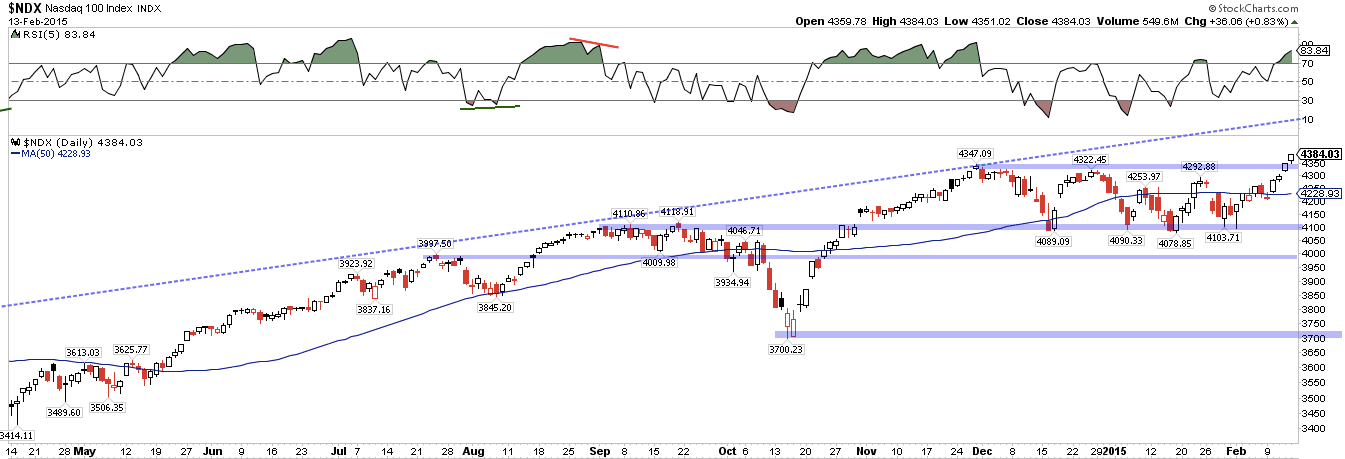

The SPX has risen two weeks in a row for the first time in 2 1/2 months. For the week, SPX gained 2%, DJIA 1% and RUT 1.5%. The big winner was the previously worrisome laggard, NDX, which gained 3.7%.

SPX and RUT closed the week at all-time highs and NDX closed at a 15 year high. So, is the bottom in?

