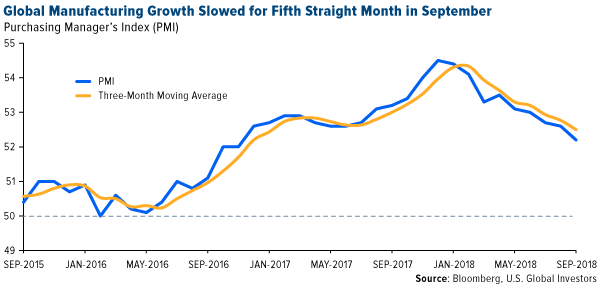

According to a recent Cornerstone Macro report, the three most influential macro trends this year have been 1) the strengthening US dollar, 2) the flattening yield curve and 3) slowing global manufacturing expansion. I’ve written about all three topics numerous times this year, but the one I’ve watched the most closely has been global manufacturing, as measured by the purchasing manager’s index (PMI). Since its 12-month high of 54.5 in December 2017, the PMI has declined in eight of the past nine months. September marked the fifth straight month of slower manufacturing growth.

This matters because the PMI is a useful, forward-looking indicator of the economic health of the manufacturing sector, which accounted for around 15.6 percent of global gross domestic product (GDP) in 2016. Our research has shown that the index can be used to forecast world demand for materials and energy one, three and six months out, with a reasonable measure of accuracy.

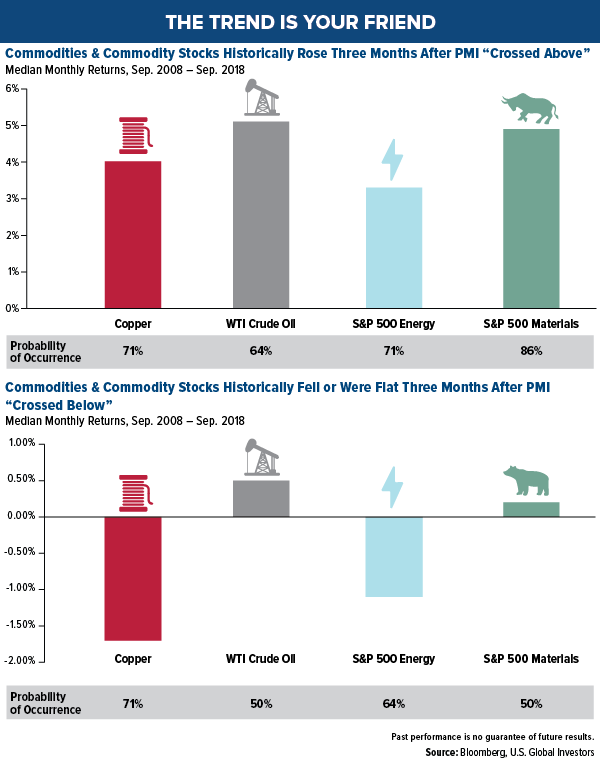

Take a look below. The chart shows that, based on 10 years’ worth of data, copper and West Texas Intermediate (WTI) crude, as well as energy and materials equities, all benefited in the three months after the PMI crossed above its three-month moving average. WTI saw the biggest jump; 64 percent of the time, it gained 5 percent on average.

Conversely, in the three months after the PMI crossed below its three-month moving average, those same assets either fell or were effectively flat. Seventy-one percent of the time, copper lost a little over 1.5 percent on average when manufacturing growth began to slow.

Energy Up, Materials Down

So how accurate has the PMI been so far this year? The index crossed below its moving average in February, and since then, materials have predictably failed to gain traction. The S&P 500 Materials Index is down about 6 percent, while copper prices are off 13 percent on fears that demand in China, the world’s largest consumer of the metal, is shrinking. (Australian miner BHP Billiton (NYSE:BHP) reported last week, however, that it believes Chinese copper consumption is actually set to increase substantially, by as much as 1.6 million metric tons, between now and 2023, thanks to its ambitious Belt and Road Initiative (BRI)).

Crude oil and energy stocks, on the other hand, have fared very well on tightening supply in Venezuela and Iran, the latter of which is scheduled to face a new round of US sanctions effective November 4. Since February, WTI prices have surged 13.6 percent and are now at four-year highs, while the S&P 500 Energy Index is up 2.7 percent. Oil traders are now betting that crude could rise to as high as $100 a barrel by next year, Reuters reports.

Does oil’s outperformance, despite a steadily cooling PMI, mean our research is flawed? Hardly. The index, remember, only tells us the probability that a price change will occur. Extraordinary government policies, such as the US reimposing sanctions on Iran, must also be taken into consideration. If the PMI alone were 100 percent accurate 100 percent of the time, we would all be multibillionaires from betting on the winners every time. Sadly, that’s not the case.

Could We Reach “Peak Oil” Sooner Than Anticipated?

But back to $100-per-barrel oil. Not only are traders betting on a return to these prices, but banks are also baking it into their forecasts. In a note last week, HSBC said it sees “real risks of this happening” by 2020, adding that “there are clear signs of falling exports and builds in Iranian exports. We would expect to see much more tangible signs of falling exports ahead of the November cut-off.”

