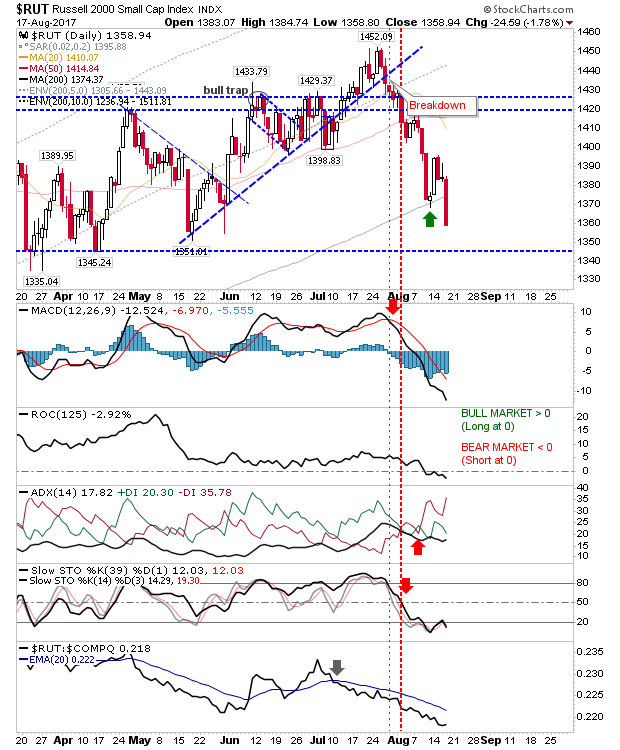

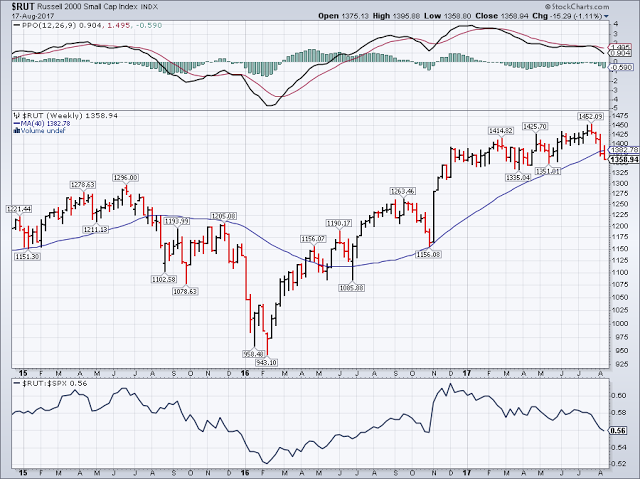

Thursday's losses look big on current charts but in a historic context, they weren't too severe. However, big red bars are not to be ignored and 'market leading' Small Caps have felt the full brunt of the selling from July which is bad news for the broader market. Thursday's losses in the Russell 2000 undercut the 200-day MA leaving 1,345 as next support (of which I would not be too confident of it holding).

If the Russell 2000 gives up 1,350s then a drop to 1,150s could be on the cards. Things could get ugly if this scenario plays out.

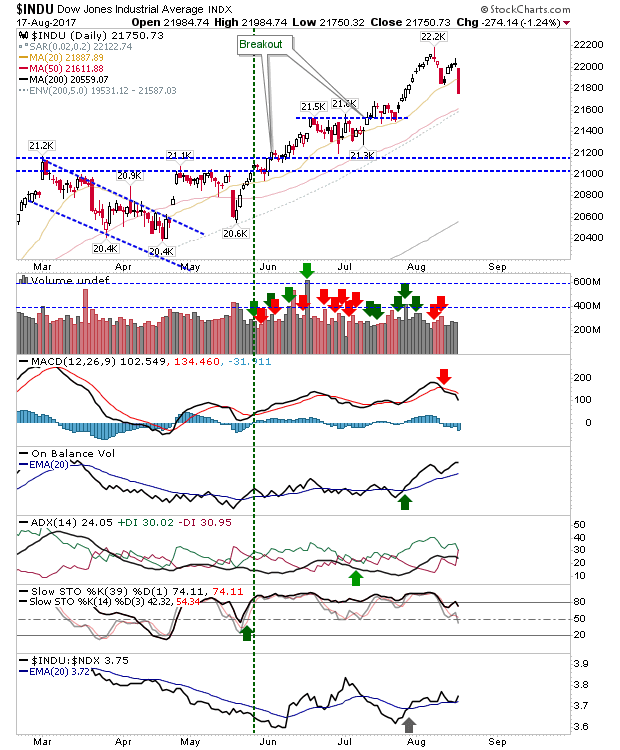

Those who played the spike high in the Dow as a short will be feeling good after Thursday. The next downside target is 21,500 which is a handy reward for those going against the prior bull trend.