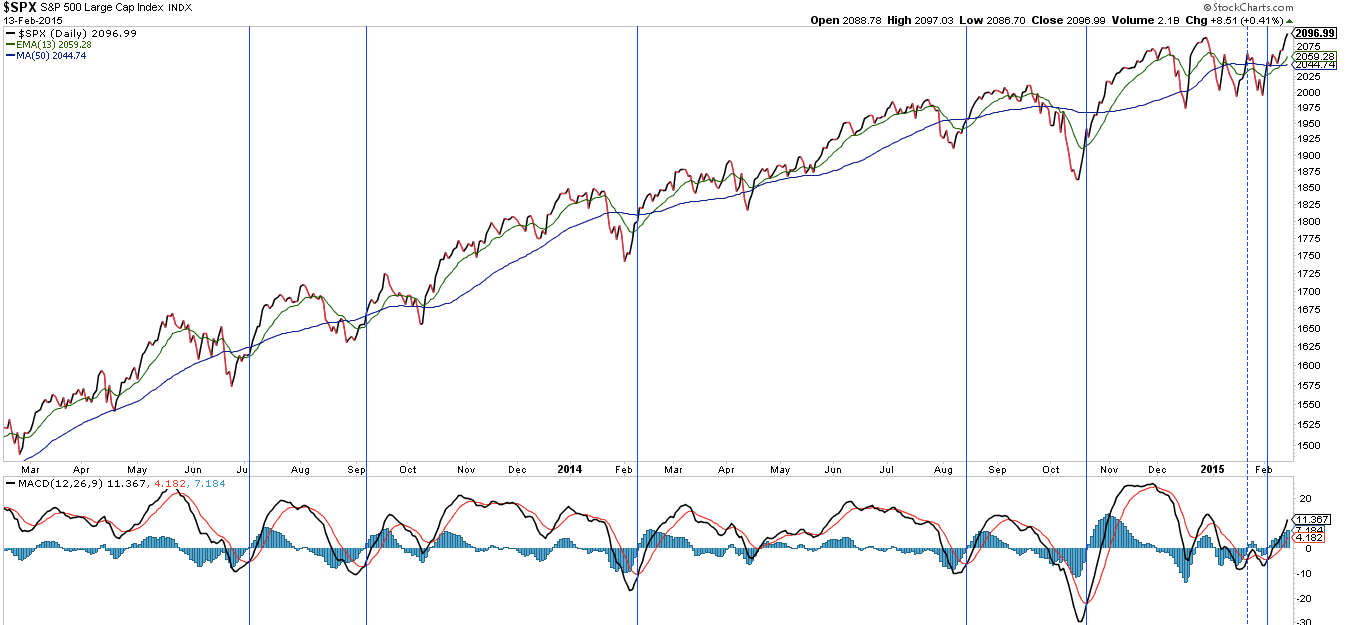

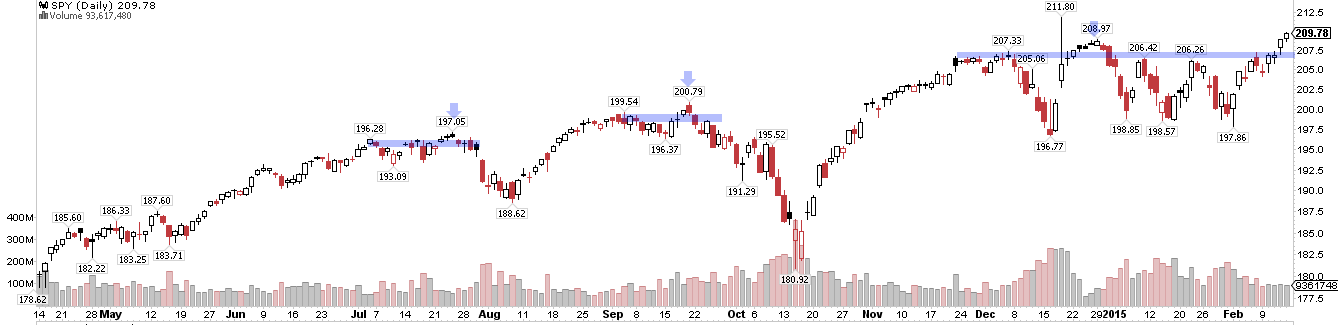

Let's start with SPDR S&P 500 (ARCA:SPY). It is now trading above its key moving averages and making higher highs. This is the definition of an uptrend. The first warning sign will be weakness in the shorter-term trend; an inflection down in the 13-ema (green line). The channel top is above 112. This is all positive.

This past week, NDX, like SPX and RUT, broke out of a trading range dating back to November. The lagging performance in NDX was a concern; it now appears to be leading again. It would not be surprising if NDX backtested 4350 resistance in the coming week. Again, this is all positive.

