Market Summary

Asia

Asian markets kicked off 2018 in a solid fashion, gaining broadly in the holiday shortened week. Despite trading only two days last week, Japan’s Nikkei saw the best weekly performance, adding 4.2% as the Nikkei finally broke convincingly above the 23,000 level. Gains were quite solid for Chinese markets as well, after the release early in the week of better than expected manufacturing PMI data for the mainland. The Shanghai Composite finished the week with a 2.6% gain as it rose in all four sessions. That was outpaced by Hong Kong’s Hang Seng, which also rose for all four sessions, tacking on 3% for the week. South Korea’s Kospi hit a pothole on Thursday, limiting it to a weekly gain of 1.2%. In Australia the S&P/ASX 200 got off to a slow start as gains from mining and energy plays were offset by losses from financials and health care. The Australian market wrapped up the week with a solid day on Friday, giving it a 0.9% gain for the week.

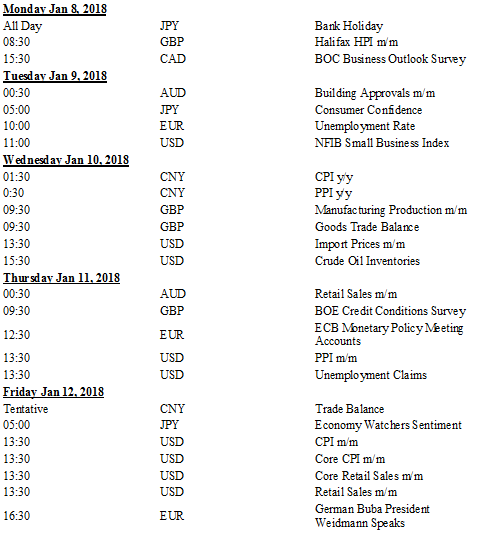

In the upcoming week Asian investors will almost certainly be keeping their eyes on the U.S. dollar, whose weakness has helped raise Asian equities. The commodities rally will also play a prominent part in the results from Australia. On Wednesday we’ll get the latest Chinese PPI and CPI numbers, which could set the tone for the remainder of the week across much of Asia. Japanese markets will have another short trading week as they will be closed on Monday for a holiday.

Europe

European markets started the week on shaky footing, falling broadly as investors returned to the first trading day of 2018. They were able to shake off that weakness the following session, and showed increased strength as the week progressed. Strong global economic data and broker upgrades for the automotive sector helped. The broadest measure of European equities, the Stoxx Europe 600, finished the week with a solid 2.1% gain. Germany’s DAX outperformed as it tacked on 3.5% for the week. In France the CAC 40 advanced 2.3%, and London’s FTSE underperformed the broader market as it gained just 0.5%, but also finished at a record high.

The upcoming week has a light schedule for economic data, which could leave the markets following the lead from Wall Street; and given the recent strength in U.S. markets, this would be a good thing. Alternatively, investors could turn their attention to the Euro, which continues to strengthen versus the U.S. dollar. Continued firming of the Euro would provide a headwind for equity markets. Thursday will see the release of the latest ECB Monetary Policy Meeting Accounts; and given recent comments from ECB leaders, markets might get hints of coming tightening from the ECB.

US

U.S. markets started the New Year on a high note, maintained that momentum throughout the entire week. By Friday the major indices had put in four consecutive winning sessions, entering 2018 with a level of strength indicative of another bull run similar to that seen the previous year. Technology took the lead again after its poor year-end performance, and the Nasdaq outperformed as it gained 3.4% for the week. The S&P 500 also gave solid results as it gained steadily all week to finish with a 2.6% gain. And the Dow Industrials underperformed major U.S. markets, but was still 2.2% higher for the week. Continued strong economic data promises to keep U.S. markets marching higher into the first earnings season of 2018.

The beginning of the coming week will be slow for economic data, so while there won’t be anything new to drive markets higher, there also shouldn’t be anything negative to derail the current momentum. This should give gains for equities in the first half of the week. The latter part of the week will see trade, employment and critical inflation and retail sales data released, and these could all have an impact on markets, although we think it’s only the Friday inflation and retail sales data that could derail markets. Expectations are fairly modest already, however, so we should get another good week for equities.

Cryptocurrencies

Bitcoin found support around the $14,000 level early in the week, and spent the week moving steadily, but slowly higher until it took off Friday, surging more than 15% and topping the $18,000 level. Other major coins followed Bitcoin’s lead, although Litecoin was an underperformer early in the week. It has since recovered alongside the rally in Bitcoin. Alt-coins did well throughout much of the week, but pulled back Friday as Bitcoin rallied.

We think the coming week could see Bitcoin pulling back early, with alt-coins rising. Later in the week interest will return to Bitcoin in what we’re beginning to see as a pattern of weekend strength for the more established and stable coins, and profit taking from the volatile alt-coins.