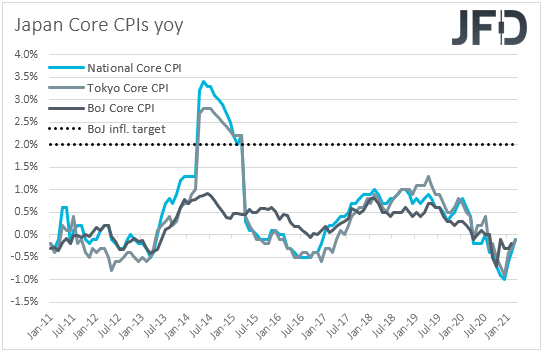

Nonetheless, with both the headline and core CPI rates staying in negative waters, we expect them to lower their inflation projections. With all that in mind, we don’t expect the Japanese yen to react much to this decision. We stick to our guns that its broader path will stay dependent on developments surrounding the overall market sentiment.

As for Tuesday’s data releases, the only one worth mentioning is the US Conference Board consumer confidence index for April, which is expected to rise to 112.1 from 109.7.

On Wednesday, the central bank torch will be passed to the FOMC. At the prior meeting, policymakers decided to keep all their policy settings unchanged via a unanimous vote, noting that bond purchases will continue until substantial further progress has been made towards their maximum employment and price stability goals.

As far as the new dot plot is concerned, 4 members voted for hikes in 2022, while 7 members saw rates higher in 2023, but the median dots suggested that interest rates are likely to stay at present levels even in 2023.

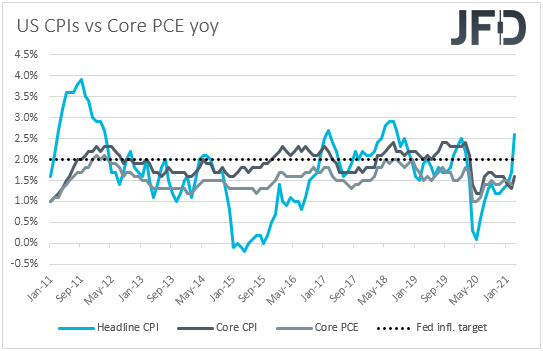

Even though officials upgraded their economic and inflation forecasts—inflation is seen at 2.4% this year—Fed Chair Jerome Powell clearly said that this will be temporary and would not meet their standards. He also stuck to his guns that it is too early to discuss tapering QE.

Taking all that into account, we don’t expect any policy changes at this week’s gathering, neither a different message by policymakers.

Since the previous meeting, data showed that the headline CPI rate jumped to +2.6% yoy, but we expect officials to maintain the view that this will prove to be temporary. However, with other data suggesting that the US economy is recovering from the coronavirus-related damages at a fast pace, especially last week’s PMIs which stood above 60, it would be interesting to see for how much longer the Fed will be able to keep market participants convinced that it is still too early to put policy normalization on the discussion table.

In any case, for now, with the Fed sticking to its dovish language, we see the case for equities to continue drifting north, and for the US dollar and other safe havens, like the yen, to stay under selling interest.

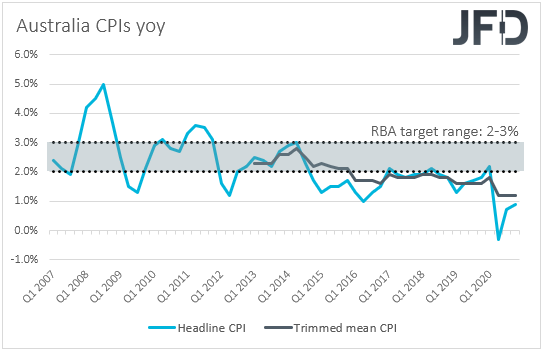

As for Wednesday’s other events, during the Asian session, we get Australia’s CPIs for Q1. The headline rate is forecast to have risen to +1.4% yoy from +0.9%, but the trimmed mean one is expected to have stayed unchanged at +1.2% yoy.

Although RBA officials have been repeatedly noting that the economic recovery in Australia is well underway and stronger than previously expected, with both inflation rates staying well below the lower end of their 2-3% target range, we don’t believe that they will start thinking normalization any time soon.

That said, maintaining their optimism with regards to the economy and feeling content with the Aussie’s trading levels means that they are unlikely to ease policy further either. Thus, the faith of the risk-linked aussie will probably depend more on developments surrounding the broader market sentiment, and perhaps any Chinese data, as Australia has very close trading ties with the world’s second largest economy.

