Investing.com’s stocks of the week

With China vying with Greece for Worst Financial Headline, buyers were hard to find. Yesterday's late surge - typical of capitulations - was completely reversed by today's selling.

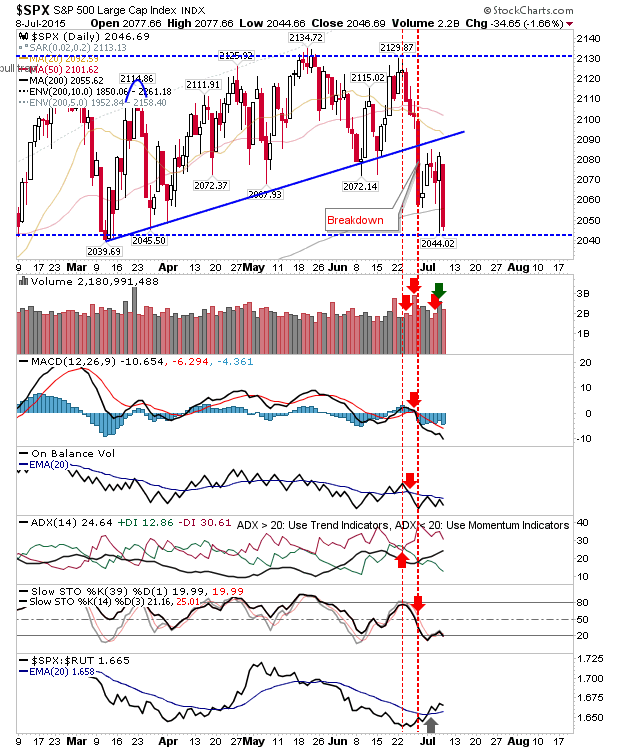

Where the S&P was knocking on the door of a break of 2085, it instead finished the day below its 200-day MA. It has been a long time since it last traded below this average, but we may be now looking at the start of the capitulation. While losses were big, it maintained its relative strength against the Russell 2000.

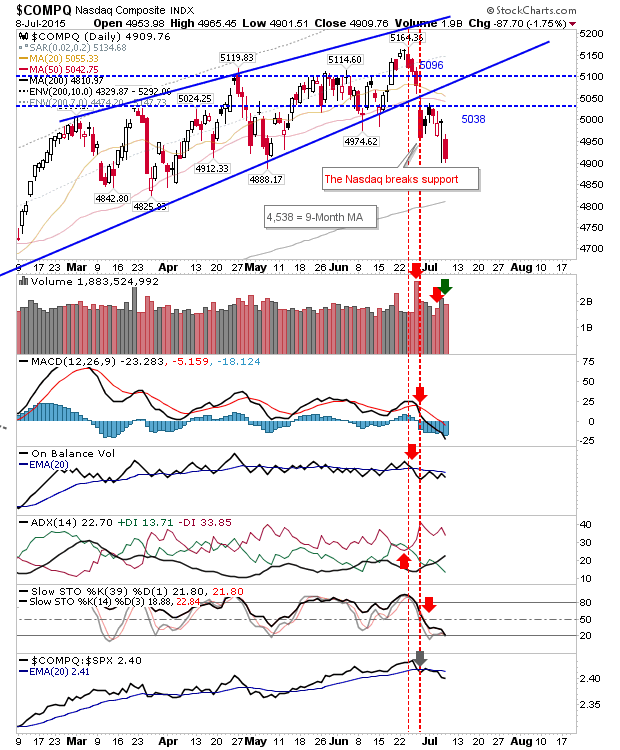

The Nasdaq suffered significant losses, but remains some distance from its 200-day MA. Despite this, the index has fallen into a period of relative under-performance against the S&P. Further losses look favoured.

