Summary: US equities have already gained more in the first few weeks of January than they do in many full years. The recent trend is being termed unprecedented, but these types of gains have happened before. The current trend is also being called unsustainable, but in most prior cases, equities have continued higher. The equity market is undeniably hot, and that can often lead to a period of retracement and decline, but trends weaken before they reverse, and this one has not shown any sign of weakness. The longer term outlook remains favorable.

All of the US indices made new all time highs (ATHs) again this week. This includes the very broad NYSE (composed of 2800 stocks) as well as the small cap index, RUT. The dominant trend remains higher.

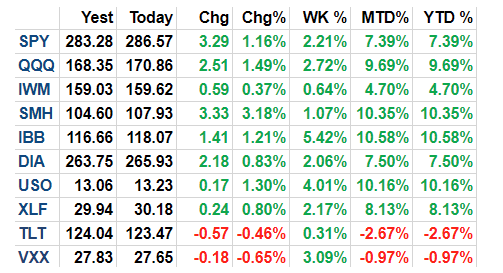

US markets have started the year like a rocket. SPX and DJIA are up 7.5% and NDX is up 9.7% YTD (from Alphatrends).

These gains are equivalent to those of a full year, and it is still only January. In fact, SPX closed Friday at 2872, higher than the December 31, 2018 target for all but 3 of Wall Street's top strategists (from Barron's).

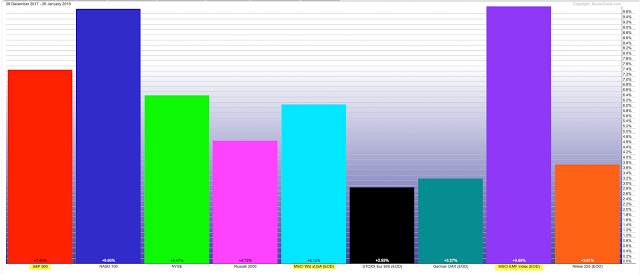

World equity markets are rallying, too. Emerging Markets are up 10% YTD. The US is the next best performing market. Europe is up by 3% and Japan up 4%.

Breadth is excellent. 8 of 10 sectors are trading at 1-year highs. Only the Utilities and Real Estate sectors are lagging.

Overall, 83% of SPX companies are trading above their 200-dma, the most in a year, and 84% are trading above their 50-dma, the most since July 2016.

While the push higher in 2018 is undeniably (and surprisingly) strong, it is not unprecedented. Pundits fear that is unsustainable, yet the evidence suggests that is.

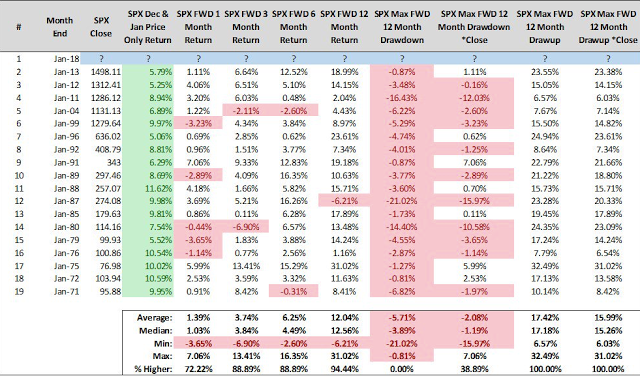

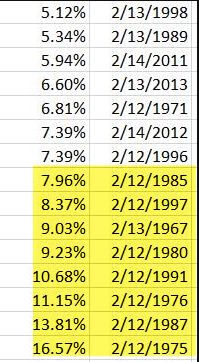

18 days into the year, SPX is up 7.5%. Unprecedented? No. 8 other years since 1963 have gained more during their first 30 days. Many of these years also followed strong gains like those in 2017 (from Rory Handyside).

