Coming into this week, SPDR S&P 500 (ARCA:SPY) had been above its 5-DMA for 30 days in a row. This was a new record, unlike any streak the index has ever seen. We reviewed prior examples of these streaks earlier; our conclusion was that the streak rarely marked the top in the market, meaning there were higher highs immediately ahead after the streak ended. But the index also struggled in the following weeks, often trading lower (the full post is here).

The set up we had been looking for after the streak ended was the first touch of SPY's 13-EMA. That has been a reliable buy point which we have highlighted many times in the past. That occurred on Monday, with SPY at 205.5. By Wednesday, SPY had already gained $2.50.

That may not seem like much of a gain, but consider the context. In the past 4 weeks (since November 10), SPY has gained $4, but more than $2 of that gain occurred overnight on November 21 following announcements from both the PBOC and ECB to provide greater stimulus. Without that one gap, SPY is up less 1% in the past month.

Overall, the trend remains higher for both the main US indices and well as for a majority of the individual sectors. All of the US indices except the Russell 2000 made new highs in the past week; all of the sectors except energy (via SPDR Energy Select Sector Fund (ARCA:XLE)) have made new uptrend highs in the past two weeks.

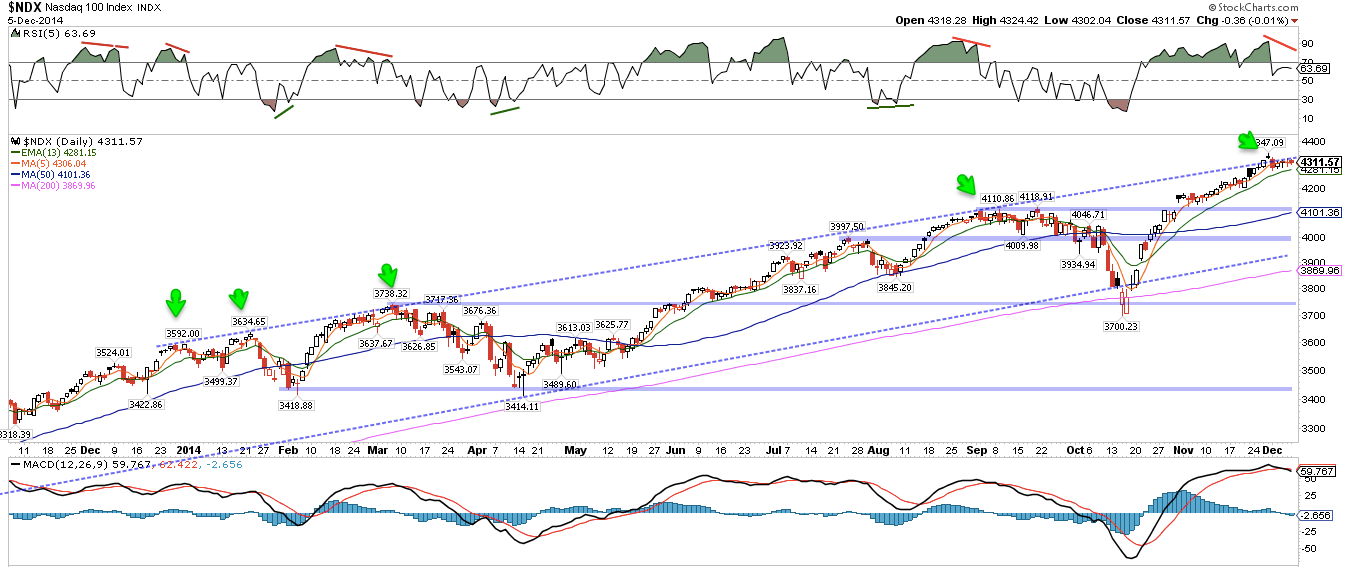

New highs imply limited resistance. After all, there are no prior buyers holding unprofitable shares at a higher price. So the main risk to trend is whether it is overextended. The NASDAQ 100 (NDX) may be the clearest example that it perhaps is. As the leader, NDX has the highest rate of appreciation; last week, it met its 2014 trend line, and this week, while SPX andDJIA closed higher, NDX closed lower.

NDX, by the way, still has not touched its 13-EMA since coming out of the October low. That's a set up worth watching into next week.

