Market Brief

Released on Friday, the US nonfarm payrolls greatly surprised to the upside. The US economy added 255,000 non-farm jobs in July versus an expected 180k and an upwardly revised figure of 292k in the previous month. Average earnings accelerated slightly by 0.3% on month, beating expectations of 0.2% and 0.1% last read.

The unemployment rate and participation rate remained broadly unchanged with the first printing at 4.9% (versus 4.8% consensus and 4.9% last month) while the latter ticked up to 62.8% versus 62.9% in June.

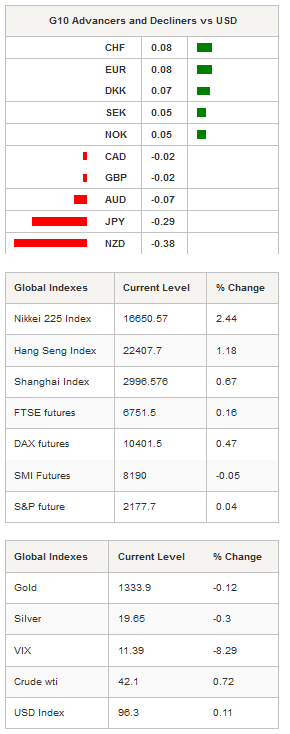

Very positive data triggered an aggressive USD rally in the New York session but the gains were unevenly distributed among the G10 complex while the Canadian dollar and Japanese yen took the biggest hits. USD/CAD hit 1.32 on Friday, up 1.40% and stabilised at around 1.3170 during the Asian session in a very low volatility environment. USD/JPY continued to trade on a firm footing on Monday; the Japanese yen losing 0.30% against the greenback in overnight trading.

US treasury rate rallied strongly amid Friday’s job report before stabilising in Tokyo. Monetary policy sensitive 2-Year yields rose 9bps to 0.7350%, while 10-Year yields were up 11bps to 1.5885%. The probability of a federal funds rate hike at the September FOMC meeting rose to 26% on Friday, compared to 18% pre-NFPs. Overall, the market is increasingly confident that Janet Yellen will be able to lift rates before the end of the year, despite the persistently weak upside pressure on inflation and an ever-mounting currency war. EUR/USD erased early Asian session gains and returned to 1.1085 after testing the 1.11 threshold. The currency has not escaped its downtrend channel yet and is now heading for the 1.10 support area (multi-low and psychological level).

On the equity market, the party is going full swing on Monday with all Asian regional equity markets trading in positive territory. In Japan, the Nikkei and the Topix index were up 2.44% and 1.18% respectively. In China, mainland shares were up with the Shanghai and Shenzhen Composites up 0.64% and 0.79% respectively. In Hong Kong, the Hang Seng was up 1.19%. In Australia, the ASX rose 0.74%, while in New Zealand the NZX was up 0.55%. Finally, in Europe, indices should open higher as futures are blinking green across the board.

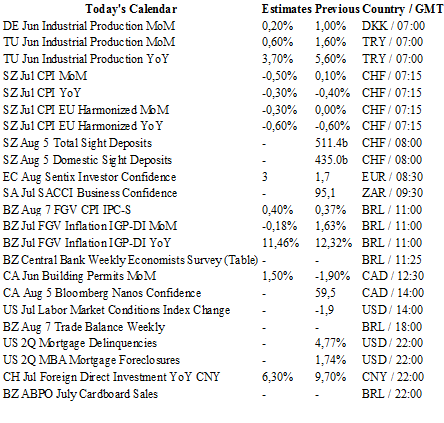

Today traders will be watching industrial production from Denmark, Turkey and Brazil; CPI from Switzerland; building permits from Canada; sight deposits from Switzerland.

Currency Tech

EUR/USD

R 2: 1.1428

R 1: 1.1234

CURRENT: 1.1085

S 1: 1.0913

S 2: 1.0822

GBP/USD

R 2: 1.3981

R 1: 1.3534

CURRENT: 1.3059

S 1: 1.2851

S 2: 1.2798

USD/JPY

R 2: 107.90

R 1: 102.83

CURRENT: 102.13

S 1: 100.00

S 2: 99.02

USD/CHF

R 2: 1.0328

R 1: 0.9956

CURRENT: 0.9805

S 1: 0.9634

S 2: 0.9522