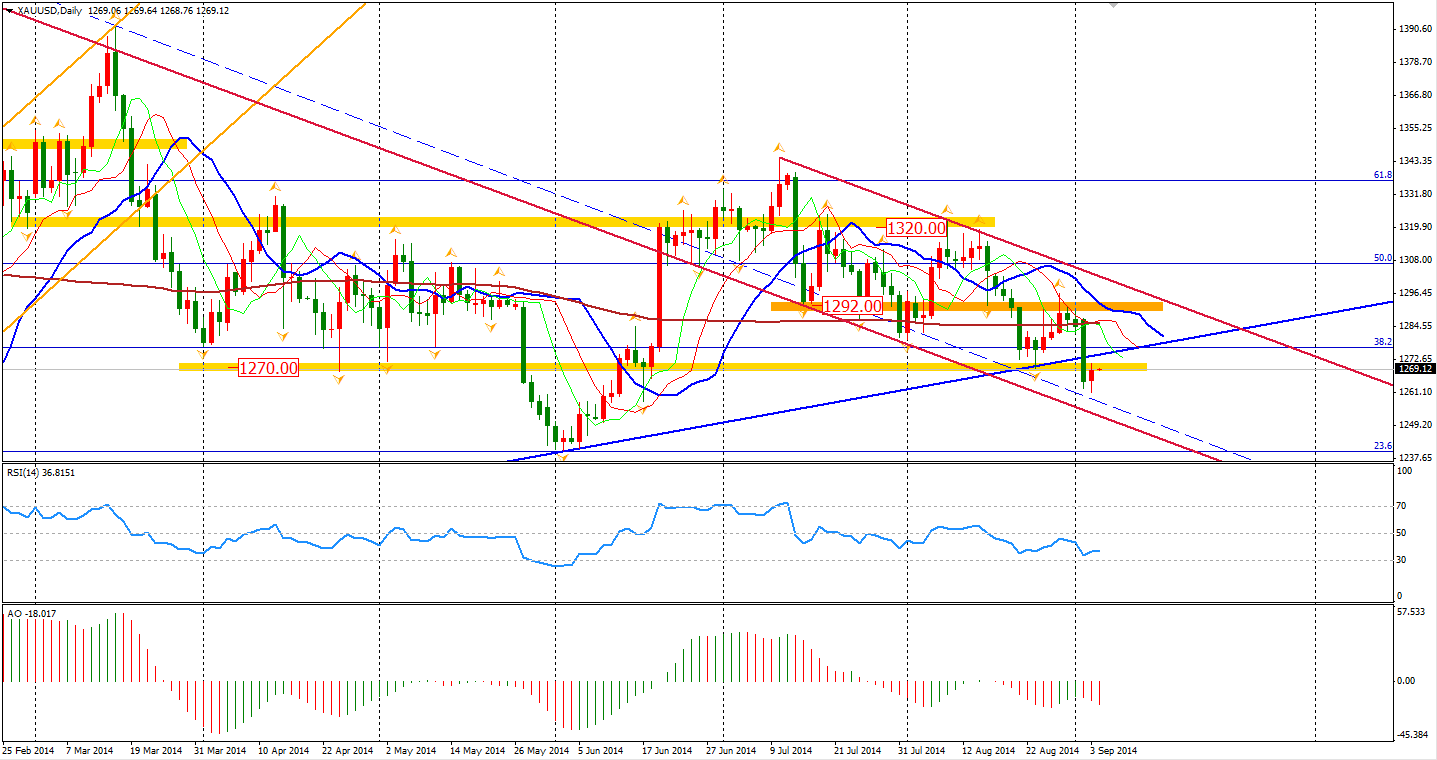

The Gold price was on a rollercoaster with each wave of conflicting news on Ukrainian crisis. Kiev first announced that an agreement on a ‘cease-fire regime’ had been reached. The Gold price plunged from the day’s high of $1269 to $1263 per ounce on this peace deal. However, the Kremlin denied the news and restated that Russia was never involved in a conflict and only made an outline for fire ceasing.

As I have mentioned a couple of times before, a full-scale confrontation with the West would not be a wise option for Russia. This five-month-long conflict in Eastern Ukraine is just the Kremlin’s warning and a reaction to the expansion of the EU and NATO in pro-USSR nations. Now, maybe would be a good time to ease the tension before it goes too far.

As such, the recovery of the U.S. economy will be the main aspect of the Gold price movement in the middle run. The negative outlook of the Gold price remains and last night’s bright Factory orders gave us more confidence. The orders spiked 10.5% in July, which was the highest record since the data collection started in 1992. The Dollar retreated in the U.S. afternoon, but the Gold price was still subdued by $1270.

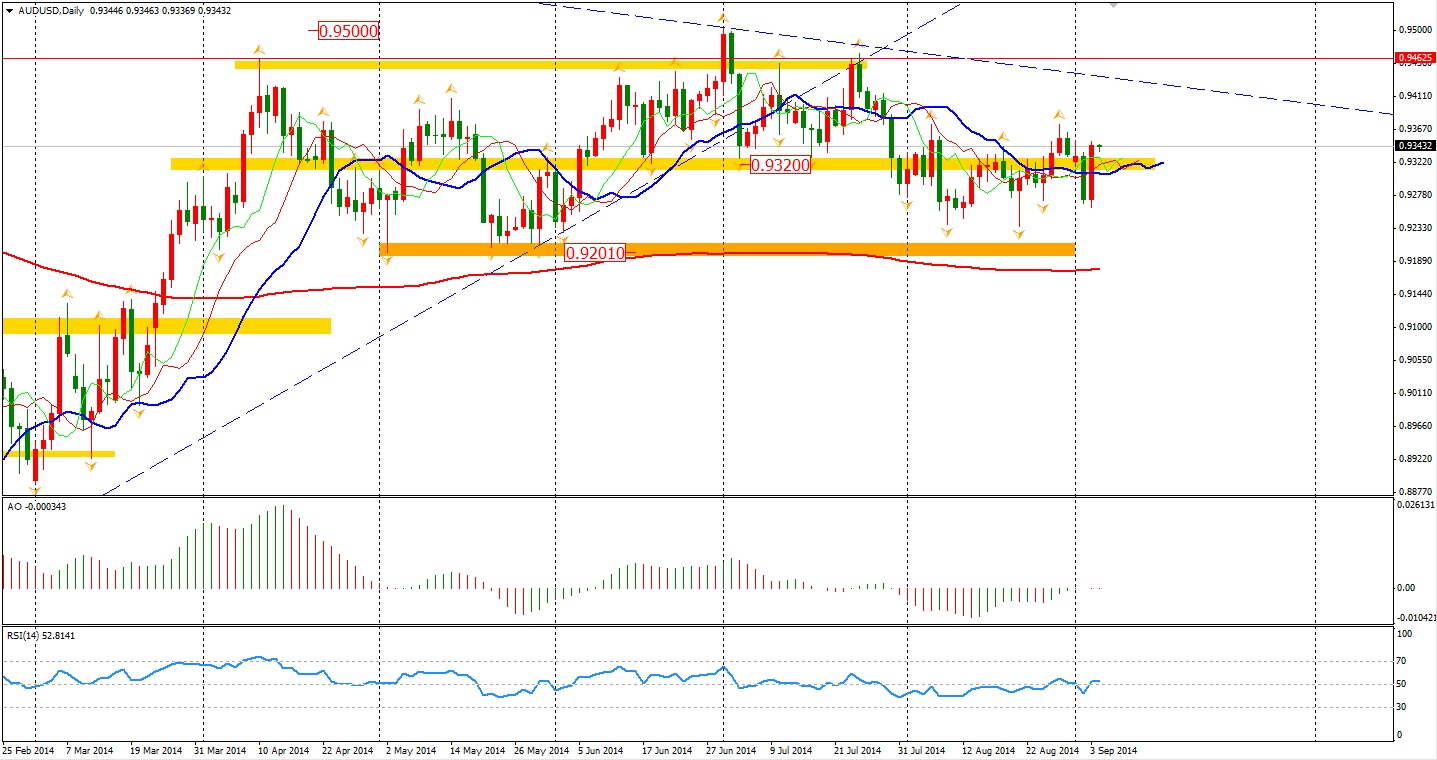

The AUD/USD bounced back beyond 0.9320 again yesterday. The Q2 GDP rose 0.5%, better than the expected 0.4% expansion. The sideways movement may continue. This pair may not be a good choice for traders who tend to gain profits from the rising Dollar.

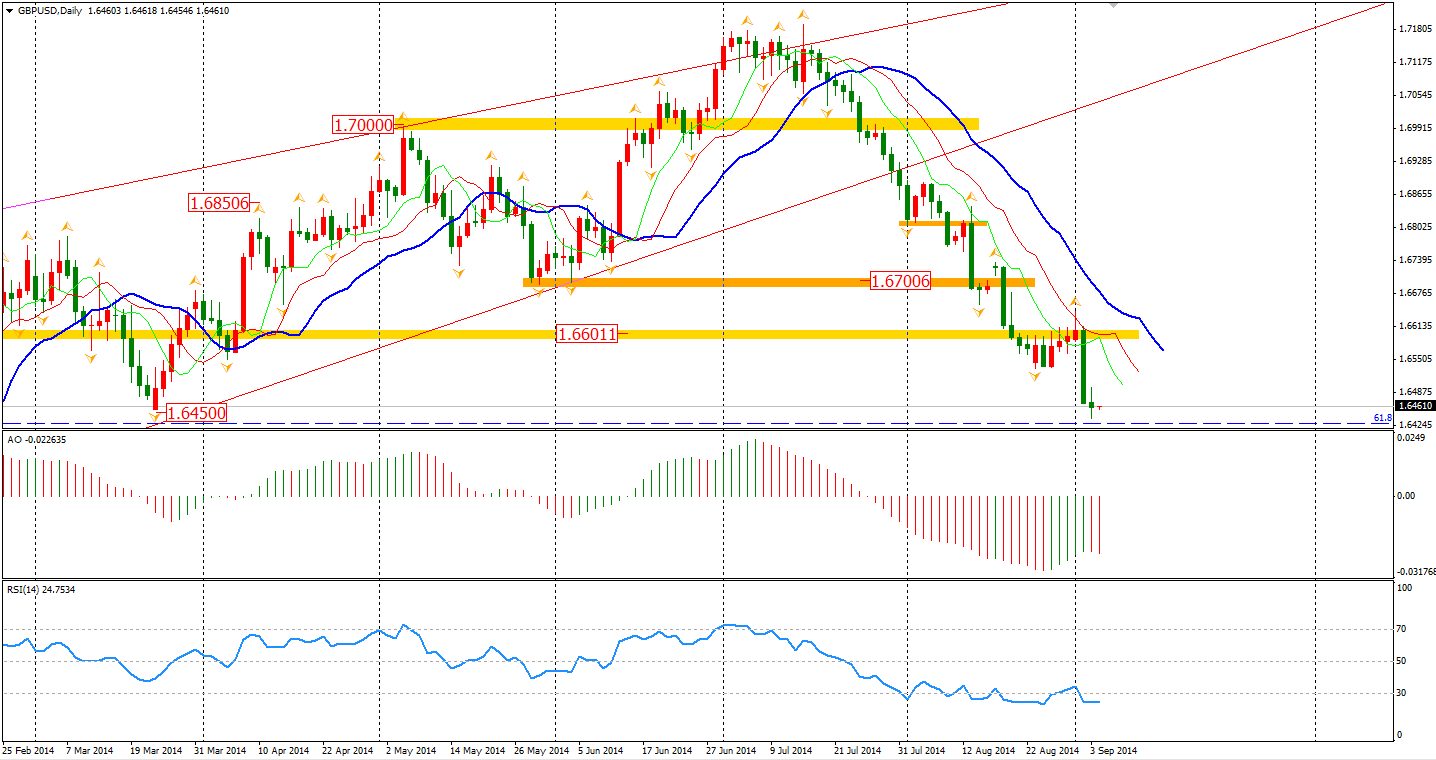

However, the Sterling kept falling yesterday against Dollar. The latest poll shows that more people in Scotland are in favour of quitting the United Kingdom, which is a clarion for selling Sterling as an event like this would be a disaster for the UK and Scottish economy. The GBP/USD has reached 7-month low 1.6440.

Asian stocks markets were in a sea of green on Tuesday. The Shanghai Composite's surge continues, rising 1 % to 2288. The Nikkei 225 Stock Average gained 0.38%. The Australia 200 was almost unchanged at 5656. European stock markets were inspired by the cease-fire news, the UK FTSE was up 0.65%, the German DAX gained 1.26% and the French CAC Index lifted 0.99%. U.S. stocks closed lower, dragged by technology shares. The S&P 500 closed flat at 2000. The Dow's gained 0.06% to 17078, while the Nasdaq Composite Index was down 0.56% to 4573.

Today is an exciting day full of events. To start with, Australia Retail Sales and Trade Balance will be released at 11:30 AEST. The rate decisions of BOJ, ECB and BOE will all be out at today. U.S. ADP Non-Farm Employment Change, Unemployment Claims and Trade Balance will also be watched tonight.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Waves Of Gold And A Green Sea Of Surging Stocks

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.