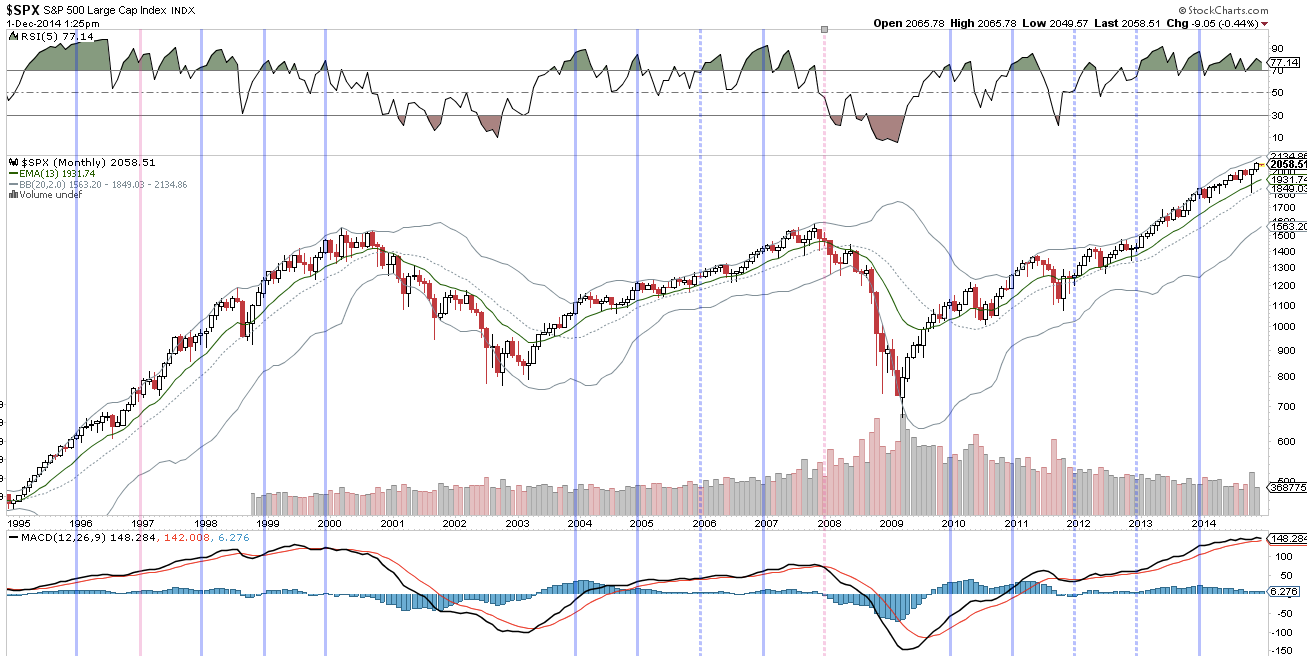

The Dow is also up against its trendline; moreover, it normally has resistance at its upper Bollinger®, which is now just 0.1% higher. The trend is clearly up, but note the loss of momentum in RSI and MACD.

The same set up in the Dow also exists in SPY. The trend is higher; moreover, note how the index hugged the top trend line in June and July and again in late August and into September. With strong seasonality into year end, it would not be surprising to see SPY hug the top trend line for several more weeks.

The trend line shown above extends back 9 months. Interestingly, SPY is also up against a trend line extending back nearly 5 years. Again, there are no unprofitable buyers at current levels, but the rate of appreciation may be reaching its multi-month as well as its multi-year limit.

