by Pinchas Cohen

The Week That Was

Talking point of the week: Janet Yellen’s 2-day Congressional testimony.

Investors have been frustrated that nothing has been happening, either on economic growth or US fiscal policy.

Monetary Policy

We need to take a step back and look at interest rates globally. Overall, things are just getting started: whether in Europe, the UK or even Canada, where rates were just raised for the first time in 7 years.

We are now entering a world where interest rates are beginning to move up. This s what investors should be rooting for.

After all, why do central banks raise rates? Because economies are getting better; because they want to get ahead of inflation. All the things we’ve been rooting for since the 2008 financial crisis.

On the other hand, there are traders who’ve been in the markets for ten years or less and have never traded within a robust interest rate environment. As such, we're entering a period in which everything the Fed does will be analyzed.

Therefore, the Fed will go slow, to allow everyone to analyze what they're up to. In the big picture, we shouldn’t be scared of rising rates, neither in the US or abroad, because of what it signifies. Equity and bond markets are reacting with a bit of choppiness, but rising rates signify expanding economies – which is a good thing. But on a day-to-day basis, investors will continue to scrutinize every word released by the Fed, something we've seen reflected recently in the markets.

US Fiscal Policy

There's been a lot of conversation on Capitol Hill around both healthcare and tax reform. The Trump administration is taking on two monumental tasks simultaneously. Compare that to the fact that it took President Reagan years to get tax reform through, and it took Obama years to get healthcare through. If the extraordinary size of the task weren't enough, this administration keeps getting bogged down by political distractions.

Investors have been waiting for a long time for Trump’s initiatives to be enacted. If and when anything gets through, will it be proportionate to the wait? At this point, can investor expectations realistically be met? What might the market reaction be once either (or both) of these initiatives actually take effect considering we are already in the second-longest bull market in history. If investors are disappointed, it has the potential to be the catalyst for its end.

Irrational Exuberance?

The classic market top psychology is irrational exuberance – investors are confident about a continuous rally, no matter what. Still, many analysts see this as not yet a market top since not everyone is jumping it all at once, which means there remains a good chance of the market continuing to climb, no matter what.

However, we've already seen two instances of irrational exuberance:

Trump – The Evil Good-Doer

First, the market went up on the premise that Trump wouldn't be elected, because he was considered bad for the market. When he in fact won the election, the market went up because he was considered good for the market – a change of sentiment that took place within three hours.

Rising rates? Good! Not rising rates? Also Good!

When the Fed made the case for raising rates, markets went up on the outlook of economic strength. When Yellen made the case recently for slower rate hikes, the market went up on cheaper liquidity.

Investors seem to be in a loop that is the exact opposite of “damned if you do, damned if you don’t,” rather “it’s all good, no matter what.” The attitude appears to be: you tell me what’s happening, and I’ll tell you why the market should keep going up.

Risk-on / Risk-off…all at the same time

Since the US elections in early November, there have been periods when both equities and safe havens have gone up, simultaneously, on the same news. That's an anomaly and contrary to inter-market logic, which may suggest a coming catalyst, one way or another.

Economic Leadership

After the Brexit vote, a eurosceptic trend in Europe was triggered, which led many analysts to forecast that Europe was heading toward considerable political uncertainty. However, since the Italian constitutional referendum in early December, which was brought on by sentiment that mirrored that causing EU/UK split, the rest of Europe, while still maintaining a strong eurosceptic political presence, has elected pro-EU parties. As things stand now, we're seeing political stability in Europe, while the US is being buffeted by political uncertainty. Coincidentally—or perhaps not—economic growth is booming in Europe but lagging in the US.

While Europe and emerging markets have taken the lead, the US has higher valuations, making a globally diversified portfolio a promising investment plan.

The Week Ahead

Politics

Overhauling the Federal budget continues to be job one in Washington. The House of Representatives' Budget Committee may roll out a new spending proposal that is critical to crafting a budget that would need no more than a simple majority to pass.

Earnings

Banks, technology and healthcare lead a week jam-packed with earnings reports, including from Netflix (NASDAQ:NFLX), Bank of America (NYSE:BAC), Microsoft (NASDAQ:MSFT), Johnson & Johnson (NYSE:JNJ), General Electric (NYSE:GE) and United Continental (NYSE:UAL).

All times are EDT

Sunday

22:00: China - GDP (Q2), Retail Sales (June): GDP growth expected to be 6.8% YoY and 1.7% QoQ, from 6.9% and 1.3% respectively. Markets to watch: China indices, CNY crosses

The Shanghai Composite, although still within an uptrend, as well as having overcome the major moving averages, seems to have pressure ahead, as it reaches the December and April 3300 level peaks. As well, MACD and RSI are struggling to maintain their high levels.