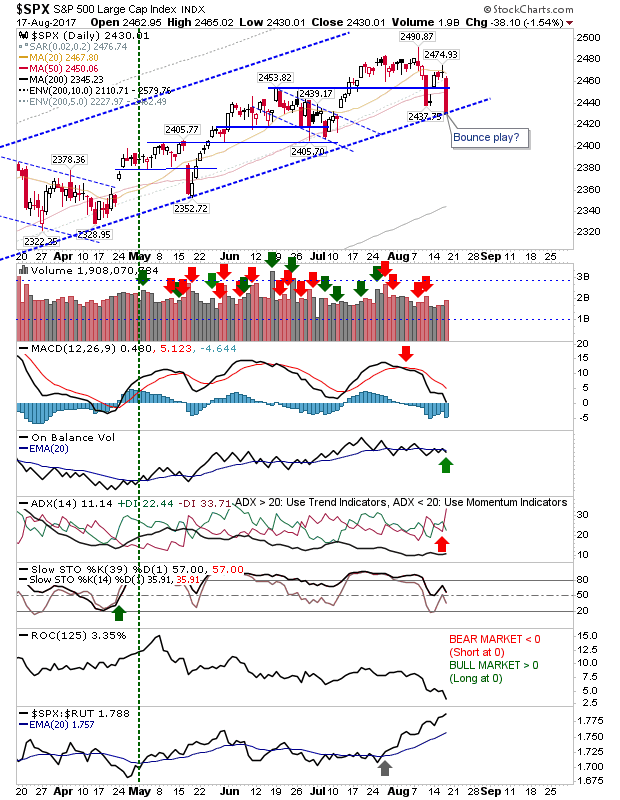

The S&P also took a hit but the index did something similar in May and recovered. Don't be surprised if there is another like bounce on Friday. If you are looking for a recovery bounce then the S&P is the index to watch. There is an On-Balance-Volume 'buy' trigger to work off too.

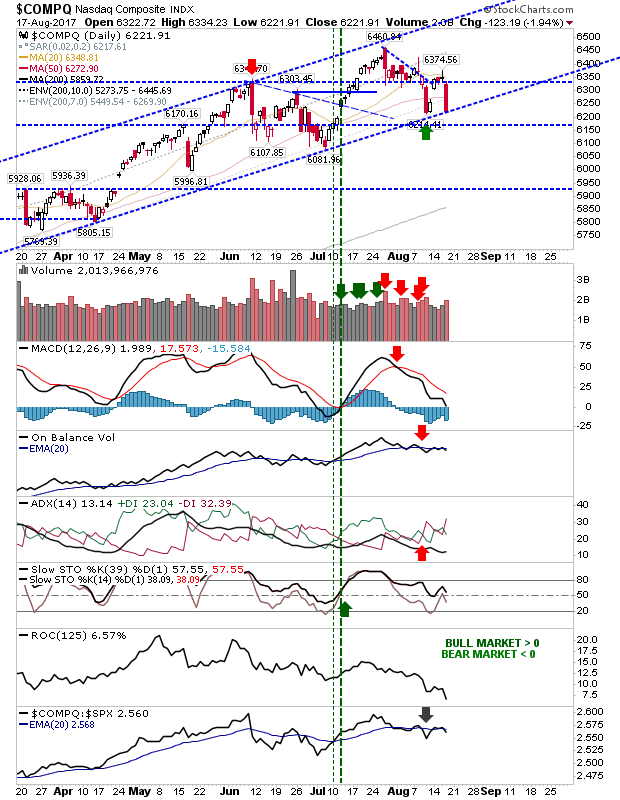

Another is the NASDAQ; a practical carbon copy of the S&P. The one difference is that there is a 'sell' trigger in On-Balance-Volume which might be a deal breaker for some. Thursday's selling volume also registered as distribution.

For Friday I would be looking at aggressive longs (day trades?) in the NASDAQ and S&P. Action in the Russell 2000 suggests something worse is in the works so I wouldn't be rushing to buy these sell offs if you are looking for the long term (1 year+).