Shares in China suffered their second biggest ever fall on Monday as the main Shanghai Composite plummeted by 8.5%. There was uncertainty as to what caused the latest sharp losses given recent signs of stabilization after intervention by state authorities to support share prices. Friday’s weak manufacturing PMI and expectations of a US rate rise were some of the potential triggers. But some reports suggested that the state-run margin lender may have repaid loans taken out to support stocks ahead of schedule, which would have panicked investors about the government’s commitment to shoring up the market.

The main share indices reversed or cut earlier losses after see-sawing in early Asian trading. The Shanghai SE Composite was down by 1% while the Shenzen CSI300 index was up by 0.4% in late Asian session. Plans by China’s central bank to pump 50 billion yuan into the money markets through reverse bond repurchases may have helped improve sentiment on Tuesday.

The volatility in China boosted safe-haven currencies such as the yen which rose against the euro and the pound. But the dollar managed to retain overnight gains against the yen as it rose to 123.54 in late Asian trading. The greenback was also firmer against the euro. The single currency eased to 1.1064, after peaking at a 2-week high of 1.1129 on Monday. It was also weaker against the pound at 0.7109.

The euro was boosted yesterday after German IFO business climate came in above expectations and strong durable goods orders data for the US had limited impact on the dollar.

In commodity markets, oil prices continued to slide as Brent Crude prices dropped to $52.95 in late Asian session. The aussie, which has come under pressure from weak commodity prices and China worries, recovered from an earlier new 6-year low of 0.7256 against the dollar to climb to 0.7310 later in the session. The kiwi continued to move away from its mid-July lows and climbed to 0.6654 against the dollar.

Sterling gave up Monday’s gains against the dollar to head lower at 1.5547 as it awaits today’s GDP data for the first quarter. Initial estimates for first quarter growth are expected to show the UK economy expanded by 0.7% quarter-on-quarter. This would likely put the Bank of England on track to raise rates in early 2016.

Also coming up later today are the Markit services PMI as well as the Conference Board Consumer Confidence index for the US for the month of July.

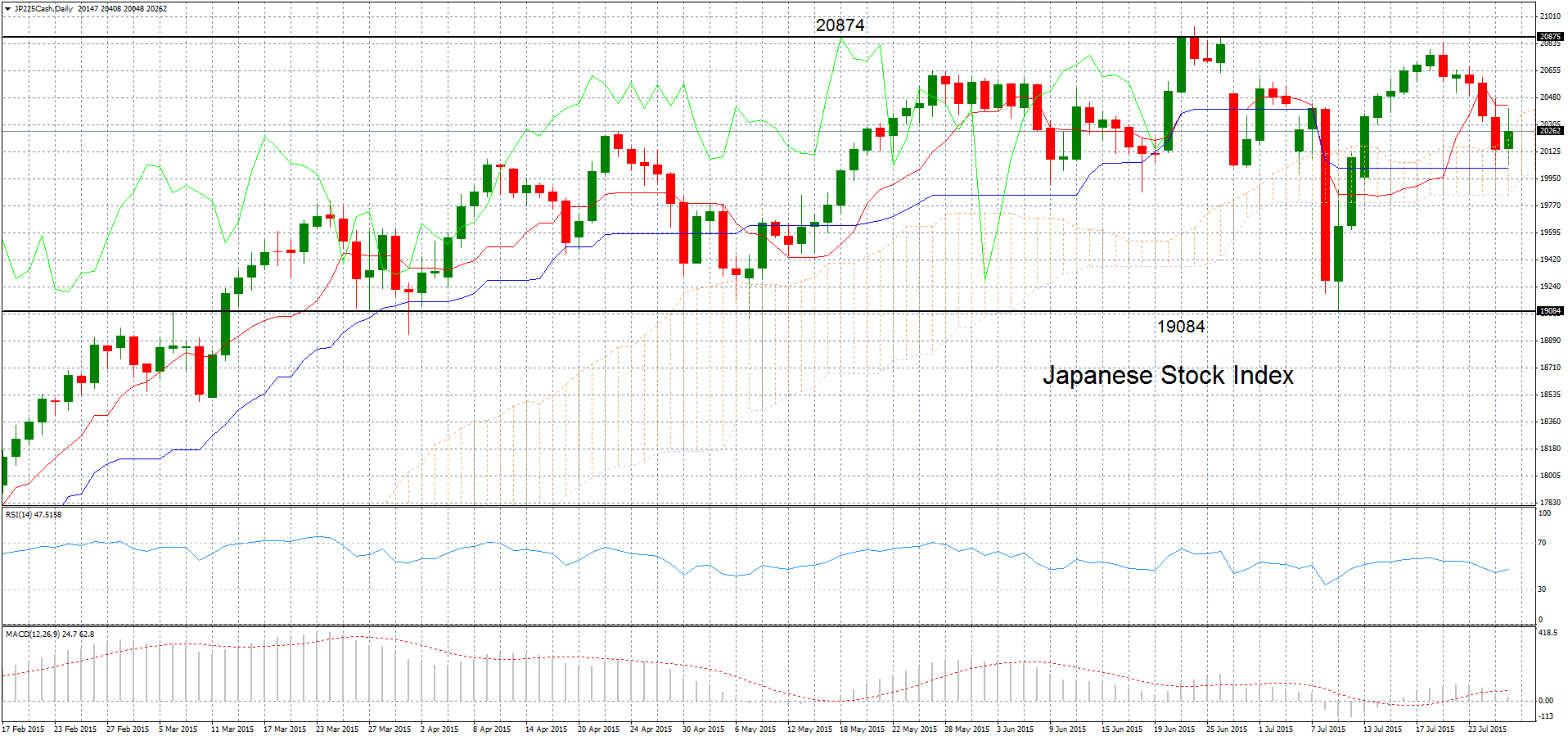

Technical Analysis – Japanese stock index consolidating after 15-year highs

Following a 15-year high on 23rd June, the Japanese stock index has given back some of those gains; correcting as much as 9% in the following 2 weeks. The closing high on 23/6 was 20874. An attempt to make new highs on July 21/22 failed and the index has turned back into the Ichimoku cloud. The Tenkan-sen line is still above the Kijun-sen, which is bullish.

The overall trend is bullish and it is worth noting that Japanese equities have been one of the strongest performing asset classes in the word during 2015 – up by 16.5% year-to-date.

Should the index fall below 19850-19900 (Senkou Span B – the bottom of the cloud), it could signal more bearishness. Even more downside could be triggered by a fresh low below 19000 that could signal a 10% correction from the highs.

If price action climbs above the 20300 upper cloud on the other hand, fresh longs could be established. Fresh multi-year highs above 20900 would also confirm the bullish prospects.