The yuan has recently advanced on speculation of intervention, technically breaking a long-term uptrend line. The moving averages are entering a bearish pattern, but the price still has to break the 6.7598 June 30 bullish hammer support, before it can continue its declining trend.

Monday

5:00: Eurozone - CPI (June, final): expected to be 1.3% YoY. Markets to watch: EUR crosses

The euro is making a second attempt at its 2-year downtrend line, though the MACD and RSI are having a hard time staying up, suggesting a correction may be necessary first, unless of course readings will shock on the upside.

8:30: US - Empire State Manufacturing Index (July): expected to fall to 15 from 19.8. Markets to watch: US indices, USD crosses

The dollar index is in a clear downtrend line, with the nearest support at $94.08, the August 18 low. Indicators suggest an upward correction is due.

21:30: Australia - RBA Meeting Minutes: these will provide further detail on the bank’s outlook for policy. Market to watch: AUD crosses

Last week, the Aussie overcame its August and February peak resistance. Now, it must contend with the April peak at $0.7839, only 6 pips above its current price. MAC and RSI are not yet oversold. The 200 DMA (red) is offering a higher resistance at $0.8026.

EARNINGS

Netflix is scheduled to report earnings after-market, with an estimated $0.16 EPS vs $0.09 YoY, on $2.76B in revenue, with a $69.44B market cap. The stock had broken above its tech sell-off downtrend line, but it still needs to overcome its $1.6687 June 8 high, one day before the first sell0off. Otherwise, it could turn into a double-top. The MACD provided a buy signal on July 12, the say it broke above its selloff downtrend line, confirming the break. The RSI is not yet overold.

Tuesday

4:30: UK - CPI (June): expected to rise 2.7% YoY and 0.1% MoM, from 2.9% and 0.3%. Core CPI expected to be 2.5% YoY, from 2.6%. Market to watch: GBP crosses

The pound has overcome its May peak’s resistance, making last week’s climb for cable the highest since September. It is now clear above the Asian flash crash, providing it with good momentum, using the 50 dma (green) as a catapult till the 100 dma (orange) at 1.3611. The RSI and MACD indicators are under some pressure, but that makes sense, when the price has to contend with such major resistance forces. The fact that the pound can climb despite the UK Brexit problem, and close at the high of the week, demonstrates investor confidence in the UK economy.

5:00: Germany - ZEW (July): economic sentiment forecast to rise to 19.5 from 18.6. Markets to watch: eurozone indices, EUR crosses

On the daily chart, the Euro Stoxx 50 closed on Thursday above the 100 dma (orange) and kept its advance on Friday – with the 200 dma (red) below it, it created a doji, following a shooting star, both showing weakness, suggesting the end of the uptrend. The MACD, however, provided a buy signal on Thursday, while the RSI weakened mid-range.

On the weekly chart, however, the MACD provided a sell signal mid-June, still in effect, and the RSI is trending down. On the other hand, the 50 week moving average (green) crossed over the 100 (orange) and 200 (red) weekly averages. These mixed signals are expected as the index is contending with its May peak, before confronting its April 2015 record high. While on the daily chart, the two Dojis signified weakness, on the weekly chart, it closed near the top of its range, signifying strength. However, after considering all the components, it might still correct before a rally.

EARNINGS

Bank of America is scheduled to report earnings before-market, with an estimated $0.43 EPS vs $0.36 YoY, on $21.79B in revenue, with a $240.94B market cap.

Bank of America's share price has been declining from its June 6, $25.11 peak, its highest since the '08 crash. It has reached the 50 (green) and 100 (orange) dma, its uptrend line since mid-June. While the RSI and MACD both provided sell signals, a bounce off the support line may provide a good buying opportunity.