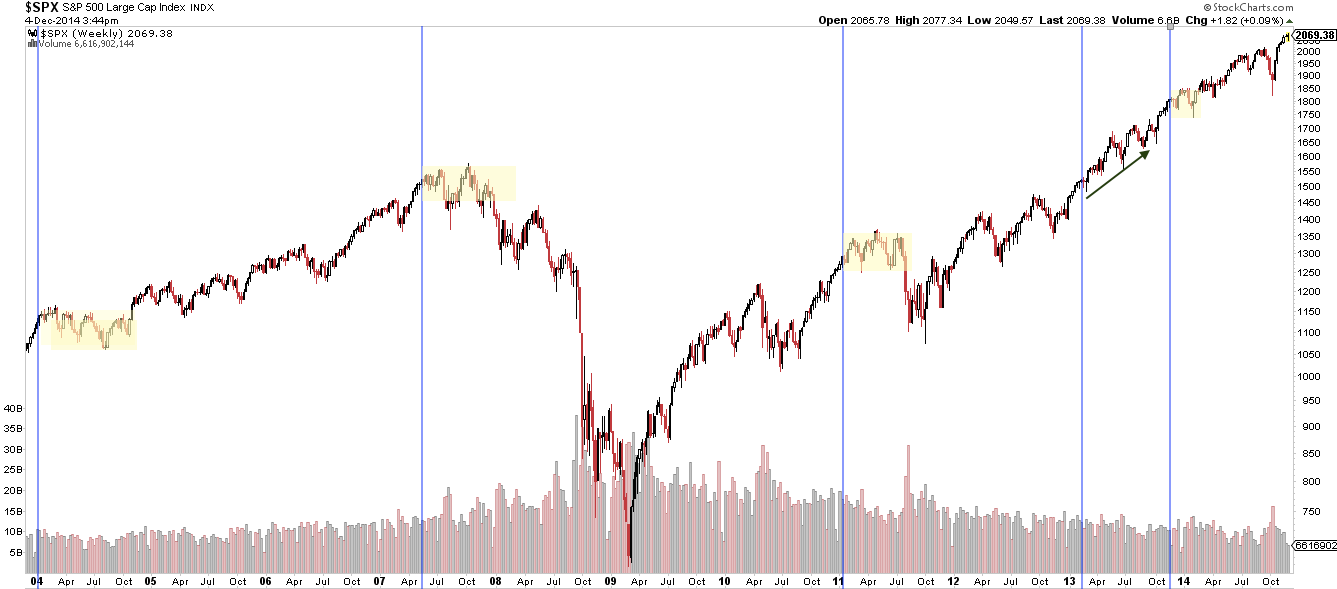

The chart above is on a weekly timeframe. Note that SPY is now up 7 weeks in a row. This is rare. In the past 10 years, this has only happened 4 other times. What happens next? In the past 4 cases, 3 closed lower the following week; the one positive case gained just 0.06% and then lost 1.6% two weeks later (data from Chad Gassaway).

Let's look at more examples, starting most recently. The vertical lines denote a 7 week up streak. Since 2004, the index has mostly struggled after the streak ended. Perhaps not immediately, but over the next weeks and sometimes longer. There is one exception where the index closed only slightly lower for two weeks and then zoomed higher (February 2013). Some of these streaks occurred before very long chop (2004) or major market tops (2007 and 2011).