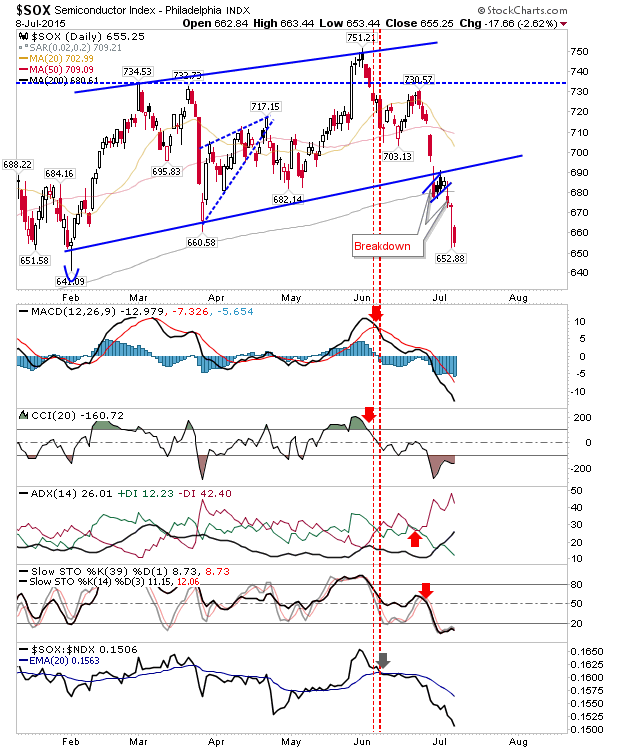

The Semiconductor Index is close to panic mode, as global demand for technology / business upgrades heads south. It's struggling to hold on to the February low. The May breakout of 734 is feeling like a long time ago.

Small Caps has dropped back to trendline support, but has it enough to give bulls something to work with? It would be a brave buyer to take a punt here. The 200-day MA at 1,204 may offer more joy.

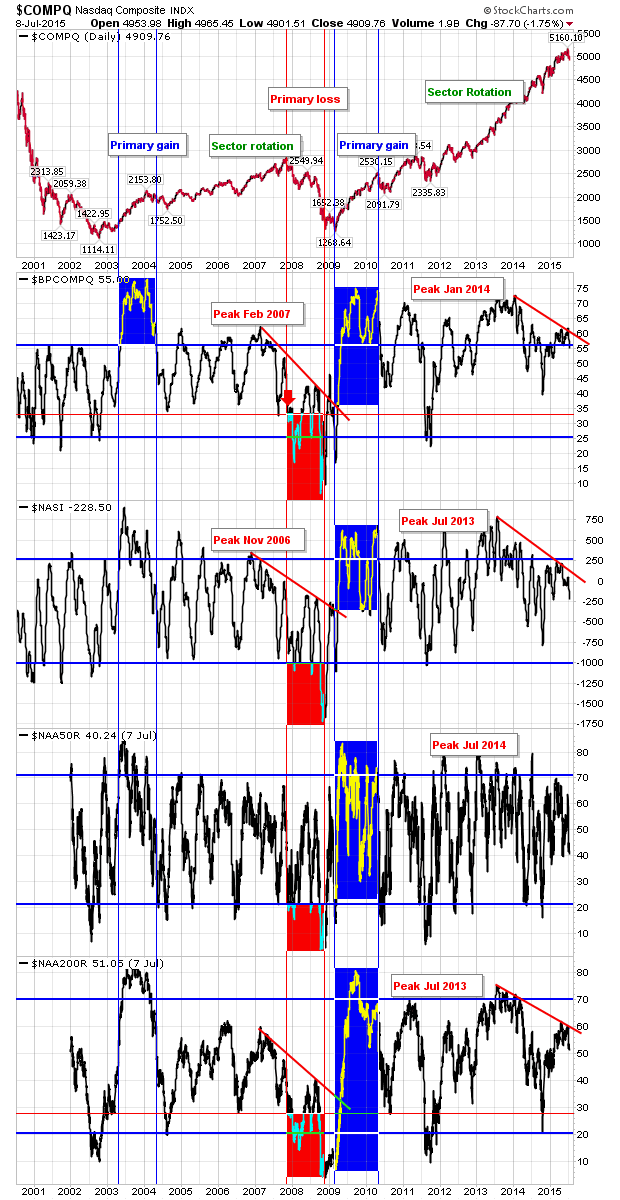

Sentiment has been mapping bearish divergences since 2014 (2013 for the Percentage of Nasdaq Stocks above the 200-day MA), but none of the key metrics are oversold to suggest a bottom is near.

Tomorrow is open for bears, or at least likely to keep bulls away. Further losses in the cards?