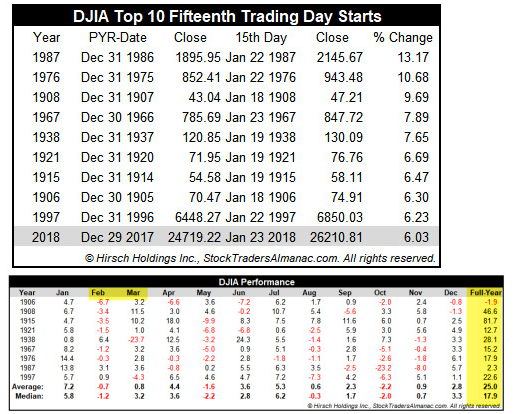

The DJIA's gain after the first 15 days ranks only 10th in history. Unsustainable? No. 8 of the prior 9 closed the full year higher. In no instance was January the high of the year; there was a higher high in the months ahead every time. Note, however, that February and/or March retraced some of those gains (from Stock Almanac).

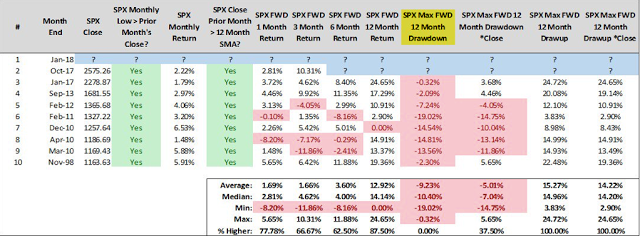

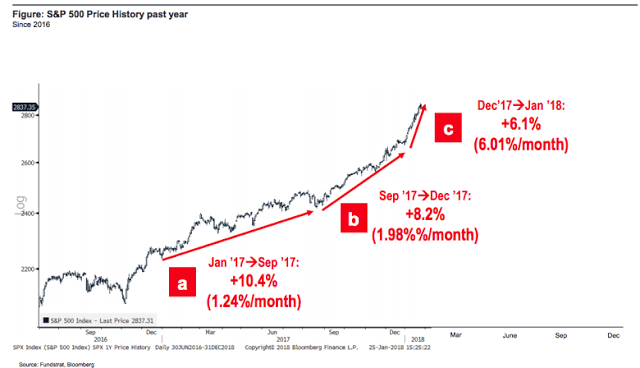

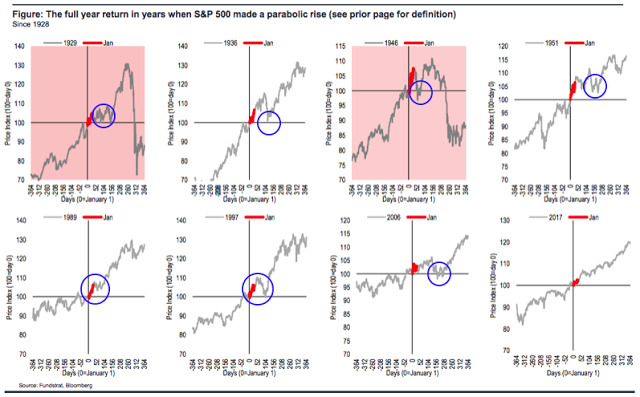

The accelerating trend in SPX is becoming parabolic. It looks climatic and unsustainable (the next two charts from Tom Lee).

Unsustainable? No. Mr. Lee compares the current phase to 8 similar instances. It's a small sample, but SPX ended higher after the next 12 months in 6 of these 8. Importantly, none of these parabolic phases marked the top. That said, in the short run, in all except one, SPX either consolidated existing gains or, if it moved higher, gave those gains up (blue circles). In other words, expecting the current torrid pace to continue unabated is low odds, but the gains so far in in 2018 are unlikely to mark a significant top.