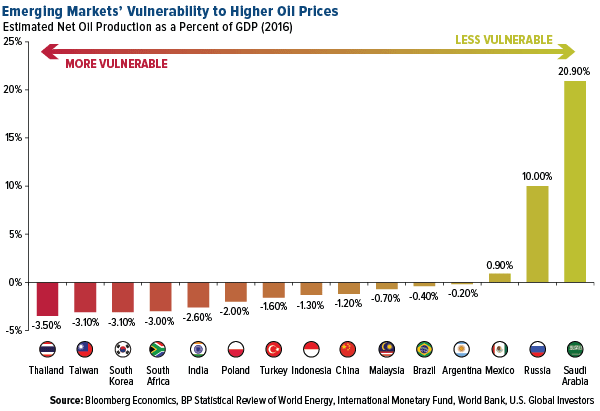

So how will this affect the global economy? It shouldn’t come as a surprise that net import countries would be most impacted by higher fuel costs. Among the emerging markets Bloomberg Economics estimates would feel the greatest pain are Thailand, South Korea, South Africa and India. Conversely, the economies that stand to benefit the most from rising oil prices are Mexico, Russia and Saudi Arabia.

Even higher prices could become a reality as soon as the next decade if world supply continues to tighten. Energy and mining research firm Wood Mackenzie (WoodMac) recently issued a warning that not enough oil discoveries are being made to replace capacity. “We need more Guyanas, a lot more, and we need them soon,” WoodMac chairman and chief analysts Simon Flowers urged, referring to the massive find made in the South American country early last year.

Spending on exploration collapsed following the price crash in 2014, which has propelled the world closer to “peak oil” much sooner than anticipated. “The oil market could be running short of oil capacity by the late-2020s at the current low discovery rate,” Flowers said. “That’s worryingly near at hand given it takes the best part of 10 years for the average new discovery to build to peak production.”

The supply gap, according to WoodMac, could reach 3 million barrels per day (b/d) by 2030, 9 million b/d by 2035 and a “formidable” 15 million b/d by 2040.

A Promising New Copper Discovery

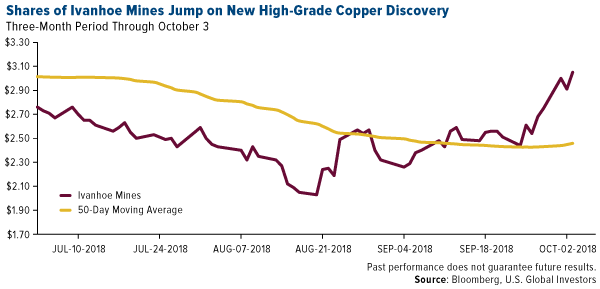

Speaking of new discoveries, I want to congratulate my friend Robert Friedland, founder and executive chairman of Ivanhoe Mines Ltd. (TO:IVN). The Canadian copper mining company announced last week the “important new discovery” of the metal on its 100 percent owned Western Foreland property in the Democratic Republic of Congo (DRC). Makoko, as it’s called, is Ivanhoe’s third major find in the DRC, following Kamoa-Kakula, which WoodMac has called the world’s largest, undeveloped, high-grade copper discovery.

After last Monday’s announcement, shares of Ivanhoe popped 9 percent on the Toronto Stock Exchange.

In the press release, Robert chalked the find up to “the accumulation of in-depth, proprietary geological insights gained by Ivanhoe’s exploration team during nearly two decades of exploring in the region.”

“Given the early drilling success at Makoko,” he added, “we are highly confident that we have the secret blueprint for additional exploration successes in the Western Foreland area in 2019 and beyond.”

Earlier this year, Robert visited our office and said that by 2021, “you’re going to need a telescope to see copper prices.” China’s BRI, as I mentioned earlier, is expected to boost demand dramatically as scores of new power plants and electrical grids come online. The Asian giant has also joined several other countries in requiring that electric vehicles (EVs) replace gas-powered ones over time. EVs need three to four times as much copper as traditional vehicles do.

With copper prices down close to 16 percent for the year, now might be an ideal buying opportunity.

Poland Adds to Its Gold Reserves. Should You?

Stocks sold off more sharply late last week than we’ve seen since late June, with the S&P 500 Index sliding below its 50-day moving average. The unemployment rate fell to 3.7 percent, its lowest level in nearly half a century, convincing many investors that the Federal Reserve will now begin to raise rates more aggressively in an effort to prevent the economy from overheating.

As I’ve shared with you before, all but three recessions of the past 100 years were preceded by a rate hike cycle.

Meanwhile, the trade dispute between the world’s two largest economies doesn’t appear to be abating anytime soon. Now that President Donald Trump has succeeded in rebooting NAFTA—provided it gets ratified by Congress—he’s likely to turn up the heat on Beijing. Some analysts predict the US will eventually max out tariffs on all Chinese imports. J.P. Morgan now forecasts a “full-blown trade war” as its “new base case scenario for 2019.”

The US economy is humming along robustly, but it’s better to prepare for the next downturn while the bull is still running than after it’s crashed into a wall. Last week I spoke with Daniela Cambone of Kitco News and explained the reasons why I’m bullish on gold, including Vanguard’s decision to slash its exposure to metals and mining, and the recent Barrick Gold-Randgold Resources merger deal.

During the interview, I also discussed the news that Poland purchased gold this past summer at a pace not seen in 20 years. The Eastern European country, which was just upgraded to a developed market,added nine metric tons to its gold reserves in July and August, the most since 1998, and the most by any European Union country in the past two decades. Speaking with Bloomberg, mBank senior economist Marcin Mazurek said the Polish central bank’s decision was likely based on diversification,“combined with the expectation for higher global inflation.”

Disclosure: This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.