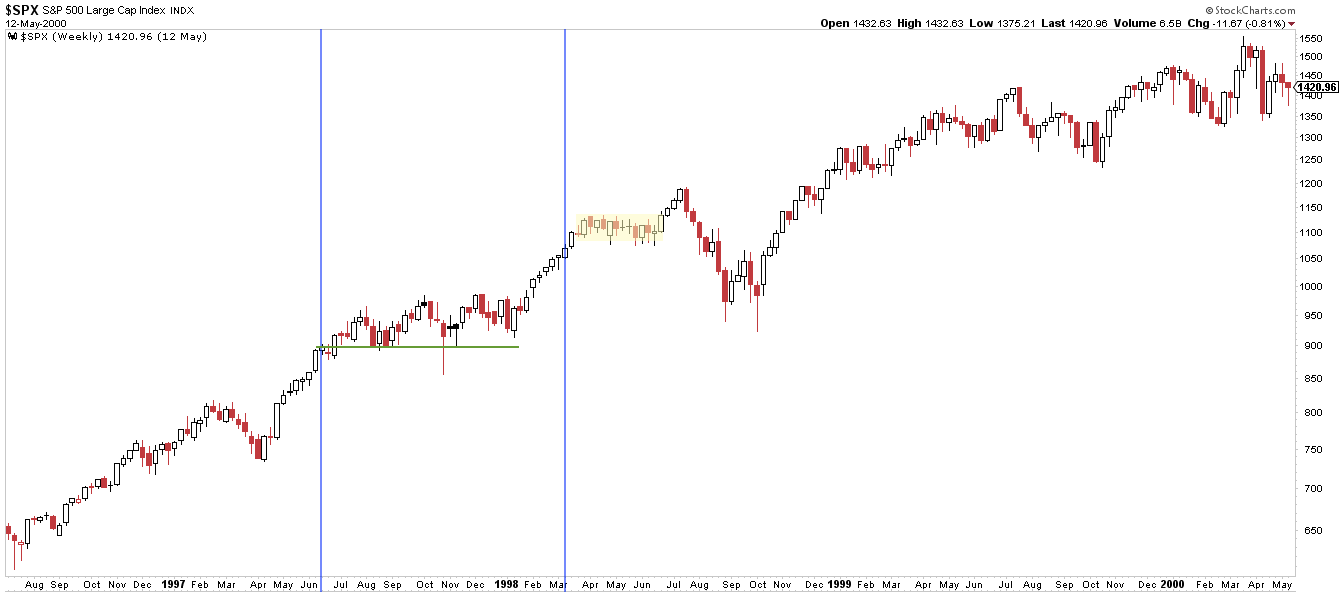

There were only two examples of 7 week streaks in the late 1990s. In 1997, the index closed down one week and then went higher, but it was still trading at the same level 6 months later (green line). In 1998, the index moved higher in week 8 and then settled into a 13-week long choppy trading range (yellow highlight).

Since 1980, there have only been three other cases; in two, SPY generally struggled for many months and in the other it did not (this was 1985, early in a new bull market).

Overall, in 8 of these 10 examples, SPY struggled to retain any gains over the next two months or longer, and in two SPY basically continued higher. We should stress that in all 10 cases, the end of the 7 week streak did not mark an exact top; the index always made a higher high in the weeks ahead. That means that investors should be looking to accumulate on near term weakness, at least for a trade.

