Market Brief

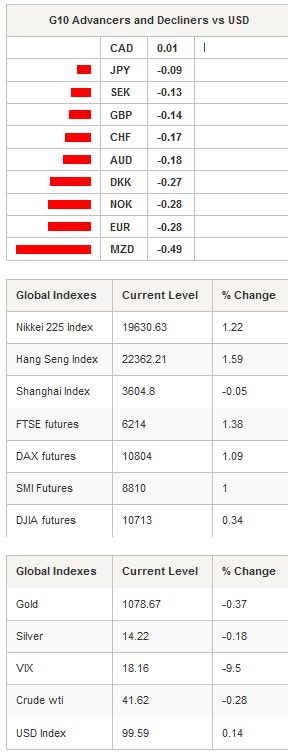

In the FX markets the USD was stronger in the G10 and Asia EM. The recovery in risk appetite was driven by a reversal 1.5% decline in S&P 500 in the futures markets. US 10-year yields rose to 2.27%, recovering recent loses. AUD/USD slipped marginally from 0.7110 to 0.7080 after the unrevealing RBA minutes were released. EUR/USD traded to a post-payroll low at 1.065 and selling pressure remains heavy. News that Athens and creditors had reached an agreement over the next tranche of bailout out funds failed to produce a positive bounce in euro. NZD/USD weakened through most of the session from 0.6496 to 0.6453 as inflation expectations dropped. Regional equity indices were broadly higher with the Nikkei and Hang Seng up 1.22% and 1.42% respectively. The Shanghai composite was flat after spending much of the session higher, while PBoC lowered the USD/CNY fix by 10 pips to 6.3740. We remain constructive on the CNY, not based on economic conditions but expectations for inclusion in the IMF SDR and the resulting demand.

Overnight, New Zealand 2-year inflation expectations declined to 1.85% in 4Q from 1.94% in 3Q. However, 1 year inflation exception increased to 1.51% in 4Q from 1.46%. In Singapore, October non-oil domestic export contracted 0.5% y/y, from 0.3% prior expansion, as demand for electronics decreased (-3.2% y/y ). Singapore regional trading was significantly soft indicating that trade lead recovery is unlikely near term. The Australia RBA minutes indicated that the outlook for inflation remained subdued providing scope for further easing. The minutes suggested that economic conditions had marginally improved as the weakened AUD had help supporting falling external demand. Elsewhere in Australia, RBA’s Assistant Governor Christopher Kent indicated that commodity prices would have limited upside as China's development path had shifted. AUD/USD bearish conditions persist as the downward trend remains intact suggesting a retest of September lows of 0.6896.

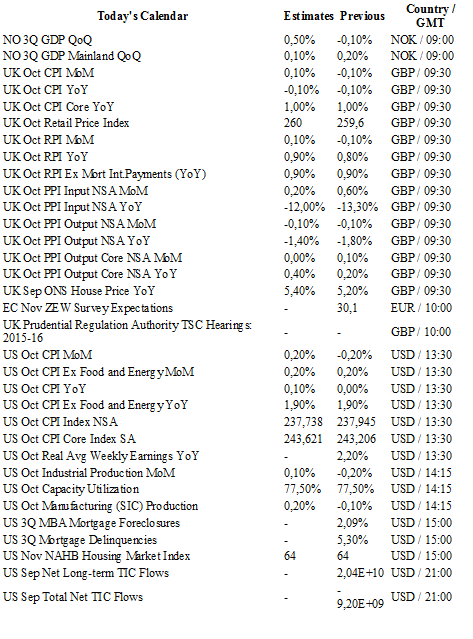

Traders will be facing a data filled day. In the European session, German ZEW expectations is anticipated to improve to 6.0 from 1.9 however, recent weakness in German data and sluggishness in European trading partners provides scope for a disappointing read. In the UK, CPI inflation is expected to stay flat at -0.1% y/y (core 1.0% y/y). Easing inflation pressure and dovish BoE has pushed out the first rate hike (into 2017) indicating that a weak read should support further GBP/USD sell-off back to 1.5027. Norway GDP growth is expected to fall to 0.1% q/q from 0.2% q/q in 3Q. A surprise uptick in growth, plus prospects for ECB easing could give the EUR/NOK a downside push to 9.1517. In the afternoon session, the US will release CPI, which should rise 0.2% from -0.2% m/m. Core CPI is forecasted to increase 0.2%, which puts y/y rate at 1.9%. Finally, industrial production should increase to 0.1%, ending its two consecutive monthly decline. We remain constructive on the USD over CHF, CAD and EUR.

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0654

S 1: 1.0458

S 2: 1.0000

GBP/USD

R 2: 1.5659

R 1: 1.5529

CURRENT: 1.5185

S 1: 1.5027

S 2: 1.4566

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 123.28

S 1: 120.07

S 2: 118.07

USD/CHF

R 2: 1.0240

R 1: 1.0129

CURRENT: 1.0118

S 1: 0.9739

S 2: 0.9476