Market Brief

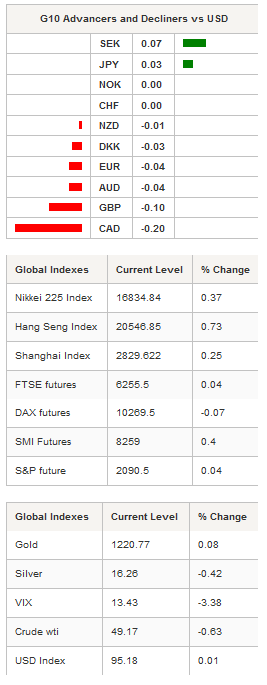

The latest batch of economic data from the US indicated that the manufacturing sector is not out of the woods just yet. In spite of solid headline figures - US durable goods orders jumped 3.4%m/m in April, beating median forecast of 0.5%, while previous month’s reading was revised from 0.8% to 1.9% - the details do not look great. Indeed, the sharp rise in durable goods orders is mostly due to a strong demand for transportation equipment, especially non-defense aircraft, motor vehicles and transportation. The ex-aircraft gauge rose 0.4%m/m versus 0.3% expected. However, orders for capital goods, excluding aircraft - a proxy for spending business plans - contracted 0.8% in April, missing estimates of +0.3%. All in all, the data suggests that the manufacturing industry is still suffering from the effects of weak global demand and things are not set to improve just yet. Initially, the greenback dropped on the release but quickly returned to its initial levels. EUR/USD jumped 0.50% to 1.1217 before returning slightly below the 1.12 level. A support can be found at 1.1129, while on the upside a resistance lies at 1.1315 (Fibo 38.2% on April-May debasement).

In Japan, the yen continued to move sideways as April’s inflation figures came in roughly in-line with market expectations. CPI contracted 0.3%y/y, down from -0.1% in the previous month but beating median forecast of -0.4y/y. The BoJ’s preferred measure of inflation, the gauge that excludes fresh food, contracted 0.5%y/y, also missing estimates of -0.4% and below last’s month figure of -0.3%. We therefore would not be surprise if the BoJ announces another delay in its inflation target timing. USD/JPY has been trading range bound between 109.42 and 110.21 since yesterday. We maintain our upside bias.

Crude oil prices tumbled on the $50 threshold as traders wonder whether the easing glut supply will last. The Brent crude was down 0.73% in Tokyo to $49.23 a barrel, while the West Texas Intermediate fell 0.63% to $49.17. In spite of a weaker crude oil, commodity currencies remained roughly unchanged, with the exception of the Canadian dollar, which fell 0.20% against the greenback. USD/CAD hit 1.30, up from 1.2911 yesterday in New York. The Australian dollar edged down 0.04%, the New Zealand dollar and the Norwegian krone remained.

In the equities market, Asian regional indices were broadly trading in positive territory across the board. In Japan, Nikkei is up 0.37%, while the broader Topix index rose 0.53%. In mainland China, the CSI 300 was up 0.07%. In Hong Kong, the Hang Seng surged 0.73%. The Australian S&P/ASX rose 0.33%. In New Zealand, the NZX was up 0.64%. In Europe, equity futures were mixed.

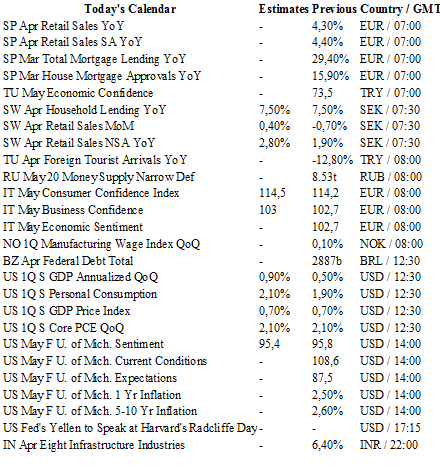

Today traders will get retail sales from Spain and Sweden; consumer and business confidence from Italy; GDP, personal consumption, core PCE and Michigan sentiment index from the US.

Currency Tech

EUR/USD

R 2: 1.1349

R 1: 1.1243

CURRENT: 1.1181

S 1: 1.1058

S 2: 1.0822

GBP/USD

R 2: 1.4969

R 1: 1.4770

CURRENT: 1.4642

S 1: 1.4404

S 2: 1.4300

USD/JPY

R 2: 111.91

R 1: 110.59

CURRENT: 109.71

S 1: 108.23

S 2: 106.25

USD/CHF

R 2: 1.0257

R 1: 1.0093

CURRENT: 0.9897

S 1: 0.9751

S 2: 0.9652