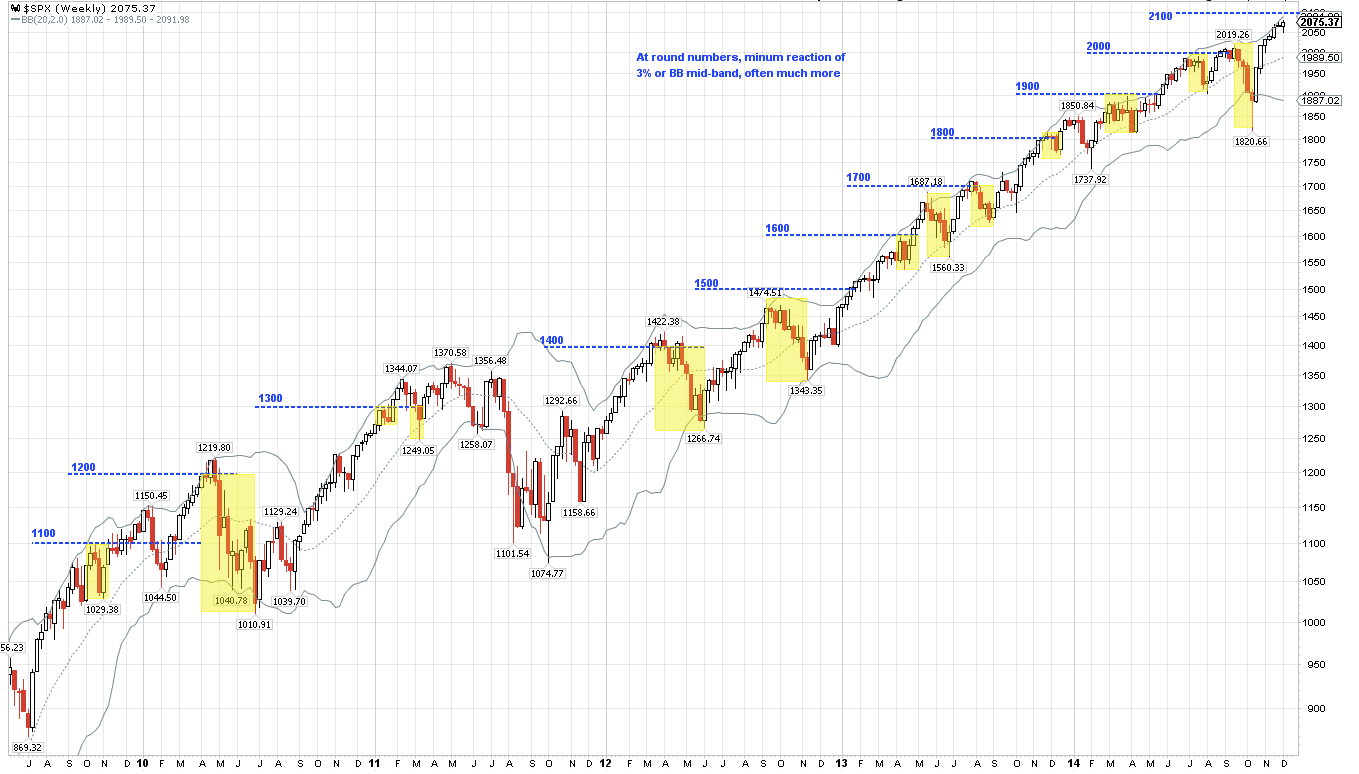

One more technical set up related to SPY is that it is again within 1% of a "round number" (e.g., 1900, 2000. 2100). In the past, these milestones have provided psychological resistance. There has been a minimum drawdown of 3%, but often much more. We often look for a retrace to the middle of the Bollinger, in this case about 4% lower (1980 on SPX). About half of these have started before the round number was formerly hit.

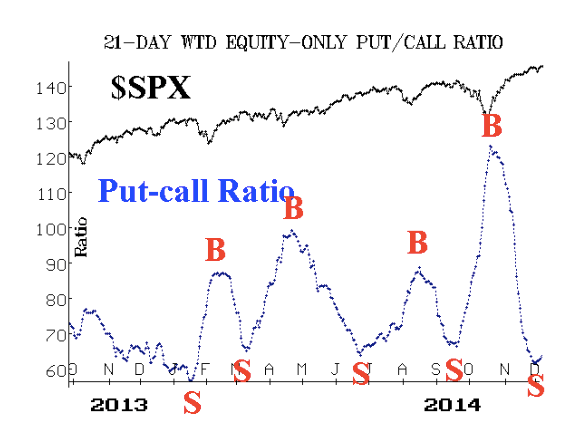

These technical patterns are arriving just as sentiment is once again becoming heated. This is to be expected when the index is up 12% in 7 weeks. The weighted put/call ratio for equities is now at an extreme where SPY often turns (chart from McMillan).

Moreover, inflows into equity ETFs and mutual funds reached $44b over the past 6 weeks. Inflows have been positive all 6 weeks; in the past 20 months, inflows extended into week 7 only three times: mid-August 2013, mid-July 2014 and mid-September 2014. Those occurrences are shown below with the subsequent drawdown.

Combining inflows and equity put/call ratios, among other indicators, is the basis for Sentimentrader's "dumb money" indicator. That indicator hit a fresh 2014 high this week. There is reason to suspect that bullish sentiment is reaching an extreme where the index either makes little progress or retraces.

We are now into December and the end of the year is near. This time period is particularly strong from a seasonality standpoint. The index might suffer a drawdown (the average since 2000 is 3.6%) but closes higher more than 80% of the time. When the index is in an uptrend, SPY has only closed more than 1% lower twice since 1980 and both times it regained all those losses and then some in January (a full post on this is here).

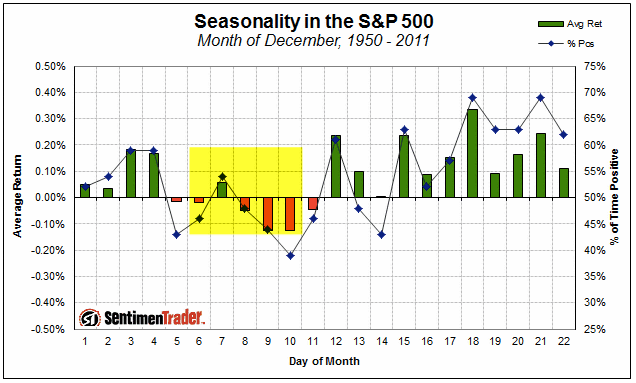

The only week in December that is not seasonally strong is coming up now (chart from Sentimentrader).