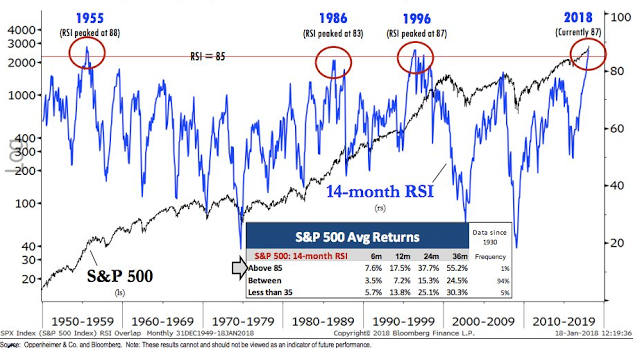

The monthly relative strength index (RSI) for SPX reached 88% on Friday. Unprecedented? No, but certainly rare. It reached a similar level in both 1955 and 1996, and came close in 1986. None of these marked a top. In 1955, SPX gained another 15% in the months ahead; in 1986, SPX gained another 50% in the next year; in 1996, SPX was still more than 3 years from its peak, 128% higher (from Oppenheimer).

In 1986 and 1996, SPX ran into a wall in the following month, falling 5%, 6% and 9% at its lowest point.

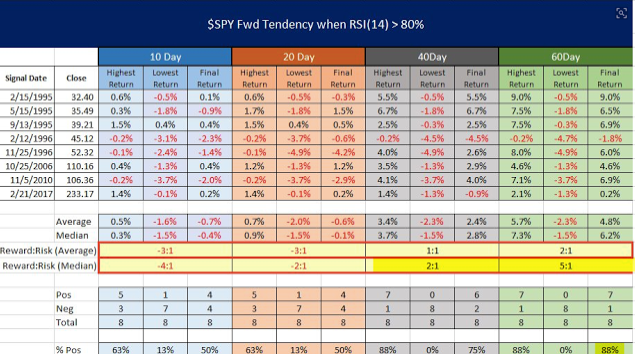

The daily RSI is unquestionably stretched, closing at 87 on Friday, the highest in more than 37 years. It first closed over 80 two weeks ago. In the past, SPX has closed lower within the following 20 days every time. Notably, 3 months later, the index closed higher in all instances but one (1996), which closed higher in the 4th month (from @Twillo1).

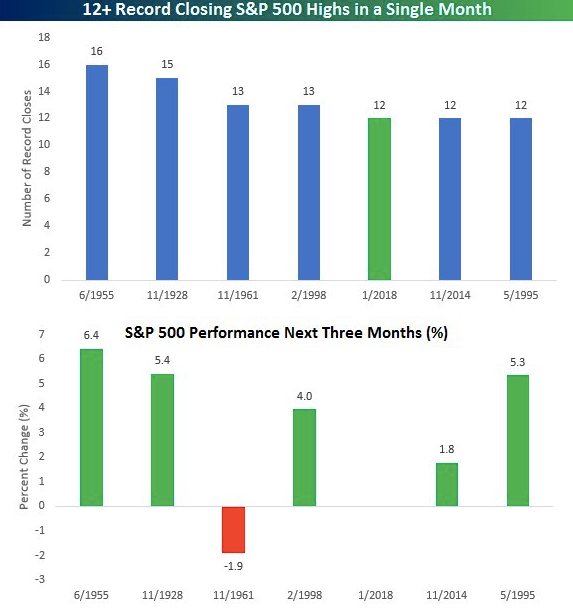

SPX has made more than 12 record highs so far this month. It's very impressive, but not unprecedented. In all but one instance, SPX continued higher in the next 3 months (from Bespoke).