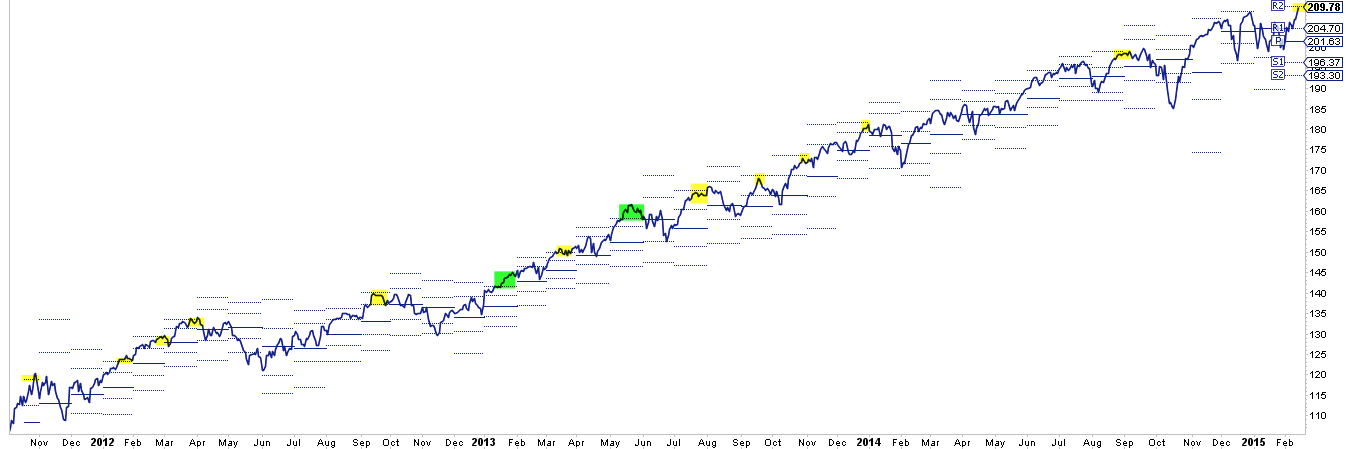

Theoretically, at new highs, there are no unprofitable shareholders and thus no forced sellers. And, to be clear, there's no doubt that new highs now are a positive. The reality, however, can be a bit more complicated. For example, SPY traded at new highs in July, September and December and after a small rise further, fell back again (arrows).

The positive this time is that the indices (except DJIA) are coordinated, with all breaking higher in unison. Perhaps the breakout is therefore more durable this time. Nonetheless, it's worth bearing in mind that other factors can intercede with a price trend.

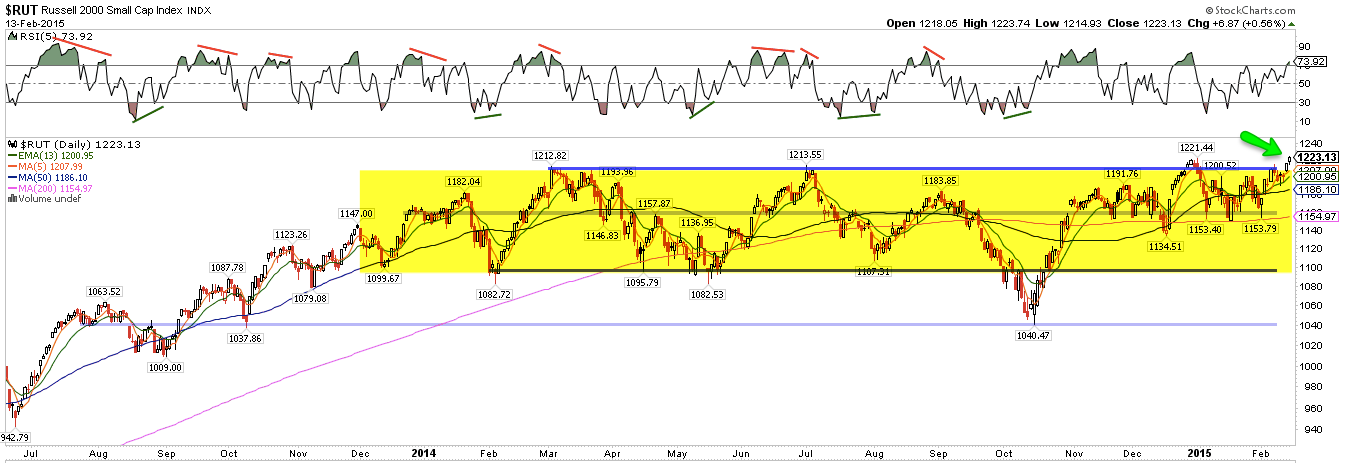

The other likely positive this time is the long base formed over the prior months; in the case of RUT, the base extends back a year. Breakouts from a long base are usually more likely to be durable.

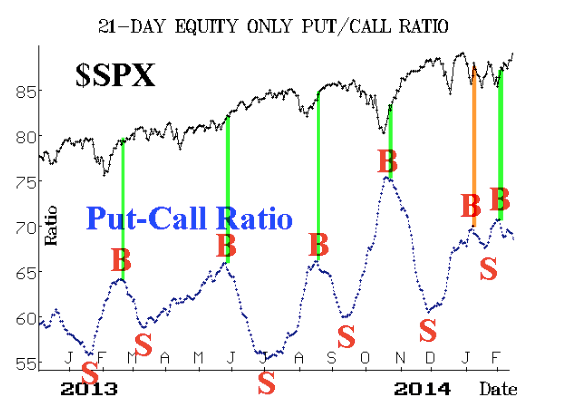

Finally, supporting higher prices, as we have mentioned in the prior two weeks, is short term sentiment. Equity put/call ratios continue to fall from an elevated level. There was a signal in January but that quickly failed; this one has not. There is considerable room for these ratios to move down (chart from McMillan).

