Market Summary

Asia

Asian markets got off to a good start last week, but the rally dried up by mid-week, with most markets in the region falling in response to a weaker U.S. dollar. The exemption to this was the Chinese linked markets, which continued climbing higher throughout the week. Australia’s S&P/ASX 200 had the worst performance in the region as it fell 0.9% for the week. South Korea’s Kospi was nearly flat, losing just 0.1%. Despite falling for most of the week on a strengthening Yen, the Nikkei in Japan ended with a 0.3% weekly gain. Mainland China’s Shanghai Composite rose 1.2% for the week, keeping its string of twelve consecutive winning sessions intact. The Hang Seng in Hong Kong did even better, scoring a record breaking fourteenth consecutive winning session on Friday and adding 1.9% for the week. The Hang Seng is up by 5% already in 2018 after scoring a more than 35% gain in 2017.

The strength in Chinese markets is likely to persist early in the week, although investors may become cautious after so many consecutive rising sessions, and with Chinese GDP and industrial production data due on Thursday. Rising commodity prices should help Australian markets, although the continued weakness from other sectors could keep the S&P/ASX 200 as a laggard. Japan’s Nikkei is highly dependent on the strength or weakness of the Yen, so continued weakness from the U.S. dollar will likely keep pressure on Japanese equities.

Europe

European markets also got off to a good start, but by mid-week the rally had come to a screeching halt. Losses on Wednesday and Thursday weighed heavily on markets, but a gain on Friday allowed the Stoxx Europe 600 to move back into positive territory for the week, scoring a gain of 0.3% and rising for the sixth consecutive week. Things weren’t as rosy in Germany, where the DAX had a weekly loss of 0.9%. France’s CAC 40 did well by contrast, rising 0.9%, while the FTSE in London outperformed as it closed out the week at a new record high with a weekly gain of 1.4%. News of an initial agreement for a coalition government in Germany sent both the Euro and Pound surging higher by more than 1% against the U.S. dollar on Friday.

That surge higher for the Euro and Pound will likely have consequences as markets reopen on Monday, and if the current strength is maintained it could weigh on markets throughout the week. European markets are off to the worst start this year, despite signs of increasing economic strength. Shares of exporters will remain under pressure in the face of stronger currencies, with the Pound trading at its highest level since the Brexit vote, and the Euro trading at a more than three year high. There is no critical economic data from Europe this coming week, so markets will have to take their lead from Wall Street for the most part.

US

U.S. markets had another outstanding week, although they did pause mid-week, snapping the winning streak that began with the New Year. Still, by the end of the week the S&P 500 had added 1.6%, the Dow Industrials gained 2.0%, and the Nasdaq tacked on 1.7%. Just two weeks into 2018, the S&P 500 is 4.2% higher, the Dow has a 4.4% gain and the Nasdaq is up by 5.2%. Investors in the U.S. remain exceedingly bullish, after seeing equities continue the rally that began last year. Friday saw earnings season begin, with Wells Fargo (NYSE:WFC) and JPMorgan (NYSE:JPM) reporting mixed results for the fourth quarter, but investors had expected the results, so there were no surprises. Another good earnings season will almost certainly keep this bull market alive, but weak results could derail the good beginning to 2018.

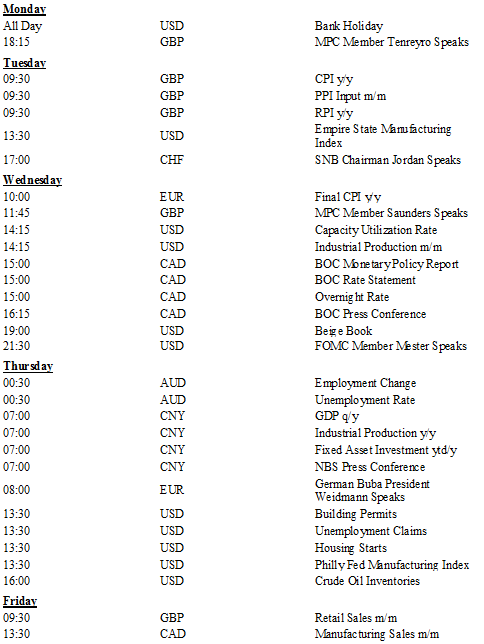

The coming week will be a holiday shortened one in the U.S., with equity markets closed on Monday for Martin Luther King Jr. Day. Trading will resume on Tuesday, with little in the way of economic data, but more earnings reports from banks and financial companies. This could cause some volatility in the financial sector; and with that making up the heaviest weighting in the S&P 500, this could also cause some volatility in the broader indices. Wednesday will provide readings on industrial production and capacity utilization, giving investors clues to the strength of the U.S. economy. Thursday will bring housing and unemployment data, which has been good of late, as well as earnings from IBM (NYSE:IBM) to kick off the tech sector’s earnings season.

Cryptocurrencies

It was a fairly depressed week for cryptocurrencies, although NEO performed well, as did Ethereum. Bitcoin remained under pressure for most of the week, but a recovery was building in the crypto space on Friday. Ripple was one of the worst performing major coins of the week, dropping back below the $2 level mid-week, but recovering enough Friday to trade slightly above that psychological level. Much of the bearishness came as South Korean regulators were discussing whether to ban cryptocurrency trading. This would strike quite a blow to markets as South Korea has one of the highest trading volumes in cryptocurrencies of any nation.

Performance in the cryptocurrency space this week will likely be determined by news from South Korea. If the trading ban comes into effect expect a sharp drop in markets. If South Korean regulators retract their decision to ban cryptocurrency trading we could get a strong rally. If there is little news from South Korea we expect markets to begin heading higher as well, though results could be mixed.