Market Brief

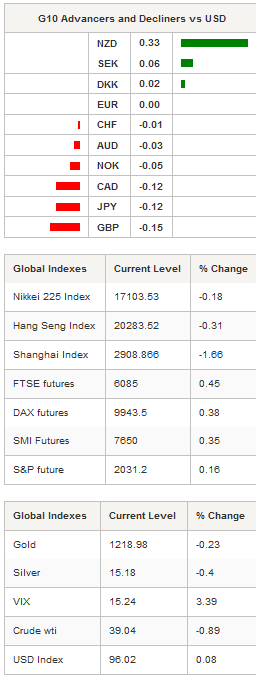

Yesterday, the US dollar got slammed in the early US session, after sluggish economic data. The greenback dropped 0.50% against the euro on Monday in thin liquidity trading conditions as most markets remained closed for the Easter holiday; EUR/USD hit 1.1220, while the dollar index fell to 95.84 as inflation data came in on the soft side. The Fed’s preferred gauge of inflation, the personal consumption expenditure core price index, rose 0.1%m/m in February from 0.3% in the previous month, missing consensus of 0.2%. On a year-over-year basis the gauge remained stable at 1.7% versus 1.8% in January. Separately, data showed that American consumers remain cautious, preferring to increase their savings, despite income continuing to increase at a steady pace. However, personal spending for the month of January was revised substantially lower, suggesting that a US domestic driven recovery will take some time. Overall, the US dollar lost ground against most currencies on Monday. However, we expect the market to price this info back in as traders return from the Easter break. EUR/USD moved back below the 1.12 threshold; from a technical standpoint, the bias remains on the downside with the 1.1144 level as the closest support (Fibo 38.2% on March rally).

USD/JPY continued to gain ground, up 2.75% from its low from mid-March as Japanese economic data keeps disappointing. The jobless rate rose to 3.3% in January from 3.2% in the previous month. Separately, retail trades printed at +0.5%y/y, missing estimates of 1.6% and a downwardly revised figure of -0.2% in January. Finally, retail sales contracted 2.3%m/m, well below median forecast of -0.9%. However, January’s reading was revised higher to -0.4% from 1.1%. Overall, we expect the Japanese yen to remain under pressure as the BoJ will likely step in to prevent a potential JPY appreciation.

The New Zealand dollar was the biggest winner in overnight trading as NZD/USD tested the 0.6761 before easing slightly to 0.6745 as traders failed to find a meaningful reason to push the Kiwi higher against the backdrop of looming rate cuts by the RBNZ and the Fed’s rate tightening cycle. The Kiwi stumbled over the 0.6750-75 resistance area (top of February’s range). Should commodity prices remain under pressure, we expect the New Zealand dollar to reverse earlier gains and to return to the 0.66 level.

In the equity market, European equity futures are pointing to a higher open in spite of Asia’s negative lead. In Japan, the Nikkei and Topix fell 0.18% and 0.31% respectively. Mainland Chinese shares were also trading in negative territory with the CSI 300 down 1.22%. Finally, in Hong Kong the Hang Seng was down 0.31%, while in Australia the S&P/ASX 200 slid 1.57% as iron ore prices continue to fall, with the September contract on the Dalian commodity exchange down 4.30% to 375 yuan/metric ton.

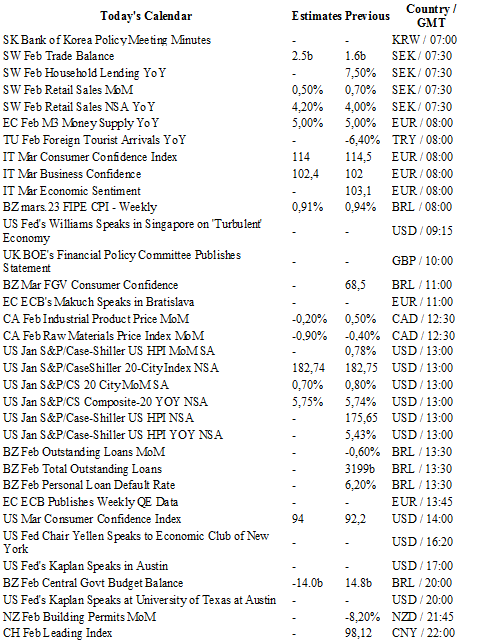

Today traders will be watching retail sales from Sweden; business & consumer confidence from Italy; Fed’s Williams and Kaplan (both non-voters) speeches, Yellen will also speak in NY later today and consumer confidence index from the US; the BoE will release a statement from its March 23 meeting.

Currency Tech

EUR/USD

R 2: 1.1495

R 1: 1.1376

CURRENT: 1.1179

S 1: 1.1058

S 2: 1.0810

GBP/USD

R 2: 1.4591

R 1: 1.4398

CURRENT: 1.4208

S 1: 1.4033

S 2: 1.3836

USD/JPY

R 2: 117.53

R 1: 114.91

CURRENT: 113.68

S 1: 110.67

S 2: 107.61

USD/CHF

R 2: 1.0093

R 1: 0.9913

CURRENT: 0.9750

S 1: 0.9651

S 2: 0.9476