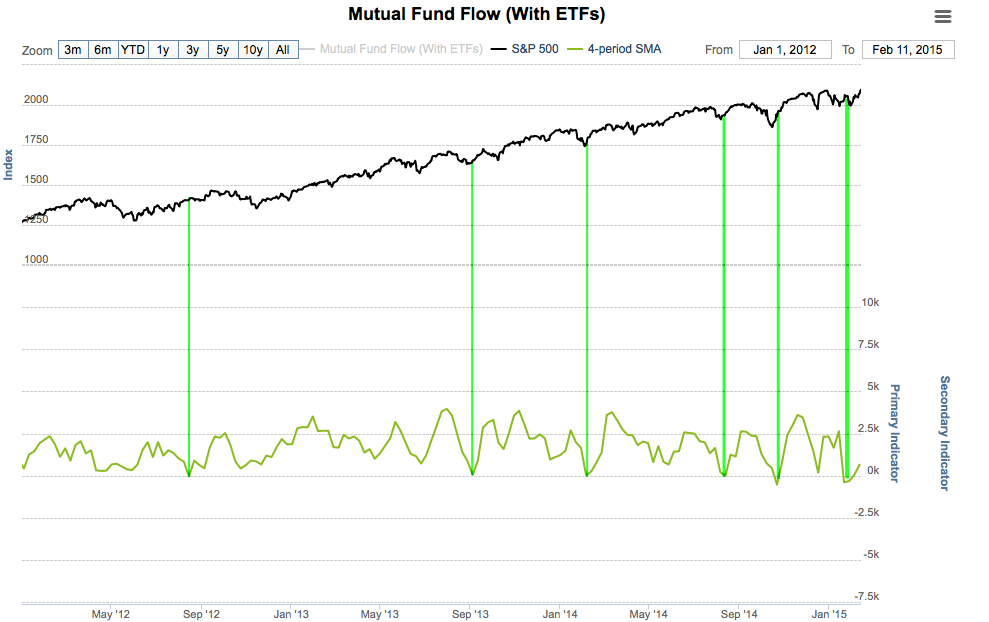

Similarly, inflows to equity ETFs and mutual funds turned positive this week. Since December, fund outflows had totaled a substantial $27b. The inflow this past week was small ($4.3b) and the pattern suggests that investors are only now coming back into equities.

It's accurate to say that longer term sentiment is heady. For example, there are now 3.5 times as many Investors Intelligence bulls as bears. At some point, we expect this to exert downward pressure on equities but it has been a poor barometer for more than a year.

So there are a number of positives that suggest indices will continue broadly higher. But there a few other considerations that are potentially negative.

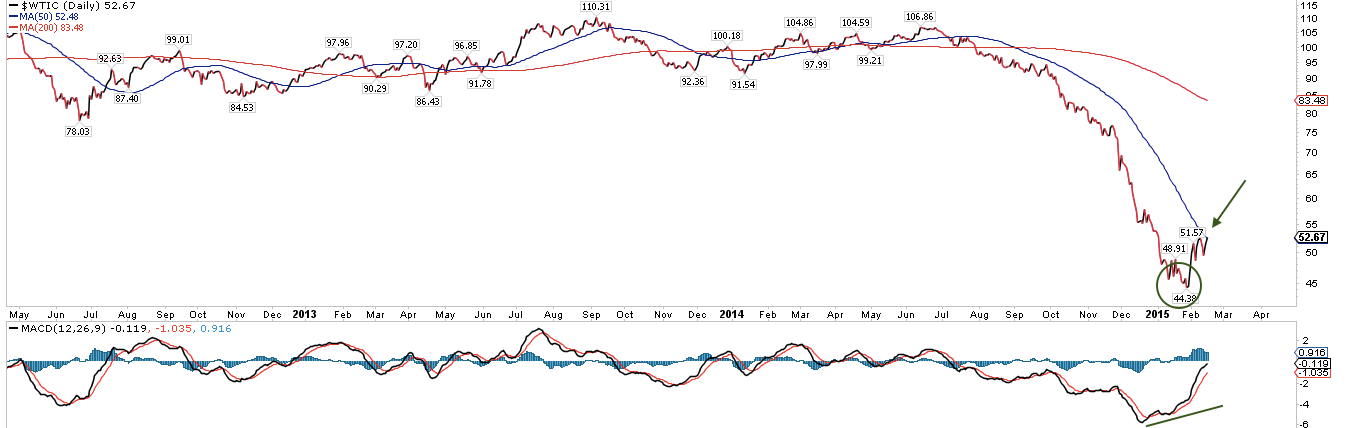

Most importantly, if we had to choose a single narrative for the past two weeks' equity rally it would be the bounce in oil prices. That's a reasonable hypothesis, for two reasons.