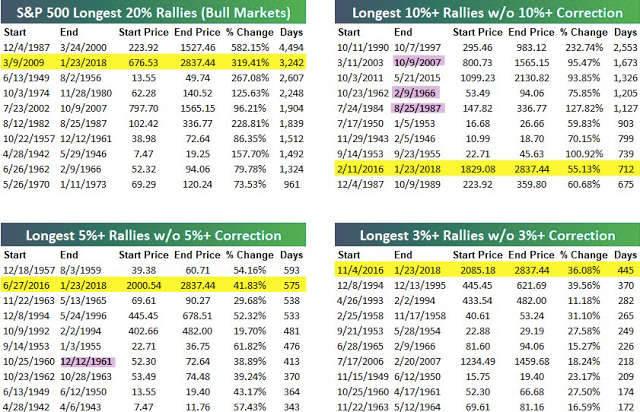

This week, SPX set a new record for the longest rally without a 3% correction. That is unprecedented. But none of the other long rallies without a 3% correction marked a significant top; in fact, only two became a 5% correction. The current rally is the second longest without a 5% correction; only 1961 led directly into a bear market. In short, the current rally is undeniably long, not wholly unprecedented (look at the longer rallies without a 5%, 10% or 20% correction) and very unlikely to lead directly into calamity (from Bespoke).

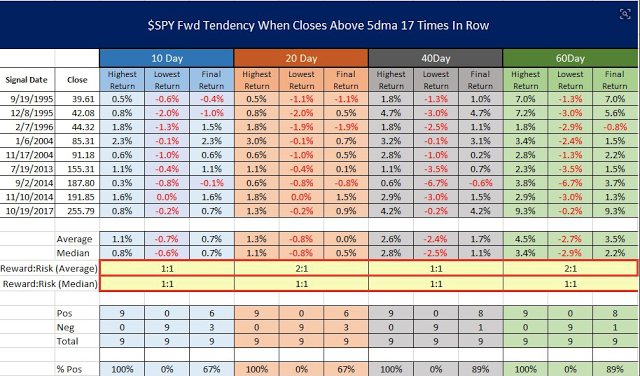

Uptrends weaken before they reverse, and this one has not shown any sign of weakness. SPX has not even closed below its 5-dma once in the past 18 days. Successive closes below the 5-dma will flatten the uptrend; this is often a signal to be alert for a change in trend.

Long streaks without a close below the 5-dma have happened before. In the next 10 days, the index was biased higher, but risk/reward was poor. But the index was higher 2-3 months later every time, although risk/reward was modest (from @Twillo1).

SPX has gained about 9% since the beginning of December. There have been 18 similar instances since 1971. That has boded well for the future: SPX closed higher 3 and 6 months later 89% of the time and closed higher a year later in all cases except in 1987. None of the prior instances marked a top (from Steve Deppe).

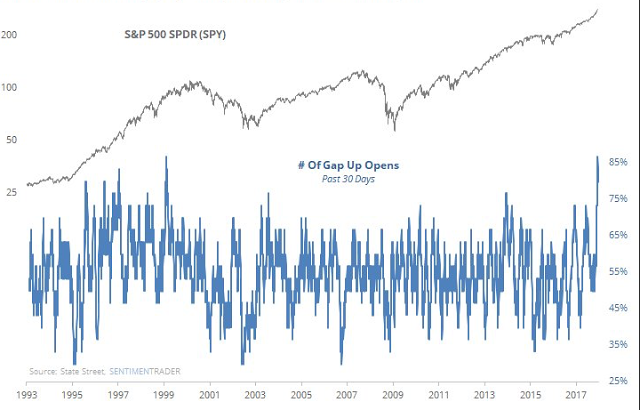

SPX has had a strong tendency to gap up overnight during the past month, doing so 25 of 30 days. A similar streak occurred in 1999. This has, without a doubt, contributed to the rally's strength, as each day starts with a chase. But prior instances with a large percentage of overnight gaps have not generally marked a top (from Sentimentrader).

The first 4 days of the year all began with gap ups, for the first time ever. Through the first 18 days of the year, SPX has left 8 unfilled gaps. Gaps tend to fill. To that end, it is is notable that SPX has not traded below its December's close. This has happened 9 times before; in each, SPX has eventually traded below the prior month's close. It's not a large sample, but it does suggest many of the existing gaps will likely fill in the months ahead. A year later, SPX has always been higher (from Steve Deppe).

