Market Brief

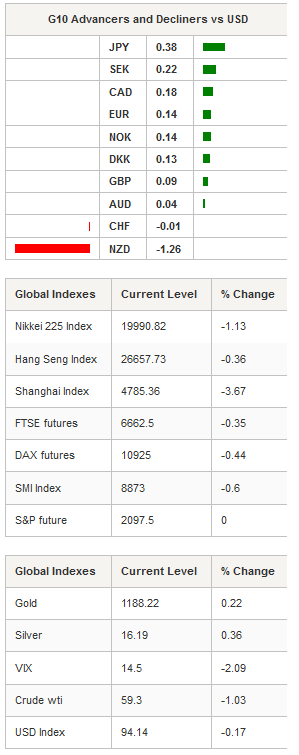

As broadly expected, the Federal Reserves decided to maintain its funds rate unchanged at 0.25%. Janet Yellen, Fed chairwoman, declared that the Committee wants to see further improvements in the labour market and to feel reasonably confident that inflation will reach the 2% target over the medium term before starting to increase the federal funds rate. The Fed also lowered its GDP growth forecast to between 1.8% and 2%, compared to between 2.3% and 2.7% in March, while Janet Yellen reaffirmed, during the press conference, that the policy will be data dependent and that “economic conditions are currently anticipated to evolve in a manner that will warrant only gradual increases in the target federal funds rate.” The dot-plots show that Fed officials shifted lower their projection for the Federal funds rate for 2015 and 2016. All in all, the relative dovish tone triggered a sharp sell-off of the USD, with the dollar index down 1% to 94.10. EUR/USD gained roughly one figure to test the 1.1350/1.14 resistance area. On the downside, the closest support stands at 1.1105 (Fib 38.2% on April-May rally). Wall Street cheers the dovish statement with S&P up 0.20%, the Nasdaq 0.19% and the Dow Jones 0.18%.

The New Zealand dollar was heavily sold-off yesterday after Q1 GDP surprised substantially to the downside, as the economy expanded “only” 2.6%q/q versus 3.1% median forecast. The Kiwi economy suffered mostly from lower milk production - due to falling dairy prices – which causes the agriculture industry to contract 2.3% in the first quarter. The mining sector was also badly hit by lower commodity prices, decreasing exploration activity and oil and gas extraction, the industry contracted 7.8%. With the lack of recovery in the dairy sector and sluggish developments of the mining industry, we think that the odds of a rate cut at the July RBNZ’s meeting have increased significantly. NZD retreated 1.30% against the dollar and 1.15% against the Aussie.

In Switzerland, we expect the SNB to keep monetary policy unchanged despite a contracting economy. EUR/CHF moved sideways overnight and is currently trading at 1.0465-. USD/CHF accelerated its fall yesterday night and is now heading toward the next target at 0.9073 (low from May 7).

On the equity front, Asian stocks are suffering a massive sell-off, with the Nikkei down -1.13%, Shanghai Composite down -3.67%, Hang Seng down -0.36% and ASX/S&P down -1.26%. In Europe, stocks opened lower - the Footsie down -0.35%, the DAX down -0.44% and the SMI down -0.60% - ahead of the Eurogroup meeting.

Today, traders will be watching SNB rate decision, Norges deposit rate; retails sales from UK; CPI figures, initial jobless claims, Bloomberg consumer comfort and leading index from the US.

Today's Calendar Estimates Previous Country / GMT SP Apr Trade Balance - -890.6M EUR / 07:04 NO Bloomberg June Norway Economic Survey (Table) - - NOK / 07:15 SZ Jun 18 SNB 3-Month Libor Lower Target Range -1.25% -1.25% CHF / 07:30 SZ Jun 18 SNB 3-Month Libor Upper Target Range -0.25% -0.25% CHF / 07:30 SZ Jun 18 SNB Sight Deposit Interest Rate -0.75% -0.75% CHF / 07:30 NO Jun 18 Deposit Rates 1.00% 1.25% NOK / 08:00 BZ Jun 15 FIPE CPI - Weekly 0.60% 0.61% BRL / 08:00 SZ SNB President Jordan Will Discuss Interest-Rate Decision - - CHF / 08:00 UK May Retail Sales Ex Auto Fuel MoM -0.20% 1.20% GBP / 08:30 UK May Retail Sales Ex Auto Fuel YoY 4.30% 4.70% GBP / 08:30 UK May Retail Sales Inc Auto Fuel MoM -0.10% 1.20% GBP / 08:30 UK May Retail Sales Inc Auto Fuel YoY 4.60% 4.70% GBP / 08:30 EC 1Q Labour Costs YoY - 1.10% EUR / 09:00 BZ Jun IGP-M Inflation 2nd Preview 0.53% 0.41% BRL / 11:00 US 1Q Current Account Balance -$117.3B -$113.5B USD / 12:30 US May CPI MoM 0.50% 0.10% USD / 12:30 US May CPI Ex Food and Energy MoM 0.20% 0.30% USD / 12:30 US May CPI YoY 0.10% -0.20% USD / 12:30 US May CPI Ex Food and Energy YoY 1.80% 1.80% USD / 12:30 US May CPI Index NSA 237.995 236.599 USD / 12:30 US May CPI Core Index SA 241.819 241.409 USD / 12:30 US Jun 13 Initial Jobless Claims 277K 279K USD / 12:30 US May Real Avg Weekly Earnings YoY - 2.30% USD / 12:30 US Jun 6 Continuing Claims 2210K 2265K USD / 12:30 US Jun 14 Bloomberg Consumer Comfort - 40.1 USD / 13:45 US Jun Bloomberg Economic Expectations - 44 USD / 13:45 US Jun Philadelphia Fed Business Outlook 8 6.7 USD / 14:00 BZ Jun CNI Industrial Confidence - 38.6 BRL / 14:00 US May Leading Index 0.40% 0.70% USD / 14:00 BZ May Tax Collections 94000M 109241M BRL / 22:00

Currency Tech

EUR/USD

R 2: 1.1534

R 1: 1.1385

CURRENT: 1.1365

S 1: 1.0882

S 2: 1.0521

GBP/USD

R 2: 1.6189

R 1: 1.5879

CURRENT: 1.5866

S 1: 1.5191

S 2: 1.5090

USD/JPY

R 2: 135.15

R 1: 125.64

CURRENT: 122.95

S 1: 122.03

S 2: 118.18

USD/CHF

R 2: 0.9712

R 1: 0.9573

CURRENT: 0.9200

S 1: 0.9072

S 2: 0.8986