First, equities started to struggle in early December, which is when oil prices accelerated their decline, losing 40% in the next 8 weeks. Then, in the past two weeks, oil has jumped 20%, during which equities have rallied. They seem highly correlated.

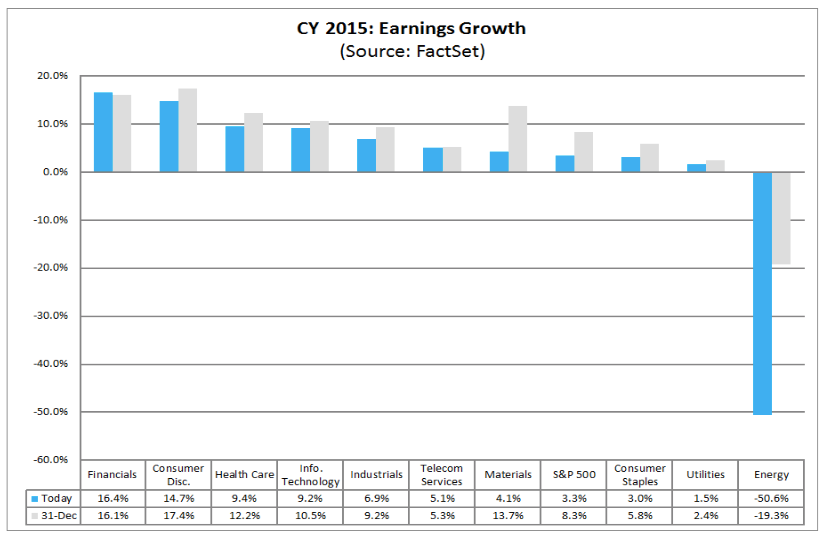

That oil and SPX move together is grounded in fundamentals. Excluding energy companies, S&P 4Q14 EPS grew 6%; with energy, it grew at only 3%. The drop in oil prices is the main reason 1Q15 EPS is expected to decline by 3.6%. The market had been expecting growth of 4% (data from FactSet).

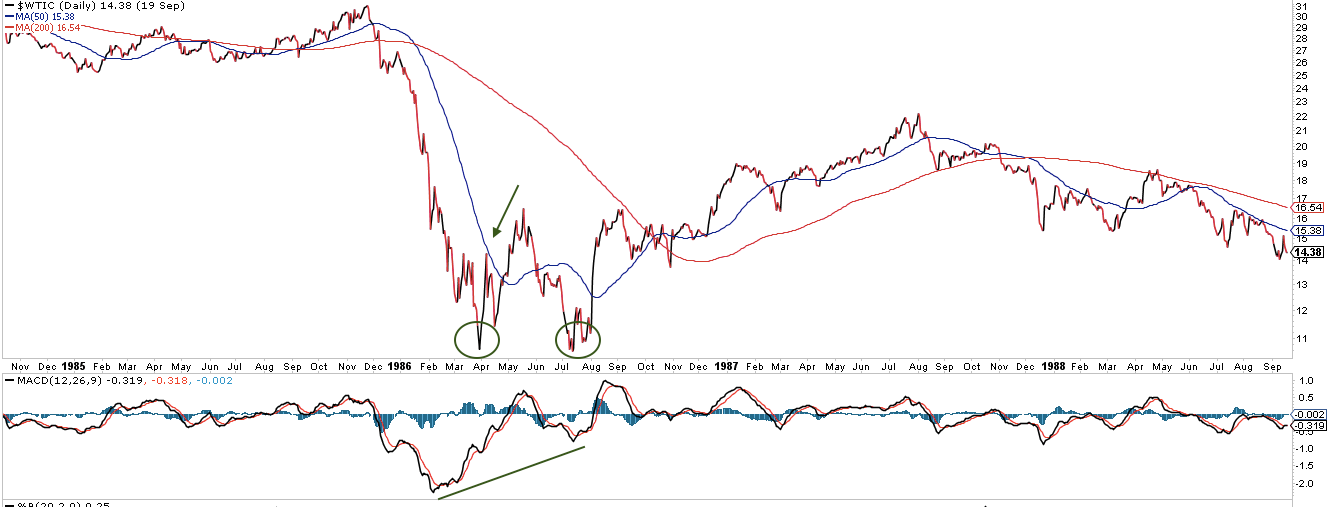

Oil has now rallied up to its declining 50-dma for the first time (arrow in the chart above). If the prior pattern in oil exerts itself again, price should begin to struggle as it carves out a bottom. Below is an example from 1986; the arrow in the chart below is comparable to the current set up in oil (a full post on the pattern in oil price bottoms is here).

