Market Brief

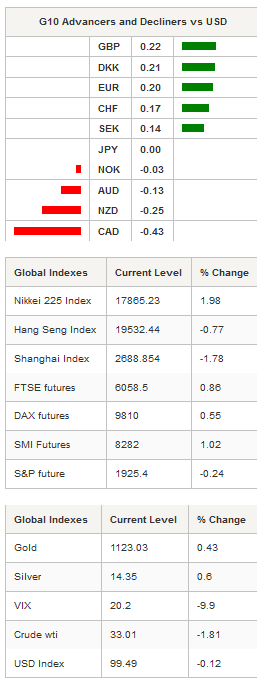

In the wake of Friday’s BoJ easing move, the policy divergence theme is back under the spotlight. During the Asian session, the US dollar consolidated earlier gains but lacked the strength to reach higher grounds as expectations for Fed tightening got pushed away. The entire US yield curve shifted lower last week, with the 2-year treasury rate back below 0.78% for the first time since early November. The 10-year is currently stabilising around 1.92%, down 41bps since the beginning of the year.

USD/JPY spent the entire Asian session trading in a very narrow range, between 121.11-121.49, after surging 2.25% amid the BoJ’s rate cut. Overall, the bias remains on the upside as the policy divergence will act in favour of the greenback. However, the decision has also cast a shadow on the US dollar outlook as the Fed finds itself being the only central bank on the tightening path.

In China, January official manufacturing PMI came in on the soft side, printing below the 50-point mark, signalling contraction, for the sixth straight month, coming in at 49.4 versus 49.6 median forecast and 49.7 in December. Non-manufacturing PMI also eased compared to December, printing at 53.5 versus 54.4 in Dec., but still above the threshold. The PBoC is in a tough spot as it faces a Cornelian decision where it has to choose between further monetary easing, which would help the economy to weather the slowdown, or to stand-by in order to avoid further yuan weakness, which would accelerate capital outflow. However, from our standpoint, the PBoC will have no choice but to support the economy further by cutting the rates and lowering the RRR. The People’s Bank of China set the USD/CNY mid-rate at 6.5539 this morning, up 0.04% from Friday.

In the equity market, returns are mixed this morning as Chinese data weighs. The Nikkei is up 1.98% in spite of a weaker manufacturing PMI (53.5 in Jan. vs 54.4 in Dec.). However, traders still have Friday’s rate cut on their minds. The Topix index was up 2.14%. In mainland China, the Shanghai and Shenzhen Composite were down -1.78% and -1.04% respectively. Hong Kong’s Hang Seng lost -0.77%, while in Singapore the STI fell 0.96%.

In Australia, we expect the RBA to leave its benchmark interest rate unchanged. Inflation levels are back within the 2%-3% target range. TD securities inflation measures came in at 2.3%y/y in Jan. or 0.4% on a month-over-month basis. AUD/USD tested its 50dma on Friday and lacked the strength to break it to the upside. The tone used to communicate the decision will be decisive. We expect the RBA to sound relatively dovish, especially given the easing bias of most of its peers, as Governor Stevens will want to lock-in the competitive level of the Australian dollar.

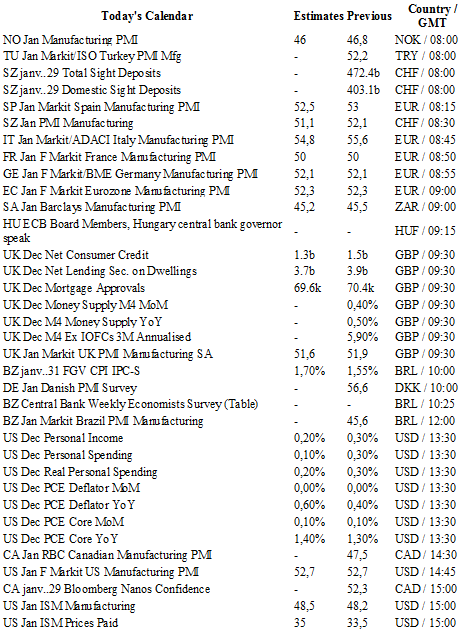

Today traders will be watching manufacturing PMI from Norway, Switzerland, France, Germany, the euro zone, Turkey, UK, Spain, Italy, Brazil and South Africa; mortgage approval from the UK; personal income and spending, PCE deflator, ISM manufacturing and construction spending from the US; trade balance from Brazil; RBA rate decision (during the night).

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0849

S 1: 1.0458

S 2: 1.0000

GBP/USD

R 2: 1.5242

R 1: 1.4969

CURRENT: 1.4283

S 1: 1.3657

S 2: 1.3503

USD/JPY

R 2: 125.86

R 1: 123.76

CURRENT: 121.15

S 1: 115.57

S 2: 105.23

USD/CHF

R 2: 1.0676

R 1: 1.0328

CURRENT: 1.0217

S 1: 0.9786

S 2: 0.9476