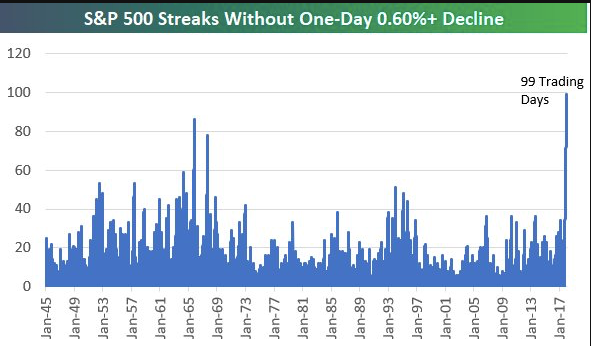

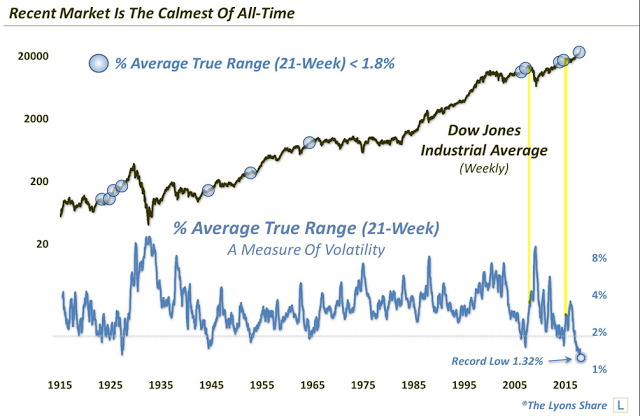

In one respect, the current rally really is unique. There has been a record low amount of volatility. SPX has gone 99 days without so much as a 0.6% decline (from Bespoke).

SPX has declined 3 days in a row only once in the past 5-1/2 months (on December 5).

Similarly, the 21-week average true range (ATR) is the lowest in the past 100 years for DJIA. While that might seem ominous, none of these marked a significant top in equities (bubbles in the top panel). That was true for both the equity peaks in 2007 and 2015 (yellow lines; from Dana Lyons).

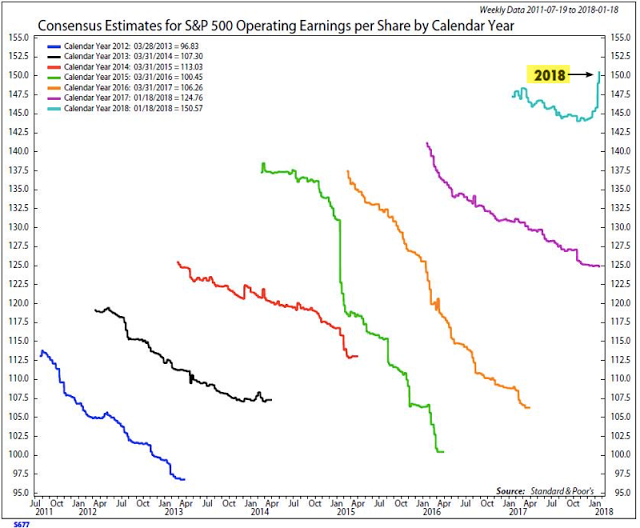

Part of the reason equities are rallying so hard is better than expected earnings. Earnings are typically revised downward throughout the year. 2018 is starting very differently. The combination of tax reductions, higher oil prices and the falling dollar have pushed earnings estimates for 2018 sharply higher (from NDR).

81% of companies have beaten revenue estimates so far in 4Q17. For 2018, EPS has been revised upwards from 12% to 16% growth. These earnings revisions are the highest in more than 20 years (from FactSet).