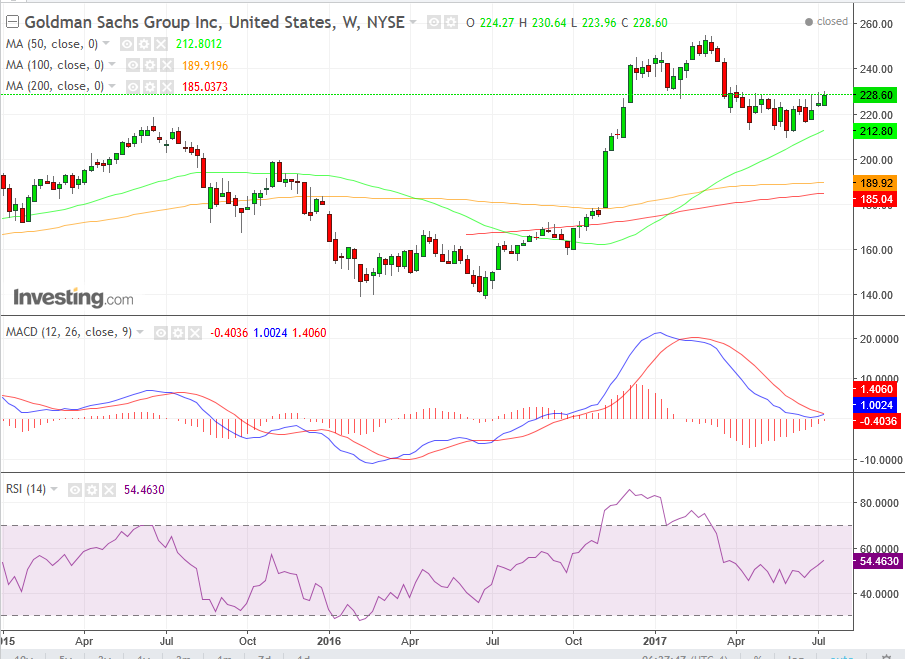

Goldman Sachs (NYSE:GS) is scheduled to report earnings before-market, with an estimated $3.51 EPS vs $3.72 YoY, on a $7.52B in revenue, with a $89.98B market cap.

In the short term, the stock is trapped between the 100 (orange) and 200 (red) moving averages, while the price and momentum has been slowly rising. In the long term, while the price has crossed over the major moving averages in the post US election frenzy, it has corrected down since February and found support at the 50 week moving average (green). However, the concern should be its inability to overcome the resistance of the April 24, $229.36 shooting star, after repeated attempts, including in the past consecutive three weeks. Should it pass that level, the price will take on the $255.15 February high, its highest since the 2008 crash. If during this coming week, its fourth week at this resistance, it won’t manage to overcome it, it may retest the May 209.62 low support.

IBM (NYSE:IBM) is scheduled to report earnings after-market, with an estimated $2.73 EPS, vs $2.95 YoY, on $19.47B revenue, with a $144.91B market cap.

Johnson & Johnson (NYSE:JNJ) is scheduled to report earnings before market, with an estimated $1.79 EPS vs $1.74 YoY, on $18.93B revenue, with $3.57.20B market cap.

United Continental is scheduled to report earnings after market, with an estimated $2.47 EPS vs $2.61 YoY, on $9.95B revenue, with $24.73 market cap.

Wednesday

8:30: US: Housing Starts and Building Permits (June): building permits to rise to an annual rate of 1.21 million, while housing starts rise to an annual rate of 1.18 million. Markets to watch: US indices, USD crosses

10:30: US - EIA Crude Inventories (w/e 14 July): expected to see a fall of 920,000 barrels after a 7.56 million barrel drop a week earlier. Markets to watch: Brent, WTI

19:50: Japan - Trade Balance (June): last month exports rose 14.9%. Markets to watch: Nikkei, USD/JPY and additional yen crosses

21:30: Australia - Employment Data (June): 21,600 jobs expected to have been created, from 42,000 in May, while the unemployment rate stays at 5.5%. Market to watch: AUD crosses

23:00: Tentative - Bank of Japan (BoJ) Rate Decision: no change in policy expected. Markets to watch: Nikkei, JPY crosses

EARNINGS

American Express (NYSE:AXP) is scheduled to report earnings after market, with an estimated $1.45 EPS vs $2.1 YoY, on $8.20B revenue, with $76.22B market cap.

Thursday

4:30: UK - Retail Sales (June): expected to rise 0.8% MoM and 2.3% YoY, from -1.2% and 0.9% respectively. Market to watch: GBP crosses

7:45: Eurozone - ECB Rate Decision (Press Conference at 1.30pm): no change on policy expected, but some discussion on the outlook of quantitative easing (QE) is likely. Markets to watch: eurozone indices, EUR crosses

8:30: US - Initial Jobless Claims (w/e 15 July): 247,000 claims expected, from 246,000 a week earlier. Markets to watch: US indices, USD crosses

10:00: Eurozone - Consumer Confidence (July, flash): expected to rise to -0.6, from -1.3. Markets to watch: eurozone indices, EUR crosses

EARNINGS

eBay (NASDAQ:EBAY) is scheduled to report earnings after market, with an estimated $0.36 EPS, flat YoY, on $2.31B in revenue, with a $40.13B market cap.

Microsoft (NASDAQ:MSFT) is scheduled to report earnings after market, with an estimated $0.71 EPS vs $0.69 YoY, on $24.26B Revenue with $561.90B market cap.

Friday

8:30: Canada - CPI (June): expected to be 1.4% YoY from 1.3%. Market to watch: USD/CAD and other CAD crosses

EARNINGS

General Electric is scheduled to report earnings before market, with an estimated $0.25 EPS vs $0.51 YoY, on $29.02B in revenue, with a $232.56M market cap.