So it's possible that the tailwind for equities from rising oil prices has mostly been played out for the time being.

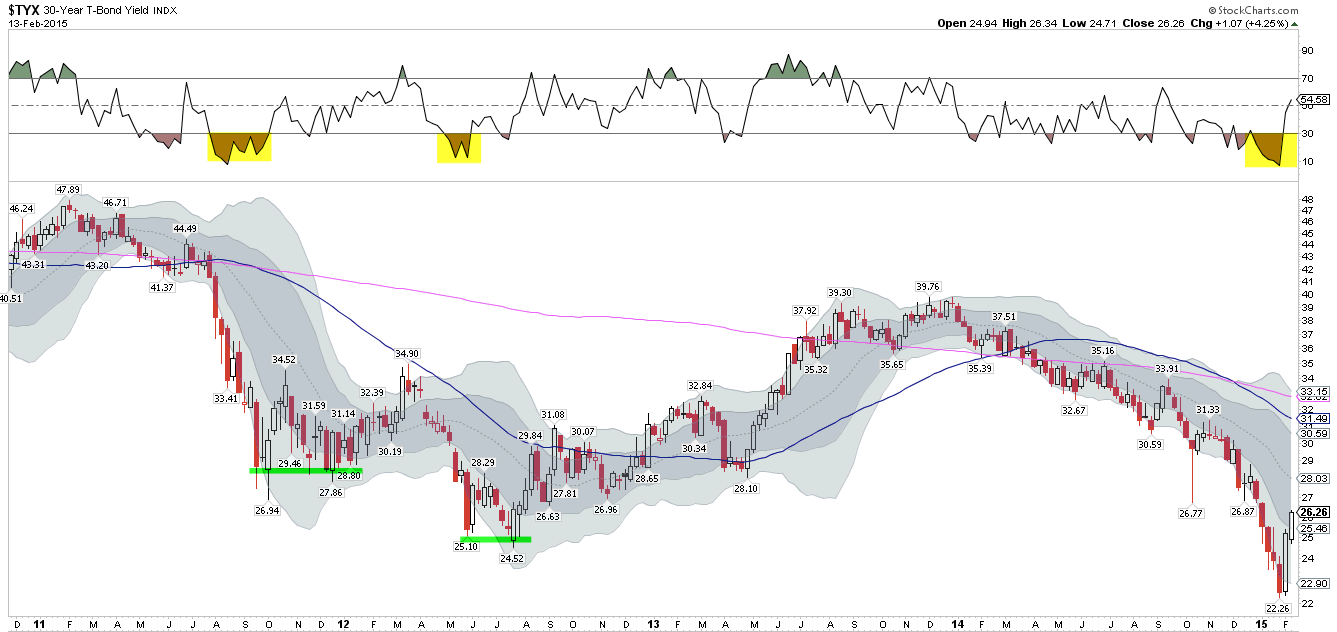

The second tailwind for equities in the past two weeks has been Treasury yields. These are also correlated to oil, at least in part: the drop in oil weighed on inflation expectations and drove yields sharply lower, also starting in early December. Likewise, the 20% rise in oil the past two weeks corresponds exactly with a 40 bp rise in U.S. 30-Year yields.

10- and 30-year yields are now up against their falling 50-dma for the first time since December (arrows in the chart above). Both are up against their upper Bollinger® Band as well. This has been where the rise in yields has slowed and reversed since the start of 2014.

It's possible yields have bottomed. More likely, like oil, the move up the past two weeks is the beginning of a bottoming process in yields. The chart below is on the weekly timeframe; note RSI (top; yellow shading) was very oversold in January. If past is prologue, then--like in 2011 and 2012--yields will retest lows and base before making a sustained move higher (green lines). This is something to watch in the weeks ahead.

