Market Brief

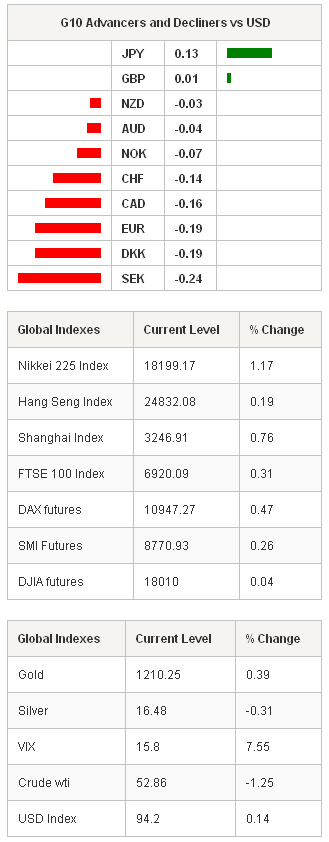

Forex markets remain focused on developments surrounding the Greece aid negotiations. Yesterday’s rumors that Greece might request extensions to the current bailout helped reduce the pressure on financial markets. However, clearing away the rhetoric anonyms statements, parties still are at an impasse and time for finding a solution is limit. In addition, on the geopolitical front, the recently negotiated cease-fire agreement between Russia and Ukraine looks to be on the brink of collapse. FX markets need solid, verifiable positive news to keep the current risk recovery moving. Asia regional indices are mostly higher, following S&P 500 closing at a record high of 2100. The Nikkei 225 rose 1.18%, Hang Seng and Australia 200 up 0.19% and 0.98% respectably.

USD/JPY in thin trading, bounced about 118.90 to 119.30 as the BoJ held monetary policy in a vote 8-1, to maintain QQE. Higher US yields were supportive but large option expiries at 119.00 and 119.50 kept upside restrained. JPY spikey price action was due to US 10 Year T-Note treasury’s moving sharply upwards in Asia before settling down at 2.11%. Optimism over a potential deal with Greece had traders cut safe-haven trades including US treasuries and Gold which has fallen 2.63% in three days. EUR/USD consolidated around 1.1400 for most of the session but now bearish monument is starting to take hold. Yet with EUR/USD short still dominate, downside should be limited despite mounting headwinds from Russia and Greece. AUD/USD remained bid post RBA less dovish minutes trading between 0.7805 and 0.7832. Traders are focused on 0.7880 which would signal a trend reversal. AUD/NZD consolidated loses around 1.0370 right above all time low at 1.0333.

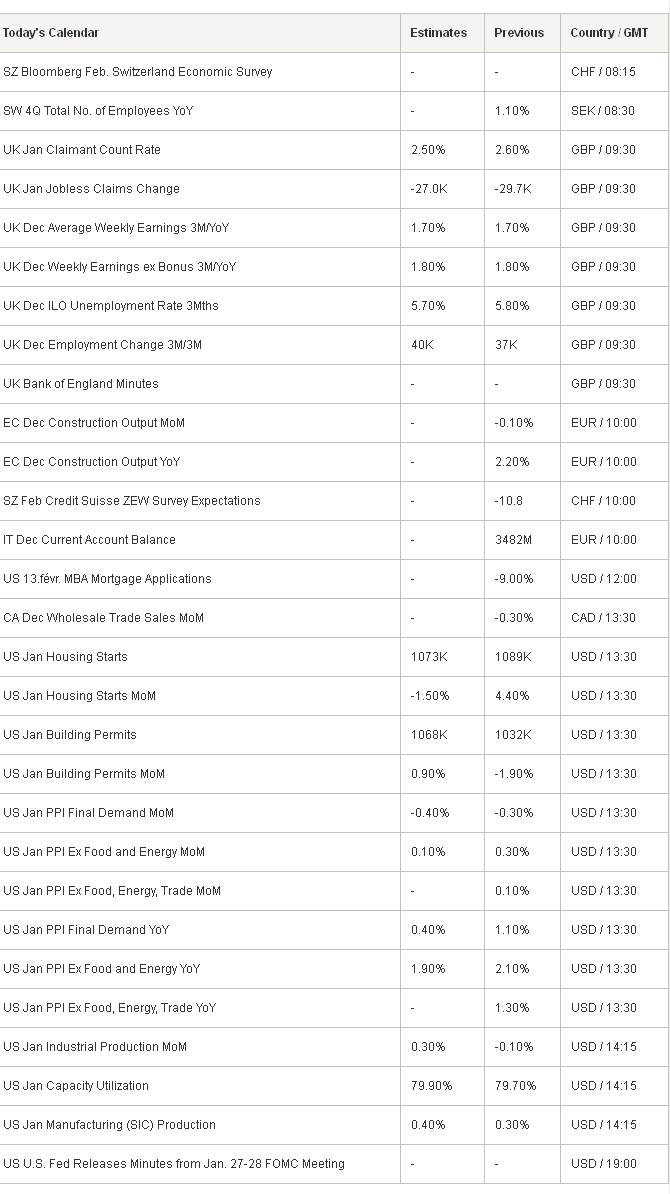

As was wildly expected that Bank of Japan held is current monetary policy in a 8-1 vote. However, the bank significantly upgraded its assessment of the economy. Bright spot in the economy were noted to be exports and industrial production. Recent comments from members that additional stimulus would be counterproductive while further JPY weakness might have a destabilizing effect, has investors questioning the forward strategy. This potentially shifting view will put the focus on Kuroda’s press conference later today. That’s said hold our view that CPI will head lower and that the BoJ will respond with additional easing.

Minutes of the Bank of England policy meeting and unemployment report will the key data release today. Markets expect no change in voting pattern with all nine member voting to keep policy stable while headline unemployment will stay flat at 5.8%. This follows data that indicated that UK inflation has eased to a record low as energy and food prices contracted. Dovish expectations are weighting on GBP/USD demand.

Outside of the fluid headlines emulating from Greece and international creditors, traders will also be watching minutes of the January FOMC statement. It will be interesting to view the discussion around certain phases such as “international developments” and “patient”, yet no real signal on timing is expected. Therefore market volatility should be limited. More likely Yellen’s congressional testimony next will could provide insight on to when the Fed is planning the first hike. That said, we should hear that the pace of US economic growth is solid, being led by job creation. It will be interesting to see any concern over the soft inflation reads. Overall, the minutes should be slightly more hawkish illustrating the Fed “patient” is waning.

EUR/CHF continues to stage a solid recovery to 1.690 area. Break above key resistance 1.7000 (61% fibo level from sell-off) would give scope for extension to 1.0850 then 1.1005. The catalyst has been the singlet strong EUR but also comments from SNB's Chairman Jordan. Jordon took the opportunity yesterday to repeat that he viewed the CHF is significantly overvalued, which traders took as a warning that additional FX intervention is possible.

Currency Tech

EUR/USD

R 2: 1.1534

R 1: 1.1423

CURRENT: 1.1324

S 1: 1.1262

S 2: 1.1098

GBP/USD

R 2: 1.5486

R 1: 1.5352

CURRENT: 1.5234

S 1: 1.5197

S 2: 1.5140

USD/JPY

R 2: 121.85

R 1: 120.83

CURRENT: 120.24

S 1: 119.20

S 2: 118.34

USD/CHF

R 2: 0.9500

R 1: 0.9347

CURRENT: 0.9279

S 1: 0.9170

S 2: 0.8936