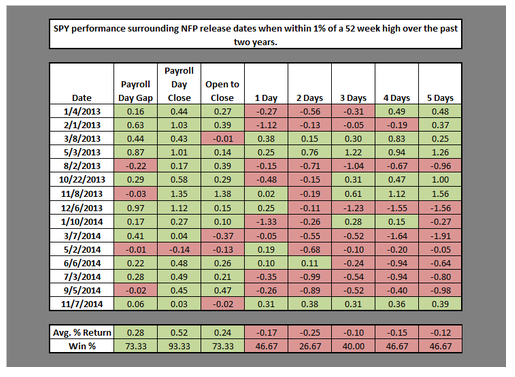

The week after last month's NFP release was uncharacteristically strong. However, over the last two years, the week following the release of NFP (which was this week) has been weak; two days later, SPY has been higher than Friday's close just 27% of the time (chart from Chad Gassaway).

Finally, an excellent post from Brett Steenbarger, discussing both breadth and sentiment, is worth reading closely (link). It highlights, using different metrics, some of the same issues discussed in this post.

Finally, an excellent post from Brett Steenbarger, discussing both breadth and sentiment, is worth reading closely (link). It highlights, using different metrics, some of the same issues discussed in this post.

In summary, when the market has been up 7 weeks in a row, it has gone on to at least one more higher high. This tendency will be aided by end of year seasonality. Weakness this week would therefore be a set up. But equity inflows and investor sentiment as measured by things like put/call suggest that gains may not be large or sustained for long.

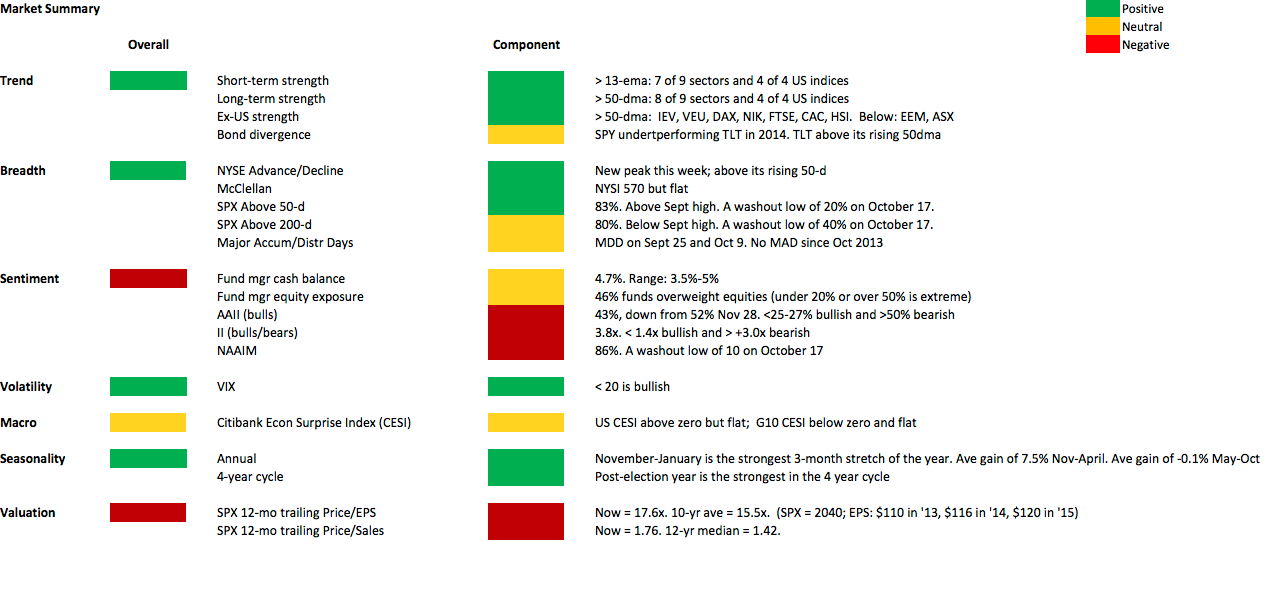

Our weekly summary table follows.