Later in the day, Canada’s retail sales for February are due to be released. Both the headline and core rates are forecast to have rebounded to +4.0% mom and +3.7% mom from -1.1% and -1.2% respectively.

At last week’s meeting, the BoC decided to scale back its bond purchases and sounded very optimistic with regards to the economic outlook. So, a potential rebound in retail sales is likely to add credence to the Bank’s view and perhaps help the Canadian dollar to rise further.

On Thursday, during the Asian trading, New Zealand’s trade balance for March and the ANZ business confidence index for April are coming out, but no forecast is available for neither release.

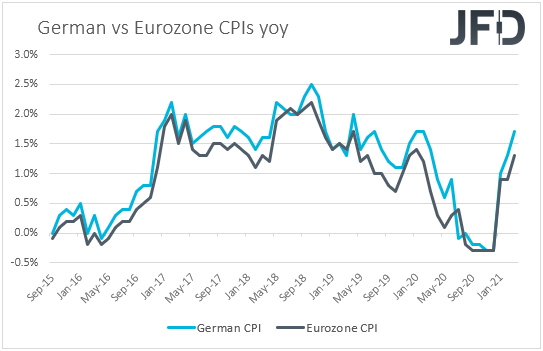

During the European session, Germany’s preliminary inflation data for April is due to be released. The CPI rate is expected to have ticked up to +1.8% yoy from +1.7%, while the HICP one is anticipated to have held steady at +2.0% yoy. This is likely to raise speculation that Eurozone’s headline CPI, due out on Friday, may also rise somewhat.

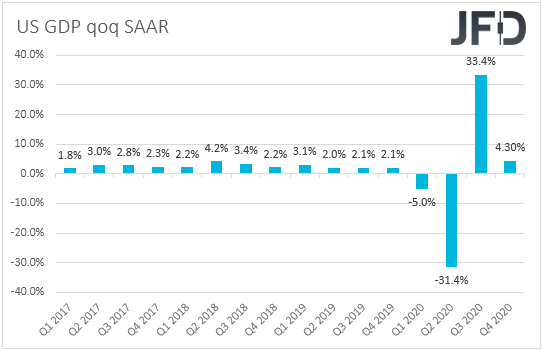

Later in the day, we get the preliminary GDP for Q1 from the US. The forecast suggests that economic activity in the US accelerated to +6.5% qoq SAAR from +4.3%.

If indeed this is the case, this will confirm that the world’s largest economy is recovering from the coronavirus-related damages at a fast pace and may tempt some participants to start thinking as to whether the Fed should consider normalizing its policy earlier.

Pending home sales for March are also scheduled to come out and expectations are for a 6.0% mom rebound, following a 10.6% tumble in February.

On Friday, Asian time, we get the usual end-of-month data dump from Japan. The unemployment rate and the jobs-to-applications ratio for March are both expected to have held steady at 2.9% and 1.09 respectively, while the preliminary industrial production for the month is anticipated to have tumbled another 2.0% mom after sliding 1.3% in February.

The core Tokyo CPI rate is anticipated to have ticked down to -0.2% yoy from -0.1%, but no forecast is available for the headline rate.

From China, we get the official PMIs for April. That said, there is forecast available only for the manufacturing index, which is expected to have slid fractionally, to 51.7 from 51.9.

In any case, we expect the indices to confirm that the world’s second largest economy continues to perform well, which may encourage market participants to continue increasing their risk exposure.

Later, during the European day, we have Eurozone’s 1st estimate of GDP for Q1 and the preliminary CPIs for April. Although no forecast is available for the GDP, the headline CPI rate is expected to have risen to +1.6% yoy from +1.3%, while the HICP excluding energy and food one is forecast to have stayed unchanged at +1.0% yoy.

This means that the rise in the headline rate may be due to transitory effects and may confirm the ECB’s view that any rise in inflation is likely to be temporary. In any case, we don’t expect the euro to react to this data set.

Following last week’s ECB gathering, where nothing much happened and, according to sources, officials did not discuss plans for their bond purchases, euro-traders may now be eager to get new information from the June meeting, where we will also get new staff macroeconomic projections.

From the US, we get personal income and spending for March, alongside the core PCE index for the month. Personal income is expected to have jumped 20.0% mom after shrinking 7.1%, while spending is anticipated to have rebounded 4.2% mom after sliding 1.0%. The core PCE index is anticipated to have risen to +1.8% yoy from +1.4%.

The final UoM consumer sentiment index for April is also coming out and expectations are for an upside revision to 87.5 from 86.5.