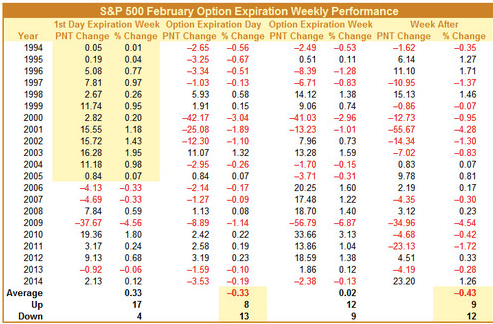

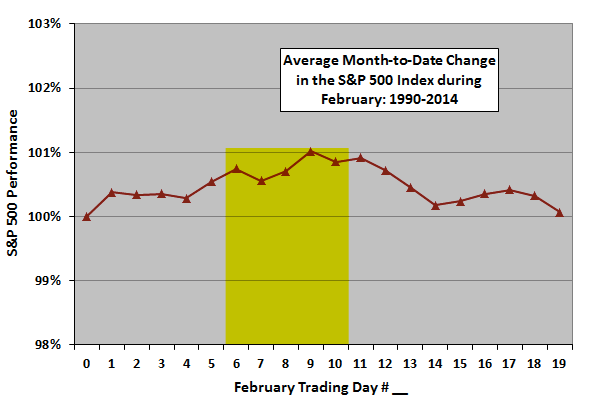

This upcoming week is Options Expiration. February OpX week has a mixed track record. Over time, it has been one of the weaker OpX weeks of the year. That said, it has risen 7 of the last 9 years, so a new pattern may have emerged (data from Stock Almanac).

The second half of February has been historically weak. The indices normally peak the week that just ended (yellow shading). Recall that February overall is typically a flat month, so it's not unusual for early month gains to be given back. That would be surprising now since it implies a return to 1980 on SPX. But a period of consolidation is not unlikely.

Similarly, both NDX and SPX hit their monthly R2 pivot points at Friday's close. That means that all of January's price range has been traded above February's pivot (this is more fully explained here). At a minimum, that has most often been a speed bump; in other words, price stalls near this level (yellow shading).

There were two exceptions in the past 3 years (green shading): January 2013, when price stalled for a week, then continued higher, and May 2013, when price continued higher but then gave back all those gains and more into the June 2013 low.

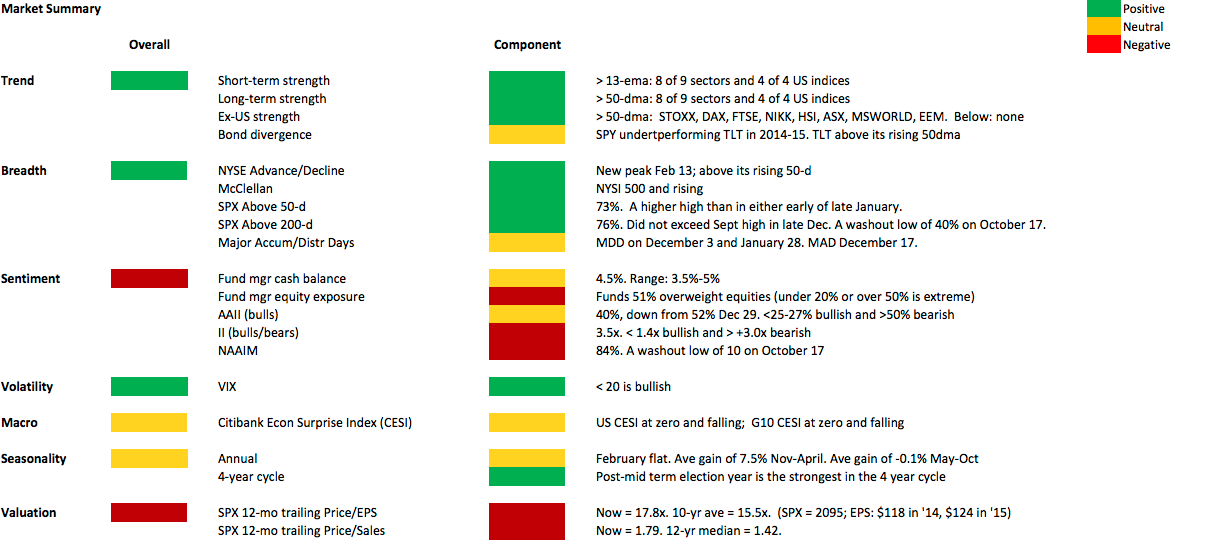

Our weekly summary table follows: