One of the best ways to get a quick snapshot of the market is by using Mish’s Economic Modern Family.

Using 5 sectors and 1 index, it can help guide us through the overall market as well as reveal potential weak spaces to be cautious of.

Tuesday saw members of the Modern Family reach pivotal price levels.

With that said, let’s look at which key points we are seeing and how this could affect the coming week of trading from a technical standpoint.

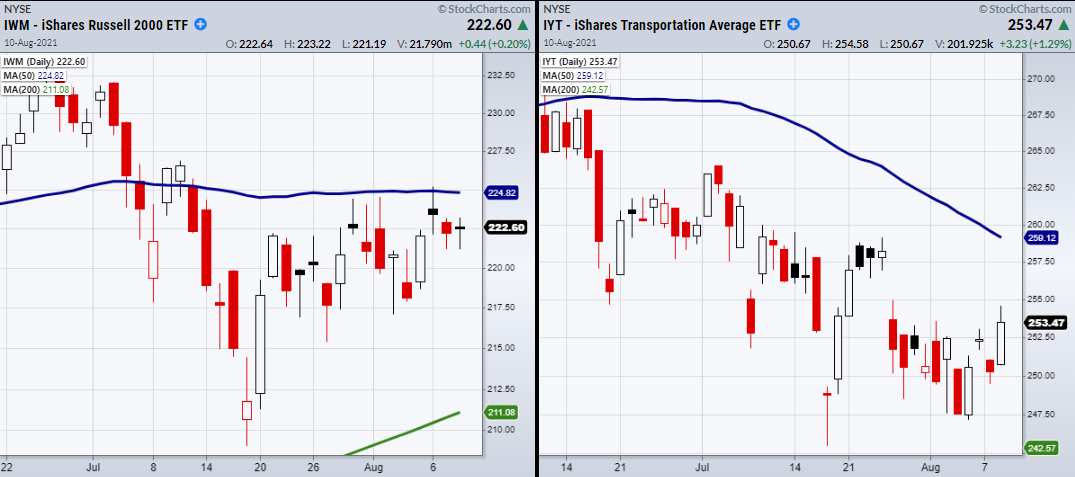

Starting with the small-cap index Russell 2000 (NYSE:IWM), one thing is very clear.

The 50-Day moving average at $224.86 -225 is a major resistance level that needs to clear and stay over.

For the past two weeks, IWM has failed 4 separate attempts to clear resistance at $225.

Next up is the Transportation sector (IYT).

Stuck within a downward trend, it could be looking to clear over last week’s consolidation area sitting at $253.57.

If it can clear resistance at $253.57 it will need to show it can hold with multiple closes over this price area to prove the downward trend is giving up.

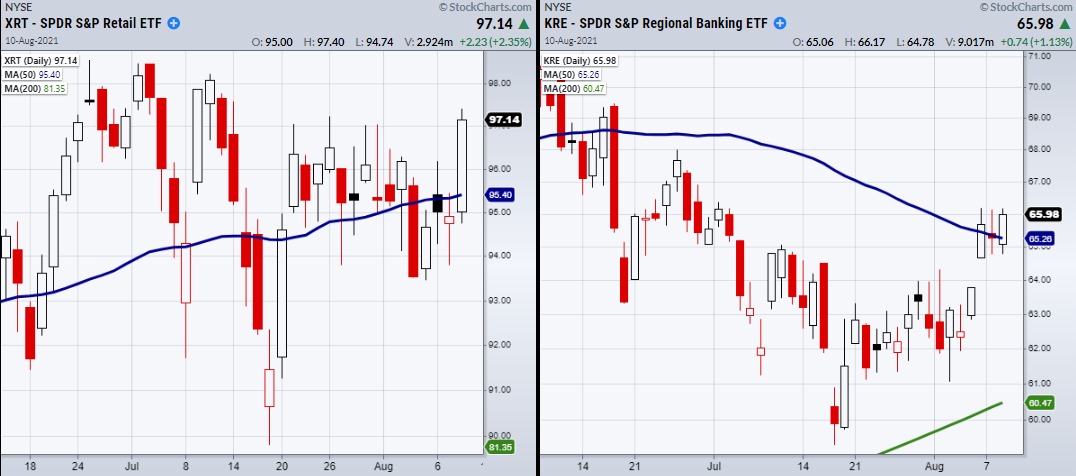

Moving on, the Retail space (XRT) made a surprise comeback from last weeks’ breakdown and is once again testing resistance at $97.

Like IYT, it will need multiple daily closes over this level to prove it can clear resistance and hold.

Looking at the Regional Banking sector (KRE), it will need to confirm a bullish phase change with a second close over its 50-DMA at $65.25.

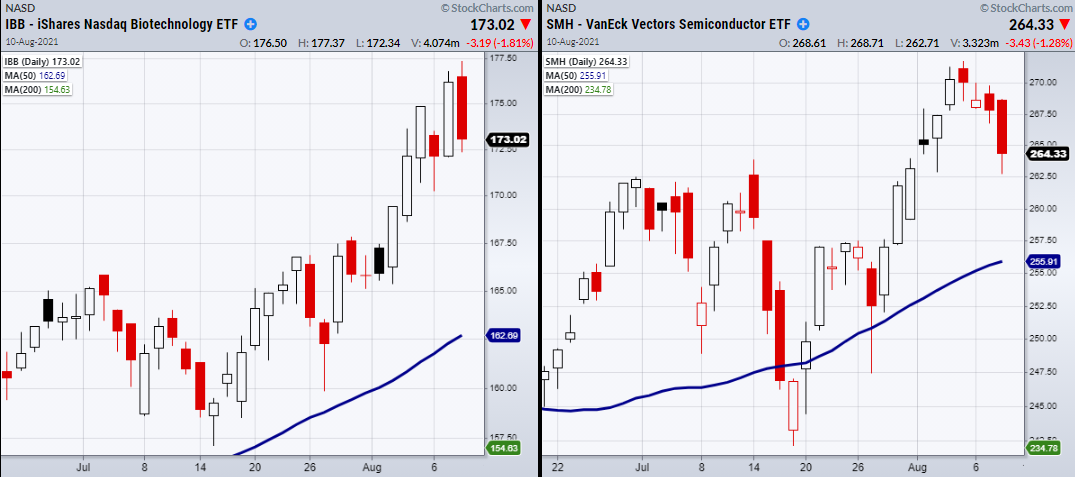

On the other hand, both the Biotech (IBB) and Semiconductor (SMH) sectors are taking a breather from their recent moves higher.

Specifically, SMH is looking to test its recent support area from the highs of June through July.

Overall, the market is sitting in a very pivotal price area with the potential to make a sold push higher if it can clear these main price levels and hold recent support.

Especially if IWM clears $225 and IYT can clear and hold over $253.57.

ETF Summary

S&P 500 (SPY) Holding highs with support 436.

Russell 2000 (IWM) Still needs to clear 225 resistances.

NASDAQ (QQQ) Flirting with the 10-DMA 366.89.

KRE (Regional Banks) Watching for second close over the 50-DMA at 65.35.

SMH (Semiconductors) 263.86 support area.

IYT (Transportation) Looking for another close over 253.57 area.

IBB (Biotechnology) 174 possible resistance area from weekly chart.

XRT (Retail) Sitting in resistance from 97.

Junk Bonds (JNK) 108.65 support to hold.

IYR (Real Estate) 105.22 support area.

XLP (Consumer Staples) Held the 10-DMA at 71.21.

GLD (Gold Trust) Watching for new support level.

XME (S&P Metals and Mining) 45.89 high to clear.

USO (US Oil Fund) 45.85 new support.

TLT (iShares 20+ Year Treasuries) Broke support from the 200-DMA 146.88.

USD (Dollar) 93.19 resistance to clear.

DBA (Agriculture) 19.05 gap to fill.