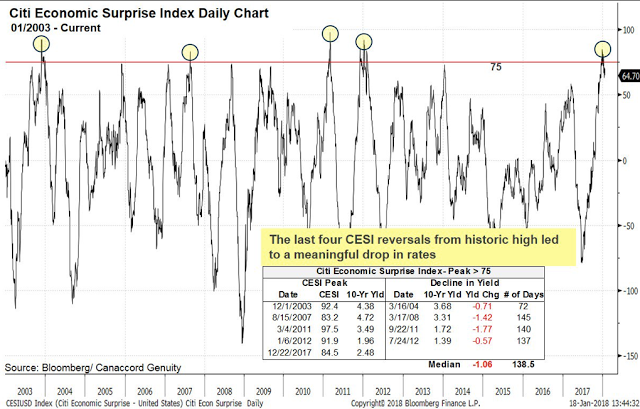

Economic reports have also beaten expectations. The Citi Economic Surprise Index (CESI) is at one of the highest levels in the past 15 years. This is a highly mean reverting series, meaning economic reports are likely to underperform expectations in the months ahead. That hasn't been a useful predictor for equities, but treasury yields have declined in each of the prior instances when CESI has rolled over (first chart from Liz Ann Sonders; second chart from Tony Dwyer).

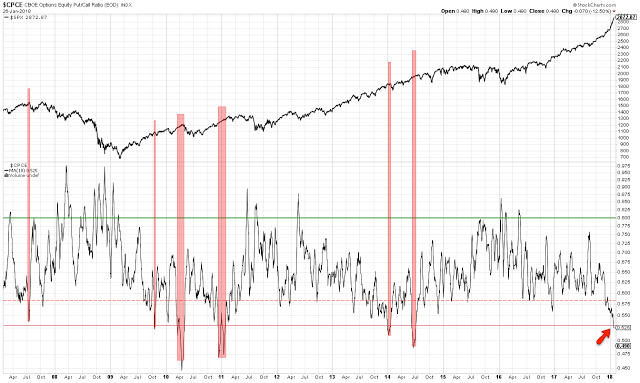

The strong trend, solid breadth, low volatility and favorable corporate and economic reports have made investors bullish. The 10-day equity-only put/call ratio is now the lowest in nearly 4 years. This has been a poor timing indicator; in some cases, stocks fell in the next week, in others they continued higher. In all cases, however, gains were eventually given back. SPX added another 2% in June 2014 before falling 4% a month later. The index chopped sideways until October. The gains were larger and the time to retracement was longer in 2010, but the result was eventually the same.

In summary, US equities have already gained more in the first few weeks of January than they do in many full years. The recent trend is being termed unprecedented, but these types of gains have happened before. The current trend is also being called unsustainable, but in most prior cases, equities have continued higher. The equity market is undeniably hot, and that can often lead to a period of retracement and decline, but trends weaken before they reverse, and this one has not shown any sign of weakness. The longer term outlook remains favorable.

The macro calendar is heavy this week. PCE on Monday, an FOMC meeting announcement on Wednesday, auto sales Thursday and the monthly employment report on Friday.

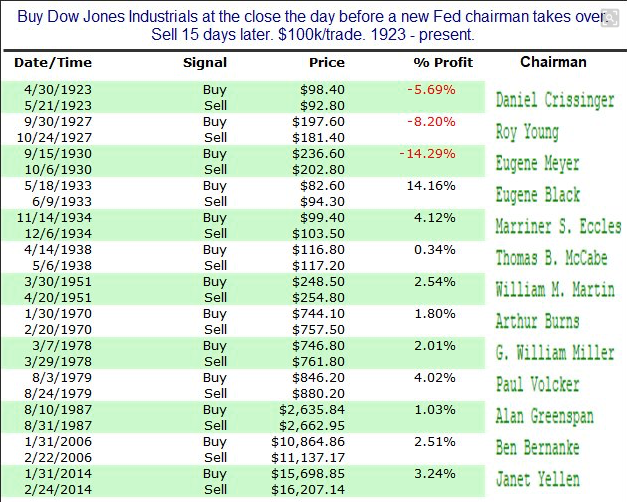

Next Saturday, Jerome Powell becomes the next chair of the Federal Reserve. Since 1933, US equities have risen during a new Fed Chair's first 3 weeks (from Quantifiable Edges).

If you find this post to be valuable, consider visiting a few of our sponsors who have offers that might be relevant to you.