Investing.com’s stocks of the week

Market Brief

Released on Friday, the US nonfarm payrolls greatly surprised to the upside. The US economy added 211,000 nonfarm jobs in November versus 200k expected and an upward revision of 298k in October. The average earnings stayed stable at 0.2% on month, matching expectations. The unemployment rate remained stable at 5%, while the participation rate rose to 62.5% from 62.4% in the previous month. Finally, the underemployment rate climbed to 9.9% from 9.8% previous reading, showing that there is still slack in the US labour market. However, the better-than-expected data did not trigger a dollar index rally, suggesting that a December liftoff is already fully priced in. US treasury yields spiked on the news before returning to pre-NFP levels. The 2-year held ground at 0.9550%, the 5-year stayed around 1.7170%, while on the long end of the curve, the 10-Year was trading slightly below 2.30%. EUR/USD stabilised between 1.08 and 1.10 after surging 3.30% amid disappointing ECB.

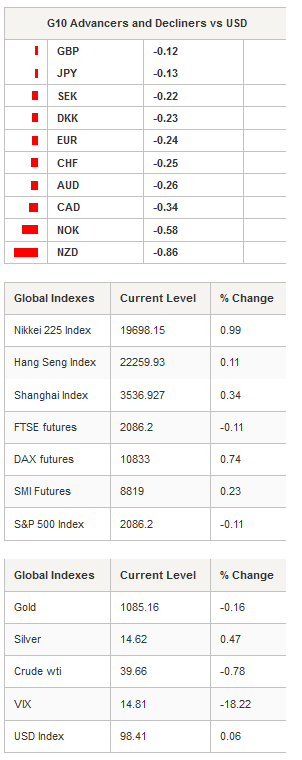

Today's worst performers verses the USD have been NZD, NOK, AUD and CAD. The commodity currencies got hit after the OPEC decided to maintain production close to current levels (around 32 barrel/day). West Texas Intermediate fell 5.60% from Friday’s high to $39.65 a barrel, while its counterpart from the North Sea slid 4.60% to $42.80. The Kiwi fell 1.25% from its Friday peak amid NZ Treasury said the growth outlook is weaker than anticipated. Moreover, the RBNZ is expected to cut the OCR later this week (on Wednesday) as the economy struggles with weak global demand and persistently low commodity prices. The New Zealand dollar is currently trading at $0.6705. We expect the Kiwi to depreciate further against the greenback as monetary policy divergence is adding downside pressure on NZD/USD.

In the equity market, Asian regional markets are trading in positive territory, following Wall Street’s lead. In Japan, the Nikkei 225 gained 0.99% and the TOPIX rose 0.71%. In mainland China, the Shanghai and the Shenzhen Composites are up 0.34% and 1.26 respectively, while in Hong Kong, the Hang Seng edged up 0.11%. In Europe, futures are pointing to a higher open with the FTSE 100 up 0.57%, the DAX up 0.74%, the SMI up 0.23% and the Euro STOXX 600 up 0.78%.

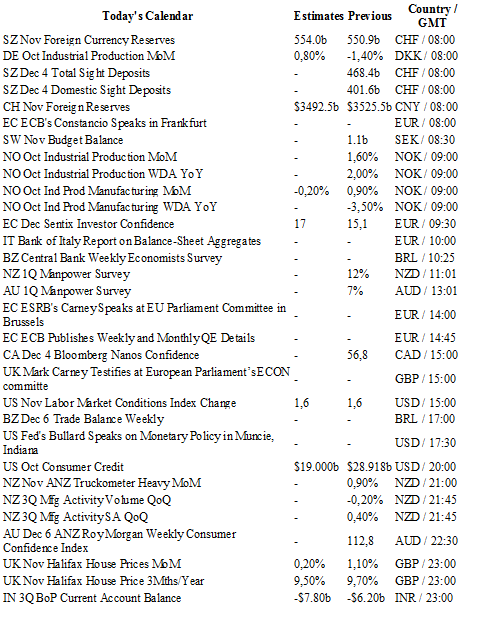

Today traders will be watching domestic sight deposits from the SNB; budget balance from Sweden; industrial production from Norway; the ECB will publish the weekly and monthly details of the QE; Mark Carney will testify before the European Parliament; in the US Fed Chief Bullard will speak on monetary policy.

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0842

S 1: 1.0458

S 2: 1.0000

GBP/USD

R 2: 1.5659

R 1: 1.5529

CURRENT: 1.5070

S 1: 1.4857

S 2: 1.4566

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 123.35

S 1: 120.07

S 2: 118.07

USD/CHF

R 2: 1.1138

R 1: 1.0676

CURRENT: 1.0004

S 1: 0.9739

S 2: 0.9476